Bike insurance coverage vs automobile insurance coverage: Choosing the proper coverage is an important for any car proprietor. This complete information explores the nuanced variations, from protection comparisons and top rate buildings to claims processes and legal responsibility concerns. Working out the specifics of each and every coverage sort will empower you to make an educated choice, making sure your car and your monetary well-being are safe.

From the preliminary price of premiums to the intricacies of legal responsibility protection, this exploration unveils the distinct options of each and every coverage. We’re going to navigate the complexities, offering transparent insights that can assist you perceive which form of insurance coverage absolute best aligns along with your wishes and way of life. Whether or not you are a seasoned rider or a brand new motive force, this comparability equips you with the data to make the best selection.

Protection Comparability

Yo, so that you wanna know the deets on motorbike insurance coverage vs. automobile insurance coverage? It is completely other, fam. One’s for zipping round on two wheels, the opposite for cruising in a steel beast. Let’s ruin it down.Bike insurance coverage and automobile insurance coverage each have their very own distinctive protection wishes, relying at the dangers concerned.

Other ranges of coverage are wanted for various scenarios.

Standard Coverages

Insurance coverage insurance policies have a number of various coverages, like legal responsibility, collision, complete, and extra. Every one protects you from various kinds of harm or injuries. Working out those differing kinds is essential to choosing the right coverage to your experience.

| Protection Sort | Bike Insurance coverage Main points | Automobile Insurance coverage Main points |

|---|---|---|

| Legal responsibility | Covers damages you motive to other folks or their assets whilst driving. Elementary legal responsibility is normally required, however you may want additional protection for upper limits. | Covers damages you motive to other folks or their assets whilst riding. Very similar to motorcycles, legal responsibility is needed however upper limits are a good suggestion. |

| Collision | Covers harm on your motorbike in case you crash into one thing, like every other car or a pole. An important if you are driving at the street, and will get great pricey if you are now not insured. | Covers harm on your automobile in case you crash into one thing, together with different vehicles. Once more, crucial for street use and crucial for now not going through large expenses. |

| Complete | Covers harm on your motorbike from issues past injuries, like vandalism, robbery, or climate harm. Call to mind this as additional coverage for the surprising stuff. | Covers harm on your automobile from issues past injuries, like vandalism, robbery, or climate harm. Complete is a significant plus if you need peace of thoughts. |

| Uninsured/Underinsured Motorist | Protects you if you are in an twist of fate with any individual who does not have insurance coverage or does not have sufficient insurance coverage to hide the damages. You do not need to be left keeping the bag if any individual else screws up. | Protects you if you are in an twist of fate with any individual who does not have insurance coverage or does not have sufficient insurance coverage to hide the damages. This can be a primary must-have, severely. |

Commonplace Exclusions

Those insurance policies ain’t magic, they’ve some stuff they may not duvet. Understanding what is now not integrated is great necessary, so you aren’t getting stunned later.

- Put on and tear: Standard put on and tear to your car is not normally coated. Call to mind it like, in case your motorbike’s paint fades just a little, that is not normally coated.

- Pre-existing prerequisites: In case your motorbike or automobile has issues sooner than the insurance coverage begins, it may not be coated. So, test for any problems sooner than purchasing a coverage.

- Racing or stunt driving: In case you are doing loopy stunts to your motorbike, or racing illegally, your insurance coverage may now not duvet you. Keep throughout the felony and protected limits, fam.

- Harm led to deliberately: Insurance coverage may not duvet harm you motive on function. Do not do anything else silly, or your coverage may now not lend a hand.

Upload-on Coverages

Further coverages are like add-ons, you’ll be able to customise your coverage to suit your wishes. Some commonplace add-ons come with roadside help, condo automobile protection, and extra.

- Roadside help: This is helping you out in case you ruin down or have hassle at the street. That is great useful, particularly if you are a ways from house.

- Condo automobile protection: In case your motorbike or automobile is broken and cannot be pushed, this may occasionally duvet a condo automobile whilst upkeep are being made. That is great useful when you wish to have to get round.

- Non-public results protection: This covers private pieces for your motorbike or automobile that get broken or stolen. This turns out to be useful in case you lose your stuff whilst driving.

Coverage Premiums

Yo, so like, insurance coverage premiums for motorcycles and vehicles are completely other, proper? It is not as regards to the kind of protection, it is far more complicated than that. Various factors completely impact how a lot you pay, and we are gonna ruin it down for you.Bike insurance coverage premiums are frequently approach less than automobile insurance coverage premiums, however there is a catch. It is all concerning the dangers concerned.

Automobiles are heavier, have extra transferring portions, and are excited about extra injuries. Motorcycles are far more at risk of harm, and the rider’s enjoy and the motorbike’s options play an enormous position in the associated fee tag.

Elements Influencing Bike Insurance coverage Premiums

Insurance coverage corporations have a look at a number of items when working out your motorbike insurance coverage value. Stuff like your age, how lengthy you have had a license, and the place you reside all play a job. In addition they test your driving historical past, together with any injuries or tickets. These things is completely necessary as it tells them how most probably you’re to get right into a damage.

The kind of motorbike you experience additionally issues. A great-powered sports activities motorbike is clearly riskier than a kick back cruiser, so it will most likely price extra to insure.

Elements Influencing Automobile Insurance coverage Premiums

Automobile insurance coverage corporations imagine a ton of things too. Age, riding historical past, location, or even your credit score ranking can all impact the associated fee. A automobile with a better cost will normally have a better top rate. The kind of automobile, its security measures, and the way frequently you force all of it play a job. Insurance coverage corporations need to know if you are a protected motive force and the way most probably you’re to motive an twist of fate.

Evaluating Standard Top rate Prices

Most often, bike insurance coverage premiums are inexpensive for identical protection ranges. Take into consideration it – a fundamental coverage for a fundamental automobile may well be $1000+ a 12 months, however for a motorbike, it may well be $500 or much less. However, like, it relies so much at the explicit coverage, the motorbike’s options, and your riding historical past.

Affect of Rider Enjoy and Car Options

A rider with a blank riding file and numerous enjoy on a motorbike with just right security measures will most probably pay much less for insurance coverage. In case you are a brand new rider or have a historical past of injuries, it is going to price extra. The similar is going for the motorbike itself. A motorcycle with anti-theft options or complicated protection apparatus may have a decrease top rate.

Stuff like ABS brakes or complicated traction keep an eye on could make a large distinction in the fee.

Top rate Diversifications In response to Other Elements

| Issue | Bike Top rate Affect | Automobile Top rate Affect |

|---|---|---|

| Age | More youthful riders frequently pay extra. | More youthful drivers frequently pay extra. |

| Using Historical past | Injuries and violations build up premiums. | Injuries and violations build up premiums. |

| Location | Top-accident spaces generally imply upper premiums. | Top-accident spaces generally imply upper premiums. |

| Car Sort | Top-performance motorcycles normally price extra. | Top-value vehicles normally price extra. |

| Protection Stage | Upper protection ranges build up premiums. | Upper protection ranges build up premiums. |

| Car Options | Anti-theft options or protection apparatus can decrease premiums. | Security features and anti-theft units can decrease premiums. |

Claims Procedure: Bike Insurance coverage Vs Automobile Insurance coverage

Yo, so that you wanna understand how to report a declare in case your motorbike or experience will get wrecked? It is completely other from a automobile, you already know? This breakdown will completely transparent issues up.

Bike Insurance coverage Claims

Submitting a declare to your motorbike is lovely easy. First, you gotta touch your insurance coverage corporate ASAP. They’re going to stroll you during the procedure and get you began with a declare quantity. Subsequent, accumulate the entire vital data – just like the police record (if there used to be one), pictures of the wear and tear, and your insurance plans main points. Your insurance coverage supplier will most likely ship a claims adjuster to evaluate the wear and tear.

They’re going to evaluation the wear and tear on your motorbike and come to a decision at the payout. You’ll be able to most likely want to supply evidence of possession too. If the entirety assessments out, they will provide the money or restore the motorbike. It is all lovely kick back.

Automobile Insurance coverage Claims

Automobile claims are identical, however with a couple of extra hoops to leap thru. You may have gotta record the twist of fate to the police, get a police record. Then, touch your insurance coverage corporate right away and get a declare quantity. Accumulate the entire data – insurance coverage main points, police record, harm pictures, scientific expenses (if appropriate), and witness statements. An adjuster will come and investigate cross-check the automobile’s harm.

They’re going to additionally examine the reason for the twist of fate and the fault. Relying at the coverage and the location, your insurer may require a automobile inspection record. After that, they will decide the agreement quantity and will let you know if you are gonna get a restore or a payout.

Time frame for Claims Agreement

The time it takes to settle a declare varies wildly. For minor motorbike damages, it may be great fast, like every week or two. Main motorbike wrecks may take a couple of weeks longer. With vehicles, it may be even slower. It in point of fact depends upon the complexity of the declare, the supply of the portions, and the insurance coverage corporate’s workload.

On occasion, problems like getting a substitute phase can sluggish issues down.

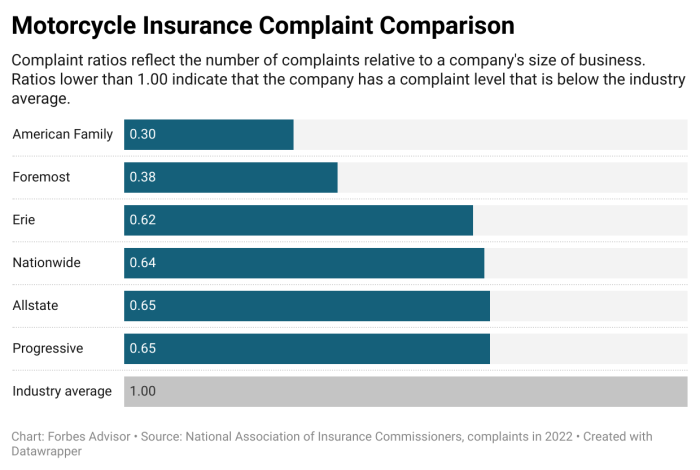

Insurance coverage Supplier Variations

Other insurance coverage corporations maintain claims another way. Some are great speedy and environment friendly, whilst others generally is a general drag. Some may have other payout choices, like providing a money agreement as an alternative of restore. Some corporations may also have other standards for harm review or the time-frame for the declare.

Declare Procedure Comparability

| Step | Bike Insurance coverage | Automobile Insurance coverage |

|---|---|---|

| Document Coincidence/Harm | Touch insurance coverage ASAP, accumulate pictures, police record (if appropriate) | Report back to police, get police record, touch insurance coverage ASAP, accumulate pictures, witness statements, scientific expenses |

| Claims Overview | Claims adjuster inspects motorbike, evaluates harm | Claims adjuster inspects automobile, evaluates harm, investigates fault |

| Agreement | Money payout or restore, relying at the coverage | Money payout or restore, relying at the coverage |

| Standard Time frame | Most often sooner than automobile claims, however varies in accordance with complexity | Most often longer than motorbike claims, varies in accordance with complexity and availability of portions |

Legal responsibility and Duty

Yo, so like, insurance coverage for motorcycles and vehicles is completely other with regards to who is accountable if somethin’ is going down. It is not as regards to the coverage, it is about the true rules, which generally is a genuine headache if you are now not clued in. Understanding your felony tasks is essential to avoidin’ a significant mess.

Criminal Responsibilities for Motorbikes

Bike house owners face other felony tasks in comparison to automobile house owners. For starters, you might be in most cases held to a better same old of consciousness and warning at the street, since motorcycles be offering much less coverage in a crash. Take into consideration it, a motorbike is far more uncovered to the weather and different cars than a automobile. This implies you gotta be additional cautious and be careful for the entirety.

Plus, you may want to be extra acutely aware of attainable hazards like unhealthy climate prerequisites.

- Following visitors rules is an important. Velocity limits, lane adjustments, and sign utilization are great necessary. Ignoring those may end up in critical penalties, like tickets and even injuries.

- Keeping up your motorbike could also be a large deal. Be certain it is in most sensible form, with just right tires, brakes, and lighting fixtures. This isn’t best to your protection but in addition for the security of alternative drivers.

- Wearing the best forms could also be a should. License plates, registration, and insurance coverage paperwork must at all times be readily to be had. You’ll get an enormous price tag in case you would not have the best papers.

Criminal Responsibilities for Automobiles

Automobile house owners have a identical set of tasks, however with some added layers of complexity. Automobile injuries may also be extra vital, each financially and relating to accidents, so the principles are somewhat extra stringent. You may have gotta be additional wary at the back of the wheel, particularly with passengers and load.

- Site visitors rules are simply as an important for vehicles as they’re for motorcycles. Following velocity limits, signaling, and riding safely are crucial. You’ll’t simply forget about visitors regulations and be expecting to be protected.

- Keeping up your automobile’s situation is very important. Be certain your brakes, lighting fixtures, and different security measures are operating correctly. This isn’t as regards to your protection however the protection of others at the street.

- Being acutely aware of your setting is important. Be aware of different cars, pedestrians, and attainable hazards like potholes. In case you are now not paying consideration, you might be atmosphere your self up for hassle.

Legal responsibility Variations in Injuries

The consequences of injuries vary considerably between motorcycles and vehicles. A motorcycle twist of fate can frequently lead to much less critical harm, however accidents can nonetheless be critical. Alternatively, automobile injuries could have far more in depth harm to assets and extra critical accidents. Take into consideration it – a automobile twist of fate can contain more than one cars and probably extra folks.

| Side | Bike Insurance coverage | Automobile Insurance coverage |

|---|---|---|

| Legal responsibility for Accidents | Normally covers accidents to others, however limits may practice relying at the coverage. | Covers accidents to others and probably passengers, with protection quantities frequently considerably upper than for motorcycles. |

| Legal responsibility for Assets Harm | Covers assets harm led to through the motorbike, however limits may also be decrease in comparison to automobile insurance coverage. | Covers harm to different cars and assets, and normally comprises upper protection limits. |

| Monetary Duty | Might contain decrease payout quantities in comparison to automobile injuries because of the lower price of the car. | Normally comes to upper payout quantities because of the upper price of the car and attainable for extra critical accidents. |

Further Options and Advantages

Yo, so that you wanna stage up your experience coverage? Insurance coverage ain’t as regards to the fundamentals, fam. It is about the entire additional sweets that include it. Those add-ons can severely save your bacon if issues pass sideways. We are breaking down the additional options for motorcycles and vehicles, appearing you ways other suppliers stack up.

Further Options for Bike Insurance coverage

This segment dives into the additional options that may make your motorbike insurance coverage sport robust. Those add-ons can severely spice up your coverage and peace of thoughts.

- Breakdown Duvet: This can be a primary one. In case your motorbike bites the mud, this cap can pay for upkeep or a substitute. Assume general loss or critical harm, like a complete write-off. That is like having a security web for when your experience is going kaput.

- Non-public Coincidence Duvet: This one’s an important. In the event you get harm whilst driving, this covers your scientific expenses and misplaced source of revenue. It is a lifesaver in case you get wrecked.

- 3rd-Birthday celebration Hearth and Robbery Duvet: This is going past the fundamentals. It covers harm to other folks’s assets in case your motorbike reasons it, and protects towards robbery. You might want to for duty.

- Emergency Roadside Help: This one’s completely grab. In the event you get stranded, it is like having a squad of ride-helpers. This covers towing, leap begins, and different emergencies.

Further Options for Automobile Insurance coverage

Now, let’s communicate concerning the additional sweets for vehicles. Those extras can provide you with primary peace of thoughts if you find yourself cruising round.

- Complete Duvet: That is the bomb. It protects your automobile from just about anything else, from injuries to vandalism to herbal failures. It covers the automobile’s harm and service prices. It is like having a complete defend to your experience.

- Uninsured/Underinsured Motorist Protection: This can be a must-have. In the event you get hit through any individual with out a insurance coverage or now not sufficient insurance coverage, this protection steps in to lend a hand pay to your damages. It is an important for protection.

- Condo Repayment: In case your automobile’s within the store after an twist of fate, this selection can pay for a condo automobile. It is a lifesaver if you wish to have a experience whilst your automobile’s getting mounted.

- Glass Protection: That is for the ones inevitable rock chips and cracked windshields. It covers the price of solving or changing the glass to your automobile.

Comparability of Options through Supplier

Other insurance coverage corporations be offering various ranges of additional options. Some corporations may well be great beneficiant with add-ons, whilst others are somewhat extra fundamental. Store round and examine! Do not be a dummy, do your analysis.

| Function | Bike Insurance coverage | Automobile Insurance coverage |

|---|---|---|

| Breakdown Duvet | Sure (some suppliers) | No (once in a while as an add-on) |

| Non-public Coincidence Duvet | Sure (some suppliers) | Sure (some suppliers) |

| 3rd-Birthday celebration Hearth and Robbery Duvet | Sure (same old) | Sure (same old) |

| Emergency Roadside Help | Sure (some suppliers) | Sure (some suppliers) |

| Complete Duvet | Hardly | Sure (maximum insurance policies) |

| Uninsured/Underinsured Motorist Protection | Hardly | Sure (maximum insurance policies) |

Distinctive Upload-on Coverages

Some insurance coverage suppliers be offering distinctive add-ons for sure scenarios. Some corporations are extra versatile with their choices.

- Bike Insurance coverage: Some corporations may be offering specialised duvet for racing or off-roading actions. This turns out to be useful for riders who push their motorcycles to the max.

- Automobile Insurance coverage: Some suppliers may be offering further protection for explicit automobile options like GPS monitoring or anti-theft units. This is helping give protection to tech and dear options.

Coverage Sorts and Choices

Yo, so that you wanna know the various kinds of insurance coverage insurance policies for motorcycles and vehicles? It is like, completely an important to grasp your choices, cuz you do not wanna be caught with a coverage that is not best for you. Other insurance policies have other ranges of protection, so that you gotta pick out the one who suits your wishes and your pockets.Insurance coverage insurance policies are mainly contracts between you and the insurance coverage corporate.

They Artikel what is coated and what is now not. Working out those main points is secret to meaking certain you might be safe.

Bike Insurance coverage Coverage Sorts

Other bike insurance coverage insurance policies cater to more than a few wishes and budgets. Understanding the categories to be had is helping you select the most productive are compatible to your experience.

- Legal responsibility Most effective: This coverage is the naked minimal, protecting best harm you motive to others. Call to mind it like, absolutely the necessities, in case you damage any individual’s automobile, you might be coated, however now not to your personal motorbike.

- Collision Protection: This coverage kicks in in case your motorbike will get wrecked in an twist of fate, regardless of who is at fault. It is like, the assurance for when issues pass sideways, even supposing you might be now not the motive.

- Complete Protection: That is without equal coverage, protecting harm from issues but even so injuries, like robbery, vandalism, and even climate harm. It is like, general coverage towards anything else that may occur on your motorbike.

- Uninsured/Underinsured Motorist Protection: This protection steps in if you are hit through any individual who does not have insurance coverage or does not have sufficient to hide the wear and tear. It is like, your protection web when others don’t seem to be.

Automobile Insurance coverage Coverage Sorts

Other automobile insurance coverage insurance policies duvet other eventualities and supply various ranges of coverage.

- Legal responsibility Protection: That is the basic protection, paying for damages you motive to other folks’s vehicles or accidents to them. It is like, the naked minimal, however it is an important.

- Collision Protection: This kicks in in case your automobile will get broken in a collision, regardless of who is at fault. It is like, the assurance that your automobile is roofed if you are excited about a crash.

- Complete Protection: Covers damages past collisions, like vandalism, hearth, or robbery. It is like, all the bundle, protective your automobile from anything else that would pass incorrect.

- Uninsured/Underinsured Motorist Protection: This protection steps in if you are hit through an uninsured or underinsured motive force. It is like, your protection web when any individual else is not accountable sufficient.

- Non-public Damage Coverage (PIP): Covers scientific bills and misplaced wages for you and your passengers in an twist of fate, without reference to who is at fault. It is like, caring for your well being and price range if one thing is going incorrect.

Examples of Other Coverage Sorts

Shall we say you will have a brand spanking new game motorbike. A fundamental legal responsibility coverage may well be sufficient in case you essentially experience round the city, however in case you experience at the freeway so much, you may desire a coverage with collision and complete protection. For a circle of relatives automobile, a coverage with legal responsibility, collision, complete, and PIP may well be the most productive wager.

Coverage Choices Desk

| Coverage Sort | Bike Description | Automobile Description |

|---|---|---|

| Legal responsibility Most effective | Covers harm you motive to others | Covers harm you motive to different vehicles |

| Collision | Covers harm on your motorbike in an twist of fate, without reference to fault | Covers harm on your automobile in a collision, without reference to fault |

| Complete | Covers harm on your motorbike from robbery, vandalism, or climate | Covers harm on your automobile from robbery, vandalism, hearth, or climate |

| Uninsured/Underinsured | Covers you if hit through an uninsured/underinsured motive force | Covers you if hit through an uninsured/underinsured motive force |

| PIP (Non-compulsory) | No longer generally presented | Covers scientific bills and misplaced wages for you and passengers |

Protection Exclusions

Yo, peeps! Insurance coverage insurance policies, they are like the ones super-detailed contracts, proper? They gotta spell out what is coated and, extra importantly, what is NOT coated. Understanding the exclusions is essential to warding off surprises down the road. So, let’s dive into the no-fly zones for motorbike and automobile insurance coverage.Working out exclusions is an important. They save you you from getting screwed if one thing occurs that is not throughout the scope of your coverage.

This manner, you already know precisely the place the limits are, so that you don’t seem to be left at the hook for belongings you did not comply with pay for.

Commonplace Bike Insurance coverage Exclusions

Bike insurance policies frequently have a number of exclusions, like put on and tear on portions. This implies in case your motorbike will get beat up from commonplace use, your coverage most likely ain’t gonna duvet it. Additionally, pre-existing harm or problems that were not correctly disclosed whilst you purchased the coverage are frequently excluded. Take into consideration it like this: if you already know your motorbike’s were given an issue, you gotta inform the insurance coverage corporate, another way, they won’t pay out if one thing is going incorrect.

Harm from intentional acts, like vandalism or a damage led to through you seeking to do a in poor health wheelie, normally is not coated. And, if you are the use of the motorbike for unlawful actions, put out of your mind about it.

Commonplace Automobile Insurance coverage Exclusions

Automobile insurance coverage insurance policies have identical exclusions. Standard put on and tear to your experience? Nope, now not coated. Pre-existing harm? Most likely excluded.

Harm led to through neglecting common upkeep? Most probably now not. Additionally, injuries involving a car that is not insured, or isn’t legally at the street, is generally a no-go. In case you are in a damage whilst racing or doing one thing great dangerous, your insurance coverage may now not let you out. And, in fact, intentional acts of wear and tear or robbery fall out of doors the protection.

Examples of Eventualities The place Protection May No longer Follow

Shall we say you might be driving your motorbike and get right into a fender bender with every other rider, however you were not following visitors rules. Your coverage may now not duvet the damages, as it most probably excludes injuries led to through reckless riding. In a similar fashion, in case your automobile will get stolen and also you left the keys within the ignition, your coverage may now not duvet the robbery as it most probably excludes scenarios the place the robbery is led to through your negligence.

Comparability of Commonplace Exclusions

Each bike and automobile insurance coverage insurance policies exclude harm from commonplace put on and tear. In addition they normally exclude pre-existing prerequisites or harm that wasn’t disclosed. On the other hand, there are some variations. For instance, bike insurance policies frequently have exclusions associated with the use of the motorbike for unlawful actions, while automobile insurance coverage insurance policies have a tendency to center of attention extra on intentional acts of wear and tear or forget of standard upkeep.

Abstract Desk of Commonplace Exclusions

| Coverage Sort | Commonplace Exclusions |

|---|---|

| Bike | Put on and tear, pre-existing harm, intentional acts (vandalism, reckless driving), unlawful actions |

| Automobile | Put on and tear, pre-existing harm, neglecting upkeep, injuries involving uninsured cars, intentional acts, robbery because of negligence, dangerous actions |

Illustrative Situations

Yo, so that you wanna know when motorbike insurance coverage is the transfer and when a automobile coverage is the easier wager? It is all concerning the scenario, fam. We are breaking down some real-life examples to lend a hand you make a decision which coverage is best for you.

State of affairs The place Motorbike Insurance coverage Laws

That is for if you find yourself completely rocking the two-wheeler lifestyles, and your rides are extra about zipping round the city than cruising lengthy distances. Assume day-to-day commutes, fast errands, or hitting up native spots. Motorbike insurance coverage normally has decrease premiums, and you might be saving primary money in comparison to a automobile coverage.

- Day-to-day Go back and forth: Believe you reside a 5-minute motorbike experience out of your process, and also you best use the motorbike to your day-to-day shuttle. A automobile isn’t wanted. Motorbike insurance coverage is much inexpensive and very best for this state of affairs.

- Brief Journeys: In case you are hitting up the shop, the park, or a pal’s area, a motorbike is far more sensible and less expensive than hauling round a automobile. Motorbike insurance coverage suits the invoice for those brief journeys.

State of affairs The place Automobile Insurance coverage Is the Winner

Now, let’s discuss when a automobile coverage is without equal selection. This is applicable to eventualities the place a automobile is more effective, more secure, or simply undeniable vital.

- Lengthy Journeys: In case you are hitting the open street for a weekend getaway or an extended holiday, a automobile is a must have. Automobile insurance coverage provides complete protection for those journeys, together with attainable harm or injuries all the way through the adventure.

- Wearing Passengers: In the event you regularly lift pals or circle of relatives, a automobile is frequently the easier possibility. Automobile insurance coverage normally covers accidents or damages to passengers within the tournament of an twist of fate. A motorcycle isn’t an acceptable possibility for this sort of state of affairs.

- Heavy Lots: In case you are transporting better pieces, a automobile is a lot more appropriate. Motorbike insurance coverage would not duvet the ones types of so much.

State of affairs Comparability

The variation is very large. Motorbike insurance coverage is a complete game-changer for town dwellers or individuals who principally use their motorcycles for brief journeys. Automobile insurance coverage, alternatively, is the best way to pass for many who desire a automobile for lengthy journeys, wearing passengers, or hauling heavy stuff.

Particular Eventualities and Results, Bike insurance coverage vs automobile insurance coverage

Let’s ruin it down with some examples:

- Scholar State of affairs: A school pupil who essentially makes use of a motorbike for campus commutes and native errands will have the benefit of motorbike insurance coverage. A automobile insurance plans can be overkill and unnecessarily pricey.

- Circle of relatives Go back and forth: A circle of relatives with younger youngsters wanting to move them to university and different actions will desire a automobile. Motorbike insurance coverage isn’t appropriate for this example.

Insurance coverage Protection Implications Desk

| State of affairs | Motorbike Insurance coverage | Automobile Insurance coverage |

|---|---|---|

| Day-to-day Go back and forth (brief distances) | Nice possibility, decrease top rate | Overkill, upper top rate |

| Weekend Getaways | No longer appropriate, restricted protection | Highest possibility, complete protection |

| Wearing Passengers | No longer appropriate, restricted protection | Preferrred, covers passenger accidents |

Epilogue

In conclusion, navigating the panorama of bike insurance coverage vs automobile insurance coverage calls for cautious attention of more than a few components. Whilst each give protection to towards monetary losses, the precise protection, premiums, and claims processes vary considerably. This comparability highlights the original traits of each and every, enabling you to make a well-informed choice adapted on your private instances. In the end, the most productive coverage is the one who supplies ok coverage and peace of thoughts.

Make a selection correctly!

FAQ Compilation

What are the everyday exclusions in motorcycle insurance coverage insurance policies?

Commonplace exclusions in motorcycle insurance coverage frequently come with harm led to through negligence or reckless riding, injuries involving unlicensed riders, or pre-existing prerequisites at the motorbike.

How do rider enjoy and car options impact motorcycle insurance coverage premiums?

A rider’s enjoy, together with years of enjoy and any earlier injuries, considerably influences premiums. In a similar fashion, the kind of motorcycle, its options (like anti-theft programs), and its cost all have an effect on the overall top rate price.

What are the variations in felony responsibilities between proudly owning a bike and a automobile?

Criminal responsibilities vary significantly. Bike house owners frequently have fewer necessary necessities in comparison to automobile house owners, equivalent to explicit registration and inspection procedures. On the other hand, the felony tasks for injuries and liabilities are nonetheless necessary to imagine.

What distinctive add-on coverages are to be had for each and every form of insurance coverage?

Each motorcycle and automobile insurance coverage be offering a variety of add-on coverages. Those can come with complete protection for injuries, private damage coverage, and roadside help. The specifics of to be had add-ons will range relying at the insurer.