What’s threat pooling in automobile insurance coverage? It is like a large, reasonably chaotic potluck the place everybody brings their automobile coincidence woes to the desk, hoping the full does not bankrupt the entire celebration. Insurance coverage corporations are the hosts, juggling claims and premiums like they are juggling flaming bowling pins. This potluck, or reasonably, threat pool, is designed to unfold the monetary burden of injuries amongst many drivers, making sure everybody can have the funds for insurance coverage with out breaking the financial institution.

Consider an international the place each motive force’s insurance coverage premiums have been calculated founded only on their particular person coincidence threat. It might be a wild journey, with some drivers paying exorbitant quantities, and others getting off scot-free. Chance pooling, alternatively, is sort of a protection internet, making a extra predictable and fairer machine for everybody. It is all about spreading the chance and making sure a smoother, much less bumpy journey for all events concerned.

Advent to Chance Pooling

Yo, peeps! Ever puzzled how automobile insurance coverage premiums keep slightly solid even with loopy injuries going down always? It is all about threat pooling! Principally, it is a sensible option to proportion the monetary burden of surprising automobile injuries amongst a large workforce of drivers. Consider a large, collective pot the place everybody chips in a bit of, and when one individual has a large declare, the pot is helping duvet it.Chance pooling is a basic theory in automobile insurance coverage, necessarily a gaggle effort to regulate uncertainty.

It is like a security internet the place everybody contributes a small quantity to hide the possible dangers of a couple of unfortunate folks. This manner, no person has to shoulder all the charge of a big declare on their very own, holding premiums inexpensive for everybody.Chance pooling immediately tackles the issue of unpredictable automobile insurance coverage claims. Since injuries are, neatly, unpredictable, some months can have a number of claims, whilst others may well be lovely calm.

Chance pooling smooths out those fluctuations, making sure the insurance coverage corporate pays out claims constantly, with out going bankrupt. It is a win-win for everybody concerned!Traditionally, threat pooling has been a cornerstone of insurance coverage. Early types of mutual support societies, the place folks pooled sources to offer protection to every different from monetary losses, have been the forerunners of contemporary insurance coverage. This idea advanced into the advanced risk-sharing mechanisms we see in insurance coverage nowadays.

The core thought stays the similar: sharing the weight to verify steadiness.

Key Advantages of Chance Pooling

Chance pooling is not just about masking claims; it additionally advantages everybody within the machine. Here is a breakdown of the important thing benefits for automobile insurance coverage shoppers:

| Get advantages | Rationalization | Instance | Have an effect on on premiums |

|---|---|---|---|

| Reasonably priced Premiums | By way of sharing threat, the insurance coverage corporate can unfold out the price of claims throughout a big workforce of policyholders. This ends up in decrease premiums for everybody. | Consider 100 drivers pooling their dangers. If 5 drivers have injuries, the price is unfold throughout all 100, making the person charge less than if every motive force needed to duvet their very own injuries. | Decrease premiums, making insurance coverage extra out there to a much wider vary of drivers. |

| Monetary Safety | Chance pooling guarantees that despite the fact that a person reviews a high-cost declare, the insurance coverage corporate is in a position to pay out. This saves drivers from catastrophic monetary losses. | A motive force has a big coincidence with really extensive restore prices. Chance pooling guarantees the declare is roofed, combating the motive force from going through the total monetary burden. | Diminished monetary rigidity for policyholders, realizing their claims will probably be lined. |

| Balance of the Insurance coverage Business | By way of spreading the chance throughout many policyholders, threat pooling creates steadiness for the insurance coverage business. This prevents extensive fluctuations in claims from impacting the corporate’s monetary well being. | A surprising spike in injuries in a particular area would not reason a huge monetary pressure at the insurance coverage corporate for the reason that threat is unfold throughout all the pool of policyholders. | A extra solid insurance coverage marketplace, decreasing the danger of top class will increase because of surprising declare spikes. |

| Coverage from Catastrophic Occasions | Chance pooling performs an important position in mitigating the affect of main occasions, like herbal failures or well-liked injuries. By way of spreading the price throughout many policyholders, insurance coverage corporations can deal with large-scale claims. | All through a big earthquake that damages many cars, threat pooling guarantees the insurance coverage corporate can duvet the entire claims with out collapsing. | Coverage in opposition to vital monetary shocks, making sure insurance coverage stays out there all through disaster eventualities. |

How Chance Pooling Works in Automobile Insurance coverage

Chance pooling in automobile insurance coverage is sort of a workforce financial savings plan for surprising automobile injuries. As an alternative of every individual saving personally, everybody contributes a bit bit to a shared fund. This shared fund, or pool, is used to pay for claims from injuries, ensuring everybody’s lined it doesn’t matter what. It is a sensible option to organize threat and make automobile insurance coverage extra inexpensive for everybody.Chance pooling is a basic idea in insurance coverage.

It leverages the main of diversification to scale back the monetary affect of possible losses. By way of spreading the chance throughout a big workforce of policyholders, the chance of a catastrophic match affecting any unmarried insurer is minimized. This interprets into extra solid premiums and higher affordability for everybody.

Mechanics of Top class Contributions

Person premiums are calculated in line with plenty of elements, together with the motive force’s age, riding historical past, the kind of automobile, and placement. A tender motive force with a blank document, riding a small automobile in a low-accident space, will most likely pay lower than an older motive force with a number of injuries, riding a big SUV in a high-accident zone. Those elements are used to estimate the chance of a declare.

Upper-risk drivers give a contribution extra to the pool, whilst lower-risk drivers give a contribution much less. This guarantees that the pool has sufficient price range to pay for claims whilst additionally reflecting the real threat every motive force poses.

Claims Cost from the Pool

When a declare is filed, the insurance coverage corporate assesses the wear and tear and verifies the policyholder’s eligibility. If the declare is authentic, the cash is drawn from the chance pool. The quantity paid is dependent upon the main points of the declare, such because the severity of the wear and tear and the coverage protection. The program guarantees that everybody advantages from the pooling impact, without reference to whether or not they have got an coincidence or now not.

Position of Actuarial Science

Actuarial science is a very powerful in threat pooling. Actuaries use statistical fashions and knowledge research to estimate the chance of claims and the volume had to duvet them. They imagine more than a few elements comparable to historic coincidence charges, demographics, and car sorts to resolve the suitable top class for every motive force. By way of predicting the long run wishes of the pool, actuaries lend a hand take care of the monetary steadiness of the insurance coverage corporate.

As an example, an building up within the common charge of upkeep because of more moderen applied sciences may also be factored into the calculations.

Calculating Person Premiums

The method of calculating particular person premiums is advanced, incorporating many variables. Actuaries use refined algorithms and statistical fashions to calculate premiums in line with threat tests. Those fashions ceaselessly contain intricate formulation and calculations to expect long run claims in line with elements like age, location, and riding document. Imagine a motive force in Jogja with a blank document. Their top class will probably be decrease in comparison to a motive force in the next coincidence space.

Declare Processing Flowchart

+-----------------+

| Declare is Filed |

+-----------------+

|

V

+-----------------+

| Declare Review |

+-----------------+

|

V

+-----------------+

| Coverage Verification|

+-----------------+

|

V

+-----------------+

| Declare Validation |

+-----------------+

|

V

+-----------------+

| Cost from Pool|

+-----------------+

|

V

+-----------------+

| Declare Resolved |

+-----------------+

This flowchart illustrates the fundamental steps focused on processing a declare the usage of threat pooling.

Each and every step is significant in making sure that says are processed quite and successfully, the usage of the collective sources of the chance pool.

Advantages and Benefits of Chance Pooling

Chance pooling in automobile insurance coverage is sort of a super-cooperative workforce. As an alternative of everybody going through the monetary threat of injuries personally, they pool their sources in combination. This method, as you’ll be able to see, gives a large number of benefits for each the insurance coverage corporations and the policyholders. It is a sensible option to organize threat and stay premiums cheap.

Benefits for Insurance coverage Firms

Chance pooling considerably reduces the volatility of insurance coverage corporate profits. By way of spreading the monetary burden of claims throughout a big workforce of policyholders, the corporate mitigates the affect of a couple of main injuries or a surprising spike in claims. This makes their monetary state of affairs extra solid and predictable, which is tremendous vital for long-term sustainability. Consider an enormous wave of injuries—threat pooling is helping the corporate journey it out with out sinking.

It permits them to higher organize their funding portfolios and plan for the long run.

Stabilizing Insurance coverage Corporate Funds

Chance pooling creates a buffer in opposition to catastrophic occasions. When a couple of policyholders have injuries, the pooled price range can duvet the ones claims. This saves the insurance coverage corporate from insolvency, particularly all through classes of excessive coincidence charges or surprising failures. This steadiness permits them to be offering constant and dependable protection to all policyholders, even all through tricky instances. This predictability is a very powerful for his or her trade operations.

Advantages for Person Policyholders

Chance pooling ceaselessly ends up in extra inexpensive premiums. Since the insurance coverage corporate stocks the chance, the price of insurance coverage is unfold throughout a bigger pool of other folks. This interprets into decrease premiums for particular person policyholders, making automobile insurance coverage extra out there. Call to mind it like a gaggle cut price—everybody advantages from the collective coverage. This makes it more uncomplicated for other folks to have the funds for insurance coverage.

Have an effect on on Automobile Insurance coverage Premiums

Chance pooling, in essence, creates a extra solid and predictable charge construction for automobile insurance coverage premiums. The affect on particular person premiums is dependent upon more than a few elements like the person’s riding document, location, and the precise phrases in their coverage. On the other hand, the overall impact is a extra inexpensive and manageable worth. By way of reducing the price of insurance coverage, threat pooling makes it more uncomplicated for other folks to have the funds for automobile insurance coverage, which in flip is helping to extend automobile insurance policy.

Comparability to Selection Chance Control Strategies

| Means | Price | Protection | Chance Control |

|---|---|---|---|

| Chance Pooling | Normally decrease premiums | Complete protection for a much wider vary of dangers | Reduces monetary volatility for the corporate |

| Person Chance Retention | Probably greater premiums | Protection restricted to what folks can have the funds for | Complete accountability for monetary losses |

| Separate Insurance coverage Insurance policies for Prime-Chance Drivers | Upper premiums | Protection catered to the precise dangers | Control of threat from high-risk folks |

Chance pooling is a extra environment friendly and equitable option to deal with automobile insurance coverage threat in comparison to the opposite strategies. It is a win-win for each insurance coverage corporations and policyholders.

Components Affecting Chance Pooling in Automobile Insurance coverage

Yo, peeps! So, we’ve got mentioned how threat pooling works in automobile insurance coverage, and the way it is all about spreading the chance amongst a number of drivers. However what if truth be told

-influences* the costs? It is not only a random quantity generator, consider me. There are heaps of things at play. Let’s dive in!

Components Influencing Top class Calculation

Chance pooling in automobile insurance coverage is not magic. It is in line with real-world information about how most likely other drivers are to get into injuries. Insurance coverage corporations analyze heaps of information to determine one of the best ways to worth insurance policies quite for everybody concerned. This is helping them to verify the corporate is winning, whilst additionally providing inexpensive premiums for patrons.

Position of Demographics in Top class Resolution

Your age, gender, or even the place you reside can affect your automobile insurance coverage premiums. Insurance coverage corporations use statistical information to peer how positive demographics have a tendency to be focused on injuries extra ceaselessly. As an example, more youthful drivers ceaselessly have greater coincidence charges than older drivers, and is the reason why their premiums have a tendency to be greater. This is not about discrimination, it is about managing threat in line with noticed patterns.

Have an effect on of Using Historical past on Top class Calculation

Your riding document is a HUGE issue. When you have a historical past of injuries or violations, your premiums will probably be greater. It is because you constitute the next threat to the insurance coverage corporate. Insurance coverage corporations use this knowledge to evaluate how a lot threat you pose, and the pricing is adjusted accordingly. A blank riding document is essential to getting a decrease top class!

Position of Location in Top class Resolution

The place you reside performs a vital section for your insurance coverage prices. Spaces with greater coincidence charges most often have greater insurance coverage premiums. It is because the chance of injuries is statistically greater in positive areas. For example, spaces with extra visitors congestion or greater speeds ceaselessly see extra injuries, which immediately affects insurance coverage costs.

Have an effect on of Coincidence Charges on Total Insurance coverage Prices

Coincidence charges in a particular space or for a selected workforce are an enormous motive force in surroundings premiums. If injuries are extra widespread, the total charge of insurance coverage for all the threat pool will increase. Insurance coverage corporations should issue this in when figuring out premiums. Prime coincidence charges make it dearer to offer protection for everybody within the pool.

Frequency and Severity of Automobile Injuries and Premiums

The frequency (how ceaselessly) and severity (how dangerous) of auto injuries in a threat pool immediately affect top class prices. Extra widespread and critical injuries result in greater premiums for everybody within the pool. It is a option to account for the larger monetary burden at the corporate. The insurance coverage corporate wishes to hide the price of extra claims.

Desk: Chance Components and Have an effect on on Premiums

| Chance Issue | Description | Have an effect on on Top class | Instance |

|---|---|---|---|

| Age | More youthful drivers ceaselessly have greater coincidence charges. | Upper premiums | A 20-year-old motive force may pay greater than a 50-year-old motive force. |

| Using File | Injuries and violations building up threat. | Upper premiums | A motive force with a couple of rushing tickets can pay greater than a motive force with a blank document. |

| Location | Spaces with greater coincidence charges have greater premiums. | Upper premiums | A motive force dwelling in a town with excessive visitors congestion may pay greater than a motive force in a rural space. |

| Automobile Kind | Sure cars are extra vulnerable to injury or robbery. | Upper or decrease premiums | A sports activities automobile may have the next top class than a compact automobile because of its greater restore prices. |

Barriers and Demanding situations of Chance Pooling: What Is Chance Pooling In Automobile Insurance coverage

Chance pooling, whilst a forged idea, is not with out its hurdles within the automobile insurance coverage recreation. It is like a large workforce undertaking—everybody chips in, however some surprising problems can crop up. Working out those boundaries is essential to navigating the complexities of auto insurance coverage.

Attainable Barriers of Chance Pooling

Chance pooling is determined by the concept that a big workforce of drivers will steadiness out the chance. On the other hand, this is not all the time the case. Sure segments of the inhabitants, or particular geographic spaces, may have higher-than-average coincidence charges. It will create an imbalance within the pooling machine. As an example, a tender motive force with a historical past of reckless riding may disproportionately carry the premiums for everybody else within the pool.

Demanding situations of Managing a Massive and Numerous Chance Pool

Managing an enormous and numerous workforce of drivers is an enormous logistical problem. Insurers want refined methods to gather, analyze, and organize information for every motive force, maintaining a tally of their riding information, places, and extra. This huge information control and research calls for really extensive sources and complex era. Knowledge breaches or mistakes within the machine may end up in vital issues for all the threat pool.

Have an effect on of Fraud and Abuse on Chance Pooling

Fraud and abuse can critically disrupt the steadiness of threat pooling. Pretend claims or inflated injury reviews throw off all the calculation. Insurance coverage corporations ceaselessly use complex ways to hit upon and save you fraud, however it is an ongoing battle. It will in the end building up premiums for fair policyholders. For example, a well-liked fraudulent declare scheme may end up in vital top class will increase for everybody concerned.

Hostile Variety in Chance Pooling

Hostile variety is a vital risk to threat pooling. It happens when folks with the next threat of injuries or claims are much more likely to buy insurance coverage. It will reason the common threat stage of the pool to extend, doubtlessly resulting in top class hikes for everybody. As an example, drivers with a historical past of injuries or high-risk riding behavior could also be extra motivated to shop for insurance coverage, thus pushing up the common threat profile of the pool.

Attainable Issues Coming up from Chance Pooling

- Asymmetric Top class Distribution: Drivers in low-risk classes may really feel their premiums are unfairly excessive, whilst the ones in high-risk classes could also be pissed off with premiums they understand as too low. This may end up in dissatisfaction and doubtlessly regulatory scrutiny.

- Knowledge Safety Considerations: Insurance coverage corporations deal with delicate non-public information. A knowledge breach or insufficient security features may end up in vital issues for policyholders and reason mistrust within the machine.

- Higher Premiums for All: If a good portion of the chance pool has a higher-than-average threat profile, the premiums for everybody within the pool can upward thrust. This is a hardship for low-risk drivers.

- Complexity of Claims Control: Managing a big quantity of claims, in particular in a various threat pool, may also be advanced. This may end up in delays in processing claims and create frustrations for policyholders.

- Issue in Figuring out and Addressing Rising Dangers: Maintaining with rising dangers, comparable to new applied sciences, riding behavior, and environmental elements, could be a vital problem for insurance coverage corporations. Adjustments in riding behaviour and utilization patterns may want adjustment to threat pooling fashions.

Chance Pooling and Insurance coverage Premiums

Chance pooling is sort of a workforce hug for automobile insurance coverage. It is a machine the place everybody within the workforce stocks the monetary burden of possible claims. This shared accountability is a very powerful in surroundings truthful and inexpensive insurance coverage premiums. It is a basic idea that shapes how a lot you pay on your automobile insurance coverage.

Have an effect on on Automobile Insurance coverage Coverage Pricing

Chance pooling immediately impacts how a lot automobile insurance coverage prices. By way of pooling dangers, insurers can expect the total frequency and severity of claims extra correctly. This prediction is a very powerful for calculating premiums which are each cheap for the insurer and inexpensive for the insured. A extra correct prediction interprets to extra correct premiums.

Have an effect on on Top class Charges for Other Motive force Teams

Other motive force teams have various threat profiles. As an example, more youthful drivers ceaselessly have greater coincidence charges than older, extra skilled drivers. Chance pooling lets in insurers to mirror those variations in top class charges. It is a truthful option to distribute the prices of insurance coverage amongst other teams. Premiums are adjusted to mirror the chance of a motive force desiring insurance policy.

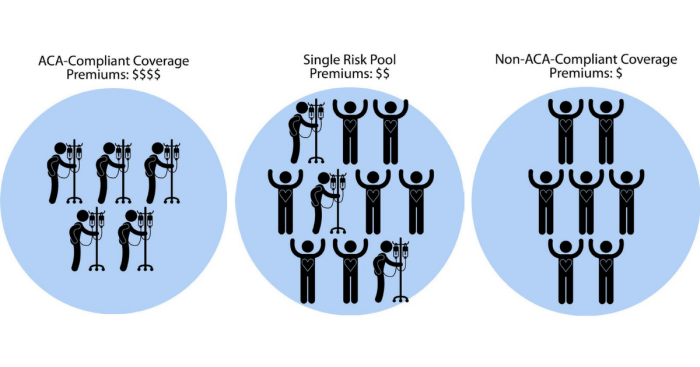

Comparability of Premiums Between Chance-Pooling and Non-Chance-Pooling Fashions

In a non-risk-pooling type, every motive force could be answerable for their very own claims. This might result in considerably greater premiums for people with the next threat of injuries. Chance pooling, alternatively, spreads the price throughout a bigger workforce, making premiums extra manageable for everybody. Premiums in risk-pooling fashions are most often decrease in comparison to particular person accountability fashions.

Have an effect on on Affordability of Automobile Insurance coverage

Chance pooling is very important for making automobile insurance coverage extra inexpensive for the common individual. By way of spreading the price of claims amongst a bigger workforce, the person top class is ceaselessly less than it will be in a non-risk-pooling machine. This makes automobile insurance coverage extra out there to a much wider vary of drivers. It is a machine that ranges the taking part in box and makes insurance coverage extra manageable for all concerned.

Desk: Have an effect on of Components on Top class Quantities

| Issue | Description | Have an effect on on Top class | Instance |

|---|---|---|---|

| Motive force Age | More youthful drivers ceaselessly have greater coincidence charges. | Upper premiums for more youthful drivers. | A 20-year-old motive force may pay greater than a 40-year-old motive force. |

| Using Historical past | Drivers with a historical past of injuries or violations face greater threat. | Upper premiums for drivers with injuries or violations. | A motive force with a couple of rushing tickets may pay the next top class. |

| Automobile Kind | Sure car sorts are extra vulnerable to robbery or injury. | Premiums adjusted in line with car kind. | A sports activities automobile may have the next top class than a regular sedan because of greater robbery threat. |

| Location | Spaces with greater coincidence charges or crime charges can have greater premiums. | Upper premiums in high-risk spaces. | Residing in a town with excessive visitors density may building up your top class. |

Chance Pooling and Insurance coverage Merchandise

Chance pooling is not just about sharing the monetary burden of claims; it basically shapes the very design of insurance coverage merchandise. It is like a large, collaborative effort to regulate threat, influencing the whole thing from top class charges to the protection presented. Working out how threat pooling affects insurance coverage merchandise is essential to navigating the auto insurance coverage panorama, particularly if you are on the lookout for the most efficient deal.

Chance pooling considerably impacts how automobile insurance coverage merchandise are structured and presented. It creates a framework for managing various threat profiles, resulting in merchandise which are extra adapted to precise wishes and personal tastes. That is particularly a very powerful on the planet of auto insurance coverage, the place drivers have other threat ranges in line with elements like age, riding historical past, and the kind of automobile they personal.

Have an effect on on Insurance coverage Product Design

Chance pooling basically reshapes the design of auto insurance coverage merchandise by way of developing other tiers and ranges of protection. That is executed to regulate the inherent threat permutations among drivers. For example, younger drivers, statistically, have the next chance of injuries than older, extra skilled drivers. This distinction in threat is immediately mirrored within the top class construction, making insurance coverage extra inexpensive for the ones with a decrease chance of injuries.

Examples of Adapted Insurance coverage Merchandise

Other threat swimming pools result in more than a few insurance coverage merchandise designed to cater to precise motive force traits. One outstanding instance is the supply of “younger motive force” programs. Those programs ceaselessly include greater premiums however may come with further options like coincidence forgiveness or reductions on defensive riding lessons. Conversely, skilled drivers with a blank document might qualify for decrease premiums with extra complete protection choices.

New Product Building Pushed by way of Chance Pooling

Chance pooling too can spark the advance of completely new insurance coverage merchandise. As an example, the upward thrust of telematics-based insurance coverage, which makes use of information from a motive force’s riding behavior to evaluate threat, is an instantaneous results of threat pooling. Those methods permit insurers to spot and praise protected riding habits, resulting in extra personalised and cost-effective insurance coverage answers.

Chance-Primarily based Pricing in Automobile Insurance coverage Merchandise

Chance-based pricing is a key element of auto insurance coverage, deeply intertwined with threat pooling. By way of examining other threat elements, insurers can set premiums that mirror the chance of a declare for a selected motive force. As an example, a motive force with a historical past of rushing tickets may pay the next top class in comparison to a motive force with a blank riding document.

This method goals to be sure that everybody will pay a good worth in line with their particular person threat profile.

“Chance-based pricing goals to mirror the real threat a motive force poses to the insurer.”

Customization of Automobile Insurance coverage Insurance policies

Chance pooling lets in for larger customization of auto insurance coverage insurance policies. Insurers can be offering more than a few add-on coverages or particular reductions that cater to other threat swimming pools. For example, a motive force dwelling in a space with a excessive prevalence of robbery may go for enhanced anti-theft protection, reflecting their distinctive threat profile. The power to customise insurance policies in line with particular person wishes is a vital benefit of threat pooling, making the insurance coverage procedure extra versatile and adapted.

Long run Tendencies in Chance Pooling

Chance pooling in automobile insurance coverage is ready to get a big improve, guys. It is not with reference to combining dangers anymore; it is about the usage of super-smart tech to make issues far more environment friendly and correct. This implies higher offers for everybody concerned, from the insurance coverage corporations to the drivers. Get in a position for a long run the place threat pooling is smoother, quicker, and fairer.

Rising Tendencies in Chance Pooling

The auto insurance coverage recreation is evolving all of a sudden. We are seeing new approaches to threat review, and the usage of information is converting how we calculate premiums and organize dangers. Insurance coverage corporations are taking a look at extra than simply riding information; they are the usage of such things as location information, riding behavior (from apps!), or even climate patterns to get a extra complete image of threat.

Inventions in Chance Pooling Tactics

New applied sciences are paving the best way for recent approaches to threat pooling. As an example, usage-based insurance coverage is changing into increasingly more widespread. This implies premiums are adjusted in line with how a motive force if truth be told drives, the usage of information from telematics units. Consider getting a cut price for being a clean, protected motive force! Any other cutting edge methodology is predictive modeling. By way of examining huge quantities of information, insurance coverage corporations can expect long run dangers with extra accuracy, bearing in mind extra focused threat control.

Generation’s Position in Making improvements to Chance Pooling Fashions, What’s threat pooling in automobile insurance coverage

Generation is the important thing to unlocking a extra actual and personalised threat pooling type. Subtle algorithms can analyze large datasets, figuring out patterns and tendencies that have been in the past inconceivable to hit upon. Device finding out is being applied to refine threat review fashions, making them extra correct and dependable. This ends up in extra truthful and clear pricing for drivers.

Long run Evolution of Chance Pooling

The way forward for threat pooling in automobile insurance coverage is taking a look shiny, with a robust emphasis on personalised threat profiles. Be expecting extra personalised insurance coverage merchandise, adapted to particular person riding types and threat elements. Consider insurance policies adjusting in real-time in line with your riding habits. Consider a machine the place you earn rewards for protected riding, resulting in even decrease premiums.

Developments in Generation and Chance Pooling

The affect of technological developments on threat pooling is vital. Knowledge from attached vehicles and cellular units supplies a wealth of knowledge, bearing in mind extra actual threat review and pricing. This knowledge-driven method ends up in extra environment friendly threat control, and may considerably cut back insurance coverage premiums. The creation of AI and gadget finding out algorithms will revolutionize how insurance coverage corporations analyze information and alter pricing.

Consider algorithms predicting possible injuries prior to they occur!

Concluding Remarks

So, what’s threat pooling in automobile insurance coverage? Necessarily, it is a sensible option to proportion the monetary burden of auto injuries, making insurance coverage extra inexpensive and sustainable. Call to mind it as a group effort, the place everybody pitches in to hide the inevitable mishaps at the highway. It is a machine that advantages each insurers and drivers, making sure that everybody can force with peace of thoughts, with out the worry of being crushed by way of astronomical premiums.

It is like a large, collective hug for everybody concerned.

FAQ Compilation

What if my coincidence is outstandingly dear?

The chance pool is designed to take in those high-cost claims. The premiums accumulated from everybody within the pool lend a hand pay for those dear injuries, so that you shouldn’t have to shoulder all the monetary burden.

Can I affect my top class thru threat pooling?

Completely! Your riding historical past, location, or even the kind of automobile you force can all affect your top class. The extra accountable you’re, the decrease your top class might be.

How does threat pooling have an effect on the cost of insurance coverage for various motive force teams?

Chance pooling in most cases ends up in decrease premiums for protected drivers. Conversely, drivers with a historical past of injuries will most likely pay extra. It is a truthful machine, in reality.

What occurs if the pool does not find the money for to hide the entire claims?

Insurance coverage corporations have reserve price range and techniques in position to deal with eventualities the place the chance pool may now not duvet the entire claims. For this reason actuarial science is so vital in calculating the suitable premiums.