Prudential insurance coverage longer term care – Prudential insurance coverage long-term care supplies essential coverage towards the escalating prices of long run care. This information delves into the intricacies of Prudential’s insurance policies, inspecting protection choices, prices, and the claims procedure. Working out your wishes and to be had alternatives is an important when dealing with attainable long-term care bills.

From working out other coverage varieties and advantages to evaluating Prudential with different insurers, this complete evaluate empowers you to make instructed choices. We will navigate the complexities of long-term care insurance coverage, making sure you could have the data to devise for the long run.

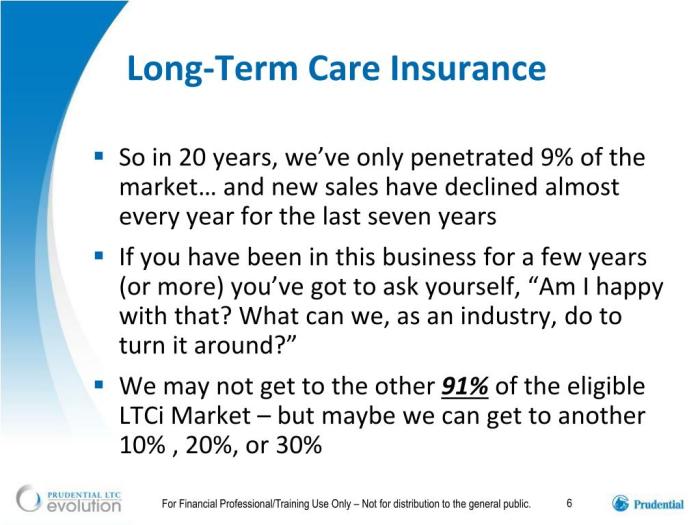

Advent to Lengthy-Time period Care Insurance coverage

Lengthy-term care insurance coverage is a an important monetary device for shielding your self and your family members towards the numerous prices related to extended healthcare wishes. It supplies a security internet when conventional sources are inadequate to hide the escalating bills of caregiving, nursing houses, or in-home help. This coverage is especially precious in a global the place healthcare prices proceed to upward thrust.Working out the quite a lot of facets of long-term care insurance coverage is very important for making instructed choices about your monetary safety.

This data empowers you to safeguard your long run well-being and peace of thoughts.

Definition of Lengthy-Time period Care Insurance coverage

Lengthy-term care insurance coverage is a kind of insurance coverage designed to hide the prices of long-term care products and services. Those products and services can come with help with actions of day by day dwelling (ADLs), equivalent to bathing, dressing, and consuming, in addition to hospital therapy and professional nursing. It is distinct from different forms of insurance coverage, equivalent to medical insurance, that specialize in the long-term care facet of getting older or incapacity.

Sorts of Lengthy-Time period Care Insurance coverage Insurance policies

Other long-term care insurance coverage insurance policies cater to numerous wishes and budgets. Those insurance policies range of their get advantages buildings, premiums, and protection intervals. The most typical varieties come with:

- Mounted Get advantages Insurance policies: Those insurance policies be offering a predetermined buck quantity in step with day or monthly of care. This permits for predictable payouts without reference to the precise care required.

- Indemnity Insurance policies: Those insurance policies reimburse a share of the particular prices of care. Those can be offering extra flexibility however might require the next out-of-pocket expense.

- Care Control Insurance policies: Those insurance policies ceaselessly come with products and services that attach the policyholder with care suppliers. It will come with help with selecting the proper care choices and coordinating caregiving.

Not unusual Advantages and Options

Lengthy-term care insurance coverage insurance policies normally come with a variety of advantages and contours. Those parts are an important for assessing the coverage’s suitability on your person wishes. Key options come with:

- Protection for quite a lot of care settings: Insurance policies might quilt care in nursing houses, assisted dwelling amenities, in-home care, and even grownup day care facilities.

- Number of get advantages quantities: Policyholders can make a choice day by day or per 30 days get advantages quantities that align with their expected wishes and funds.

- Coordination of advantages: Insurance policies ceaselessly combine with different current insurance coverage to keep away from overlapping bills and make sure environment friendly use of sources.

- Waiver of top class choices: Some insurance policies be offering the choice of waiving premiums after a undeniable duration of care is gained.

Prices Related to Lengthy-Time period Care Insurance coverage

The prices of long-term care insurance coverage range considerably according to components such because the coverage sort, protection quantity, and the policyholder’s age and well being. Premiums are normally calculated according to those components.

- Premiums: Premiums are the periodic bills made to the insurance coverage corporate. They rely on person cases and the selected protection.

- Ready sessions: Maximum insurance policies have ready sessions earlier than advantages start, which is able to range considerably.

- Annual evaluation: Policyholders will have to in moderation evaluation their coverage every year to make certain that it aligns with their evolving wishes and cases.

Key Variations Between Coverage Sorts

The next desk Artikels the important thing distinctions between other long-term care insurance coverage varieties:

| Coverage Kind | Advantages | Premiums |

|---|---|---|

| Mounted Get advantages | Predetermined day by day/per 30 days get advantages quantities | In most cases decrease premiums in comparison to indemnity insurance policies |

| Indemnity | Repayment according to precise care prices | In most cases upper premiums in comparison to fastened get advantages insurance policies |

| Care Control | Help to find and coordinating care suppliers | Premiums can range, ceaselessly together with administrative charges |

Prudential Lengthy-Time period Care Insurance coverage: Prudential Insurance coverage Lengthy Time period Care

Prudential Monetary, a famend title within the insurance coverage business, provides a variety of long-term care insurance coverage merchandise designed to assist folks navigate the monetary complexities of long run care wishes. Working out their particular choices and the way they evaluate to different main insurers can empower you to make instructed choices. This phase delves into Prudential’s historical past, product options, aggressive panorama, and total worth proposition.Prudential’s long-term care insurance coverage merchandise supply a an important protection internet towards the emerging prices of long-term care.

Their choices are adapted to handle quite a lot of person wishes and fiscal scenarios, providing a variety of choices for policyholders. This detailed research explores the strengths and weaknesses of Prudential’s insurance policies in comparison to different main insurers available in the market.

Prudential’s Historical past and Recognition in Lengthy-Time period Care

Prudential has an extended and established presence within the insurance coverage marketplace, with a confirmed monitor report of offering complete protection answers. Their popularity is constructed on years of enjoy and a dedication to offering dependable and protected merchandise for his or her policyholders. Prudential has a considerable marketplace percentage in long-term care insurance coverage, indicating a known degree of consider and credibility.

Particular Options of Prudential’s Lengthy-Time period Care Insurance policies

Prudential’s long-term care insurance coverage insurance policies normally be offering numerous customizable choices. Those come with other get advantages quantities, day by day care protection, and quite a lot of cost choices. Protection choices ceaselessly come with particular care varieties equivalent to nursing domestic care, assisted dwelling, and residential care. Coverage phrases are versatile, and a few insurance policies permit for riders to make stronger the protection, equivalent to inflation coverage or expanding get advantages quantities.

Many Prudential insurance policies have transparent definitions of eligible bills, making sure policyholders perceive the level in their protection.

Comparability with Different Primary Insurers

The long-term care insurance coverage marketplace contains a lot of competition, every with their very own strengths and weaknesses. Prudential’s choices are ceaselessly in comparison to the ones of MetLife, AIG, and different main gamers within the box. Key distinctions lie in coverage phrases, get advantages quantities, premiums, and the precise forms of care coated. Working out those nuances is significant for potential policyholders.

Benefits and Disadvantages of Opting for Prudential

Prudential’s long-term care insurance coverage merchandise be offering a complete array of advantages, ceaselessly with sexy premiums and customizable options. Then again, policyholders will have to pay attention to attainable boundaries, equivalent to ready sessions, get advantages boundaries, and restrictions on positive care varieties. Prudential’s popularity and fiscal steadiness are important benefits, however the price of premiums can range relying on person cases.

Coverage Comparability Desk

| Characteristic | Prudential | MetLife | AIG |

|---|---|---|---|

| Get advantages Quantity (day by day) | $200-$500 | $150-$400 | $250-$550 |

| Ready Length | 90 days | 60 days | 90 days |

| Inflation Coverage | Sure (adjustable) | Sure (fastened price) | Sure (variable price) |

| Premiums (instance – $500 day by day get advantages) | $50-$100/month | $45-$90/month | $60-$110/month |

Prudential’s insurance policies ceaselessly be offering adjustable inflation coverage, permitting policyholders to evolve their protection to converting care prices over the years.

Protection and Advantages

Securing your long run well-being calls for a complete working out of the long-term care insurance policy you are taking into account. Prudential’s insurance policies be offering a spectrum of advantages designed to handle the varied wishes of people dealing with attainable long-term care necessities. This phase delves into the scope of protection, outlining particular advantages and an important issues.Prudential’s long-term care insurance coverage insurance policies are structured to offer monetary strengthen all through sessions of prolonged care wishes.

Those insurance policies, adapted to other cases and fiscal scenarios, be offering various ranges of protection. Working out the precise protection and advantages is very important to creating an educated resolution about your monetary safety.

Scope of Protection

Prudential’s long-term care insurance coverage insurance policies normally quilt a variety of products and services, from professional nursing care to assisted dwelling and residential well being care. The precise products and services coated rely at the selected coverage and its choices.

Particular Advantages in Coverage Choices

The advantages inside of every coverage choice range. Some insurance policies might quilt professional nursing amenities, whilst others might come with domestic well being care or assisted dwelling amenities. Components like day by day get advantages quantities, get advantages sessions, and most protection quantities considerably have an effect on the entire worth of the coverage.

Examples of Crucial Protection

Lengthy-term care insurance coverage is an important for scenarios the place folks require help with day by day actions because of power sicknesses or disabilities. For instance, an individual with Alzheimer’s illness might require in depth care, making long-term care insurance coverage a very important monetary useful resource. Every other instance is a stroke survivor desiring rehabilitation and ongoing care; insurance coverage can considerably ease the monetary burden. In a similar way, folks experiencing a innovative sickness like Parkinson’s illness or a couple of sclerosis might to find the protection useful.

Exclusions and Barriers

Whilst Prudential’s long-term care insurance coverage targets to offer complete protection, you need to to concentrate on exclusions and boundaries. Those exclusions and boundaries range by way of coverage. Components like pre-existing prerequisites, particular diagnoses, and the kind of care required can affect the protection. It is an important to check the coverage main points totally to know any exclusions or boundaries that can observe.

This contains working out the ready sessions, get advantages sessions, and any prerequisites that can have an effect on protection.

Sorts of Care Coated, Prudential insurance coverage longer term care

| Form of Care | Description |

|---|---|

| Professional Nursing Amenities | Care supplied by way of authorized pros, together with nurses and therapists, for people requiring extensive clinical supervision and remedy. |

| Assisted Residing Amenities | Supportive dwelling environments providing help with day by day actions, equivalent to dressing, bathing, and meal preparation. |

| House Well being Care | In-home products and services supplied by way of educated pros, together with nurses, bodily therapists, and occupational therapists, to take care of or toughen purposeful skills. |

| Grownup Day Care | Care supplied all through the day to folks requiring help with day by day actions, permitting members of the family to take care of their paintings and private schedules. |

This desk supplies a basic evaluate of the forms of care coated by way of Prudential’s long-term care insurance coverage insurance policies. A complete evaluation of the coverage paperwork is essential to make certain that the precise wishes of the insured person are absolutely addressed.

Coverage Variety and Components to Imagine

Selecting the proper long-term care insurance coverage is a an important step towards securing your long run. It isn’t simply about deciding on a product; it is about aligning a monetary safeguard together with your particular wishes and cases. This procedure calls for cautious attention, thorough analysis, and a proactive strategy to working out the complexities of long-term care insurance coverage.Working out your distinctive wishes and cases is paramount when comparing long-term care insurance coverage insurance policies.

A one-size-fits-all means is never efficient. Every person’s monetary scenario, well being historical past, and expected care necessities will form the optimum coverage design. A complete evaluation guarantees the selected coverage successfully addresses your particular considerations.

Assessing Particular person Wishes and Monetary State of affairs

A crucial preliminary step comes to comparing your present monetary scenario and long run care wishes. Imagine components like your projected lifespan, well being prerequisites, and attainable for power sickness. The expected charge of care to your space could also be a significant component. A practical evaluation of your monetary sources will assist decide the extent of protection you wish to have and the premiums you’ll with ease have the funds for.

Detailed monetary making plans is very important for instructed decision-making.

Evaluating Coverage Choices

Evaluating other coverage choices is a an important facet of the choice procedure. In moderation read about protection main points, premiums, and advantages to spot the most productive are compatible. Working out the coverage’s particular phrases and prerequisites is essential for a transparent comprehension of your rights and duties.

Coverage Comparability Means

A structured strategy to evaluating insurance policies will be sure that a transparent working out of every choice. A desk structure can successfully illustrate the variations between quite a lot of insurance policies.

| Coverage Supplier | Protection Quantity | Top rate Quantity | Get advantages Length | Exclusions |

|---|---|---|---|---|

| Corporate A | $5,000 monthly | $500 monthly | Limitless | Pre-existing prerequisites, psychiatric care |

| Corporate B | $4,000 monthly | $400 monthly | 5 years | Actions of day by day dwelling (ADLs) no longer coated |

| Corporate C | $6,000 monthly | $650 monthly | 10 years | Professional nursing facility care handiest |

This desk provides a simplified comparability. A extra complete research will necessitate reviewing every coverage’s advantageous print and working out the precise main points of protection, exclusions, and boundaries.

Coverage Exclusions and Barriers

You have to in moderation scrutinize coverage exclusions and boundaries. Those clauses outline scenarios the place the coverage won’t supply protection. Working out those provisions is an important to make certain that the coverage aligns together with your wishes and avoids attainable pitfalls. Reviewing coverage exclusions and boundaries intimately is significant to keeping off unsightly surprises. For instance, some insurance policies might exclude protection for pre-existing prerequisites, or restrict protection for positive forms of care.

This cautious analysis is essential for a valid monetary technique.

Prices and Premiums

Unlocking the long run ceaselessly calls for a monetary dedication, and long-term care insurance coverage isn’t any exception. Working out the prices and premiums concerned is an important for making instructed choices about your long run well-being. Through comprehending the standards influencing those prices, you’ll strategically make a choice a coverage that aligns together with your funds and wishes.Premiums for long-term care insurance coverage aren’t static; they’re dynamic, conscious of quite a lot of components.

This dynamic nature calls for a proactive strategy to working out the interaction between those parts and the ensuing have an effect on in your total monetary technique.

Components Affecting Premiums

Premiums for long-term care insurance coverage are influenced by way of a number of an important components. Those components assist insurers assess the danger related to offering protection for long run care wishes.

- Age: Your age is a number one determinant of premiums. More youthful folks in most cases pay decrease premiums in comparison to older folks, reflecting the diminished probability of desiring long-term care at a more youthful age.

- Well being Standing: Your present well being standing performs a vital function. People with pre-existing well being prerequisites or power sicknesses ceaselessly face upper premiums. Insurers in moderation assess the possible possibility of long-term care wishes related to those prerequisites.

- Protection Quantity: The quantity of protection you choose immediately affects the top class. Insurance policies providing upper protection ranges normally lead to upper premiums.

- Coverage Options: Particular coverage options, equivalent to the kind of care coated (e.g., professional nursing, assisted dwelling), the period of protection, and get advantages cost choices, affect the top class. Imagine the variability of care choices introduced and make a choice a coverage that meets your expected wishes.

- Ready Classes: Insurance policies with shorter ready sessions ceaselessly include upper premiums, reflecting the insurer’s evaluation of higher possibility with expedited protection.

Top rate Examples

Insurance coverage firms use actuarial information and quite a lot of possibility evaluation fashions to decide top class quantities. Those fashions are designed to replicate the possible prices related to offering long-term care, bearing in mind components like age, well being, and coverage options.

Imagine two folks, each 65 years previous. Particular person A has superb well being and chooses a coverage with a modest protection quantity and an extended ready duration. Particular person B has a pre-existing situation and selects a coverage with the next protection quantity and a shorter ready duration.

Predictably, Particular person B’s top class could be upper than Particular person A’s because of the blended components of pre-existing situation and better protection.

Top rate Comparability Desk

The next desk illustrates how premiums can range according to coverage sort and protection quantity. This comparability is illustrative and no longer exhaustive; precise premiums will range according to person cases.

| Coverage Kind | Protection Quantity (in step with yr) | Estimated Annual Top rate |

|---|---|---|

| Elementary | $50,000 | $2,500 |

| Same old | $100,000 | $4,000 |

| Complete | $200,000 | $6,500 |

Lengthy-Time period Value Concerns

Comparing the long-term charge of long-term care insurance coverage comes to extra than simply the preliminary top class. It is vital to believe the cumulative charge over the coverage’s period.

Insurance policies with upper premiums would possibly be offering extra complete protection or quicker get advantages get entry to, probably saving you cash ultimately in case you require really extensive care. A coverage with a decrease top class is also extra inexpensive to start with, however the cumulative charge over the years might be better if the protection is inadequate to fulfill your wishes.

Claims Procedure and Management

Unlocking the reassurance that incorporates long-term care insurance coverage hinges on a easy and environment friendly claims procedure. Prudential’s dedication to streamlined management guarantees a swift and clear adventure for you and your family members when the time comes. Working out the declare procedure empowers you to navigate this crucial facet with self assurance.The Prudential long-term care insurance coverage claims procedure is designed to be easy and supportive, guiding you via every step with readability and potency.

This phase main points the method, administrative strengthen, and conventional timeframes, equipping you with the data to expectantly pursue your declare.

Declare Submitting Process

Submitting a declare for long-term care advantages is a structured procedure designed to make sure accuracy and potency. Beginning the declare procedure comes to collecting the vital documentation and meticulously finishing the declare bureaucracy. This meticulous means guarantees that your declare is processed appropriately and successfully.

- Accumulate Required Documentation: Collect all vital supporting paperwork, together with clinical information, doctor statements, and related monetary knowledge. Correct documentation is an important for a swift declare processing. Make sure that the paperwork are transparent, concise, and readily to be had.

- Whole Declare Paperwork Appropriately: In moderation evaluation and whole all sections of the declare shape, offering all asked knowledge. Finishing the bureaucracy with precision minimizes delays and guarantees the declare is processed correctly.

- Put up Declare to Prudential: Apply the directions Artikeld to your coverage file to post the finished declare shape and supporting documentation to Prudential. Use the designated channels for submission to take care of a transparent audit path.

Administrative Make stronger

Prudential provides complete administrative strengthen to make sure a easy claims procedure. This contains devoted declare representatives, get entry to to on-line portals, and ongoing verbal exchange updates. This strengthen is significant for making sure a good enjoy right through the method.

- Devoted Declare Representatives: Prudential’s declare representatives are educated to lend a hand you with any questions or considerations you will have all through the declare procedure. They act as your level of touch for steering and updates.

- On-line Portals: Get admission to to protected on-line portals permits you to monitor the standing of your declare, post paperwork, and be in contact with declare representatives successfully. This streamlined means helps to keep you instructed and in keep an eye on.

- Conversation Updates: Prudential supplies common updates at the standing of your declare. You are going to obtain well timed notifications about any vital follow-up movements, making sure you’re well-informed right through the method.

Declare Processing Time frame

The processing time for a long-term care insurance coverage declare can range relying on a number of components, together with the complexity of the declare and the provision of supporting documentation. Prudential strives to procedure claims successfully, normally inside of an outlined time-frame. Examples come with 30 to 60 days for regimen claims, whilst extra complicated claims would possibly prolong to 90 days.

“Prudential’s dedication to well timed declare processing displays our determination to supporting policyholders all through difficult instances.”

Declare Procedure Flowchart

The next flowchart illustrates the standard declare procedure for long-term care insurance coverage.[Imagine a simple flowchart here. It would start with “Policyholder submits claim” and proceed through steps like “Gathering documentation,” “Form completion,” “Submission to Prudential,” “Review by claim representative,” “Potential follow-up requests,” “Claim approval/denial,” and “Payment.” Each step would have arrows connecting them.]The flowchart visually represents the sequential steps concerned, highlighting the important thing phases and attainable interactions with Prudential representatives.

This visible assist is helping to know the method’s linearity and potency.

Buyer Opinions and Testimonials

Working out buyer stories with Prudential’s long-term care insurance coverage is an important for comparing its effectiveness and worth. Buyer evaluations and testimonials be offering direct insights into policyholder pleasure, highlighting each certain and unfavourable facets of the product. Inspecting this comments permits us to raised comprehend the coverage’s strengths and weaknesses from the standpoint of those that have applied or thought to be it.

Abstract of Buyer Comments

Buyer evaluations on quite a lot of platforms, equivalent to on-line boards and insurance coverage comparability internet sites, supply a combined bag of evaluations referring to Prudential’s long-term care insurance coverage. Some policyholders categorical profound pleasure with the protection and claims procedure, whilst others voice considerations in regards to the complexity of the coverage or the perceived charge.

Certain Comments Examples

Certain comments ceaselessly facilities across the perceived reliability of the insurance coverage corporate’s claims dealing with. Many testimonials emphasize a easy and environment friendly claims procedure, with policyholders expressing gratitude for recommended and honest reimbursements for care products and services. Some additionally commend the comprehensiveness of protection, noting it adequately addressed their particular long-term care wishes. Moreover, the readability of coverage paperwork and responsive customer support representatives are ceaselessly cited as strengths.

“I used to be extremely inspired with the velocity and potency of the claims procedure. Prudential treated the whole thing with care and professionalism, making a troublesome time a lot more uncomplicated.”

John Smith

Detrimental Comments Examples

Detrimental comments ceaselessly makes a speciality of the perceived complexity of the coverage’s phrases and prerequisites. Some shoppers categorical frustration with navigating the coverage’s intricacies and the executive burden related to managing their claims. Others cite the moderately top premiums as a vital problem. From time to time, considerations are raised in regards to the availability of positive protection choices or the perceived inflexibility of the coverage.

“The coverage used to be too difficult to know, and the preliminary bureaucracy used to be overwhelming. I felt misplaced in the main points and fearful about making errors.”

Jane Doe

General Sentiment Research

The total sentiment expressed in buyer evaluations is in most cases certain, but nuanced. Whilst many shoppers reward the potency and reliability of the claims procedure and the comprehensiveness of the protection, a vital minority voices considerations in regards to the complexity and price. This means a necessity for probably clearer coverage explanations and extra out there buyer strengthen.

Possible choices and Comparisons

Embarking at the adventure to protected your long run well-being ceaselessly comes to taking into account quite a lot of avenues. Working out the spectrum of long-term care insurance coverage choices empowers you to make instructed choices, aligning your coverage together with your distinctive wishes and fiscal cases. This exploration delves into selection choices past Prudential, highlighting their strengths and weaknesses.Comparing selection long-term care insurance coverage choices is a crucial step in securing complete coverage.

This comparability procedure permits you to tailor your approach to maximize advantages and decrease prices. Inspecting the professionals and cons of every selection is helping you choose the coverage that most closely fits your long-term care wishes.

Choice Lengthy-Time period Care Insurance coverage Choices

A large number of choices exist past Prudential’s insurance policies. Those selection choices might come with the ones introduced by way of different insurance coverage suppliers, govt systems, and even self-funding methods. Working out those choices permits for a extra thorough analysis of your total coverage technique.

- Different Non-public Insurers: Many personal insurers be offering long-term care insurance coverage insurance policies with various protection choices and premiums. Evaluating insurance policies throughout other insurers, like taking into account other suppliers for medical insurance, permits you to to find essentially the most appropriate are compatible on your person wishes.

- Govt Techniques: Govt systems, equivalent to Medicaid, can probably quilt long-term care bills. Then again, eligibility necessities and protection limits range considerably. Bear in mind that eligibility for presidency systems is also suffering from your property and source of revenue ranges.

- Self-Investment Methods: People might make a choice to self-fund long-term care bills via financial savings or investments. This means calls for cautious monetary making plans and a vital monetary reserve, given the possible unpredictability of long-term care prices.

Comparability of Prudential Insurance policies to Competition

This comparative research supplies a concise evaluate of key options and issues, assisting within the collection of essentially the most suitable coverage. You have to evaluate no longer simply the premiums, but in addition the protection main points, because the specifics of protection can range very much.

| Characteristic | Prudential | Corporate A | Corporate B |

|---|---|---|---|

| Per 30 days Top rate (Instance, $100,000 Get advantages) | $500 | $450 | $550 |

| Day-to-day Get advantages Quantity | $250 | $200 | $300 |

| Removing Length (Days) | 90 | 180 | 30 |

| Get advantages Length Prohibit (Years) | 5 | 10 | 7 |

| Coverage Rider Choices | Sure (e.g., inflation coverage) | Sure (e.g., supplemental protection) | Sure (e.g., prolonged care) |

| Buyer Provider Ranking | 4.5/5 | 4.2/5 | 4.7/5 |

“Evaluating insurance coverage insurance policies comes to extra than simply value; believe protection limits, removal sessions, and get advantages duration limits. Thorough analysis is an important for locating essentially the most appropriate long-term care plan.”

Execs and Cons of Every Choice

A complete working out of the benefits and drawbacks of every choice is an important. Inspecting the strengths and weaknesses of various methods permit you to align your choices together with your monetary targets.

- Different Non-public Insurers: Execs: Number of plans, probably decrease premiums, and probably higher protection choices. Cons: Premiums might nonetheless be really extensive, and protection might range considerably throughout insurance policies.

- Govt Techniques: Execs: Possible for cost-free or cheap protection. Cons: Strict eligibility necessities, restricted protection, and attainable lengthy wait instances for approval.

- Self-Investment Methods: Execs: Possible for whole keep an eye on over price range and versatility. Cons: Vital monetary dedication, attainable for inadequate price range, and loss of insurance-related safeguards.

Lengthy-Time period Care Making plans

Embarking on a adventure towards monetary safety calls for a proactive means, in particular when taking into account long-term care. Proactive making plans guarantees your long run well-being and peace of thoughts, safeguarding your independence and family members from unexpected cases. This comes to no longer handiest working out your choices but in addition growing a method adapted on your particular wishes and targets.Lengthy-term care making plans is not only about insurance coverage; it is about orchestrating a complete technique on your long run well-being.

It is about expecting attainable wishes, safeguarding your property, and making sure your high quality of existence stays top right through your later years. This proactive means transforms uncertainty right into a manageable pathway, fostering a way of keep an eye on and self assurance.

Significance of Lengthy-Time period Care Making plans

Lengthy-term care making plans is an important for keeping up monetary steadiness and protecting independence all through probably long sessions of care. Unexpected well being crises can result in really extensive monetary pressure if no longer expected. Failing to devise may end up in depleting financial savings, jeopardizing retirement price range, and probably burdening members of the family with sudden bills. A well-defined plan alleviates those considerations, offering a security internet for each you and your family members.

Steps in Growing a Complete Lengthy-Time period Care Plan

Developing a strong long-term care plan calls for a structured means. Start by way of assessing your present monetary scenario, together with property, liabilities, and projected source of revenue streams. Working out your expected long-term care wishes is paramount. This comes to taking into account attainable well being prerequisites, dwelling preparations, and the extent of care required. Evaluation quite a lot of care choices, equivalent to assisted dwelling, nursing houses, or domestic healthcare.

This evaluation is an important for correct making plans and collection of suitable protection.

- Monetary Evaluation: Evaluation present property, liabilities, and projected source of revenue. Imagine expected long run source of revenue adjustments and attainable bills.

- Wishes Evaluation: Determine attainable well being prerequisites and dwelling preparations. Imagine the extent of care most probably wanted, together with clinical, private, and day by day dwelling help.

- Care Choices Analysis: Discover other care choices, equivalent to assisted dwelling, nursing houses, and residential healthcare. Assess prices related to every choice.

- Insurance coverage Analysis: Analysis and evaluate long-term care insurance coverage insurance policies. Perceive protection main points, premiums, and claims processes.

- Felony and Property Making plans: Visit prison and fiscal pros to make sure your property plan aligns together with your long-term care targets.

- Evaluate and Adjustment: Frequently evaluation and modify your plan as your cases alternate. Lifestyles occasions, equivalent to process adjustments or well being traits, require periodic changes.

Position of Lengthy-Time period Care Insurance coverage in a Broader Monetary Plan

Lengthy-term care insurance coverage performs a very important function in a complete monetary plan. It acts as a an important protection internet, mitigating the monetary have an effect on of prolonged care. Through offering a pre-funded useful resource, insurance coverage protects retirement financial savings and property, making sure that those sources are to be had for different existence targets. It additionally is helping households keep away from important monetary burdens, lowering the tension on family members.

Flowchart: Making a Lengthy-Time period Care Plan

A easy flowchart illustrating the important thing steps in making a long-term care plan:

[Start] --> Monetary Evaluation --> Wishes Evaluation --> Care Choices Analysis --> Insurance coverage Analysis --> Felony and Property Making plans --> Evaluate and Adjustment --> [End]

Finish of Dialogue

In conclusion, prudential insurance coverage long-term care generally is a an important element of a complete monetary plan. Through working out the other coverage choices, prices, and claims processes, you’ll make well-informed choices about your long run care wishes.

Take into account to rigorously believe your own cases and search skilled recommendation when vital.

Query & Resolution Hub

What are the standard prices related to Prudential’s long-term care insurance policies?

Premiums range according to components like age, well being, and the selected protection degree. An in depth desk within the information Artikels top class comparisons for various coverage varieties and protection quantities.

What are some choices to Prudential’s long-term care insurance coverage?

The information explores selection choices, evaluating their options and advantages with Prudential’s insurance policies. This permits you to assess the professionals and cons of every selection and make a choice the most productive are compatible on your wishes.

How do I evaluate other long-term care insurance coverage insurance policies?

The information supplies a structured way for evaluating insurance policies according to protection, premiums, and advantages. A desk structure facilitates simple comparability of key options.

What are the typical exclusions and boundaries in long-term care insurance coverage insurance policies?

Particular exclusions and boundaries range by way of coverage. The information main points those facets that will help you perceive the scope of protection and attainable gaps in coverage.