Unum provident longer term care insurance coverage provides an important coverage towards the monetary burden of long term care wishes. This complete information delves into the specifics of those insurance policies, from figuring out protection choices to integrating them into your total monetary technique.

Navigating the complexities of long-term care insurance coverage will also be daunting. This useful resource simplifies the method, empowering you to make knowledgeable selections about your long term well-being and peace of thoughts. Discover some great benefits of Unum’s choices, evaluate them to different suppliers, and learn to seamlessly combine this an important protection into your retirement making plans.

Figuring out Lengthy-Time period Care Insurance coverage Wishes

Lengthy-term care insurance coverage is sort of a protection web in your long term well being wishes. It is not with regards to the massive image, but additionally concerning the daily realities of getting old and attainable well being problems. It is a good move to start out interested by this now, similar to making plans in your retirement or your youngsters’ training. It permit you to handle your independence and luxury on your golden years.

Varieties of Lengthy-Time period Care Insurance coverage

Lengthy-term care insurance coverage is available in more than a few bureaucracy, every with its personal set of options and advantages. Figuring out the differing kinds permit you to make a selection the most suitable option in your explicit instances. Conventional insurance policies are the most typical, providing a hard and fast get advantages quantity for a suite length. Hybrid insurance policies mix components of conventional and different varieties of protection. Those choices be offering extra flexibility and customization.

Protection Choices in Lengthy-Time period Care Insurance policies

Other insurance policies be offering various protection choices, from elementary care to extra complete help. Some insurance policies duvet professional nursing amenities, whilst others would possibly come with domestic well being aides and assisted dwelling. This pliability permits you to tailor the coverage in your wishes and funds.

Evaluating Coverage Sorts

| Coverage Kind | Description | Advantages | Drawbacks |

|---|---|---|---|

| Conventional | Mounted get advantages quantity for a suite length. | Predictable payouts, simple to grasp. | Won’t duvet all care wishes, rigid. |

| Hybrid | Combines components of conventional and different varieties of protection. | Higher flexibility in protection, attainable for personalisation. | Can also be extra advanced to grasp, attainable for upper premiums. |

| Catastrophic | Covers care handiest after a vital length of decline. | Decrease premiums, higher for many who wait for minor wishes. | Restricted protection, doubtlessly inadequate for primary wishes. |

This desk supplies a elementary evaluate. All the time seek advice from a monetary marketing consultant to get a customized comparability of choices.

Prices of Lengthy-Time period Care Wishes

The price of long-term care varies considerably by way of area. In primary towns like Jakarta, prices are usually upper because of upper dwelling bills and specialised care choices. Rural spaces ceaselessly have decrease prices, however get right of entry to to express care products and services could be extra restricted.

Components Influencing Lengthy-Time period Care Insurance coverage Prices

A number of components have an effect on the cost of a long-term care insurance coverage. Those come with your age, well being standing, the kind of care you want, and the protection quantity you select. You probably have pre-existing prerequisites, premiums is also upper. Additionally, the duration of the protection length can affect the full price. Imagine those components when evaluating insurance policies.

Unum Lengthy-Time period Care Insurance coverage Assessment

Whats up Jakarta South fam! Unum’s long-term care insurance coverage is an attractive forged choice in case you are searching for a plan to assist with long term care prices. It is designed to hide bills for such things as nursing domestic remains, in-home care, and different long-term care wishes. Let’s dive into what Unum provides!Unum’s long-term care insurance policies purpose to offer monetary fortify right through instances of want, serving to you or your family members arrange the prices of prolonged care.

They perceive the significance of making plans forward for attainable long-term care bills, and their merchandise are designed to be versatile and adaptable to person wishes.

Unum’s Coverage Choices

Unum provides a variety of long-term care insurance policy adapted to other budgets and desires. They remember that one-size-fits-all does not paintings, so they have created more than a few choices to deal with other eventualities.

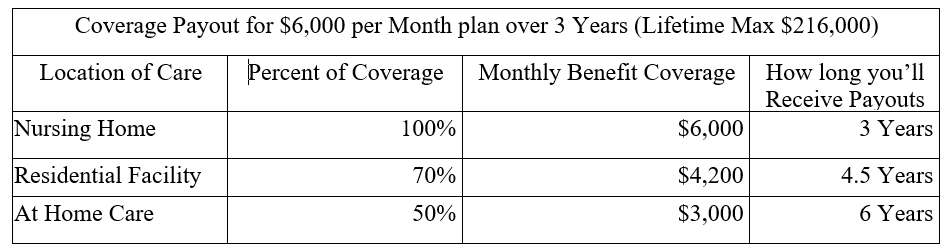

- Protection Choices: Unum provides several types of protection, like day-to-day get advantages quantities, most get advantages classes, and non-compulsory riders (like inflation coverage). This permits you to select a plan that aligns together with your expected care wishes and monetary capability.

- Premiums and Prices: Unum’s premiums are depending on a number of components, together with your age, well being, and the particular protection you select. It is an important to check quotes from more than a few suppliers to seek out probably the most reasonably priced and appropriate choice.

- Coverage Options: Unum ceaselessly contains options like sped up advantages, which may pay out a portion of your advantages early within the tournament of a vital sickness or different qualifying instances. They may also have choices for inflation coverage, making sure your advantages stay tempo with emerging healthcare prices over the years.

Key Options and Advantages

Unum’s insurance policies are designed to offer peace of thoughts and monetary coverage right through difficult instances. They are ceaselessly versatile sufficient to evolve in your evolving wishes.

- Get advantages Cost Choices: The cost construction of Unum insurance policies permits you to select how you need your advantages allotted. This may contain day-to-day bills for in-home care or nursing domestic remains.

- Eligibility Necessities: Unum’s eligibility standards normally imagine components like age and well being standing. Which means that sure prerequisites may have an effect on your eligibility for protection.

- Coverage Riders: Unum ceaselessly supplies supplementary advantages via riders, including additional layers of coverage or adjusting your protection. Those may just come with such things as inflation coverage or sped up advantages.

Coverage Choices Comparability

This desk supplies a snappy evaluate of Unum’s other coverage choices. This permits you to evaluate options and pricing to seek out the most efficient have compatibility.

| Coverage Kind | Day-to-day Get advantages Quantity | Most Get advantages Length | Top rate (Instance) |

|---|---|---|---|

| Fundamental Plan | $100 | 2 years | $150/month |

| Usual Plan | $200 | 5 years | $250/month |

| Top rate Plan | $300 | 10 years | $400/month |

Protection Comparability to Different Suppliers

Unum’s protection will have to be in comparison to different suppliers out there. This may occasionally be sure that you might be getting the most efficient worth in your cash and settling on a coverage that meets your wishes and funds.

- Aggressive Pricing: Unum’s pricing will have to be in comparison to different suppliers within the long-term care insurance coverage marketplace. This comparability is helping to make sure you get probably the most aggressive charges for the protection you want.

- Complete Advantages: Review the comprehensiveness of the advantages introduced by way of Unum towards different suppliers. Have a look at the variability of coated bills and any riders that could be recommended in your explicit wishes.

- Claims Procedure: The claims means of Unum will have to be in comparison to the ones of different suppliers. Examine the potency and simplicity of submitting and receiving payouts.

Claims Procedure

Unum’s claims procedure is designed to be simple. The method ceaselessly comes to documentation and verification to verify accuracy.

“Unum’s claims procedure is designed to be environment friendly and clear, with transparent pointers and procedures.”

Lengthy-Time period Care Insurance coverage and Monetary Making plans

Making plans in your long term, particularly your golden years, is an important, and long-term care insurance coverage is a crucial a part of that plan. It is like having a security web for sudden well being problems that would affect your independence and monetary steadiness. Recall to mind it as a proactive means to offer protection to your property and handle your way of life.Integrating long-term care insurance coverage into your total monetary technique guarantees that you are keen for the possible prices of care, whilst nonetheless having the monetary sources to experience retirement conveniently.

That is greater than only a plan; it is a peace of thoughts funding.

Integrating Lengthy-Time period Care Insurance coverage right into a Complete Monetary Plan

A complete monetary plan considers your present monetary state of affairs, objectives, and possibility tolerance. Integrating long-term care insurance coverage approach aligning your protection together with your retirement financial savings and property making plans. This holistic manner guarantees that your plan addresses your wishes and your circle of relatives’s wishes, too.

Significance of Lengthy-Time period Care Insurance coverage in Retirement Making plans

Retirement making plans is not only about amassing financial savings; it is about safeguarding your long term way of life. Lengthy-term care insurance coverage protects your retirement nest egg from the really extensive prices of care, making sure that your financial savings are to be had for different monetary objectives. It is like having a buffer to make sure you do not fritter away your financial savings simply to pay for care.

Estimating Long run Lengthy-Time period Care Prices

Estimating long term long-term care prices calls for cautious attention of things like inflation, the kind of care wanted, and attainable scientific developments. Other ranges of care, like assisted dwelling or nursing domestic amenities, may have various prices. Imagine your personal well being historical past and the projected wishes for long term care to get a extra correct estimate. For instance, any individual with a historical past of power prerequisites may want a upper protection quantity than any individual with excellent well being.

It is good to get skilled recommendation to personalize your estimation.

Monetary Methods for Investment Lengthy-Time period Care Wishes

A number of monetary methods permit you to fund long-term care wishes. You’ll imagine putting in a devoted financial savings account, the usage of a portion of your retirement budget, or exploring long-term care insurance coverage choices. The proper technique depends upon your personal instances and monetary objectives.

Position of Property Making plans in Relation to Lengthy-Time period Care Insurance coverage

Property making plans is an important at the side of long-term care insurance coverage. It is helping to offer protection to your property from attainable claims whilst making sure your needs are performed, even though you might be not able to regulate your affairs. A well-structured property plan minimizes the affect of long-term care bills to your beneficiaries. A certified property making plans legal professional permit you to craft a plan adapted in your explicit wishes and instances.

This can be a must-do to verify your legacy is protected and that your family members are looked after.

Coverage Variety and Choice Making: Unum Provident Lengthy Time period Care Insurance coverage

Selecting the correct long-term care insurance coverage is an important in your long term. It is like opting for the very best trip for an extended adventure—you need one thing dependable, reasonably priced, and adapted in your explicit wishes. Do not simply leap on any coverage; perceive the nuances to make your best option.This segment delves into the method of settling on a coverage, from figuring out the more than a few choices to operating with a monetary marketing consultant.

We will duvet crucial components like premiums, advantages, riders, and why a professional marketing consultant is your best possible guess.

Figuring out Coverage Premiums and Advantages

Coverage premiums and advantages are elementary facets of any long-term care coverage. Figuring out the standards influencing those components is helping you evaluate insurance policies successfully. Premiums rely on components like your age, well being, and the protection quantity you select. Upper protection most often interprets to raised premiums. Advantages confer with the monetary fortify supplied in case of long-term care wishes.

Other insurance policies be offering more than a few get advantages quantities and day-to-day cost schedules.

Comparing Other Coverage Options

Insurance policies be offering more than a few options, and selecting the proper ones depends upon person instances. Key options to imagine come with the varieties of care coated (e.g., nursing domestic, assisted dwelling), day-to-day get advantages quantities, and the period of protection. Some insurance policies will have caps on overall advantages paid, which is a vital attention. Insurance policies additionally range of their ready classes sooner than advantages start.

Figuring out those specifics is an important for matching the coverage in your expected wishes.

Evaluating Coverage Riders and Upload-ons

Riders and add-ons are non-compulsory options that may toughen your coverage. Those additions can lengthen protection or tailor it to express eventualities. For instance, a rider may duvet inflation coverage, permitting advantages to stay tempo with emerging care prices. Any other commonplace rider may duvet the next day-to-day get advantages quantity. Cautious attention of those add-ons is very important for optimizing your protection.

Operating with a Certified Monetary Guide

A certified monetary marketing consultant is a useful asset within the procedure. They may be able to let you overview your explicit monetary state of affairs, perceive your long-term care wishes, and counsel appropriate insurance policies. They are going to additionally information you within the decision-making procedure, factoring in premiums, advantages, and the full price of care. They are your relied on spouse, making sure your alternatives align together with your objectives.

They may be able to additionally supply insights into the monetary implications of various coverage choices, making sure you are making the most efficient resolution in your long term.

Lengthy-Time period Care Insurance coverage and the Unum Supplier

Selecting the correct long-term care insurance coverage is an important for peace of thoughts, particularly as we grow older. Unum has been a distinguished participant on this house, providing choices that many other folks in finding useful. Let’s dive into why Unum could be a good selection for you.Unum sticks out for its complete long-term care insurance coverage choices. They have were given a forged monitor report, and their products and services are sponsored by way of a dedication to buyer delight.

Figuring out Unum’s manner permit you to make a good move.

Advantages of Opting for Unum

Unum supplies a variety of advantages that may ease your worries about long term care wishes. They provide versatile protection choices to suit various wishes and budgets, making it more uncomplicated to discover a plan that works for you.

- Versatile Protection Choices: Unum understands that everybody’s state of affairs is exclusive. Their plans be offering alternatives in the case of day-to-day dwelling help, healthcare products and services, and extra. This implies you’ll tailor your protection in your explicit necessities, making sure you might be well-prepared for more than a few situations.

- Aggressive Premiums: Unum ceaselessly supplies aggressive premiums in comparison to different insurers. Whilst costs can range relying on components like age, well being, and protection quantity, Unum normally strives to be reasonably priced and available.

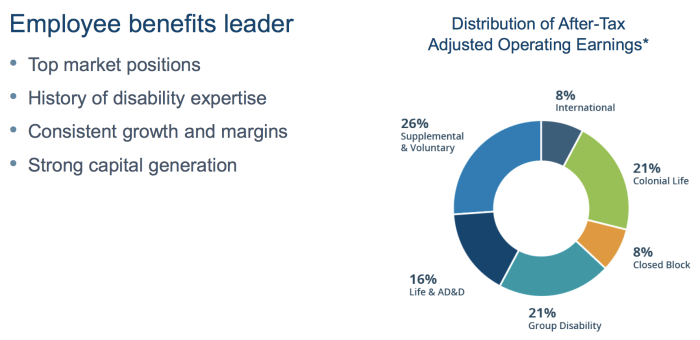

- Robust Monetary Balance: Unum’s monetary steadiness is a key issue. A financially sound corporate is much more likely to honor its commitments and supply long-term care advantages. This can be a an important facet to imagine when opting for a supplier.

Unum’s Buyer Carrier

Customer support is paramount. Unum’s dedication to buyer delight shines via of their interactions with policyholders.

- Certain Opinions and Scores: Many purchasers reward Unum’s responsiveness and helpfulness. Unum’s customer support receives prime marks, constantly hanging them a number of the higher gamers within the trade.

- Obtainable Strengthen Channels: Unum normally supplies more than a few tactics to hook up with their customer support group. This may come with telephone fortify, e-mail, or on-line portals.

Unum’s Historical past and Recognition

Unum’s historical past within the long-term care insurance coverage trade is a major factor.

- Established Monitor File: Unum has a long-standing historical past of offering long-term care insurance coverage, construction a name that displays their dedication to policyholders.

- Trade Popularity: Unum has earned reputation for its willpower to providing dependable and faithful protection.

Unum’s Dedication to Buyer Delight

Unum actively demonstrates its dedication to buyer delight.

- Buyer-Targeted Way: Unum ceaselessly makes a speciality of figuring out and addressing the particular wishes of its policyholders. This guarantees a adapted solution to protection and repair.

- Steady Growth: Unum constantly seems to be for methods to toughen its products and services and merchandise. They most often incorporate comments to make their processes and choices higher for his or her consumers.

Unum’s Monetary Balance

Unum’s monetary power is a vital attention.

- Robust Monetary Scores: Unum normally receives favorable monetary rankings from impartial ranking businesses. Those rankings mirror the corporate’s skill to satisfy its monetary duties and handle its monetary steadiness. Dependable rankings are a transparent indicator of the corporate’s capability to satisfy guarantees made to policyholders.

- Confirmed Skill to Meet Duties: Unum’s historical past demonstrates a dedication to assembly its duties. This constant monitor report assures policyholders of the corporate’s capacity to offer advantages as promised.

Illustrative Case Research

Whats up, so you are looking to stage up your monetary sport, proper? Lengthy-term care insurance coverage ain’t just a few random factor; it is a severe funding on your long term, particularly as you grow older. Those case research will display you the way it can truly affect your pockets and peace of thoughts. Let’s dive in!

The Have an effect on of Lengthy-Time period Care Insurance coverage on a Circle of relatives’s Monetary Neatly-being

Believe a state of affairs: Budi, a a hit entrepreneur, is now in his 60s and calls for help with day-to-day actions. With out long-term care insurance coverage, his circle of relatives would face a vital monetary burden. The price of domestic care, assisted dwelling, or nursing domestic amenities can temporarily drain financial savings and affect the circle of relatives’s total monetary steadiness. However with a well-structured coverage, Budi’s circle of relatives may just use the protection to assist pay for care, making sure they do not have to dip into their retirement budget or promote property.

This proactive manner preserves circle of relatives sources and maintains their monetary well-being.

Opting for the Proper Protection

Selecting the proper protection is secret to meaking probably the most of long-term care insurance coverage. Protection varies very much, so figuring out your wishes is an important. Any person who anticipates wanting vital care would possibly require a extra complete coverage than any individual who expects minimum help. For instance, for those who wait for wanting the next stage of care, you may want a higher get advantages quantity.

Components like your present well being standing, way of life, and long term plans all play a task in figuring out the best protection.

Protective In opposition to Monetary Dangers

Lengthy-term care insurance coverage acts as a an important protect towards the monetary dangers related to getting old and attainable care wishes. It is like having a security web that is helping cushion the blow of sudden bills. With out it, the prices of care may just temporarily fritter away your financial savings, doubtlessly jeopardizing your retirement plans. With long-term care insurance coverage, you’ll safeguard your monetary long term and handle a relaxed way of life, even right through instances of want.

Monetary Penalties of Now not Having Lengthy-Time period Care Insurance coverage, Unum provident longer term care insurance coverage

Believe a state of affairs the place any individual wishes vital care however lacks long-term care insurance coverage. The prices can temporarily pile up, doubtlessly depleting financial savings and different property. This may end up in monetary pressure on members of the family who may must shoulder the weight of care bills. The emotional toll will also be immense as properly, with members of the family having to navigate the demanding situations of offering care.

This monetary pressure can create immense emotional and sensible issues.

Using Unum Lengthy-Time period Care Insurance coverage to Cope with Explicit Wishes

Unum Lengthy-Time period Care Insurance coverage provides more than a few choices to handle person wishes. For instance, a unmarried policyholder may make a selection a particular get advantages quantity and form of care they need to duvet. This permits people to tailor their protection to satisfy their distinctive instances. Via operating with a Unum marketing consultant, you’ll talk about your personal wishes and in finding the coverage that most closely fits your necessities, making sure a adapted monetary answer in your wishes.

Key Concerns for Policyholders

Staying on most sensible of your Unum long-term care insurance coverage is an important for a easy enjoy. It is like having a competent pal on your nook, at all times there to assist when you want it. Common critiques and figuring out the main points will stay your coverage operating as arduous as you want it to.Figuring out your coverage, commonplace considerations, and the way to care for claims are crucial portions of a excellent policyholder enjoy.

This is helping make sure you’re now not stuck off guard when sudden occasions rise up.

Common Coverage Evaluation

Often reviewing your Unum long-term care insurance coverage is necessary. Adjustments on your monetary state of affairs, circle of relatives dynamics, and even simply normal lifestyles occasions can affect your wishes. A annually overview guarantees your coverage stays aligned together with your present necessities. That is like checking your dresser—in case your wishes alternate, your insurance coverage wishes to evolve too.

Not unusual Policyholder Considerations

Some policyholders may fear about declare denials or the method itself. Others could be inquisitive about figuring out the advanced language. Addressing those considerations without delay is vital. Unum supplies sources and fortify to assist navigate any hurdles. It is like having a useful concierge to reply to your questions and get to the bottom of any problems.

Ceaselessly Requested Questions (FAQs)

- Figuring out Coverage Phrases: Policyholders will have to meticulously overview coverage phrases and prerequisites. They outline the protection limits, exclusions, and your rights and duties. Those are the principles of the sport. Know them inside and outside.

- Declare Submitting Procedure: Unum’s declare submitting procedure is easy. Their site and customer support channels be offering transparent steerage and fortify. It is like a well-marked trail, making the declare procedure simple to practice.

- Coverage Updates: Insurance policies may want updates because of lifestyles adjustments. Common communique and coverage changes are crucial. You must keep knowledgeable about any adjustments in your coverage.

- Price Concerns: Coverage prices can range in line with your preferred protection and advantages. Evaluating other choices and figuring out the monetary implications is very important. That is like opting for the most efficient deal in your funds.

Figuring out Coverage Phrases and Prerequisites

Coverage phrases and prerequisites are the advantageous print that Artikel your protection, exclusions, and boundaries. They’re crucial for making knowledgeable selections. Figuring out those components is an important to steer clear of any surprises. This is sort of a detailed map of your insurance coverage.

Submitting Claims with Unum

Unum supplies a streamlined declare submitting procedure, normally with on-line portals and devoted buyer fortify. A step by step procedure is most often Artikeld on their site. Having a transparent procedure in position guarantees that says are processed successfully. It is like having a well-oiled device in your declare submission.

Ultimate Conclusion

In conclusion, securing long-term care insurance coverage is a crucial step in protective your monetary long term. Unum provident longer term care insurance coverage provides a variety of choices, however cautious attention of your explicit wishes and an intensive figuring out of the coverage main points are paramount. Via integrating this an important protection into your monetary plan and consulting with a professional marketing consultant, you’ll navigate the method with self belief and safeguard your long term.

Questions Frequently Requested

What are the several types of long-term care insurance coverage insurance policies?

Lengthy-term care insurance coverage insurance policies usually fall into conventional, hybrid, and structured agreement classes, every with various protection choices and premiums. Researching those choices will let you decide which most accurately fits your wishes.

How a lot does long-term care insurance coverage normally price?

Lengthy-term care insurance coverage premiums range in line with components akin to age, well being, protection quantity, and the particular coverage decided on. Visit a monetary marketing consultant to estimate attainable prices.

What’s the claims procedure for Unum long-term care insurance coverage?

Unum’s claims procedure normally comes to filing required documentation, adhering to express timelines, and speaking with Unum’s claims division. Evaluation the coverage main points for explicit procedures.

How can I estimate long term long-term care prices?

Imagine present and projected inflation, attainable care wishes, and the typical prices for care on your area. Seek the advice of monetary advisors for extra personalised estimates.