Thrifty automobile condo insurance coverage charge is a the most important issue for any traveler making plans a shuttle. Navigating the complexities of protection choices, hidden charges, and ranging charges can really feel overwhelming. This in-depth exploration will demystify the prices related to Thrifty automobile condo insurance coverage, equipping you with the data to make advised choices and get monetary savings to your subsequent journey.

From figuring out the fundamentals of Thrifty’s insurance coverage insurance policies to evaluating them with different condo firms, this information covers the whole thing you wish to have to understand. We’re going to spoil down the standards influencing costs, read about quite a lot of protection choices, and provide methods for minimizing prices. Get ready to discover the secrets and techniques at the back of securing the most efficient conceivable condo insurance coverage deal.

Working out Thrifty Automobile Condo Insurance coverage

Thrifty automobile condo insurance coverage, an important element of any condo settlement, safeguards vacationers in opposition to monetary burdens stemming from unexpected occasions all through their adventure. It supplies a security internet, making sure that any harm or coincidence is treated successfully and with out over the top private charge. Comprehending the intricacies of this insurance coverage is the most important for making advised choices and making sure a clean condo revel in.

Definition of Thrifty Automobile Condo Insurance coverage

Thrifty automobile condo insurance coverage includes a suite of protection choices designed to give protection to renters from liabilities related to automobile harm or injuries all through their condo length. It acts as a monetary buffer, shielding the renter from doubtlessly really extensive out-of-pocket bills.

Key Options and Advantages

The principle advantages of Thrifty automobile condo insurance coverage are coverage in opposition to monetary losses coming up from injuries, harm, or robbery of the condo automobile. This insurance coverage continuously covers quite a lot of eventualities, similar to collision harm, legal responsibility, and private harm. It permits for a worry-free commute revel in, specializing in the adventure quite than the potential of monetary repercussions.

Protection Choices

Thrifty automobile condo insurance coverage generally gives a lot of protection choices, every adapted to express wishes and cases. Those come with legal responsibility protection, protective the renter from claims via 3rd events; collision protection, safeguarding the condo automobile in opposition to harm from collisions; and complete protection, offering coverage in opposition to a much broader vary of damages, similar to vandalism or robbery. Those quite a lot of protection ranges cope with a spectrum of doable dangers.

Comparability with Different Automobile Condo Insurance coverage

Evaluating Thrifty automobile condo insurance coverage with different suppliers finds nuanced variations in protection ranges and related prices. Whilst particular options and pricing constructions range between suppliers, Thrifty gives a complete vary of choices, aiming to offer ok coverage for varied scenarios. Evaluating the particular inclusions and exclusions of every possibility is significant to creating an appropriate selection.

Elements Influencing Price

A number of components play a task in figuring out the price of Thrifty automobile condo insurance coverage. Those come with the period of the condo length, the kind of automobile rented, and the selected protection choices. Condo period is a significant component, as longer leases generally incur upper insurance coverage premiums. The kind of automobile, together with its price and doable for harm, could also be a key determinant.

Moreover, the particular selected protection ranges, together with the level of legal responsibility coverage and complete protection, without delay affect the general charge.

Protection Choices and Prices

| Protection Sort | Description | Estimated Price (USD) |

|---|---|---|

| Legal responsibility Protection | Protects in opposition to claims via 3rd events concerned with an coincidence. | $10-$30 in keeping with day |

| Collision Protection | Covers harm to the condo automobile from collisions. | $15-$40 in keeping with day |

| Complete Protection | Covers harm to the condo automobile from occasions rather than collisions, similar to vandalism or robbery. | $10-$30 in keeping with day |

Notice: Those are estimated prices and might range in accordance with particular condo stipulations and protection possible choices. All the time seek the advice of the Thrifty automobile condo insurance coverage for actual main points.

Elements Affecting Insurance coverage Prices

The price of automobile condo insurance coverage, like a mild tapestry, is woven from quite a lot of threads. Working out those threads permits discerning vacationers to make advised choices, making sure a clean and worry-free condo revel in. Elements starting from private traits to the specifics of the condo itself affect the general value. This complete glance will light up the important thing parts impacting your Thrifty automobile condo insurance coverage premiums.

Age and Using Historical past

Condo automobile insurance coverage premiums are continuously suffering from the renter’s age and using historical past. More youthful drivers, generally, face upper premiums because of their statistically upper coincidence possibility. A blank using file, then again, can mitigate those prices, demonstrating accountable using behavior. Skilled drivers with a historical past of secure operation, conversely, are continuously granted decrease charges. This displays a discounted chance of incidents, aligning with the main of possibility review in insurance coverage.

Condo Length, Thrifty automobile condo insurance coverage charge

The period of the condo performs an important position in figuring out the insurance coverage charge. Shorter leases normally command decrease premiums in comparison to prolonged classes. It’s because the danger of an incident over a shorter length is decrease. Longer leases, then again, raise a better doable for harm or injuries, main to raised premiums. This concept is very similar to different sorts of insurance coverage, the place the longer the protection length, the upper the top class.

Protection Stage

The extent of protection decided on without delay affects the top class. Upper protection ranges, together with complete and collision insurance coverage, supply wider coverage in opposition to quite a lot of doable damages. In consequence, those choices include the next ticket. Conversely, fundamental protection supplies extra restricted coverage and normally ends up in decrease premiums. The number of protection without delay displays the renter’s desired stage of coverage and funds.

Deductibles

Deductibles are every other key issue influencing insurance coverage prices. The next deductible approach a decrease top class. It’s because the renter assumes a better monetary accountability in case of an coincidence. The renter must believe the trade-off between decrease premiums and doable out-of-pocket prices in case of wear and tear. Settling on the next deductible is a monetary resolution balancing charge financial savings with doable legal responsibility.

Condo Location

The site of the condo performs a essential position in figuring out the insurance coverage charge. Spaces with upper coincidence charges or particular dangers, similar to spaces with upper charges of robbery, have a tendency to have upper premiums. Insurance coverage firms analyze those components to regulate pricing. This displays the variable possibility profiles throughout other places, highlighting the significance of location-specific possibility review.

Condo Length vs. Price Comparability

| Condo Length (Days) | Estimated Insurance coverage Price (USD) |

|---|---|

| 3 | 50-75 |

| 7 | 100-150 |

| 14 | 150-250 |

| 21 | 200-300 |

This desk supplies a basic representation of the way insurance coverage prices would possibly range with various condo intervals. The precise figures depends on different components, together with the renter’s profile and the selected protection stage. Notice that those figures are estimates and might range relying on particular cases.

Price Comparability and Possible choices

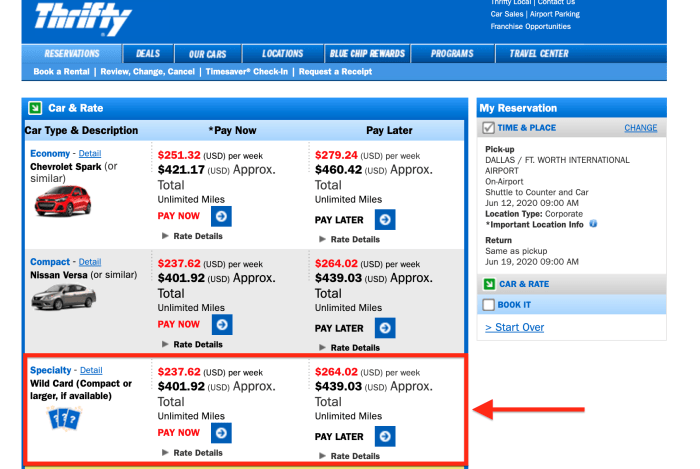

Evaluating the price of Thrifty automobile condo insurance coverage with different condo firms and figuring out choice choices is the most important for vacationers searching for essentially the most economical and complete coverage. A meticulous research of various protection ranges and add-on choices will help make advised choices. Figuring out the advantages of buying insurance coverage as opposed to forgoing it, and techniques to cut back prices, are very important parts in making plans a budget-friendly commute revel in.Working out the standards influencing Thrifty’s insurance coverage prices, along evaluating costs with different condo firms, supplies a clearer image of the to be had possible choices.

This permits for a extra calculated decision-making procedure, making sure vacationers are well-prepared and safe all through their travels.

Price Comparability of Automobile Condo Insurance coverage

Condo firms, like Thrifty, continuously be offering a spread of insurance coverage programs. Evaluating the price of Thrifty’s insurance coverage with the ones of alternative main condo firms supplies a complete figuring out of pricing permutations. This comparability considers components similar to protection ranges, deductibles, and add-on choices. A radical comparability desk can illustrate those variations in pricing constructions.

| Condo Corporate | Fundamental Insurance coverage Price (USD) | Average Insurance coverage Price (USD) | Complete Insurance coverage Price (USD) |

|---|---|---|---|

| Thrifty | 50-75 | 75-125 | 100-150 |

| Finances | 45-60 | 70-100 | 90-130 |

| Endeavor | 55-80 | 80-130 | 110-160 |

| Avis | 60-85 | 90-140 | 120-170 |

Notice: Costs are estimates and will range in accordance with components similar to the kind of automobile, condo period, and particular add-on choices.

Examples of Thrifty Automobile Condo Insurance coverage Insurance policies

Thrifty gives quite a lot of insurance coverage insurance policies with various protection ranges. Those insurance policies are designed to cater to other wishes and budgets. Examples of those insurance policies are supplied beneath.

- Fundamental Coverage: This coverage supplies the minimal required protection. It normally covers legal responsibility, however the deductible could be prime. The advantage of this coverage is the cheaper price.

- Average Coverage: This coverage gives a broader protection in comparison to the elemental coverage. It would come with collision and complete protection with a rather upper deductible. That is continuously a excellent stability between charge and protection.

- Complete Coverage: This coverage gives essentially the most intensive protection. It covers damages to the condo automobile from virtually any incident, with a decrease deductible. This selection supplies peace of thoughts for vacationers.

Upload-on Protection Choices for Thrifty

Thrifty gives add-on protection choices, together with choices like further motive force protection, roadside help, and supplemental legal responsibility protection. Those choices can build up the associated fee however too can supply extra complete coverage.

- Further Driving force Protection: This selection covers the price of damages led to via an extra motive force, protective the renter from monetary legal responsibility.

- Roadside Help: This add-on can give help in case of breakdowns or different emergencies at the street. It is a precious possibility for vacationers in unfamiliar places.

- Supplemental Legal responsibility Protection: This protection possibility extends legal responsibility coverage past the desired minimal, offering the next stage of safety.

Advantages of Buying Thrifty Automobile Condo Insurance coverage

Buying Thrifty automobile condo insurance coverage supplies important advantages. It protects the renter from monetary accountability in case of injuries or damages to the condo automobile.

- Monetary Coverage: Insurance coverage protects in opposition to monetary loss within the tournament of an coincidence or harm to the condo automobile. This is very important for making sure a relaxing commute revel in.

- Peace of Thoughts: Figuring out that you’ve ok insurance coverage permits vacationers to concentrate on taking part in their shuttle with out being concerned about doable monetary repercussions.

Tactics to Probably Cut back Thrifty Automobile Condo Insurance coverage Prices

A number of methods can lend a hand cut back the price of Thrifty automobile condo insurance coverage.

- Decrease Protection Stage: Choosing a decrease protection stage can considerably cut back the price of insurance coverage. Assess the prospective dangers and the will for complete protection.

- Examine Insurance policies: Evaluating insurance coverage insurance policies from other condo firms may end up in higher offers.

- Imagine Commute Insurance coverage: Some commute insurance coverage would possibly come with automobile condo insurance policy, doubtlessly offering a extra complete bundle.

Financial savings from Decrease Protection Ranges

Decreasing the protection stage on Thrifty automobile condo insurance coverage may end up in really extensive financial savings. The desk beneath demonstrates doable financial savings in accordance with other protection ranges.

| Protection Stage | Estimated Price (USD) | Doable Financial savings (USD) |

|---|---|---|

| Fundamental | 75 | 0 |

| Average | 100 | 25 |

| Complete | 150 | 75 |

Protection Main points and Choices

Working out the quite a lot of protection choices inside of Thrifty automobile condo insurance coverage is the most important for making advised choices. Every possibility gives other ranges of coverage, and figuring out the specifics will allow you to make a selection the most efficient are compatible to your wishes. This phase will element the other protection choices, their phrases, and their exclusions, permitting you to choose essentially the most appropriate coverage to your condo.The other insurance coverage choices to be had from Thrifty automobile condo will continuously come with complete protection, collision protection, and legal responsibility protection.

Working out the particular main points of every protection sort, together with what’s and is not coated, is very important for choosing the right plan.

Complete Protection

Complete protection, a the most important element of Thrifty’s condo insurance coverage, protects in opposition to damages led to via occasions past your regulate, similar to weather-related incidents, vandalism, or robbery. It is going past the usual collision protection, offering an additional layer of safety. It’s essential notice that this protection can range relating to what’s in particular excluded, so cautious assessment of the nice print is essential.

Collision Protection

Collision protection in particular protects in opposition to harm to the condo automobile due to a collision with every other automobile or an object. It covers maintenance or alternative, although you’re at fault within the coincidence. Collision protection is continuously an important a part of Thrifty’s insurance coverage programs. This protection is vital as it mitigates the monetary burden of wear and tear to the condo automobile.

Legal responsibility Protection

Legal responsibility protection is every other vital element of condo insurance coverage. It protects you from monetary accountability when you reason an coincidence that leads to accidents or damages to someone else or their belongings. Legal responsibility protection is needed in lots of jurisdictions and is a basic side of accountable using. This protection supplies a security internet for the ones unlucky cases.

Further Coverage Choices

Thrifty might be offering further choices like loss harm waivers (LDW) or supplemental coverage for added peace of thoughts. Those choices generally upload extra coverage and will be offering extra complete protection, however with greater prices. Working out those additional choices can lend a hand in you make a decision that aligns together with your funds and possibility tolerance.

Protection Limits

| Protection Sort | Protection Restrict (Instance) |

|---|---|

| Complete | $50,000 USD |

| Collision | $50,000 USD |

| Legal responsibility | $100,000 USD in keeping with particular person / $300,000 USD in keeping with incident |

This desk supplies a pattern of protection limits. Exact limits might range relying at the particular condo settlement and the selected protection choices. Reviewing the particular main points of the insurance coverage is the most important to grasp the fitting protection limits presented.

Working out Exclusions

“Exclusions are stipulations beneath which the insurance coverage does now not observe.”

Sparsely assessment the exclusions indexed to your Thrifty automobile condo insurance coverage. Those exclusions Artikel scenarios the place the protection does now not observe, similar to pre-existing harm to the automobile or harm led to via intentional acts. Working out the exclusions will allow you to keep away from surprises in case of an incident. Examples of doable exclusions come with damages led to via put on and tear, pre-existing harm, or harm from positive sorts of misuse.

The cautious assessment of exclusions is paramount for figuring out the real extent of protection.

Methods for Saving Cash

Securing inexpensive automobile condo insurance coverage with Thrifty calls for a strategic manner. Working out the standards influencing prices and exploring to be had reductions can considerably cut back bills. This phase Artikels quite a lot of strategies for attaining cost-effective automobile condo insurance coverage.

Negotiating the Easiest Charge

Efficient negotiation is the most important for acquiring essentially the most favorable insurance coverage charges. Thorough analysis into the present marketplace charges for identical protection is very important. Presenting this data to the Thrifty consultant demonstrates your figuring out and permits for a extra advised dialogue. Flexibility in protection choices will also be an impressive instrument in negotiations. As an example, decreasing the surplus quantity for harm protection can yield a discount within the total top class.

Exploring Reductions

Thrifty, like many condo firms, gives quite a lot of reductions. Working out those may end up in important financial savings. Those continuously come with reductions for loyalty systems, affiliations, or particular bookings. Often checking for promotional gives and bundled programs is vital.

Evaluating Quotes

Evaluating quotes from a couple of suppliers, together with Thrifty and different condo firms, is essential for purchasing the most efficient conceivable price. Web pages that specialize in commute insurance coverage comparisons can lend a hand bring together quotes from quite a lot of suppliers, offering a complete evaluation of choices and charges. This empowers you to make a well-informed resolution.

Working out the Superb Print

Thorough exam of the nice print within the Thrifty automobile condo insurance coverage is the most important. Sparsely reviewing all phrases, stipulations, and exclusions guarantees a transparent figuring out of what’s and is not coated. This detailed research is helping keep away from sudden prices or surprises all through the condo length. Paying shut consideration to the coverage’s deductible and extra quantities is very important to understand the monetary implications of doable damages.

Desk of Reductions

| Bargain | Prerequisites |

|---|---|

| Loyalty Program Bargain | Necessities range; generally contain club and a definite selection of leases. |

| Pupil Bargain | Evidence of scholar standing is normally required. |

| Army Bargain | Legitimate army id is wanted. |

| Company Bargain | Club in a identified company program. |

| Commute Agent Bargain | Reserving via a commute agent continuously qualifies. |

Visible Illustration of Information: Thrifty Automobile Condo Insurance coverage Price

Presenting information in a visually compelling approach is the most important for figuring out complicated data like thrifty automobile condo insurance coverage prices. Visible aids, similar to infographics and charts, aid you take hold of patterns, developments, and comparisons. This phase will discover other visible representations for example the standards impacting thrifty automobile condo insurance coverage prices, making an allowance for a deeper comprehension of the topic.

Elements Influencing Thrifty Automobile Condo Insurance coverage Prices

Visualizing the standards influencing thrifty automobile condo insurance coverage prices is helping in figuring out the complicated interaction of variables. An infographic, preferably a round diagram with interconnected sections, would obviously show those components. The central hub may constitute the bottom charge of insurance coverage, radiating outwards to classes like motive force profile (age, revel in, and using file), automobile sort (make, type, and 12 months), condo period, and not obligatory add-ons (e.g., roadside help).

Every phase would constitute a particular issue, and the scale or colour depth of every phase would correspond to its relative affect at the total charge. A legend would supply transparent definitions for every issue.

Pattern of Thrifty Automobile Condo Insurance coverage Prices Over Time

As an instance the craze of thrifty automobile condo insurance coverage prices through the years, a line graph can be most fitted. The x-axis would constitute the time frame (e.g., years), and the y-axis would constitute the associated fee. The graph would display the upward or downward pattern of insurance coverage premiums. As an example, a frequently emerging line would recommend an expanding pattern in insurance coverage prices over time.

One of these graph will also be precious in figuring out any doable spikes or important fluctuations. It might permit for a comparability of prices throughout other time classes.

Comparability of Thrifty Automobile Condo Insurance coverage Choices

A bar chart successfully compares the prices of various thrifty automobile condo insurance coverage choices. The x-axis would listing the quite a lot of choices (e.g., fundamental, complete, and supplemental protection), and the y-axis would constitute the corresponding charge. Every bar’s top would correspond to the insurance coverage charge for that exact possibility. This visible illustration permits for an instantaneous comparability of the associated fee variations between quite a lot of protection ranges.

Developing an Efficient Infographic

An efficient infographic calls for a transparent figuring out of the objective target audience and the important thing message to be conveyed. First, determine the core information issues. Then, choose a visually interesting structure. Imagine the usage of icons and illustrations to fortify figuring out. Take care of a constant colour palette.

Use transparent and concise labels for every part. The infographic must be simple to learn and perceive at a look.

Illustrating Other Ranges of Protection

A easy, visually attractive representation showcasing the other ranges of protection generally is a sequence of concentric circles. The innermost circle represents the elemental protection, whilst the following circles constitute expanding ranges of protection. Every circle would constitute an extra stage of coverage, similar to further legal responsibility protection, collision harm waiver, or complete protection. A transparent legend explaining every stage of protection is essential.

This visible illustration would allow a snappy figuring out of the other ranges of coverage presented.

Components of a Visually Enticing Graph

A visually attractive graph must be simply comprehensible at a look. The usage of suitable colours and fonts is the most important. Colours must be selected to put across particular meanings and evoke the specified emotion. Transparent and concise labels must be used for the axes and any information issues. A compelling identify will lend a hand to grasp the reader’s consideration.

Suitable legends will lend a hand in decoding the knowledge issues successfully. A wonderful and related background would additional fortify the visualization.

Closure

In conclusion, figuring out Thrifty automobile condo insurance coverage charge empowers vacationers to make savvy possible choices. By way of examining the quite a lot of components influencing premiums, evaluating choices, and adopting cost-saving methods, you’ll be able to safe the perfect protection with out breaking the financial institution. Take into accout, wisdom is energy, and this information fingers you with the gear to navigate the arena of vehicle condo insurance coverage with self belief and get monetary savings to your subsequent shuttle.

Choosing the proper protection guarantees a clean and worry-free adventure.

Query Financial institution

What are the everyday deductibles presented with Thrifty automobile condo insurance coverage?

Thrifty generally gives a spread of deductibles, from low to prime. The particular quantities range relying at the selected protection stage.

How does the condo location have an effect on the insurance coverage charge?

Condo places with upper dangers of wear and tear or robbery will have upper insurance coverage premiums. Thrifty’s pricing displays those localized components.

Can I cut back the price of Thrifty automobile condo insurance coverage via negotiating the velocity?

Sure, negotiating could also be conceivable, however it is determined by the particular cases and Thrifty’s insurance policies. It is value inquiring about conceivable reductions or particular gives.

What are some not unusual reductions to be had for Thrifty automobile condo insurance coverage?

Thrifty would possibly be offering reductions for AAA individuals, loyalty systems, or different affiliations. Test their web site for present promotions and reductions.