Letter of cancellation of auto insurance coverage is a very powerful for finishing your protection easily. This complete information walks you throughout the procedure, overlaying prison facets, procedures, and crucial knowledge to incorporate for your cancellation letter.

Navigating insurance coverage cancellation will also be complicated. This useful resource supplies a transparent roadmap, from working out your rights to heading off not unusual pitfalls. We’re going to discover other situations and be offering sensible examples that will help you expectantly finish your automotive insurance coverage.

Figuring out the Letter of Cancellation

A letter of cancellation for automotive insurance coverage officially notifies the insurance coverage corporate of your intent to discontinue your coverage. This record is a very powerful for keeping up a transparent list of your movements and guarantees a clean transition. Correctly documenting cancellation is important to steer clear of any long term disputes or misunderstandings.A cancellation letter serves as professional communique, confirming your choice to terminate your automotive insurance plans.

Its significance lies in its talent to obviously Artikel the phrases of the cancellation, combating ambiguity and attainable conflicts. It additionally supplies a documented list for each events concerned, the policyholder and the insurance coverage corporate.

Definition of a Letter of Cancellation

A letter of cancellation for automotive insurance coverage is a proper written notification despatched to the insurance coverage corporate through the policyholder, explicitly pointing out their want to terminate the present automotive insurance coverage. This letter acts as a legally binding settlement to finish the protection.

Goal and Significance of the Letter

This letter is significant for each events concerned. For the policyholder, it confirms the cancellation, prevents long term disputes, and guarantees a clean transition to a brand new coverage or no coverage in any respect. For the insurance coverage corporate, it supplies professional realize, permitting them to procedure the cancellation as it should be, together with any refunds or exceptional claims. This readability is very important for correct record-keeping and monetary control.

Conventional Parts of a Cancellation Letter

A complete cancellation letter comprises a number of key components:

- Coverage Data: The letter should obviously establish the insurance coverage being cancelled, together with the coverage quantity, the insured’s title, and the automobile main points (e.g., VIN). This guarantees the right kind coverage is known.

- Cancellation Date: The letter must explicitly state the date on which the cancellation is valuable. That is vital for setting up the fitting termination level.

- Reason why for Cancellation (Non-compulsory): Whilst now not at all times required, together with a short lived reason for cancellation can give context. That is not obligatory, however can assist in long term reference if wanted.

- Cancellation Request: The letter must obviously state the policyholder’s intent to cancel the coverage. It must be unequivocal and go away no room for ambiguity.

- Touch Data: The policyholder’s touch knowledge (title, deal with, telephone quantity, and e-mail) should be integrated for communique.

- Affirmation of Receipt: A cancellation affirmation from the insurance coverage corporate is very advisable, to verify the cancellation is gained and processed.

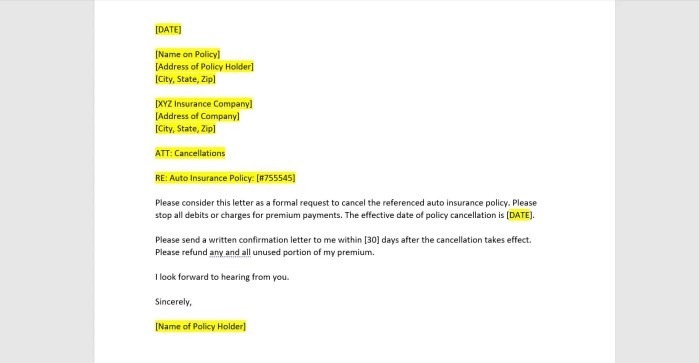

Pattern Structure for a Letter of Cancellation, Letter of cancellation of auto insurance coverage

(Insert pattern letter structure right here the usage of a desk)

| Part | Content material Instance |

|---|---|

| Date | October 26, 2023 |

| Policyholder Identify | Jane Doe |

| Coverage Quantity | 123456789 |

| Automobile Data | 2020 Toyota Camry, VIN: ABC1234567890 |

| Cancellation Date | November 30, 2023 |

| Cancellation Request | I hereby request the cancellation of the above-mentioned coverage, efficient November 30, 2023. |

| Touch Data | Jane Doe, 123 Primary Boulevard, Anytown, CA 91234, 555-1212, janedoe@e-mail.com |

Steps Occupied with Making a Cancellation Letter

Making a cancellation letter comes to a number of transparent steps:

- Accumulate vital knowledge: Gather all related coverage main points, together with the coverage quantity, automobile knowledge, and cancellation date.

- Draft the letter: Compose a transparent and concise letter outlining the cancellation request, together with all vital parts.

- Evaluation and proofread: Moderately evaluation the letter for any mistakes in grammar, spelling, or factual knowledge. Be certain all main points are correct.

- Ship the letter: Ship the letter by the use of qualified mail to the insurance coverage corporate. This offers evidence of sending the letter.

- Observe up (not obligatory): Following up with the insurance coverage corporate to verify receipt and the processing of the cancellation request is advisable.

Criminal Facets of Cancellation

Cancelling a automotive insurance coverage, whilst apparently simple, comes to explicit prison necessities and implications for each the policyholder and the insurer. Figuring out those facets is a very powerful for making sure a clean and legally sound cancellation procedure. Failure to stick to the prescribed procedures can result in unexpected penalties, starting from consequences to protracted disputes.The prison framework governing automotive insurance coverage cancellation varies throughout jurisdictions.

Other international locations and areas will have distinct laws, impacting the awareness sessions, causes for cancellation, and the processes for dispute answer. Those variations necessitate cautious attention of the appropriate rules within the explicit jurisdiction.

Criminal Necessities for Cancellation

Figuring out the prison must haves for cancelling a automotive insurance coverage is important. Those necessities incessantly come with offering written notification, adhering to stipulated realize sessions, and complying with explicit stipulations Artikeld within the coverage record. Failure to fulfill those stipulations may just doubtlessly invalidate the cancellation request. Examples come with insufficient realize sessions or non-compliance with explicit clauses within the coverage phrases and stipulations.

Implications of Non-Compliance

Non-compliance with the prison necessities for cancellation may have vital implications. Penalties can vary from the insurer refusing to just accept the cancellation to attainable prison motion, resulting in monetary consequences or the reinstatement of the coverage. Those penalties will also be particularly serious if the cancellation is deemed untimely or if the cancellation procedure isn’t correctly adopted. As an example, failing to supply enough realize can result in the policyholder being held liable for exceptional premiums.

Comparability of Criminal Frameworks

Other jurisdictions have various approaches to automotive insurance coverage cancellation. Some jurisdictions would possibly emphasize shorter realize sessions, whilst others would possibly permit for extra flexibility in positive instances. Stricter frameworks incessantly require extra detailed justifications for cancellation, resulting in a extra rigorous procedure. This distinction in prison frameworks necessitates cautious analysis and attention of the precise rules appropriate within the jurisdiction the place the coverage used to be bought.

For instance, a state requiring a 30-day realize duration for cancellation contrasts with a state that permits for instant cancellation in instances of fraud.

Tasks of Policyholder and Insurer

The obligations of each the policyholder and the insurer are outlined through the prison framework governing automotive insurance coverage cancellation. The policyholder is obligated to practice the procedures Artikeld within the coverage record and appropriate rules. The insurer, in flip, is liable for acknowledging the cancellation request, addressing any exceptional claims, and making sure a clean transition. This comes to transparent communique and adherence to the established protocols.

As an example, the insurer has an obligation to make sure the policyholder’s id and make sure the cancellation is processed as it should be.

Attainable Disputes and Solution

Disputes associated with automotive insurance coverage cancellation can rise up if both celebration fails to agree to the established procedures. Those disputes can contain problems with inadequate realize, non-payment of remarkable premiums, or disagreements in regards to the validity of the cancellation. Resolving such disputes incessantly comes to negotiation, mediation, or prison recourse. Examples come with mediation services and products equipped through business our bodies or, in excessive instances, litigation to implement the phrases of the insurance coverage contract.

A pre-dispute answer mechanism incessantly integrated in insurance coverage insurance policies can assist expedite the method.

Cancellation Procedures and Timelines

Cancelling your automotive insurance coverage calls for adherence to precise procedures and timelines. Figuring out those steps is a very powerful for a clean and environment friendly cancellation procedure, making sure you steer clear of any attainable headaches or monetary consequences. This segment main points the usual procedures, timelines, and refund processes related to terminating your protection.Cancelling automotive insurance coverage comes to a structured manner to verify each events perceive the termination of the settlement.

Correct notification, adherence to time limits, and correct calculation of remarkable premiums are vital facets of this procedure. The next sections Artikel those key components.

Same old Cancellation Procedures

The usual process for cancelling automotive insurance coverage normally comes to written notification. Insurers generally require a proper cancellation request in writing, which will also be submitted by the use of mail, e-mail, or on-line portals, relying at the insurer’s explicit insurance policies. This written communique serves as professional affirmation of your intent to terminate the coverage. At all times retain a duplicate of the cancellation realize to your information.

Cancellation Timelines

Cancellation timelines range relying at the insurance coverage supplier and the precise coverage phrases. Some insurers might require a realize duration of 30 days, whilst others would possibly permit for instant cancellation, topic to precise stipulations. A not unusual observe is a 30-day realize duration, permitting the insurer to procedure the cancellation and any exceptional claims. Examples of cancellation timelines come with:

- 30-day realize duration for many same old insurance policies, permitting the insurer enough time to procedure the cancellation and any final claims.

- Some insurance policies might permit for instant cancellation, however with imaginable conditions referring to any exceptional premiums.

- Insurance policies with explicit add-ons or riders will have other cancellation timelines, incessantly Artikeld within the coverage paperwork.

Refund Request Procedure

Inquiring for a reimbursement after cancelling automotive insurance coverage comes to working out the phrases of your coverage. In case your coverage lets in for a reimbursement, you should practice the insurer’s explicit directions. In most cases, this comes to filing a proper refund request, outlining the cause of cancellation and any exceptional premiums or changes. Be certain all related paperwork are integrated, like your coverage main points and cancellation realize.

Calculating Final Premiums

Calculating any final insurance coverage premiums comes to working out the coverage’s phrases and any exceptional fees. Insurers normally calculate premiums in accordance with the coverage’s period and any appropriate add-ons or riders. A not unusual components for calculating final premiums is:

Final Top rate = (Coverage Period – Days Elapsed)

Day-to-day Top rate Charge

For instance, if a coverage used to be for twelve months and also you cancel after 9 months, the rest top rate calculation would believe the 3 months left and the appropriate day-to-day price. Touch your insurance coverage supplier to resolve the fitting calculation to your coverage.

Notification of Related Events

Notifying related events, such because the Division of Motor Cars (DMV), is very important to verify compliance with state laws. Failure to inform the DMV of your insurance coverage cancellation may just result in headaches. Observe the DMV’s directions for updating your automobile’s insurance coverage standing. In most cases, the insurer will deal with this procedure, or you’ll immediately notify the DMV.

That is normally treated through the insurer right through the cancellation procedure, so that you must test your insurer’s procedures.

Content material for the Cancellation Letter

A transparent and concise cancellation letter is a very powerful for officially finishing your automotive insurance coverage. This letter should appropriately replicate the policyholder’s intent to terminate the contract and supply all vital main points for a clean transition. The letter must be well-structured, unambiguous, and simply comprehensible to steer clear of any attainable disputes.

Crucial Data within the Cancellation Letter

This segment main points the vital parts wanted in a cancellation letter. Correct inclusion of those components guarantees the method is environment friendly and avoids any misunderstandings.

- Coverage Quantity: That is the original identifier to your coverage, crucial for the insurance coverage corporate to find your account. With out this quantity, the corporate won’t be capable of procedure the cancellation request.

- Policyholder Identify: The overall prison title of the policyholder should be explicitly said for correct identity.

- Date of Cancellation: An exact date indicating when the policyholder needs the cancellation to take impact is vital. This date is important to ascertain the efficient termination of the insurance plans.

- Reason why for Cancellation: Obviously articulating the cause of cancellation supplies transparency and context to the request. This can be not obligatory however is incessantly useful in resolving any attainable problems or for long term reference.

- Efficient Date of Cancellation: This clarifies when the policyholder not needs to be lined beneath the coverage. This date must be aligned with the supposed cessation of insurance plans.

- Affirmation Request: Come with a remark inquiring for affirmation of cancellation, in conjunction with a most well-liked means for receiving such affirmation.

Required Data Desk

The desk beneath Artikels the crucial knowledge fields to be integrated within the cancellation letter.

| Box | Description |

|---|---|

| Coverage Quantity | Distinctive coverage identity (e.g., 1234567890) |

| Policyholder Identify | Complete title of the policyholder (e.g., John Doe) |

| Date of Cancellation | Explicit date of cancellation (e.g., October 26, 2024) |

| Reason why for Cancellation | Cause of cancellation (e.g., Transferring out of state, Discovering a greater price) |

| Efficient Date of Cancellation | Date on which the insurance plans ceases (e.g., November 1, 2024) |

Mentioning the Reason why for Cancellation

Obviously pointing out the cause of cancellation is essential for record-keeping and long term reference. Keep away from obscure or ambiguous language. Use actual and simple language to obviously articulate the explanation. For instance, as a substitute of “now not glad,” use “searching for a greater price.”

Specifying the Efficient Date of Cancellation

The efficient date of cancellation must be obviously specified. That is the date when the insurance plans terminates. The efficient date must be a minimum of a couple of days after the date of the letter, permitting enough time for the corporate to procedure the cancellation. As an example, if the letter is dated October 26, 2024, the efficient date could be November 1, 2024.

Inquiring for Cancellation Affirmation

Come with a transparent remark inquiring for affirmation of the cancellation. Specify the most popular means of receiving the affirmation, corresponding to e-mail or mail. This step guarantees the policyholder is conscious about the standing of the cancellation request. For instance, “Please verify the cancellation in writing to [email address] or through mail to [address].”

Insurance coverage Corporate Insurance policies: Letter Of Cancellation Of Automobile Insurance coverage

Insurance coverage firms care for explicit insurance policies in regards to the cancellation of auto insurance coverage. Those insurance policies dictate the procedures, timelines, and necessities for terminating protection. Figuring out those insurance policies is a very powerful for making sure a clean and legally sound cancellation procedure. Understanding the precise conditions of a given insurer can considerably affect the convenience and velocity of the cancellation.Other insurers undertake quite a lot of approaches to cancellation, starting from easy on-line portals to extra concerned bureaucracy processes.

Those variations can have an effect on the time required to finalize the cancellation and the related prices.

Comparability of Cancellation Insurance policies

Other insurance coverage firms have various cancellation insurance policies. Some might be offering on-line portals for simple cancellation, whilst others would possibly require bodily paperwork and mail-in procedures. This variance affects the potency of the cancellation procedure.

- Some firms permit cancellations thru their internet sites or cell apps, offering a snappy and handy means.

- Different firms would possibly necessitate written notification by the use of mail or qualified mail, adopted through a selected go back procedure for the cancellation shape.

- Cancellation time limits, grace sessions, and consequences for early termination range a great deal. Some firms be offering versatile cancellation home windows, whilst others have stricter time limits, which should be sparsely reviewed.

Explicit Necessities from a Given Insurance coverage Corporate

Every insurance coverage corporate has distinctive necessities for cancellation. Those necessities are Artikeld of their coverage paperwork, which must be consulted for explicit main points. Those main points incessantly come with required notification sessions, causes for cancellation, and related charges or consequences.

- Sure firms might require a selected shape to be finished and returned, in conjunction with supporting documentation.

- Coverage phrases and stipulations, generally to be had at the corporate’s web site, element cancellation insurance policies and procedures, in addition to any related consequences or charges.

- The coverage record must be sparsely reviewed for explicit cancellation time limits and necessities.

Variations in Cancellation Procedures

Cancellation procedures can range considerably amongst insurance coverage firms. This modification is incessantly because of inner operational strategies and on-line platforms. Other procedures necessitate other timeframes for processing the cancellation.

- Some firms supply a web based portal for beginning cancellation, whilst others might require a telephone name, a mailed letter, or a mix of each.

- The timeframes for processing the cancellation range and rely at the selected means and the insurance coverage corporate’s inner processes.

- Other strategies for cancellation would possibly contain filing supporting documentation, corresponding to a signed cancellation shape, which should be reviewed and processed.

Examples of Conventional Insurance coverage Corporate Cancellation Bureaucracy

Conventional cancellation paperwork incessantly come with fields for the policyholder’s title, coverage quantity, deal with, touch knowledge, and reason why for cancellation. The shape will incessantly specify the desired date of cancellation.

“Please be aware that the precise structure and content material of cancellation paperwork might range amongst insurance coverage firms.”

Not unusual Errors to Keep away from

Cancelling your automotive insurance coverage generally is a simple procedure, however positive mistakes can result in headaches and sudden penalties. Figuring out attainable pitfalls and heading off them will make sure that a clean and hassle-free cancellation.Cautious consideration to element all over the cancellation procedure is a very powerful. Mistakes in communique, neglected time limits, or incomplete bureaucracy can considerably lengthen and even save you the cancellation from taking impact.

Incomplete or Unsuitable Bureaucracy

Mistakes in filling out the cancellation paperwork are a not unusual supply of issues. Unsuitable knowledge or lacking sections can result in delays or rejection of the cancellation request. Double-checking all main points prior to filing the shape is important. For instance, if the policyholder supplies an wrong date of start or coverage quantity, the insurance coverage corporate would possibly reject the cancellation request.

Be certain all knowledge, together with dates, coverage numbers, and account main points, is correct and entire.

Failing to Meet Points in time

Cancellation procedures incessantly have explicit time limits. Lacking those time limits may end up in the continuation of the coverage or consequences. Figuring out the timeline for cancellation and adhering to the desired time limits is very important. Some firms would possibly require cancellation requests to be gained through a definite date. Evaluation the precise coverage main points and cancellation procedures equipped through the insurance coverage corporate.

Ignoring Necessary Communique

The insurance coverage corporate would possibly ship notifications or reminders in regards to the cancellation procedure. Ignoring those communications can result in confusion and neglected time limits. Evaluation all emails and letters gained from the insurance coverage corporate to verify well timed responses and steer clear of any neglected steps within the cancellation process. Common communique with the insurance coverage corporate, particularly right through the cancellation procedure, is advisable to steer clear of any misunderstandings.

Fee Problems

In some instances, the cancellation procedure would possibly contain exceptional bills. Failing to deal with those exceptional bills can obstruct the cancellation procedure. If there are any exceptional bills, make sure that those are settled prior to filing the cancellation request. This may occasionally steer clear of any headaches and make sure a clean cancellation. As an example, if a policyholder owes exceptional premiums, the cancellation will not be processed till the stability is cleared.

No longer Acquiring Affirmation

After filing the cancellation request, you need to download affirmation from the insurance coverage corporate. Loss of affirmation can result in uncertainty in regards to the standing of the cancellation. Request a affirmation letter or e-mail from the insurance coverage corporate acknowledging the cancellation request. This affirmation serves as evidence that the cancellation has been initiated and is being processed. With out this affirmation, the policyholder could be unsure if the cancellation has been permitted through the insurance coverage corporate.

Illustrative Examples

Illustrative examples are a very powerful for working out the sensible utility of auto insurance coverage cancellation procedures. Those examples exhibit quite a lot of situations, highlighting the desired steps and supporting documentation. They supply a tangible reference level for policyholders navigating the cancellation procedure.Explicit examples reveal the a very powerful steps all in favour of canceling a automotive insurance coverage. Those examples are designed to simplify the complicated procedure and make sure policyholders are conscious about their rights and obligations.

Pattern Cancellation Letter

This letter supplies a template for a proper automotive insurance coverage cancellation realize. Modify the main points to suit your explicit instances.“`[Your Name][Your Address][Your Phone Number][Your Email Address][Date][Insurance Company Name][Insurance Company Address]Topic: Cancellation of Automobile Insurance coverage Coverage – [Policy Number]Pricey [Insurance Company Contact Person, if known, otherwise use a general title like “Claims Department”],This letter officially requests the cancellation of my automotive insurance coverage, coverage quantity [Policy Number].

My coverage covers the automobile [Vehicle Make, Model, Year]. The efficient date of cancellation is [Desired Cancellation Date].Please verify receipt of this request and advise at the required documentation for processing this cancellation.Sincerely,[Your Signature][Your Typed Name]“`

Cancellation Situations

Figuring out the other situations for canceling automotive insurance coverage insurance policies is important. This desk Artikels not unusual scenarios and the vital movements.

| State of affairs | Motion |

|---|---|

| Coverage Renewal | Cancel coverage prior to renewal if you happen to not require protection. |

| Transferring to a New State | Notify the insurer of your deal with trade and supposed cancellation of the coverage within the present state. Supply evidence of residency within the new state. |

| Automobile Sale | Give you the insurance coverage corporate with evidence of sale, corresponding to a invoice of sale, to terminate protection. |

| Trade of Possession | Notify the insurer of the trade in possession and give you the vital documentation. |

| Policyholder Demise | Notify the insurer of the policyholder’s dying and supply required documentation for the coverage to be canceled. |

Detailed Cancellation State of affairs: Automobile Sale

This state of affairs illustrates the stairs all in favour of canceling automotive insurance coverage after promoting a automobile. Correct documentation is very important for a clean cancellation procedure.

1. Download Evidence of Sale

Safe a invoice of sale or different professional documentation confirming the automobile sale. This verifies the trade of possession.

2. Notify the Insurance coverage Corporate

Touch the insurance coverage corporate and tell them of the automobile sale. Give an explanation for that you just need to cancel the coverage efficient on a selected date.

3. Supply Essential Documentation

Give you the insurance coverage corporate with a duplicate of the invoice of sale. Be certain the record comprises crucial knowledge such because the automobile’s identity quantity (VIN), date of sale, and the title of the consumer.

4. Ascertain Cancellation

Examine with the insurance coverage corporate that your cancellation request has been gained and processed. Request a affirmation letter outlining the cancellation date and any final exceptional bills.

5. Go back Insurance coverage Paperwork

Go back any insurance-related paperwork to the insurance coverage corporate.

Selection Dispute Solution

Resolving disputes associated with automotive insurance coverage cancellations amicably is incessantly preferable to long prison battles. Selection Dispute Solution (ADR) strategies be offering events an opportunity to barter, mediate, or arbitrate disagreements, doubtlessly saving money and time. Those processes will also be adapted to precise scenarios, enabling a extra custom designed answer in comparison to conventional courtroom lawsuits.Efficient communique and a willingness to compromise are key to a success ADR.

Figuring out the other choices to be had can assist each the policyholder and the insurance coverage corporate discover a mutually agreeable answer.

Imaginable Dispute Solution Strategies

A number of strategies exist for resolving disputes referring to insurance coverage cancellation. Negotiation is incessantly step one, the place each events speak about their positions and take a look at to succeed in a not unusual floor. Mediation comes to a impartial 3rd celebration (mediator) facilitating communique and guiding the events towards a agreement. Arbitration, a extra formal procedure, comes to a impartial 3rd celebration (arbitrator) creating a binding choice in accordance with the introduced proof.

Arbitration Choices

Arbitration is a proper procedure by which an unbiased arbitrator, decided on through the events, hears proof and arguments from all sides. This choice is incessantly legally binding, very similar to a courtroom judgment. Various kinds of arbitration, corresponding to binding and non-binding arbitration, exist. Binding arbitration method the verdict is ultimate and enforceable, whilst non-binding arbitration lets in the events to reject the verdict and pursue different choices.

Attraction Procedure

The enchantment procedure for arbitration choices varies relying at the explicit arbitration settlement. If the arbitration settlement features a provision for enchantment, the grounds for enchantment should be obviously Artikeld. The enchantment procedure incessantly comes to a evaluation of the arbitrator’s choice through the next authority, normally an appeals panel or courtroom. This evaluation will incessantly focal point on whether or not the arbitrator acted inside of their authority, whether or not there used to be an important procedural error, or if there used to be a false impression of the info.

The enchantment procedure is ruled through the precise laws of the arbitration settlement and the related jurisdiction’s rules.

Final Recap

In conclusion, cancelling your automotive insurance coverage calls for cautious making plans and adherence to precise procedures. By way of working out the prison necessities, corporate insurance policies, and attainable disputes, you’ll make sure that a clean and environment friendly cancellation procedure. Have in mind to meticulously record all communications and steps to offer protection to your self.

FAQ Defined

What if I do not obtain affirmation of cancellation?

Observe up with the insurance coverage corporate to verify they gained your letter. Request a written affirmation to solidify the cancellation.

How lengthy does it take for a cancellation to be efficient?

Cancellation timelines range through insurance coverage corporate. Take a look at your coverage paperwork or touch your insurer for the precise time-frame.

Can I cancel my automotive insurance coverage if I am transferring out of state?

Sure, you’ll cancel. Notify the insurance coverage corporate of your transfer and the date you intend to go away the state, together with any main points required through the corporate.

What are the results of now not following right kind cancellation procedures?

Failure to practice procedures may just result in persisted billing, attainable consequences, or difficulties in acquiring a reimbursement. At all times adhere to the Artikeld steps for your coverage and any directions equipped through the insurer.