Mutual of omaha long run care insurance coverage – Mutual of Omaha long-term care insurance coverage provides the most important coverage in opposition to the emerging prices of long-term care. Working out the specifics of those insurance policies, their protection choices, and related prices is necessary for knowledgeable decision-making. This information explores the important thing options, advantages, and possible drawbacks of Mutual of Omaha’s long-term care insurance coverage, offering a complete review that will help you decide if it is the proper are compatible to your wishes.

This detailed research delves into the nuances of Mutual of Omaha’s long-term care insurance policy, evaluating them to different main suppliers and highlighting the standards influencing top rate prices. We will read about coverage main points, protection specifics, and the declare procedure, equipping you with the data important to make an educated selection.

Advent to Lengthy-Time period Care Insurance coverage

The whisper of previous age, a chilling breeze rustling throughout the leaves of the next day, carries with it the quiet specter of dependence. A time when the acquainted routines of day by day lifestyles transform a frightening problem. Lengthy-term care insurance coverage is a safeguard by contrast unsure long term, a defend in opposition to the emerging tide of caregiving wishes. It is a proactive measure, providing monetary reinforce when conventional assets falter.This insurance coverage supplies the most important monetary help for the prices of long-term care services and products, similar to nursing domestic remains, assisted dwelling amenities, or in-home care.

It could be offering a lifeline, permitting folks to care for their dignity and independence whilst going through the calls for of prolonged care.

Not unusual Sorts of Lengthy-Time period Care Insurance coverage Protection

Working out the spectrum of protection choices is very important for deciding on a coverage that aligns with person wishes and monetary instances. Quite a lot of sorts of insurance policies cater to other personal tastes and possibility tolerances.

- Person Insurance policies: Those insurance policies are adapted to precise wishes and budgets, providing versatile protection choices.

- Team Insurance policies: Incessantly introduced thru employers, those plans supply a structured option to long-term care insurance coverage, with predetermined advantages and premiums.

- Hybrid Insurance policies: Those mix parts of person and workforce insurance policies, offering a mix of customization and pre-determined options.

Significance of Taking into consideration Lengthy-Time period Care Insurance coverage Choices

The monetary implications of long-term care are considerable. Failure to devise may end up in vital monetary pressure on households and folks. Taking into consideration long-term care insurance coverage permits folks to mitigate those dangers and care for monetary safety right through a susceptible time. Proactive making plans is vital to holding assets and making sure a extra comfy and predictable long term.

Comparability of Lengthy-Time period Care Insurance coverage Insurance policies

The desk beneath highlights key options of various long-term care insurance coverage insurance policies, taking into consideration a comparative review.

Mutual of Omaha Lengthy-Time period Care Insurance coverage

A whisper of a tale, a story of shadowed corridors and flickering candlelight, echoes throughout the annals of insurance coverage. Mutual of Omaha, a reputation steeped in historical past, has navigated the treacherous currents of the business, weathering storms and rising, phoenix-like, with a name solid within the fires of reliability. Their long-term care insurance coverage choices, shrouded within the cloak of practicality, are designed to offer a security web in opposition to the unpredictable tides of getting older.Mutual of Omaha, an organization recognized for its longevity and dedication to its policyholders, has a historical past rooted in neighborhood and balance.

Their long-term care insurance coverage insurance policies, designed to offer monetary safety right through sessions of prolonged sickness or incapacity, are a testomony to their dedication to offering complete protection. They have confronted demanding situations, like every establishment navigating the ever-shifting sands of the insurance coverage marketplace, however their center of attention on offering dependable protection has helped them care for a powerful popularity.

Historical past and Popularity

Mutual of Omaha, a venerable identify within the insurance coverage international, boasts a historical past courting again a long time. Their popularity for balance and monetary power has been constructed on a basis of sound actuarial practices and a deep figuring out of the evolving wishes in their policyholders. This popularity isn’t simply a declare, however a testomony borne out via their sustained presence available in the market and constant certain buyer comments.

Options and Advantages of Mutual of Omaha’s Lengthy-Time period Care Insurance coverage Insurance policies

Mutual of Omaha’s long-term care insurance coverage insurance policies be offering a spread of options and advantages designed to handle the original wishes of people as they navigate the complexities of getting older. Those plans most often come with provisions for protection of quite a lot of sorts of care, from professional nursing amenities to assisted dwelling, and regularly come with choices for customizing protection to compare person instances. The plans are structured to offer monetary safety right through sessions of prolonged sickness or incapacity, permitting policyholders to concentrate on their well being and well-being.

Protection Choices In comparison to Different Main Suppliers

Evaluating Mutual of Omaha’s long-term care insurance coverage choices with the ones of alternative main suppliers unearths a various panorama of advantages and pricing buildings. Every supplier tailors its choices to fulfill the particular wishes and personal tastes of various demographics, and policyholders should completely analyze those components to choose essentially the most appropriate protection.

Key Variations Between Mutual of Omaha’s Plans

| Plan Characteristic | Mutual of Omaha Plan A | Mutual of Omaha Plan B |

|---|---|---|

| Day by day Get advantages Quantity | $150 | $200 |

| Get advantages Length | one year | 24 months |

| Most Get advantages Quantity | $100,000 | $150,000 |

| Premiums | (Instance: $100/month) | (Instance: $150/month) |

Mutual of Omaha provides distinct plans to deal with various wishes and monetary eventualities. The desk above highlights key variations in day by day receive advantages quantities, receive advantages sessions, and most payouts, all the most important concerns in comparing essentially the most appropriate plan. Premiums, whilst depending on a number of components, also are introduced as a information to policyholders’ figuring out of the associated fee.

Coverage Main points and Protection

A whisper of uncertainty hangs within the air, a premonition of the unknown. Lengthy-term care insurance coverage, a labyrinth of chances and obstacles, awaits exploration. Working out its intricacies is the most important, as navigating this maze can imply the adaptation between peace of thoughts and unexpected hardship.The labyrinthine nature of long-term care insurance coverage insurance policies continuously leaves folks feeling misplaced. Realizing the particular sorts of care coated, the eventualities the place those insurance policies shine, and the possible pitfalls is very important for knowledgeable decision-making.

This exploration will dissect those the most important sides, losing gentle at the intricacies of Mutual of Omaha’s choices.

Sorts of Care Lined

Mutual of Omaha’s long-term care insurance policy most often duvet a spread of services and products, from essentially the most fundamental help with day by day dwelling actions to professional nursing care. This encompasses non-public care, similar to dressing, bathing, and consuming, in addition to professional nursing care, treatment, and rehabilitation services and products. The particular services and products integrated in every plan range, so it’s good to moderately evaluation the coverage main points.

Recommended Scenarios

Lengthy-term care insurance coverage is continuously a beacon of hope in difficult occasions. Imagine eventualities the place folks require ongoing help past the scope of conventional healthcare protection. As an example, a stroke survivor desiring assist with mobility and day by day duties, or an aged person requiring round the clock care, would possibly to find long-term care insurance coverage to be a the most important protection web. The monetary burden of those prolonged care wishes will also be immense, and insurance coverage can considerably scale back the monetary pressure on households.

Coverage Exclusions and Barriers

Navigating the nuances of long-term care insurance coverage insurance policies calls for cautious attention of exclusions and obstacles. Those clauses Artikel eventualities the place protection won’t follow. Working out those sides is important to keep away from unexpected monetary implications.

Not unusual Exclusions and Barriers

| Exclusion Class | Description | Instance |

|---|---|---|

| Pre-existing Prerequisites | Prerequisites recognized or handled prior to the coverage’s efficient date are continuously excluded. This implies the coverage won’t duvet take care of a situation the insured already had. | An individual with a historical past of arthritis who applies for long-term care insurance coverage after the prognosis is probably not coated for arthritis-related care. |

| Care Equipped at House | The extent of care coated at domestic would possibly fluctuate from institutional care. The coverage would possibly prohibit the kind of care supplied at domestic. | Some insurance policies would possibly duvet simplest sure sorts of domestic care help, like assist with dressing and bathing, however no longer round the clock nursing care at domestic. |

| Explicit Care Suppliers | Insurance policies will have conditions in regards to the particular care suppliers they duvet. | Some insurance policies would possibly no longer duvet care from sure healthcare amenities or particular physicians. |

| Length of Protection | Insurance policies continuously position limits at the period of time protection is supplied. | A coverage would possibly duvet long-term take care of a most of 5 years, and then the protection would possibly stop, relying at the particular plan. |

Prices and Premiums

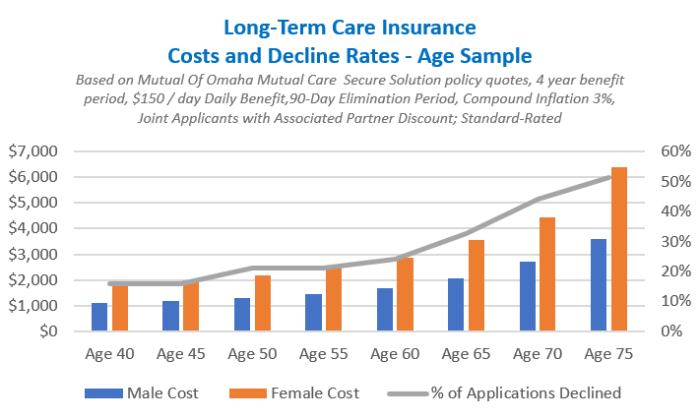

The veil of long-term care insurance coverage premiums hangs heavy, a silent whisper of long term monetary burdens. Navigating those prices can really feel like interpreting an historic, cryptic textual content, fraught with hidden variables and unexpected headaches. Working out the standards that form those prices is the most important, a key to unlocking the possible burdens and advantages of this kind of coverage.The cost of long-term care insurance coverage is not etched in stone; it is a dynamic equation, influenced via a large number of components.

Your age, naturally, performs an important position. More youthful folks most often pay much less, whilst the older you might be, the costlier the coverage turns into. Well being standing is every other pivotal component; pre-existing stipulations can affect the top rate, continuously pushing the cost upwards. The selected protection quantity, whether or not you want fundamental help or complete care, immediately impacts the associated fee.

The particular advantages integrated within the coverage, such because the day by day allowance or the period of protection, are additional determinants of the whole expense.

Elements Influencing Premiums

The intricate dance of long-term care insurance coverage premiums comes to a number of key gamers. Age is a number one determinant, as the chance of desiring long-term care will increase with advancing years. Well being stipulations, each recognized and unknown, can considerably have an effect on the top rate, reflecting the actuarial calculations of possible claims. The specified protection quantity immediately correlates with the top rate, with better monetary coverage tough a better value.

The particular advantages package deal, together with day by day allowances, the period of protection, and the extent of care integrated, additionally contributes to the top rate’s total construction.

Evaluating Mutual of Omaha Premiums with Competition

An instantaneous comparability of Mutual of Omaha’s premiums with competition is not readily to be had in a standardized layout. Insurance coverage firms continuously make use of other methodologies for pricing insurance policies, creating a easy, apples-to-apples comparability difficult. Elements similar to coverage design, receive advantages buildings, and the particular markets served give a contribution to the disparities. Direct inquiries with Mutual of Omaha and competitor firms are important for correct comparisons.

Top rate Prices for Other Age Teams, Mutual of omaha long run care insurance coverage

A glimpse into possible prices for Mutual of Omaha long-term care insurance coverage is obtainable within the following desk. Be aware that those are illustrative examples, and exact premiums will range in keeping with person instances.

| Age Team | Protection Quantity | Annual Top rate (Illustrative) |

|---|---|---|

| 50-59 | $5,000/day | $2,500 – $5,000 |

| 60-69 | $5,000/day | $3,000 – $6,000 |

Declare Procedure and Management

A whisper of uncertainty drifts throughout the halls of getting older, a chilling wind that carries the threat of monetary pressure. Lengthy-term care insurance coverage, a beacon within the twilight of lifestyles, guarantees a security web. However how does one navigate the labyrinthine declare procedure when the shadows extend and the desire arises? This exploration delves into the intricate mechanisms of claims, revealing the stairs and situations concerned.The declare procedure is a moderately orchestrated dance, requiring precision and figuring out.

A well-defined process, designed to relieve nervousness and streamline the method, is paramount. Realizing the stairs and examples of eventualities the place a declare could be filed can ease the load and be offering peace of thoughts.

Declare Submitting Scenarios

Working out the instances that necessitate a declare is the most important. Those situations surround a spread of possible wishes. A unexpected, debilitating stroke, leaving a liked one depending on consistent care, can cause a declare. A revolutionary neurological situation, slowly eroding independence, would possibly necessitate long-term care services and products and next declare submitting. Even a critical twist of fate, leading to extended rehabilitation and caregiving necessities, may end up in a declare.

Steps in Submitting a Declare

Navigating the declare procedure is a chain of moderately choreographed steps. Every step is a the most important component in making sure a easy and environment friendly solution.

- Preliminary Touch and Overview:

- Documentation Submission:

- Declare Overview and Analysis:

- Get advantages Resolution:

- Get advantages Disbursement:

The adventure starts with a choice to Mutual of Omaha. A initial review determines the character of the desire and the eligibility of the policyholder for advantages. Accumulating the important documentation and coverage data is the most important at this degree. This preliminary touch guarantees the declare is filed as it should be and successfully.

A complete packet of paperwork is the most important. Clinical information, doctor statements, and care plan main points shape the root of the declare. The completeness and accuracy of those paperwork are necessary for a swift and efficient evaluation. Lacking or incomplete documentation would possibly prolong or deny the declare.

Mutual of Omaha meticulously opinions the submitted paperwork. This step comes to assessing the policyholder’s eligibility and the need of the asked care. Clinical pros and claims adjusters overview the placement. This degree guarantees that the declare meets the coverage’s Artikeld necessities.

In keeping with the evaluation, Mutual of Omaha will decide the volume of advantages payable. This choice is in keeping with the coverage main points, the kind of care wanted, and the period of care. The policyholder will obtain notification of the licensed receive advantages quantity and the plan for disbursement.

As soon as licensed, the advantages are dispensed in keeping with the coverage phrases. The method of fee is clear and streamlined to make sure well timed receipt via the care supplier.

Declare Procedure Desk

| Step | Description |

|---|---|

| Step 1 | Preliminary touch with Mutual of Omaha and initial review of the placement. |

| Step 2 | Submission of entire and correct documentation, together with scientific information and care plans. |

| Step 3 | Overview and analysis of the declare via Mutual of Omaha’s scientific pros and claims adjusters. |

| Step 4 | Resolution of advantages payable in keeping with coverage main points, care wishes, and period of care. |

| Step 5 | Disbursement of advantages in keeping with coverage phrases to the designated care supplier. |

Buyer Opinions and Testimonials

Whispers of pleasure and unease, just like the chilling wind thru a forgotten crypt, echo throughout the virtual halls of purchaser opinions. Those murmurs, those moderately selected phrases, be offering a glimpse into the intricate tapestry of reports with Mutual of Omaha’s long-term care insurance coverage.

Unraveling those threads unearths a posh narrative, a mixture of convenience and apprehension.

Buyer Comments Research

A shadowy determine lurks throughout the realm of purchaser comments. Some voices resonate with reward, others with worry. Working out those contrasting views is the most important for comprehending the nuances of the insurance coverage program. This research dissects the typical threads woven into the opinions, each certain and damaging, to offer a complete view.

Sure Buyer Comments

A refrain of contentment rises from the virtual ether. Consumers who discovered price in this system continuously spotlight the reassurance it supplies. The protection of figuring out their long term wishes are doubtlessly coated is an impressive motivator.

- “I am perpetually thankful for the reassurance this coverage supplies. Realizing my care is roofed, it doesn’t matter what, is precious.”

- “The declare procedure was once strangely easy. The team of workers was once responsive and useful all the way through all of the procedure. I felt assured of their experience.”

- “The premiums had been affordable in comparison to different quotes I gained. The protection choices had been versatile sufficient to fulfill my particular wishes.”

Damaging Buyer Comments

A counterpoint emerges, a whisper of discontent. Issues regularly revolve across the complexity of the coverage main points, the perceived obstacles of protection, and the monetary burden of premiums. Those problems underscore the significance of thorough coverage evaluation and comparability.

| Class | Overview Excerpt |

|---|---|

| Damaging | “The coverage wording was once dense and complicated. It took me a number of hours to totally perceive the main points.” |

| Damaging | “The top rate prices had been considerably upper than I expected, particularly given the extent of protection.” |

| Damaging | “The declare procedure gave the impression overly bureaucratic. I skilled a number of delays and headaches.” |

Opting for the Proper Coverage: Mutual Of Omaha Lengthy Time period Care Insurance coverage

The labyrinth of long-term care insurance coverage insurance policies can really feel like a haunted area, stuffed with whispers of hidden prices and unsure futures. Navigating this maze calls for a willing eye and a gentle hand, and in all probability, a bit little bit of braveness. However worry no longer, for with cautious attention and the correct steerage, you’ll be able to to find the coverage that most closely fits your wishes.

A well-chosen coverage is not only about protective your monetary long term; it is about safeguarding your peace of thoughts within the face of the unknown.Deciding on the proper long-term care insurance plans is a the most important resolution. It isn’t near to numbers and premiums; it is about expecting the opportunity of long term care wishes and securing monetary coverage. An acceptable coverage can give necessary reinforce when confronted with surprising long-term well being demanding situations, combating monetary break and making sure a comfy high quality of lifestyles.

Opting for the incorrect coverage, on the other hand, can depart you susceptible and uncovered, like a boat with out a rudder in a typhoon.

Consulting a Monetary Consultant

A monetary marketing consultant acts as a an expert information within the advanced panorama of long-term care insurance coverage. They possess the experience to investigate your particular monetary state of affairs, taking into consideration your belongings, liabilities, and projected long term wishes. This customized means is helping tailor a coverage in your person instances, optimizing protection and minimizing prices. Through figuring out your distinctive state of affairs, an marketing consultant can determine possible pitfalls and spotlight optimum methods.

Elements to Imagine

A number of components affect the choice of an acceptable long-term care insurance plans. Those components vary from the projected value of care to your house in your person well being historical past. A complete analysis of those components guarantees the selected coverage aligns along with your expected wishes and finances. Imagine your present well being, expected long term well being wishes, and the monetary implications of possible long-term care bills.

Take into consideration your way of life and dwelling preparations, and the way those components would possibly impact your care necessities.

Coverage Analysis Questions

An intensive analysis of a long-term care insurance plans comes to asking particular questions to make sure it aligns along with your wishes and monetary state of affairs. Those questions assist to discover the possible advantages and downsides of various insurance policies. Do not be afraid to delve deep into the main points; your long term well-being is determined by it. Questions to invite come with:

- What are the particular sorts of care coated via the coverage? (e.g., nursing domestic care, assisted dwelling, domestic well being care)

- What’s the day by day or per month receive advantages quantity supplied beneath the coverage?

- What’s the most receive advantages length introduced via the coverage?

- What are the coverage’s exclusions and obstacles?

- What’s the coverage’s top rate construction and the way does it range through the years?

- What are the coverage’s administrative prices and declare processing procedures?

- What’s the coverage’s assured renewable clause?

Coverage Professionals and Cons

Working out the strengths and weaknesses of various coverage varieties is the most important. The next desk illustrates the possible benefits and downsides of quite a lot of long-term care insurance coverage insurance policies, labeled via key options. This may increasingly support in making an educated resolution.

| Coverage Characteristic | Professional | Con |

|---|---|---|

| Protection Quantity | Upper protection quantities supply better monetary safety in case of considerable care wishes. | Upper protection quantities continuously translate to better premiums. |

| Get advantages Length | Longer receive advantages sessions be offering prolonged monetary coverage in opposition to long-term care bills. | Longer receive advantages sessions would possibly build up premiums considerably. |

| Top rate Construction | Premiums in keeping with age and well being standing can mirror a extra correct review of possibility. | Premiums would possibly build up through the years, particularly with age. |

| Coverage Exclusions | Transparent exclusions prohibit protection to precise care wishes, doubtlessly lowering top rate prices. | Exclusions would possibly depart gaps in protection if care wishes fall out of doors the coverage’s scope. |

Concluding Remarks

In conclusion, Mutual of Omaha long-term care insurance coverage gifts an important possibility for the ones looking for coverage in opposition to the considerable bills of long-term care. Cautious attention of coverage specifics, top rate prices, and protection choices is paramount. Consulting with a monetary marketing consultant can additional help in navigating the complexities of choosing the proper coverage. This complete information objectives to empower you with the data to make an educated resolution about your long-term care insurance coverage wishes.

Query Financial institution

What are the everyday day by day receive advantages quantities introduced via Mutual of Omaha?

Mutual of Omaha provides a spread of day by day receive advantages quantities, various in keeping with the particular plan. Knowledge on exact day by day receive advantages quantities is not to be had with out particular plan main points.

How does Mutual of Omaha’s declare procedure paintings?

The declare procedure most often comes to filing important documentation, which varies relying at the particular instances. Mutual of Omaha most likely has an in depth procedure Artikeld of their coverage paperwork.

What are some not unusual exclusions in long-term care insurance coverage insurance policies?

Not unusual exclusions continuously come with pre-existing stipulations, care supplied out of doors the scope of the coverage, and likely sorts of care no longer deemed medically important. Seek the advice of the coverage file for exact main points.

Are there any age obstacles or restrictions on Mutual of Omaha’s long-term care insurance coverage?

Mutual of Omaha most likely has age restrictions on when folks should purchase insurance policies, very similar to different insurance coverage suppliers. Explicit age limits will also be discovered within the coverage main points.