Safeco auto insurance coverage condominium automotive protection: Navigating the complexities of defending your condominium car is more straightforward than you suppose. This complete information explores the intricacies of Safeco’s condominium automotive insurance coverage, outlining same old protection, choices, and doable barriers. We’re going to additionally dive into protection limits, deductibles, and how you can report claims in quite a lot of situations, empowering you to make knowledgeable choices about your condominium coverage.

Figuring out the precise phrases and prerequisites, together with coverage language and doable exclusions, is vital to maximizing your protection. We’re going to supply a transparent comparability of Safeco’s protection towards competition, empowering you to make a choice essentially the most appropriate plan. This information additionally covers including condominium automotive protection in your present coverage, and optimizing prices. In the end, we wish you to hopefully hire understanding your precious funding is secure.

Figuring out Condominium Automobile Protection

Safeco’s condominium automotive protection is designed to offer protection to you in case of an coincidence or injury to a condominium car. This protection extends past your own car insurance coverage, offering a security internet when you find yourself using a borrowed automotive. Figuring out the specifics of this protection is an important for heading off monetary burdens all through a condominium automotive incident.Safeco’s condominium automotive protection provides a complete protection internet, offering coverage towards quite a lot of dangers related to condominium automotive utilization.

This comprises complete coverage towards injuries, damages, and different sudden occasions that would possibly happen whilst the usage of a condominium car.

Usual Protection Supplied by means of Safeco

Safeco’s same old condominium automotive protection in most cases comprises legal responsibility coverage, very similar to the protection of your own auto coverage. This implies Safeco pays for damages you reason to every other celebration’s car or accidents you inflict on them, as much as coverage limits. Alternatively, it won’t duvet damages to the condominium car itself. This coverage is an important for combating you from being held for my part accountable for important monetary losses.

Condominium Automobile Protection Choices

Safeco provides quite a lot of protection choices to fulfill other wishes. A complete protection choice regularly extends to the car itself, masking damages without reference to who’s at fault. This complete protection supplies coverage towards a much wider vary of doable incidents. A fundamental choice would possibly solely duvet damages brought about by means of you, whilst a complete protection coverage would possibly supply broader coverage.

The selection of protection is determined by your own wishes and possibility tolerance.

Examples of Protection Activation

Condominium automotive protection may also be activated in a large number of eventualities. As an example, in case you are taken with a collision whilst using a condominium automotive, and the opposite celebration is at fault, your Safeco protection will most likely kick in. In a similar way, if the condominium automotive suffers injury because of vandalism or robbery, Safeco’s protection would possibly supply reimbursement. The protection will even regularly turn on in eventualities involving weather-related injury, comparable to a flood or a typhoon.

Comparability with Different Main Insurance coverage Suppliers

Safeco’s condominium automotive protection in most cases compares favorably to different primary suppliers. Alternatively, the precise phrases and prerequisites range between suppliers. Some suppliers would possibly be offering decrease deductibles, whilst others would possibly supply further advantages like roadside help. For instance, one supplier would possibly duvet injury because of pre-existing stipulations, whilst Safeco would possibly exclude such cases. Comparability buying groceries and cautious evaluate of coverage main points are an important to verify the most efficient protection to your wishes.

Possible Obstacles and Exclusions

It’s good to perceive the restrictions and exclusions of Safeco’s condominium automotive protection. For instance, injury brought about by means of pre-existing stipulations at the condominium automotive may not be lined. In a similar way, positive varieties of injury, like the ones brought about by means of intentional acts, could be excluded. Moderately reviewing the coverage report will disclose those specifics. The exclusions will have to be regarded as when making your selection.

Protection Comparability Desk

| Insurance coverage Supplier | Protection Kind | Deductible | Obstacles |

|---|---|---|---|

| Safeco | Complete Protection | $500 | Injury brought about by means of pre-existing stipulations, injury because of intentional acts. |

| XYZ Insurance coverage | Complete Protection | $1000 | Excludes injury from put on and tear, injury because of negligence by means of the renter. |

| ABC Insurance coverage | Legal responsibility Best | $250 | Does no longer duvet injury to the condominium car, solely legal responsibility to others. |

Protection Limits and Deductibles

Safeco’s condominium automotive insurance policy protects you when you have an coincidence whilst using a condominium car. Figuring out the boundaries and deductibles of this protection is an important to managing doable prices and making sure you might be adequately secure. This phase main points the everyday protection limits, to be had deductibles, and the way they impact your declare procedure.Condominium automotive protection, like different insurance coverage insurance policies, operates with outlined limits and deductibles.

Those elements considerably affect the monetary implications of a declare. Opting for an appropriate deductible can stability the price of premiums towards doable out-of-pocket bills within the match of an coincidence.

Protection Limits

Safeco’s condominium automotive insurance coverage in most cases supplies protection for damages as much as a selected prohibit. This prohibit is the utmost quantity Safeco pays for upkeep or substitute of the condominium car in case of an coincidence. The precise prohibit would possibly range relying at the condominium settlement and Safeco’s coverage. Policyholders will have to at all times seek the advice of their explicit coverage paperwork for exact main points on protection limits.

Deductible Choices

Safeco normally provides quite a lot of deductible choices for condominium automotive protection. A deductible is the quantity you might be answerable for paying out-of-pocket sooner than Safeco steps in to hide the rest prices. Decrease deductibles typically lead to upper per 30 days premiums, whilst upper deductibles scale back premiums however building up your monetary accountability in case of an coincidence.

Have an effect on of Deductible Quantity on Claims

The deductible quantity without delay affects the price of a declare. The next deductible approach a smaller top class however a bigger out-of-pocket expense if a declare arises. Conversely, a decrease deductible results in a better top class however much less monetary burden in case of an coincidence. For instance, a $500 deductible approach you pay $500 in advance, and Safeco covers the rest quantity as much as the coverage prohibit.

A $1000 deductible would imply you pay $1000, and Safeco covers the remaining.

Declare Submitting Procedure

Submitting a declare for a condominium automotive coincidence in most cases comes to reporting the incident to Safeco and offering supporting documentation, comparable to a police record, condominium settlement, and service estimates. Safeco will assess the declare and resolve the quantity of protection equipped in keeping with the coverage’s phrases.

Significance of Figuring out Protection Limits and Deductibles

Figuring out protection limits and deductibles permits you to make knowledgeable choices about your condominium automotive insurance coverage. A radical working out is helping in budgeting for doable bills and opting for the most efficient protection choices to your wishes and monetary scenario. The desk beneath supplies a comparative evaluate of various deductible choices and their related prices.

Deductible Quantities and Prices

| Deductible Quantity | Per thirty days Top class Build up | Declare Processing Time |

|---|---|---|

| $500 | $10 | 7 trade days |

| $1000 | $5 | 5 trade days |

Protection in Other Eventualities

Safeco’s condominium automotive protection supplies a security internet when sudden occasions happen whilst using a condominium car. Figuring out how this protection applies in quite a lot of eventualities, from minor fender benders to primary injuries, is an important for accountable renters. This phase main points Safeco’s condominium automotive protection software in numerous instances, outlining protection barriers and vital concerns.This phase delves into how Safeco’s condominium automotive protection safeguards policyholders in a wide selection of eventualities, starting from minor collisions to extra critical injuries.

It explains the protection’s software in several situations, together with injury brought about by means of 3rd events, and highlights cases the place protection won’t observe.

Minor Coincidence Protection

Safeco’s condominium automotive protection regularly extends to minor injuries, however the specifics rely on coverage main points. Policyholders will have to at all times take a look at their explicit coverage report for exact protection limits. Protection for minor injuries in most cases comes to injury upkeep throughout the coverage’s mentioned limits. This comprises deductibles, which would possibly range relying at the coverage.

3rd-Celebration Injury Protection

Safeco condominium automotive protection steadily covers injury to the condominium automotive brought about by means of a 3rd celebration. This coverage is typically to be had if the policyholder is deemed no longer at fault within the incident. The protection in most cases applies to the damages as a consequence of the 3rd celebration’s movements, matter to coverage limits and deductibles. Examples come with incidents like collisions brought about by means of every other driving force’s negligence or injury from every other car.

Scenarios The place Protection Would possibly No longer Observe

Safeco’s condominium automotive protection won’t observe in positive instances. This comprises eventualities the place the wear is because of pre-existing stipulations at the car or misuse by means of the renter. Moreover, if the renter is located at fault for the incident, protection is also restricted or unavailable, relying at the explicit coverage phrases. Different exclusions would possibly contain injury from herbal screw ups or intentional acts.

State of affairs-Primarily based Information to Protection Software

| State of affairs | Protection Software |

|---|---|

| Minor coincidence with minimum injury (e.g., a scratch) | Protection most likely applies, relying at the coverage’s deductible and boundaries. |

| Coincidence with considerable injury to the condominium automotive brought about by means of every other driving force | Protection most likely applies if the policyholder isn’t at fault. |

| Injury to the condominium automotive because of a pre-existing situation | Protection is not going to use. |

| Injury brought about by means of the renter’s reckless using | Protection could be restricted or unavailable. |

Claiming Protection in Case of a Main Coincidence

The method for claiming protection in a big coincidence comes to a number of steps. First, the policyholder should touch their Safeco consultant or the designated claims division. They wish to record the incident and supply essential main points, together with the coincidence location, date, time, and concerned events. Accumulating supporting documentation, comparable to police stories and service estimates, could also be an important for a easy declare processing.

Following the declare procedure Artikeld by means of Safeco is very important for a well timed and environment friendly solution.

Including Condominium Automobile Protection

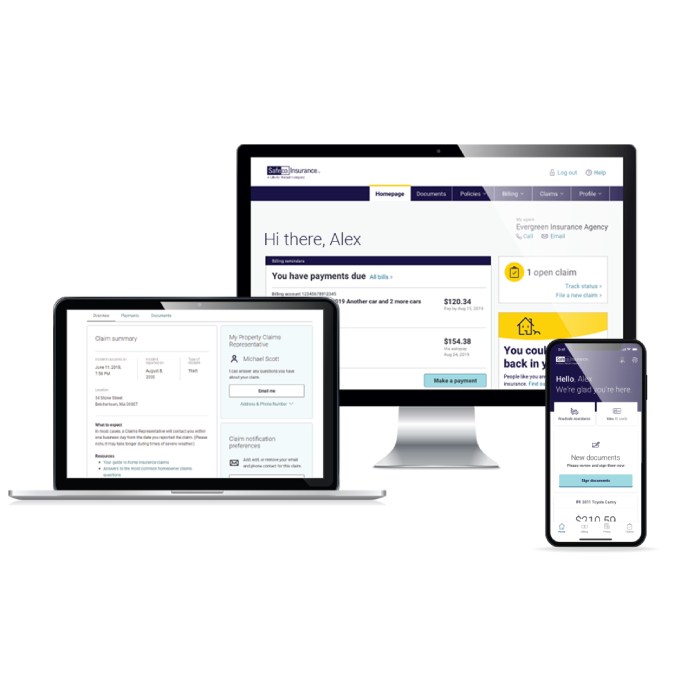

Including condominium automotive protection in your Safeco auto insurance plans supplies an important coverage when you want to hire a car. This protection extends your present coverage’s coverage past your individual automotive, providing monetary safety in quite a lot of instances. Figuring out the method and elements taken with including this protection is very important for making knowledgeable choices.Including condominium automotive protection is an easy procedure.

It is in most cases treated via your present insurance coverage agent or on-line portal. Components influencing the price of this protection range, regularly relying at the explicit phrases of your coverage and the condominium car’s traits.

Strategy of Including Condominium Automobile Protection

Including condominium automotive protection regularly comes to filing a request in your insurance coverage supplier. This may also be finished on-line, by means of telephone, or via your devoted insurance coverage agent. The precise steps and required data would possibly range moderately relying for your coverage sort and your insurance coverage supplier’s procedures. Assessment your coverage paperwork or touch your agent for essentially the most present and correct directions.

Components Influencing the Value of Condominium Automobile Protection

A number of elements affect the cost of including condominium automotive protection in your present Safeco coverage. Those elements come with:

- Protection Limits: Upper protection limits normally result in upper premiums. The quantity of protection you choose without delay affects the price.

- Deductible Quantity: The next deductible typically approach a decrease top class. It is a sum you pay out-of-pocket sooner than the insurance coverage corporate starts to pay.

- Coverage Kind: The precise form of Safeco auto insurance plans you hang, comparable to liability-only or complete protection, can impact the price of including condominium automotive protection. Extra complete insurance policies regularly come with or be offering extra beneficiant condominium automotive protection.

- Condominium Automobile Kind: The kind of condominium car you steadily use (e.g., a luxurious automotive or a compact automotive) would possibly affect the top class. That is because of elements just like the estimated charge of restore and substitute for quite a lot of varieties of cars.

- Condominium Duration: The period of the condominium duration can impact the top class quantity. An extended condominium duration normally approach a better top class.

Forms Required for Including Condominium Automobile Protection

The bureaucracy required so as to add condominium automotive protection would possibly range relying for your insurer’s procedures. Most often, the method comes to offering the next data:

- Coverage main points: Your Safeco coverage quantity and every other related coverage data.

- Condominium car main points: Details about the kind of condominium car you’ll be able to be using (e.g., make, style, yr).

- Condominium duration: Get started and finish dates of the condominium duration.

- Touch data: Your individual touch data and any additional info the insurer calls for.

Advantages of Buying Condominium Automobile Protection

Buying condominium automotive protection supplies considerable advantages. This protection regularly is helping give protection to you financially in eventualities the place your individual car is unavailable or broken.

- Monetary Coverage: Within the match of an coincidence or injury to a condominium automotive, the protection can assist reimburse the prices of upkeep, substitute, and even condominium charges.

- Peace of Thoughts: Realizing you could have condominium automotive protection can get rid of the concern and pressure related to sudden car problems.

- Felony Coverage: In some instances, condominium automotive protection is also required by means of the condominium corporate or essential to steer clear of felony repercussions.

Calculating the Value of Including Protection

Calculating the price of including condominium automotive protection to an present Safeco coverage calls for working out the various factors discussed previous. This charge is regularly decided in keeping with the precise phrases of your coverage and the options of the protection you choose. An in depth quote out of your insurer is normally essentially the most correct option to resolve the precise charge to your instances.

Figuring out Coverage Language: Safeco Auto Insurance coverage Condominium Automobile Protection

Navigating the superb print of your Safeco auto insurance coverage condominium automotive protection is an important for working out your rights and tasks. This phase delves into the important thing phrases, words, and the significance of cautious evaluate to verify a easy enjoy if you want to make use of the protection.Figuring out the coverage language prevents doable surprises and guarantees that you’re totally acutely aware of your responsibilities and the protection limits.

This comprises understanding the precise stipulations beneath which the protection applies, and how you can deal with any claims successfully.

Key Phrases and Definitions

A transparent working out of the phrases and words used on your condominium automotive protection coverage is very important. Get yourself up to speed with the precise language of your coverage. This may can help you perceive the level of your protection and the stipulations beneath which it applies. The next phrases are steadily used:

- Deductible: The quantity you pay out-of-pocket sooner than your insurance policy kicks in. This quantity varies relying for your coverage. For instance, a coverage would possibly have a $500 deductible for collision injury, that means you pay the primary $500 of restore prices your self.

- Collision Protection: Insurance coverage that covers injury in your car if it is taken with a collision, without reference to who’s at fault. This in most cases comprises injury from hitting every other automotive, a desk bound object, or an animal.

- Complete Protection: This protection protects towards injury in your car brought about by means of occasions rather than a collision. Examples come with vandalism, fireplace, hail, or robbery.

- Condominium Compensation: The portion of your coverage that covers condominium automotive bills in case your car is broken or rendered unusable because of a lined match. This regularly has its personal barriers and necessities.

- Exclusions: Particular eventualities or instances by which the condominium automotive protection is not going to observe. Those are regularly detailed within the coverage’s superb print.

- Coverage Limits: The utmost quantity your insurance coverage corporate pays for a declare. That is an important for working out how a lot protection you could have and whether or not you want further coverage.

Significance of Reviewing the High-quality Print, Safeco auto insurance coverage condominium automotive protection

Moderately reviewing the superb print is paramount for correct interpretation. The coverage’s explicit phrases and prerequisites govern the scope of your condominium automotive protection. Coverage wording can range from one insurer to every other, and the precise clauses on your Safeco coverage will resolve the level of your coverage. Ignoring the superb print may just result in misunderstandings and doubtlessly impact your talent to report a declare or obtain reimbursement.

All the time discuss with the reputable coverage report to grasp any doable barriers or restrictions.

Dealing with Unclear Coverage Issues

If any phase of your coverage is unclear, take the next steps:

- Touch Safeco without delay. Their customer support representatives may give explanation on ambiguous issues on your coverage.

- Assessment the coverage’s word list of phrases. Many insurance policies come with a word list to provide an explanation for explicit phrases in undeniable language.

- Search skilled recommendation. In case you are nonetheless not sure, consulting with an insurance coverage skilled allow you to interpret the coverage and determine doable gaps in protection.

Disputing a Declare According to Coverage Language

When you consider a declare has been treated incorrectly because of misinterpretation of the coverage language, practice those steps:

- Report the whole thing. Acquire all related coverage paperwork, correspondence, and proof associated with the declare.

- Touch Safeco’s customer support division. Give an explanation for your issues and request a evaluate of the declare in keeping with your coverage.

- Escalate the dispute if essential. If the preliminary solution is not ample, you may wish to escalate the topic to a better stage inside of Safeco.

- Believe in quest of felony recommend. In case you are not able to get to the bottom of the problem via Safeco’s inner channels, a felony skilled can advise for your rights and choices.

Pointers and Methods

Maximizing your condominium automotive protection comes to a strategic method. Figuring out your wishes, evaluating choices, and proactively managing doable problems are an important for minimizing prices and maximizing coverage. This phase supplies sensible recommendation to navigate the complexities of condominium automotive insurance coverage.Condominium automotive protection is a multifaceted resolution, and the best method hinges on cautious making plans and working out of the standards at play.

By means of using those methods, you’ll be able to be sure to’re well-prepared for any eventuality whilst minimizing monetary burdens.

Deciding on the Proper Condominium Automobile Protection

Condominium automotive insurance coverage choices range considerably, and selecting the proper one calls for cautious attention. Components just like the period of your condominium, the kind of car, and your present insurance plans all play a job. Assessment your own instances to resolve essentially the most suitable protection stage. Condominium firms regularly be offering a spread of choices, from fundamental legal responsibility to complete coverage.

Evaluate the price and scope of protection to resolve the most efficient are compatible.

Optimizing the Value of Condominium Automobile Protection

Condominium automotive insurance coverage may also be pricey, however optimizing the cost is achievable. Test for reductions introduced by means of your auto insurance coverage supplier. Many firms spouse with condominium companies to supply bundled reductions, which can lead to substantial financial savings. Assessment your present insurance plans for doable inclusions of condominium automotive protection. Believe the opportunity of self-insurance in instances the place the danger is low and the price is considerable.

Heading off Condominium Automobile Insurance coverage Claims

Minimizing the possibility of a declare is paramount for cost-effectiveness. Moderately evaluate the condominium settlement and be aware any explicit phrases associated with insurance coverage. Keep in mind of your setting and force cautiously to steer clear of injuries. Deal with the car in just right situation all through your condominium duration. Thorough documentation of the car’s situation upon pickup and go back is important.

By means of proactively combating incidents, you’ll be able to considerably scale back the danger of desiring to report a declare.

Figuring out Your Rights When Submitting a Declare

Figuring out your rights as a policyholder is an important all through the declare procedure. If an coincidence happens, promptly record it to the condominium corporate and native government. Acquire all related documentation, together with the police record, condominium settlement, and any witness statements. Deal with transparent and concise verbal exchange with the insurance coverage corporate. Be keen to supply all essential data to expedite the declare procedure.

Within the match of disputes, talk over with a felony skilled to grasp your choices.

Coping with a Condominium Automobile Insurance coverage Corporate

When coping with the insurance coverage corporate, care for a qualified and arranged method. Report all verbal exchange, together with correspondence and contact conversations. Be transparent and concise on your statements and responses. Don’t hesitate to discuss with an insurance coverage skilled or felony consultant if wanted. By means of adopting a structured and proactive method, you’ll be able to navigate the declare procedure successfully and successfully.

Epilogue

In conclusion, Safeco auto insurance coverage condominium automotive protection provides a spread of choices to fit quite a lot of wishes. Figuring out the other protection sorts, limits, and deductibles is very important. By means of moderately taking into account the nuances of your coverage, and consulting this complete information, you’ll be able to be well-equipped to make your only option to your condominium wishes. Take note, proactive wisdom is your absolute best protection in terms of protective your condominium automotive.

Crucial FAQs

What are the everyday protection limits for condominium automotive insurance coverage equipped by means of Safeco?

Safeco’s condominium automotive protection limits range relying at the explicit coverage. Refer in your coverage paperwork for precise main points, or touch Safeco without delay for explanation.

How does Safeco’s condominium automotive protection deal with injury to the condominium automotive brought about by means of a 3rd celebration?

Safeco’s protection in most cases handles injury brought about by means of 3rd events. Assessment your explicit coverage for main points at the extent of this protection and the claims procedure.

What are the stairs for including condominium automotive protection to an present Safeco coverage?

Touch Safeco without delay to inquire about including condominium automotive protection. They are going to information you throughout the procedure, together with essential bureaucracy and related prices.

What are the important thing phrases in Safeco’s condominium automotive protection insurance policies?

Key phrases, like deductible, collision protection, and complete protection, are outlined inside of your coverage paperwork. Seek the advice of the coverage itself or touch Safeco for explanation on those phrases.