Is longer term care insurance coverage advantages taxable – Is long-term care insurance coverage advantages taxable? Navigating the complexities of long-term care insurance coverage and its tax implications can really feel daunting. This exploration delves into the intricacies of this a very powerful subject, losing gentle at the possible tax advantages and liabilities related to those necessary insurance policies. From figuring out protection choices to decoding tax regulations, we purpose to empower you with the data had to make knowledgeable selections about your monetary long run.

Lengthy-term care insurance coverage is designed to offer very important beef up all over a duration of prolonged care wishes. Figuring out the tax implications of premiums paid and advantages gained is paramount. This information will allow you to explain your rights and tasks on this necessary house. This complete information supplies an in depth assessment of long-term care insurance coverage and its taxation. It covers the whole thing from top rate deductions to the tax remedy of more than a few advantages, together with in-home care, assisted dwelling, and different related products and services.

Defining Lengthy-Time period Care Insurance coverage Advantages: Is Lengthy Time period Care Insurance coverage Advantages Taxable

Lengthy-term care insurance coverage supplies monetary coverage in opposition to the really extensive prices related to extended caregiving wishes. Those insurance policies purpose to offset bills incurred as folks require help with actions of day by day dwelling (ADLs) or instrumental actions of day by day dwelling (IADLs). Figuring out the nuances of protection is a very powerful for people searching for to mitigate the monetary pressure of long-term care.Lengthy-term care insurance coverage insurance policies be offering various levels of protection, from fundamental help with day by day duties to complete care in specialised amenities.

Coverage advantages are most often induced when an insured particular person meets explicit standards associated with practical obstacles, demonstrating a necessity for ongoing care past the scope of temporary help.

Protection Choices

Lengthy-term care insurance coverage insurance policies often be offering other protection choices, catering to various wishes and monetary scenarios. Those choices might come with explicit advantages for in-home care, assisted dwelling amenities, or professional nursing amenities. Particular person coverage constructions decide the kinds and ranges of care incorporated.

Sorts of Lengthy-Time period Care Products and services Coated

Insurance policies most often duvet a spread of products and services designed to beef up folks requiring help with day by day actions. This encompasses non-public care duties equivalent to bathing, dressing, and moving, in addition to managing medicines and family chores. Insurance policies may additionally come with protection for specialised treatments, equivalent to bodily, occupational, or speech treatment, if those products and services are deemed medically important for keeping up or bettering the insured’s well being and well-being.

Techniques Lengthy-Time period Care Insurance coverage Advantages Can Be Used, Is longer term care insurance coverage advantages taxable

Lengthy-term care insurance coverage advantages can be used in numerous settings to offer complete care. Those settings can come with in-home care products and services equipped by way of nurses, aides, or different caregivers, assisted dwelling amenities providing a supportive setting with various ranges of help, and professional nursing amenities providing extensive hospital therapy. Insurance policies continuously element explicit necessities and prerequisites for using those choices, making sure that advantages are directed towards suitable care settings.

Conventional Bills Coated by way of Lengthy-Time period Care Insurance coverage

| Expense Class | Description |

|---|---|

| In-home care | Bills for caregivers offering help with non-public care, medicine control, and family duties. |

| Assisted dwelling amenities | Prices related to place of dwelling and care in amenities providing various ranges of beef up, together with help with actions of day by day dwelling. |

| Professional nursing amenities | Bills for complete hospital therapy and professional nursing products and services in amenities offering extensive care. |

| Scientific provides and kit | Prices associated with sturdy clinical apparatus, mobility aids, and different assistive gadgets. |

| Respite care | Brief-term caregiving products and services permitting number one caregivers to leisure and recuperate. |

Insurance policies range within the explicit bills coated and the repayment quantities. It is very important to scrupulously evaluate the coverage’s phrases and prerequisites to grasp the whole extent of protection.

Tax Implications of Lengthy-Time period Care Insurance coverage

Lengthy-term care insurance coverage premiums and advantages continuously have complicated tax implications, considerably affecting policyholders’ monetary making plans. Figuring out those implications is a very powerful for making knowledgeable selections referring to insurance policy and optimizing monetary results. This phase delves into the tax remedy of premiums and advantages, bearing in mind more than a few situations and forms of protection.

Tax Remedy of Premiums Paid

Premiums paid for long-term care insurance coverage are most often no longer tax deductible, very similar to different forms of insurance coverage. On the other hand, there are exceptions. Tax deductions for premiums are contingent at the explicit cases of the policyholder and their revenue.

- Deductibility in Positive Instances: In restricted instances, premiums could also be deductible. For instance, if the policyholder is self-employed and the premiums are thought to be a industry expense, or if the policyholder is eligible for a selected tax credit score or deduction underneath appropriate laws, those premiums may well be deductible. Additional, sure states can have explicit rules associated with deductibility. It is very important to seek advice from a professional tax consultant to decide eligibility.

Tax Implications of Receiving Lengthy-Time period Care Advantages

Lengthy-term care advantages gained from a coverage are most often tax-free, very similar to different forms of insurance coverage advantages that duvet clinical bills. This can be a a very powerful facet to grasp for people making plans their retirement and long-term monetary safety.

- Taxation of Advantages: The receipt of long-term care advantages is most often no longer taxable revenue. On the other hand, the particular tax implications rely at the nature of the convenience. Some advantages could also be topic to express tax regulations or necessities, equivalent to sure reimbursements or different monetary preparations associated with the advantages. Policyholders will have to seek advice from a professional tax skilled for steerage.

Variations in Tax Remedy for More than a few Sorts of Advantages

Several types of long-term care insurance coverage advantages can have various tax remedies. As an example, advantages gained for custodial care, equivalent to help with day by day actions, could also be handled another way from advantages gained for knowledgeable nursing care.

- Categorization of Advantages: The character of the care gained, whether or not it is custodial or professional nursing care, performs an important function within the tax remedy. Several types of advantages continuously have explicit laws governing their tax implications.

Comparability to Different Insurance coverage Advantages

The tax remedy of long-term care insurance coverage advantages continuously contrasts with that of different forms of insurance coverage, equivalent to medical insurance. Whilst medical insurance premiums are most often no longer deductible, long-term care premiums can have exceptions underneath explicit cases.

- Distinct Remedy: The tax remedy of long-term care insurance coverage differs from medical insurance in that the premiums aren’t most often deductible, despite the fact that exceptions exist. The advantages gained from long-term care insurance policies are most often tax-free, contrasting with possible tax implications related to medical insurance reimbursements or different advantages.

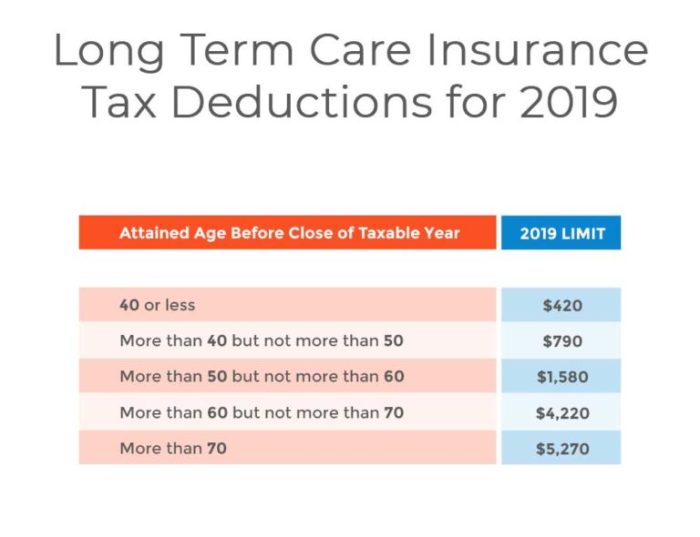

Tax Deductions for Lengthy-Time period Care Insurance coverage Premiums

The next desk illustrates possible tax deductions for long-term care insurance coverage premiums, bearing in mind other situations and revenue ranges. It is important to notice that this isn’t an exhaustive checklist, and explicit scenarios can have other implications. Tax rules are topic to modify. Seek advice from a tax skilled for personalised recommendation.

| Situation | Source of revenue Stage | Attainable Tax Deduction |

|---|---|---|

| Self-employed particular person | $50,000 – $100,000 | In all probability deductible as a industry expense |

| Worker with medical insurance | $75,000 – $150,000 | No longer most often deductible |

| Top-income particular person with vital property | Over $200,000 | Restricted deductibility, topic to express laws |

Taxability of Lengthy-Time period Care Advantages

Lengthy-term care insurance coverage advantages, whilst supposed to offer a very powerful monetary beef up all over classes of prolonged care, aren’t at all times exempt from taxation. The taxability of those advantages hinges at the explicit nature of the advantages gained and the person’s cases. Figuring out the intricacies of tax implications is very important for beneficiaries to appropriately assess the online price in their long-term care insurance coverage insurance policies.

Eventualities The place Lengthy-Time period Care Advantages Are Taxable

Lengthy-term care insurance coverage advantages are most often taxable when they’re thought to be to be fee for products and services or repayment for bills incurred. That is against this to scenarios the place the advantages are only for private wishes or bills, equivalent to a lump-sum payout for a pre-existing situation. Taxability continuously arises when the advantages duvet products and services or bills without delay associated with the recipient’s care, and no longer merely the alternative of misplaced revenue.

Explicit Instances Resulting in Taxability

A number of explicit cases may end up in the taxability of long-term care advantages. Those come with, however aren’t restricted to, scenarios the place the advantages duvet professional nursing facility care, domestic well being aides, or different skilled care products and services. Moreover, if the advantages are used to make amends for bills that will differently be deductible as clinical bills, they’re continuously deemed taxable revenue.

Crucially, advantages gained in alternate for a provider, equivalent to a caregiver’s wage, shall be thought to be taxable.

Tax Charges Acceptable to Lengthy-Time period Care Advantages

The tax charges appropriate to long-term care advantages are in keeping with the recipient’s total tax bracket. The recipient’s taxable revenue, together with some other revenue assets, is used to decide the appropriate tax charge. That is in keeping with normal revenue tax rules. Lengthy-term care advantages aren’t topic to big tax charges.

Elements Influencing the Taxability of Lengthy-Time period Care Advantages

A number of elements affect the taxability of long-term care advantages. The kind of care coated by way of the advantages, the particular provisions of the insurance plans, and the recipient’s total monetary state of affairs are vital issues. The character of the products and services equipped, the quantity of bills coated, and the fee approach used can all have an effect on the tax remedy of the advantages.

Categorization of Taxable Lengthy-Time period Care Advantages

| Circumstance | Taxability | Rationalization |

|---|---|---|

| Advantages used for knowledgeable nursing facility care | Usually Taxable | Those advantages continuously duvet bills that will differently be deductible clinical bills. |

| Advantages used for domestic well being aides | Usually Taxable | Bills to domestic well being aides are thought to be repayment for products and services rendered. |

| Advantages used for custodial care | Doubtlessly Taxable | The taxability of advantages for custodial care is dependent upon the particular coverage and the character of the care. |

| Advantages used to exchange misplaced revenue | Usually Taxable | Those advantages are continuously thought to be an alternative to misplaced income and thus taxable. |

| Advantages used to hide bills that will differently be deductible | Usually Taxable | If the advantages are used to pay for bills that will differently be deductible clinical bills, they’re continuously thought to be taxable revenue. |

Deductibility of Lengthy-Time period Care Bills

Lengthy-term care bills may also be vital monetary burdens for people and households. Figuring out the cases underneath which those bills are deductible is a very powerful for managing tax liabilities and making sure suitable monetary making plans. This phase delves into the particular regulations and laws governing the deductibility of long-term care bills, outlining eligible forms of bills, calculation strategies, and offering illustrative examples.

Instances for Deductibility

The deductibility of long-term care bills is ruled by way of explicit statutory provisions and laws. Those provisions continuously stipulate that bills are deductible handiest underneath sure stipulations, equivalent to the character of the care gained, the person’s well being standing, and the kind of care supplier.

Sorts of Deductible Lengthy-Time period Care Bills

Quite a lot of bills associated with long-term care products and services could also be deductible. Those bills most often come with the ones incurred for pro hospital therapy, such because the products and services of nurses, bodily therapists, and occupational therapists, in addition to similar provides and kit. The bills should be without delay associated with the supply of long-term care products and services and should be affordable in quantity.

Additional, prices for domestic changes to deal with long-term care wishes may additionally qualify for deductions in sure scenarios.

Calculation of Deductible Quantities

The calculation of deductible long-term care bills continuously comes to explicit regulations and obstacles. Deductible quantities are most often restricted by way of a proportion of the taxpayer’s adjusted gross revenue or by way of different prescribed limits. Moreover, any bills exceeding those obstacles aren’t deductible. The fitting calculation approach relies at the explicit statutory provisions and laws in impact.

Examples of Deductible and Non-Deductible Bills

Illustrative examples can explain the factors for deductibility. Bills for knowledgeable nursing care equipped in an authorized facility are most often deductible, equipped they meet the necessities. Conversely, bills for regimen non-public care products and services, equivalent to lend a hand with dressing or bathing, are most often no longer deductible. Bills for luxurious lodging or products and services unrelated to the supply of long-term care also are no longer deductible.

Standards for Deducting Lengthy-Time period Care Bills

| Standards | Qualifying Bills | Non-Qualifying Bills |

|---|---|---|

| Nature of Care | Bills for knowledgeable nursing care, bodily treatment, occupational treatment | Bills for regimen non-public care, housework |

| Supplier Standing | Bills for care equipped by way of approved pros | Bills for care equipped by way of untrained folks |

| Dating to Lengthy-Time period Care | Bills for clinical apparatus and residential changes important for long-term care | Bills for normal family maintenance or upgrades |

| Affordable Quantities | Bills for medically important care at affordable prices | Bills for extravagant or useless care |

Word: This desk supplies a normal assessment. Seek advice from a professional tax skilled for personalised recommendation referring to explicit scenarios.

Explicit Eventualities and Concerns

The tax implications of long-term care insurance coverage advantages are multifaceted and rely on more than a few particular person cases. Figuring out those nuances is a very powerful for people to appropriately assess the monetary have an effect on of those advantages. This phase delves into explicit situations, highlighting the interaction between revenue ranges, employment standing, state residency, and the supply of the advantages themselves.

Tax Implications for Various Source of revenue Ranges

The taxability of long-term care advantages is without delay tied to the recipient’s total revenue. Upper revenue ranges continuously lead to a better portion of the advantages being topic to taxation. That is because of the revolutionary nature of the tax gadget, the place upper earners pay a bigger proportion in their revenue in taxes. For instance, a person within the perfect tax bracket may discover a considerably better portion in their long-term care advantages taxed in comparison to any individual with a far decrease revenue.

Tax Remedy for Self-Hired Folks

Self-employed folks face distinctive tax issues referring to long-term care advantages. As a result of self-employed folks continuously have extra complicated tax scenarios, together with self-employment taxes, the taxation of long-term care advantages should be analyzed throughout the context in their complete tax image. Those folks should moderately account for the possible tax implications of each the advantages gained and any deductions associated with the premiums they paid.

As an example, if the premiums are thought to be a industry expense, the tax deduction will cut back the full tax burden.

Tax Implications In accordance with State Residency

State-level tax rules can affect the taxability of long-term care advantages. Other states have various tax charges and constructions. This will likely impact how a lot of the advantages are topic to state revenue taxes. For instance, a state with the next state revenue tax charge may result in a bigger portion of the advantages being taxed on the state point.

Cautious attention of the recipient’s state of place of dwelling is very important in calculating the overall tax legal responsibility.

Taxation of Employer-Backed Plan Advantages

Employer-sponsored long-term care insurance coverage can be offering vital tax benefits. In lots of instances, premiums paid by way of the employer are most often no longer thought to be taxable revenue for the worker. Conversely, the advantages gained are most often tax-free if they’re used for certified long-term care products and services. This creates a good tax setting for staff taking part in such plans. Additional, the employer’s contribution could also be tax-deductible, impacting the full monetary image of the corporate.

Tax Implications for Explicit Well being Stipulations

The tax remedy of long-term care advantages might range in response to the recipient’s explicit well being situation. For people with pre-existing stipulations, the calculation of the advantages may well be fairly other. For instance, if a pre-existing situation considerably affects the recipient’s talent to paintings, this may impact the tax implications.

Desk: Affect of Source of revenue Stage on Taxability of Lengthy-Time period Care Advantages

| Source of revenue Stage | Tax Implications |

|---|---|

| Low | A smaller portion of the advantages is most often taxable, or doubtlessly no portion is taxed, because of decrease total tax bracket. |

| Center | A average portion of the advantages may well be topic to taxation, relying at the explicit tax charges and brackets appropriate to the person. |

| Top | A bigger portion of the advantages will probably be taxable because of the upper tax brackets. |

Illustrative Examples

Lengthy-term care insurance coverage premiums and advantages are topic to complicated tax regulations, various considerably relying on particular person cases and explicit coverage provisions. Those illustrations display the sensible software of those regulations throughout numerous scenarios, highlighting the nuances of tax remedy in long-term care insurance coverage.

Top class Fee Tax Implications

Premiums paid for long-term care insurance coverage are most often no longer deductible as an itemized expense for federal revenue tax functions. This implies the premiums paid are thought to be non-public bills and don’t cut back taxable revenue. On the other hand, sure scenarios might be offering exceptions. As an example, some employers might be offering long-term care insurance coverage as a get advantages, and the premiums paid throughout the employer-sponsored plan will not be taxable to the worker.

Taxation of Lengthy-Time period Care Advantages

Lengthy-term care advantages gained from an insurance plans are most often taxable as peculiar revenue. This implies the recipient will want to document the convenience quantity on their revenue tax go back, and it is going to be topic to straightforward revenue tax charges. The precise quantity incorporated within the recipient’s gross revenue will range consistent with the phrases of the coverage and appropriate laws.

Deductibility of Lengthy-Time period Care Bills

In sure scenarios, long-term care bills could also be deductible. Those bills most often get up when folks pay for care outdoor in their insurance policy, and a few cases allow a deduction for those bills as itemized deductions. Examples come with clinical bills exceeding a undeniable proportion of adjusted gross revenue.

Taxation of Lengthy-Time period Care Advantages for Self-Hired Folks

Self-employed folks face distinctive tax issues referring to long-term care insurance coverage. Premiums paid for self-employed persons are most often no longer deductible as a industry expense. On the other hand, the self-employed particular person might be able to deduct the premiums paid as a industry expense underneath sure cases, equivalent to when the insurance coverage is regarded as a important industry expense to beef up the industry proprietor’s well being.

The self-employed particular person’s advantages gained could be taxed as peculiar revenue.

Variability in Tax Remedy In accordance with State Regulations

State rules can affect the tax remedy of long-term care advantages. For instance, some states might be offering explicit deductions or credit for long-term care bills, whilst others would possibly not. The presence or absence of such state-level provisions can have an effect on the full tax burden on folks receiving long-term care advantages.

Comparability of Tax Implications Throughout Receive advantages Resources

| Receive advantages Supply | Tax Remedy of Premiums | Tax Remedy of Advantages |

|---|---|---|

| Personal Lengthy-Time period Care Insurance coverage | Usually no longer deductible | Taxed as peculiar revenue |

| Employer-Backed Lengthy-Time period Care Insurance coverage | Might or might not be taxable to the worker | Taxed as peculiar revenue |

| Govt Systems (e.g., Medicaid) | No longer appropriate | Usually no longer taxable, relying at the explicit program and get advantages |

This desk illustrates the overall tax implications related to long-term care advantages from other assets. The precise tax remedy depends upon the particular coverage, plan, and appropriate laws. Folks will have to seek advice from a professional tax skilled for personalised recommendation.

Illustrative Instance: Top class Bills

A unmarried particular person, Jane Doe, will pay $2,500 once a year in premiums for a long-term care insurance plans. This quantity isn’t deductible as an itemized expense for federal revenue tax functions.

Illustrative Instance: Advantages Won

Mr. Smith receives $4,000 per thirty days in long-term care advantages from his insurance plans. This quantity is regarded as peculiar revenue and is topic to federal and doubtlessly state revenue tax.

Illustrative Instance: Deductible Bills

A retired particular person, Ms. Brown, incurs $10,000 in long-term care bills in a 12 months. If those bills exceed a undeniable proportion of her adjusted gross revenue, a portion of those bills may well be deductible as itemized clinical bills.

Illustrative Instance: Self-Hired Particular person

A self-employed contractor, Mr. Jones, will pay $3,000 in premiums for a long-term care insurance plans. On this situation, the premiums aren’t deductible as a industry expense except the insurance coverage is deemed a important industry expense. Any advantages gained could be taxed as peculiar revenue.

Illustrative Instance: State Permutations

A resident of State X receives long-term care advantages and reports a unique tax remedy in comparison to a resident of State Y. State X may be offering a tax credit score for long-term care bills, whilst State Y does no longer. This demonstrates the adaptation in tax implications throughout other jurisdictions.

Epilogue

In conclusion, figuring out the tax implications of long-term care insurance coverage is very important for making knowledgeable monetary selections. The tax remedy of premiums, advantages, and bills varies considerably in response to particular person cases, revenue ranges, and state laws. We’ve got explored the nuances of this subject, highlighting the important thing elements influencing taxability and offering a complete assessment. This information goals to empower you to navigate those complicated issues, making sure you’re well-equipped to give protection to your monetary well-being all over classes of prolonged care.

FAQ Useful resource

Are premiums paid for long-term care insurance coverage tax deductible?

In some instances, premiums paid for long-term care insurance coverage could also be tax-deductible. Explicit regulations and laws referring to deductibility range in response to particular person revenue ranges and different elements.

What forms of long-term care products and services are most often coated?

Protection choices continuously come with in-home care, assisted dwelling amenities, and professional nursing care. Explicit products and services range relying at the coverage.

How do state rules affect the tax remedy of long-term care advantages?

State rules can impact the taxability of long-term care advantages. There could also be diversifications within the tax implications relying at the state of place of dwelling.

Can long-term care bills be deductible?

Positive long-term care bills could also be deductible, however eligibility is topic to express regulations and laws. Detailed tips and explicit examples shall be equipped within the complete information.