Energy of lawyer for automotive insurance coverage functions empowers a delegated agent to maintain insurance coverage issues on behalf of someone else. This complete information explores the intricacies of organising, managing, and figuring out the criminal implications of such preparations. From navigating various kinds of energy of lawyer to figuring out insurance coverage corporate insurance policies, this text delves into the crucial sides for people and their brokers.

This information will quilt the crucial parts, together with criminal necessities, procedures, possible problems, and related eventualities. Figuring out the complexities of energy of lawyer for automotive insurance coverage is an important for clean transactions and criminal coverage.

Figuring out Energy of Lawyer for Insurance coverage

A Energy of Lawyer (POA) is a criminal device that empowers one particular person (the Major) to grant every other (the Agent or Lawyer-in-Truth) the authority to behave on their behalf in explicit issues. This bestows a sacred believe, making sure continuity and care in an important lifestyles selections, in particular when the Major’s skill to control their affairs is lowered. This record, moderately crafted and accomplished, permits for a clean transition of duty, safeguarding monetary and criminal pursuits with the maximum admire.The essence of a POA lies in its skill to delegate authority for specified movements, permitting the agent to behave with the similar criminal status because the Major, inside the scope of the granted powers.

This believe, when exercised with integrity, generally is a beacon of fortify all the way through difficult instances. Various kinds of POAs exist, adapted to more than a few wishes.

Other Forms of Energy of Lawyer

An influence of lawyer may also be basic, granting wide authority, or explicit, restricting the scope of motion to positive duties. Within the context of insurance coverage, a particular energy of lawyer is usually most popular. This record delineates the best movements the agent can take, corresponding to managing insurance coverage insurance policies, making bills, or submitting claims. A sturdy energy of lawyer stays in impact even supposing the Major turns into incapacitated.

This sort is especially an important for insurance coverage issues.

Prison Implications of POA for Automobile Insurance coverage

The use of a POA for automotive insurance coverage carries important criminal weight. The agent, appearing underneath the POA, has the authority to control the insurance plans, together with paying premiums, making claims, and updating coverage main points. The criminal status of the agent is an identical to that of the Major inside the approved obstacles of the record. This guarantees that the insurance coverage corporate acknowledges the agent’s authority to behave on behalf of the Major.

Care will have to be taken to make sure the POA record is correctly accomplished, witnessed, and registered with the related government.

Evaluating POA with Different Strategies

Different strategies for managing automotive insurance coverage for people not able to control their affairs come with guardianship or conservatorship. Those criminal processes contain a court-appointed mother or father or conservator who assumes whole regulate over the person’s funds and affairs. A POA, against this, permits for a extra managed and private means, granting authority to a depended on particular person whilst conserving positive autonomy.

The agent is immediately appointed via the Major and operates inside the specified scope. A an important attention is the extent of regulate and autonomy desired.

Scenarios Requiring POA for Automobile Insurance coverage

A POA for automotive insurance coverage is essential when the policyholder turns into incapacitated, is not able to control their affairs because of sickness or damage, or is quickly absent from the rustic or area. This will quilt scenarios starting from a chronic sickness to a brief damage, making sure that the automobile insurance coverage stays so as and claims are filed promptly. The POA empowers a depended on particular person to behave on behalf of the policyholder all the way through this era.

Position of the Designated Agent/Lawyer-in-Truth

The designated agent or attorney-in-fact performs a essential position in managing automotive insurance coverage. They’re liable for adhering to the phrases of the POA, making sure the Major’s pursuits are secure. This comes to moderately figuring out the coverage’s phrases and stipulations, holding data of all transactions, and keeping up open conversation with the insurance coverage corporate. Their duty is to be sure that the automobile insurance coverage purposes easily all the way through the length when the Major is not able to control their affairs.

This guarantees that the policyholder’s car stays secure.

Necessities and Procedures

Embarking at the trail of granting energy of lawyer for automotive insurance coverage necessitates meticulous adherence to criminal protocols and a transparent figuring out of the procedures concerned. This adventure calls for navigating jurisdictional variations and adhering to established formalities. This segment unveils the essential steps and concerns, making sure a clean and legally sound procedure.The status quo of an influence of lawyer (POA) for automotive insurance coverage functions calls for meticulous adherence to the criminal frameworks inside of each and every jurisdiction.

Navigating those frameworks guarantees the validity and enforceability of the POA. Figuring out the particular necessities of your location is paramount.

Prison Necessities for Setting up a POA

Jurisdictions international have explicit criminal necessities for organising an influence of lawyer. Those necessities make sure that the record’s validity and the security of the events concerned. Those necessities range considerably from one jurisdiction to every other. Thorough analysis and session with criminal pros are crucial.

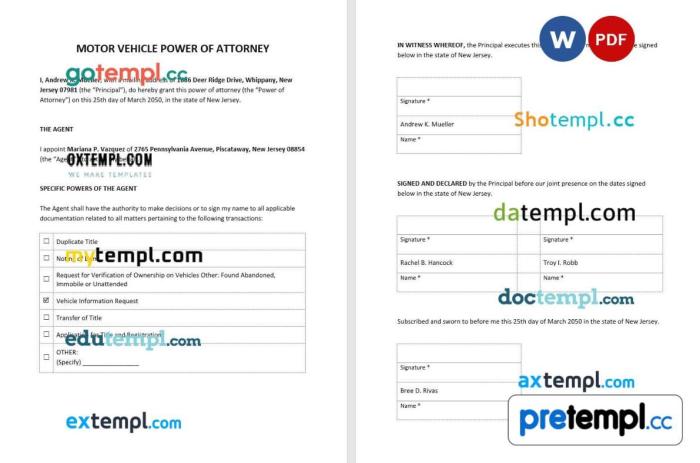

Step-by-Step Process for Making a Legitimate POA

Growing a sound energy of lawyer for automotive insurance coverage comes to a sequence of well-defined steps. This methodical means safeguards towards possible mistakes and guarantees the record’s criminal energy. The stairs range in line with the acceptable regulation.

1. Session with Prison Suggest

In the hunt for steering from a criminal skilled is an important to grasp the particular necessities on your jurisdiction.

2. Drafting the POA File

This record will have to obviously outline the powers granted to the agent.

3. Signing and Witnessing

The record will have to be signed via the major (the individual granting the facility) and witnessed in step with the necessities of the related jurisdiction. The witnesses will have to be people who don’t seem to be beneficiaries of the facility of lawyer.

4. Notarization (if required)

Some jurisdictions mandate notarization to validate the signatures and ensure the record’s authenticity.

Essential Documentation and Paperwork

A complete POA for automotive insurance coverage usally comes to explicit paperwork and paperwork. Those paperwork supply proof of the major’s aim and the agent’s authority. This documentation varies from state to state.

- Energy of Lawyer Shape: A normal shape adapted to the aim of granting energy over automotive insurance coverage issues.

- Id Paperwork: Evidence of id for each the major and the agent (e.g., motive force’s licenses, passports). This guarantees verification of the folks concerned.

- Insurance coverage Coverage Data: The coverage main points, together with the coverage quantity, to permit the insurance coverage corporate to as it should be establish the car and coverage.

- Witness Statements (if acceptable): Statements from the witnesses verifying the signing procedure, as required via native regulations.

Desk of Required Paperwork via Jurisdiction

The desk underneath supplies examples of paperwork required for organising a POA for automotive insurance coverage in more than a few jurisdictions. Word that this isn’t an exhaustive listing and must be verified with criminal pros in each and every jurisdiction.

| Jurisdiction | Required Paperwork |

|---|---|

| United States – California | Energy of Lawyer Shape, Motive force’s Licenses/State-Issued IDs, Automobile Registration |

| United States – New York | Energy of Lawyer Shape, Motive force’s Licenses/State-Issued IDs, Automobile Registration, Affidavit of Authority |

| United Kingdom | Energy of Lawyer Shape, Evidence of Identification (Passport/Riding License), Automobile Registration File |

Updating or Revoking a POA

A POA for automotive insurance coverage, like all criminal record, may also be up to date or revoked. The precise procedures for updating or revoking a POA are ruled via the regulations of the related jurisdiction. This procedure guarantees that the facility of lawyer stays present and aligned with the major’s intentions.

- Updating: A brand new POA record, changing the outdated one, must be ready and accomplished in step with the specified procedures.

- Revoking: A proper revocation record, obviously mentioning the aim to revoke the POA, must be ready and accomplished.

Speaking the POA to the Insurance coverage Corporate

Speaking the POA to the insurance coverage corporate is an important for enabling the agent to behave on behalf of the major. The conversation procedure varies relying at the explicit insurance coverage corporate. This calls for a proper procedure for the corporate to recognize the POA.

- Formal Notification: The insurance coverage corporate must obtain an authorized replica of the POA record.

- Documentation of Receipt: Confirming the insurance coverage corporate’s acknowledgment of the POA is essential for readability and responsibility.

Insurance coverage Corporate Insurance policies

Navigating the intricate global of insurance coverage can really feel like traversing a labyrinth. But, figuring out the insurance policies of various insurance coverage corporations referring to Energy of Lawyer (POA) for automotive insurance coverage is an important for making sure clean transitions and averting possible pitfalls. This information empowers us to make knowledgeable selections, fostering a way of safety and readability in those often-complex issues.

Procedures and Insurance policies of Other Insurance coverage Firms

Insurance coverage corporations range of their procedures and insurance policies relating to POAs. Those variations stem from the will to offer protection to their pursuits and make sure the legitimacy of the claims. Firms prioritize keeping up the integrity in their processes and combating fraudulent actions.

Comparability of Insurance coverage Corporate Insurance policies

A standardized strategy to dealing with POAs for automotive insurance coverage throughout all corporations would simplify the method for everybody concerned. Then again, the present panorama finds various practices. This necessitates a diligent evaluation of the particular insurance policies of the related insurance coverage corporations.

| Insurance coverage Corporate | Coverage on POA | Touch Data |

|---|---|---|

| Instance Corporate 1 | Instance Corporate 1 calls for a notarized POA record, in particular outlining the scope of authority granted to the agent. In addition they require a duplicate of the insured’s motive force’s license and evidence of cope with. | (800) 555-1212, examplecompany1@e-mail.com |

| Instance Corporate 2 | Instance Corporate 2 necessitates an authorized replica of the POA, together with the unique record for verification. They prioritize an in depth POA specifying the particular insurance policy concerned. In addition they require an extra verification step, corresponding to a telephone name to the policyholder. | (800) 555-1213, examplecompany2@e-mail.com |

| Instance Corporate 3 | Instance Corporate 3 follows a streamlined procedure. They settle for a notarized POA and a duplicate of the insured’s motive force’s license. They’ll now not require additional verification, excluding in extremely atypical circumstances. | (800) 555-1214, examplecompany3@e-mail.com |

Not unusual Insurance coverage Corporate Necessities for POAs

Insurance coverage corporations usually require positive paperwork to make sure the legitimacy and scope of a POA. Those necessities be sure that the insurance coverage corporate is coping with a sound and licensed consultant. The will for documentation varies via corporate.

Possible Obstacles of The use of a POA for Explicit Insurance coverage Claims

Whilst POAs be offering a handy approach to arrange automotive insurance coverage, positive boundaries may rise up in explicit declare eventualities. For instance, a POA will not be enough for claims involving disputes over legal responsibility or instances requiring the private testimony of the insured. A POA’s scope of authority is paramount in figuring out its applicability to more than a few claims. Insurance coverage corporations will usally scrutinize the POA’s wording to make sure it explicitly covers the particular declare.

Explicit Situations and Issues

Embarking at the adventure of a Energy of Lawyer for automotive insurance coverage is similar to charting a route, making sure your car’s coverage is guided via a transparent and loving compass. This segment delves into explicit eventualities, empowering you with insights to navigate the complexities and make sure your liked car stays safeguarded, even in difficult instances.

The most important Scenarios for a POA

A Energy of Lawyer for automotive insurance coverage is indispensable in a myriad of scenarios. It acts as a beacon of coverage, guiding the vessel of your insurance coverage via turbulent waters. Imagine those an important eventualities:

- Surprising Sickness or Incapacity: If you happen to face a debilitating sickness or damage, a POA can make sure that your automotive insurance coverage stays energetic and your car’s coverage continues. That is in particular an important for keeping up insurance policy in circumstances of long-term incapacitation.

- Seniority and Decreased Capability: As we age, our talents would possibly diminish. A POA guarantees {that a} depended on particular person can arrange automotive insurance coverage issues when you find yourself now not ready to take action independently. That is paramount for holding your car’s protection web.

- Prolonged Shuttle or Relocation: When you find yourself touring broadly or relocating, a POA can empower a depended on particular person to maintain automotive insurance coverage issues in your behalf. This is very important for seamless administrative duties, making sure steady protection when you are away.

- Emergency Scenarios: A POA may also be instrumental in managing insurance coverage issues in surprising emergencies, like injuries or robbery. A chosen particular person can impulsively cope with the insurance coverage necessities, minimizing disruption and making sure a clean procedure.

Age Workforce Issues

The optimum age for organising a POA for automotive insurance coverage varies in keeping with particular person instances. Figuring out those concerns permits for the introduction of a well-structured plan:

- More youthful Adults: For more youthful adults, a POA generally is a protection web for unexpected instances. That is in particular related for scenarios involving monetary or criminal demanding situations. That is a very powerful step in development resilience for the long run.

- Heart-Elderly Adults: Heart-aged adults would possibly discover a POA helpful for managing insurance coverage duties when dealing with busy schedules or possible well being problems. It is a sensible measure for making sure ongoing coverage for his or her car and circle of relatives.

- Seniors: For seniors, a POA is usally an important for keeping up automotive insurance policy as they age. This guarantees that their car’s protection and coverage are controlled successfully, even supposing they enjoy diminishing talents.

Emergency Enhance

A Energy of Lawyer generally is a lifeline in emergency scenarios, making sure swift and environment friendly dealing with of auto insurance coverage issues. It will possibly streamline the method and supply a way of safety.

- Coincidence Control: Within the tournament of an coincidence, a POA holder can briefly and successfully arrange insurance coverage claims and documentation. This reduces pressure and disruption all the way through a essential time.

- Automobile Robbery: A POA can expedite the method of submitting claims and acquiring essential forms associated with a stolen car. This will considerably reduce the disruption and restoration time.

- Coverage Renewals and Adjustments: A POA permits for clean renewal and changes to automotive insurance coverage insurance policies with out delays, making sure uninterrupted coverage.

POA Holder Obligations

The POA holder has a an important position in managing automotive insurance coverage insurance policies. Their tasks come with:

- Coverage Compliance: The POA holder is liable for making sure the coverage is maintained in compliance with the phrases and stipulations Artikeld within the settlement.

- Communique: Common conversation with the insurance coverage corporate is very important to deal with any inquiries or considerations associated with the coverage.

- Documentation: Keeping up meticulous data of all communications, bills, and coverage updates is an important for responsibility.

Scenarios The place a POA May No longer Be Suitable

Whilst a POA is usally recommended, there are circumstances the place it will not be the perfect resolution:

- Intentional Misuse: In circumstances the place there is a possible for intentional misuse of the POA, that you must moderately imagine choice answers to safeguard your pursuits.

- Conflicts of Pastime: If there is a important struggle of passion between the POA holder and the policyholder, it is vital to discover choice preparations.

Possible Prices and Charges, Energy of lawyer for automotive insurance coverage functions

Setting up a POA for automotive insurance coverage would possibly contain related prices and charges. Those bills can range relying at the explicit state of affairs and the selected means:

- Prison Charges: Consultations with criminal pros to draft the POA record would possibly incur related prices.

- Administrative Prices: Administrative duties inquisitive about putting in place and keeping up the POA would possibly contain positive charges.

Possible Problems and Dangers: Energy Of Lawyer For Automobile Insurance coverage Functions

The trail of empowerment via a Energy of Lawyer for automotive insurance coverage, whilst apparently easy, may also be fraught with possible pitfalls. Navigating those complexities calls for a willing consciousness of the prospective conflicts and dangers, fostering a deep figuring out that empowers knowledgeable selections. This can be a adventure that calls for vigilance and readability to make sure the graceful and equitable execution of the settlement.Navigating the prospective problems related to a Energy of Lawyer for automotive insurance coverage necessitates a profound figuring out of the complexities concerned.

The inherent dangers, whilst usally refined, may end up in disputes and difficulties if now not proactively addressed. Spotting those possible demanding situations permits one to proactively mitigate the related dangers, making sure a transparent and unambiguous pathway towards a a hit result.

Conflicts of Pastime

Figuring out the possibility of conflicts of passion when appointing a Energy of Lawyer for automotive insurance coverage is an important. A struggle arises when the person granted the facility has a private stake that might affect their selections referring to insurance coverage issues, probably jeopardizing the most productive pursuits of the major. This might manifest in scenarios the place the appointed agent has a monetary courting with the insurance coverage corporate or a competing insurance coverage supplier.

For instance, an in depth circle of relatives member appointed as a Energy of Lawyer may inadvertently prioritize their very own monetary achieve over the major’s perfect pursuits when settling on an insurance plans.

Dangers Related to The use of a POA for Automobile Insurance coverage

Using a Energy of Lawyer for automotive insurance coverage carries inherent dangers. The agent’s loss of familiarity with the nuances of auto insurance coverage insurance policies, blended with possible misunderstandings or misinterpretations of the major’s needs, may end up in unintentional penalties. For instance, an agent may inadvertently come to a decision that ends up in the next top class or a much less complete protection than what the major would have selected.

Additionally, disputes can rise up over the agent’s movements or selections, difficult the validity in their movements.

Examples of Possible Disputes

Disputes relating to a Energy of Lawyer for automotive insurance coverage can stem from more than a few assets. One commonplace situation comes to disagreements over coverage adjustments. As an example, the agent may come to a decision to cancel a coverage with out correct authorization or regulate protection ranges, resulting in a dispute in regards to the appropriateness of those adjustments. Every other possible dispute arises when the agent fails to correctly notify the insurance coverage corporate of the POA, resulting in the corporate refusing to honor the agent’s movements.

An extra complication happens when the agent makes selections in keeping with their very own personal tastes relatively than the major’s expressed wants.

Significance of In the hunt for Prison Suggest

The status quo of a Energy of Lawyer for automotive insurance coverage must now not be undertaken with out in search of knowledgeable criminal suggest. Prison suggest supplies essential steering in structuring the record, making sure compliance with acceptable regulations, and clarifying the scope of authority granted to the agent. This proactive measure is helping mitigate possible conflicts and disputes, fostering a transparent figuring out of the criminal implications concerned.

Procedures for Resolving Disputes

Disputes referring to a Energy of Lawyer for automotive insurance coverage must be addressed promptly and professionally. Preliminary steps usally contain conversation with the insurance coverage corporate and the agent to aim a solution via negotiation. If this fails, formal dispute solution mechanisms, corresponding to mediation or arbitration, may also be pursued. Those processes goal to achieve a mutually appropriate resolution whilst upholding the rights of all events concerned.

Steps to Take if Insurance coverage Corporate Refuses to Acknowledge POA

If the insurance coverage corporate refuses to acknowledge the Energy of Lawyer, a complete means is very important. Originally, evaluation the Energy of Lawyer record to make sure its validity and compliance with criminal necessities. Secondly, touch the insurance coverage corporate to request rationalization at the causes for his or her refusal. If the problem persists, discuss with criminal suggest to discover to be had choices, corresponding to beginning a proper dispute solution procedure.

This methodical means is an important for resolving the topic successfully and making sure the major’s rights are secure.

Epilogue

In conclusion, energy of lawyer for automotive insurance coverage supplies a an important framework for managing insurance coverage issues when a person is not able to take action. Navigating the criminal and sensible sides, together with explicit necessities, insurance coverage corporate insurance policies, and possible dangers, is essential for a clean procedure. This information goals to offer a transparent figuring out, enabling knowledgeable selections and a powerful strategy to managing automotive insurance coverage in more than a few instances.

Take into accout, in search of criminal suggest is at all times advisable for personalised recommendation.

Not unusual Queries

What are the various kinds of energy of lawyer related to insurance coverage?

Various kinds of energy of lawyer exist, each and every with various scopes. A sturdy energy of lawyer, for instance, grants authority that continues even supposing the major turns into incapacitated. Explicit powers of lawyer for insurance coverage are adapted to maintain insurance-related issues.

What are the standard prices and charges related to an influence of lawyer for automotive insurance coverage?

The prices of an influence of lawyer can range, depending on elements such because the jurisdiction and complexity of the record. Lawyer charges, record preparation, and any administrative prices incurred must be factored in.

How can I make sure that my energy of lawyer record is legally legitimate in my jurisdiction?

Prison validity varies via jurisdiction. Consulting with a criminal skilled on your space is very important to make sure the record complies with all essential criminal necessities.

How can I be in contact the facility of lawyer to the insurance coverage corporate?

The insurance coverage corporate wishes correct documentation of the facility of lawyer. Most often, offering an authorized replica of the signed record, together with any supporting paperwork, is needed.