Is insurance coverage upper for more recent automobiles? This burning query confronts potential automobile consumers, casting a shadow of uncertainty over the monetary panorama of vehicle possession. The solution, then again, is not a easy sure or no. A mess of things intertwine to resolve the price of insuring a brand new automobile, from its inherent worth and security measures to the driving force’s historical past and the area of acquire.

This exploration dives deep into the intricacies of vehicle insurance coverage, offering a complete research that navigates the complexities of the marketplace.

The attract of a gleaming new automobile is plain, however the related insurance coverage prices usally go away consumers at a loss for words. This complete information meticulously dissects the standards contributing to insurance coverage premiums, highlighting the often-overlooked nuances that have an effect on charges for each new and older fashions. We will delve into the make, fashion, and security measures, revealing the hidden mechanisms influencing those prices.

Moreover, we will read about the affect of riding historical past, insurance policy choices, and geographical permutations.

Elements Affecting Insurance coverage Premiums for New Vehicles

Baru-baru ondisi, angka premi asuransi untuk mobil baru memang menjadi perbincangan hangat. Banyak faktor yang dipertimbangkan perusahaan asuransi dalam menentukan harga premi. Pemahaman mengenai faktor-faktor ini penting bagi pemilik mobil baru untuk mengelola keuangan mereka secara bijaksana.Insurers assess a mess of things when surroundings insurance coverage charges for brand spanking new cars. Those components come with now not best the bodily attributes of the automobile but additionally the chance profile related to its use and possession.

Working out those issues is a very powerful for potential automobile homeowners to make knowledgeable selections.

Elements Insurers Believe

More than a few components play a job in figuring out insurance coverage premiums for brand spanking new automobiles. Those components are meticulously evaluated via insurers to evaluate the chance related to insuring a selected automobile.

- Automobile Make, Style, and Trim Degree: Status and popularity of the automobile producer can affect the top class. Luxurious cars usally command upper premiums than similar fashions in a decrease trim stage. Explicit options, comparable to complex era and distinctive design parts, too can affect insurance coverage prices. For example, a high-performance sports activities automobile, like a Lamborghini, may have a considerably upper top class in comparison to a typical sedan because of the higher chance of injuries or claims.

- Protection Options: The presence of security measures, comparable to airbags, anti-lock brakes (ABS), digital steadiness regulate (ESC), and complex driver-assistance methods (ADAS), considerably influences insurance coverage charges. Cars provided with a complete suite of security measures normally have decrease premiums, as they’re perceived as posing a decrease chance of injuries and claims.

- Horsepower and Engine Dimension: Upper horsepower and engine measurement usally correlate with the next top class. Robust engines and high-performance cars can also be extra at risk of injuries because of their higher pace and acceleration features. This added chance ends up in the next insurance coverage top class. As an example, a sports activities automobile with a high-performance engine will usually have the next top class than a extra modest automobile.

- Automobile Sort: Various kinds of cars, comparable to sports activities automobiles, sedans, SUVs, and vehicles, have other chance profiles and thus other insurance coverage charges. Sports activities automobiles are normally related to the next chance because of their upper speeds and possible for injuries, leading to the next top class. Conversely, sedans or SUVs can have a decrease top class because of their decrease chance profile.

Comparative Research of Insurance coverage Charges

Other cars have other chance profiles, and insurance coverage premiums replicate this. This phase items a comparability of insurance coverage charges throughout more than a few automobile sorts.

| Make | Style | Protection Options | Estimated Insurance coverage Top class |

|---|---|---|---|

| Toyota | Camry | Airbags, ABS, ESC | Rp. 1.500.000 – Rp. 2.000.000 in step with 12 months |

| Honda | Civic Sort R | Airbags, ABS, ESC, Complicated Motive force-Help Programs | Rp. 2.000.000 – Rp. 3.000.000 in step with 12 months |

| BMW | M3 | Airbags, ABS, ESC, Complicated Motive force-Help Programs, Efficiency Brakes | Rp. 3.000.000 – Rp. 5.000.000 in step with 12 months |

| Jeep | Wrangler | Airbags, ABS, ESC | Rp. 1.800.000 – Rp. 2.500.000 in step with 12 months |

Observe: Those are estimated premiums and might range according to particular person components, comparable to riding historical past, location, and protection choices. Premiums are indicative and will vary according to the insurer’s explicit chance evaluation.

New Automobile vs. Older Automobile Insurance coverage Comparability

Di dunia perasuransian, harga premi asuransi untuk kendaraan baru seringkali berbeda dengan kendaraan lama. Hal ini dipengaruhi oleh sejumlah faktor yang kompleks, mulai dari nilai kendaraan hingga tingkat risiko kerusakan. Memahami perbedaan ini penting bagi setiap pemilik kendaraan, baik yang baru membeli mobil atau yang sedang mempertimbangkan untuk mengganti mobil lamanya.

Normal Development of Insurance coverage Prices

Secara umum, asuransi untuk kendaraan baru cenderung lebih mahal daripada kendaraan yang lebih tua. Hal ini disebabkan oleh beberapa faktor yang akan dijelaskan lebih lanjut. Nilai pergantian yang lebih tinggi pada kendaraan baru menjadi salah satu penyebab utama perbedaan ini.

Causes At the back of Doable Variations

Perbedaan premi asuransi antara kendaraan baru dan lama berakar pada beberapa faktor kunci. Nilai jual kembali (resale worth) yang tinggi pada kendaraan baru berdampak langsung pada jumlah klaim yang mungkin terjadi. Risiko kerusakan atau pencurian juga menjadi pertimbangan penting. Kendaraan baru, dengan teknologi yang lebih canggih dan fitur keselamatan yang lebih baik, mungkin memiliki potensi risiko kerusakan yang lebih rendah dibandingkan dengan kendaraan lama.

Namun, hal ini juga tergantung pada perawatan dan pemeliharaan yang diberikan kepada mobil.

Elements Influencing Insurance coverage Premiums

Beberapa faktor dapat mempengaruhi perbedaan premi asuransi, meliputi:

- Nilai Pergantian (Substitute Worth): Kendaraan baru memiliki nilai pergantian yang lebih tinggi, sehingga premi asuransi cenderung lebih mahal untuk menutupi potensi kerugian yang lebih besar.

- Teknologi dan Fitur Keselamatan: Kendaraan baru seringkali dilengkapi dengan teknologi dan fitur keselamatan yang lebih canggih, yang dapat memengaruhi tingkat risiko kerusakan dan pencurian. Meskipun begitu, fitur keselamatan ini bisa menjadi pertimbangan dalam menentukan premi asuransi.

- Umur Kendaraan: Kendaraan yang lebih tua biasanya memiliki nilai jual kembali yang lebih rendah, sehingga premi asuransi dapat lebih rendah. Umur mobil dan kondisi fisik mobil juga menjadi pertimbangan dalam penentuan premi asuransi.

- Riwayat Perbaikan: Riwayat perbaikan dan kerusakan pada kendaraan lama dapat mempengaruhi premi asuransi. Kendaraan yang memiliki riwayat perbaikan yang signifikan mungkin memiliki premi yang lebih tinggi.

- Lokasi dan Sejarah Pencurian: Lokasi tempat kendaraan disimpan dan tingkat kejahatan di daerah tersebut dapat mempengaruhi premi asuransi. Lokasi yang rawan pencurian biasanya memiliki premi asuransi yang lebih tinggi.

Examples of Scenarios, Is insurance coverage upper for more recent automobiles

Contoh kasus di mana asuransi untuk kendaraan baru lebih tinggi:

- Pemilik kendaraan baru yang tidak memiliki catatan kepemilikan kendaraan yang baik mungkin memiliki premi yang lebih tinggi. Hal ini dapat terjadi pada pengemudi muda yang baru memiliki SIM, karena mereka lebih berisiko mengalami kecelakaan.

- Kendaraan baru yang dilengkapi dengan fitur-fitur canggih yang meningkatkan harga jual kembali juga memiliki risiko kerugian yang lebih tinggi.

- Kendaraan baru yang memiliki sistem audio atau komponen elektronik yang mahal akan meningkatkan risiko kerusakan.

Insurance coverage Price Comparability

Berikut tabel perbandingan biaya asuransi untuk kendaraan baru dan kendaraan lama yang sejenis:

| Umur Kendaraan | Perkiraan Biaya Perbaikan | Premi Asuransi |

|---|---|---|

| Baru (2023) | Rp 10.000.000 | Rp 500.000/tahun |

| Lama (2018) | Rp 5.000.000 | Rp 300.000/tahun |

Catatan: Angka di atas merupakan contoh dan dapat bervariasi tergantung pada berbagai faktor seperti perusahaan asuransi, lokasi, dan kondisi kendaraan.

Have an effect on of Riding Historical past on Insurance coverage Prices

Marga ni ari, ulaon ni siuhon, na patuduhon do pengaruh ni sejarah ni sodara ni sogot manang na sogot mangguruhon harga asuransi. Di bagasan buku on, ilehon do contoh-contoh na ringgas jala na patuduhon do pengaruh ni sejarah ni sodara ni sogot di angka harga asuransi, khususnya di mobil na imbaru.Working out a motive force’s previous riding report is a essential think about figuring out insurance coverage premiums, particularly for brand spanking new automobiles.

A blank riding report most often leads to decrease premiums, reflecting a motive force’s accountable conduct at the street. Conversely, a historical past of injuries or violations will most probably result in upper premiums, because it signifies a better chance to the insurance coverage corporate. Insurers meticulously review this historical past to evaluate the chance of long term claims, influencing the premiums accordingly.

Analysis of Riding Historical past

Insurers use a complete procedure to evaluate a motive force’s historical past. This comes to reviewing data of injuries, visitors violations, and claims filed. Knowledge accrued is meticulously analyzed to resolve the driving force’s chance profile. This procedure goals to expect the possibility of long term claims and modify premiums accordingly. The analysis usally comes to components just like the severity of the twist of fate or violation, the driving force’s age, and the frequency of incidents.

Have an effect on of a Blank Riding File

A spotless riding report is a precious asset when making use of for automobile insurance coverage, specifically for a brand new automobile. A motive force without a injuries or violations is perceived as a decrease chance, leading to decrease premiums. It’s because the insurance coverage corporate anticipates a decrease probability of claims. As an example, a tender motive force with a blank riding report might qualify for a considerably decrease top class than a motive force with a historical past of rushing tickets or injuries.

Examples of Coincidence or Violation Have an effect on

A motive force with a historical past of injuries will most probably face upper insurance coverage premiums. As an example, a motive force inquisitive about a fender bender may see a modest building up of their premiums. A extra critical twist of fate, comparable to a collision leading to important assets harm or accidents, may just result in a considerable building up in premiums. Likewise, repeated visitors violations, like rushing tickets or reckless riding fees, would additionally affect the top class, with every violation doubtlessly including to the associated fee.

Insurer’s Procedures for Figuring out Premiums

Insurers make use of a structured procedure to guage a motive force’s historical past. This procedure most often comes to:

- Having access to riding historical past data from related government.

- Comparing the severity and frequency of injuries or violations.

- Inspecting the driving force’s claims historical past (if any).

- Figuring out the driving force’s age and different related components.

Those components are mixed to evaluate the driving force’s chance profile, which in flip determines the insurance coverage top class.

Desk of Violations and Top class Have an effect on

The next desk Artikels several types of violations and their corresponding affect on insurance coverage premiums for a brand new automobile. The severity of affect is usally categorised, starting from minor to primary.

| Violation Sort | Description | Doable Top class Have an effect on |

|---|---|---|

| Minor Visitors Violation (e.g., rushing price tag below 10 km/h over the restrict) | A minor infraction. | Modest building up. |

| Severe Visitors Violation (e.g., reckless riding, DUI) | A extra important infraction. | Really extensive building up. |

| At-Fault Coincidence (e.g., minor fender bender) | The driving force was once deemed liable for the twist of fate. | Average to important building up, relying at the harm. |

| Severe Coincidence (e.g., inflicting accidents or primary assets harm) | The twist of fate concerned important harm or accidents. | Important building up, doubtlessly affecting insurability. |

Insurance coverage Protection Choices for New Vehicles: Is Insurance coverage Upper For More recent Vehicles

Working out the more than a few insurance policy choices to be had for a brand new automobile is a very powerful for protecting your funding and monetary well-being. Selecting the proper protection can considerably affect your insurance coverage premiums and make sure good enough coverage in case of injuries or damages. Similar to choosing the right apparel for an important day, deciding on the right kind insurance policy is very important in your new automobile.Complete and collision protection are vital facets of insurance coverage, offering coverage in opposition to more than a few possible incidents.

Working out those coverages is secret to meaking knowledgeable selections when buying a brand new automobile and securing the fitting insurance coverage. The number of protection immediately influences the price of your insurance coverage premiums.

Complete Protection

Complete protection protects your new automobile in opposition to perils that are not immediately associated with collisions. This comprises damages from herbal failures, vandalism, hearth, robbery, and even falling gadgets. Complete protection is usally a vital part of a complete insurance coverage package deal for a brand new automobile.

Collision Protection

Collision protection protects your new automobile in case of a collision with every other automobile or an object. It covers the wear and tear on your automobile without reference to who’s at fault. Collision protection is important for shielding your funding and is usally a typical element of complete insurance policy for a brand new automobile.

Legal responsibility Protection

Legal responsibility protection protects you from monetary accountability if you happen to purpose an twist of fate that leads to harm to someone else’s assets or accidents to someone else. It’s legally required in lots of jurisdictions. This protection safeguards your monetary well-being and is usally a vital element of a complete insurance coverage package deal for a brand new automobile.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection protects you and your automobile in case you are inquisitive about an twist of fate with a motive force who does not have insurance coverage or has inadequate protection. It’s critical in circumstances the place the at-fault birthday party lacks the monetary sources to hide damages. Having this protection guarantees you’re safe from monetary losses when inquisitive about such injuries.

Further Protection Choices

Further protection choices, comparable to condominium compensation, towing, and roadside help, can also be added on your coverage for an additional top class. Those choices can give added comfort and coverage. They’re usually bought as supplementary protection for additonal peace of thoughts and are a sensible funding in your new automobile’s insurance coverage.

Have an effect on of Protection Choices on Premiums

The number of protection choices immediately influences the insurance coverage top class for a brand new automobile. Complete protection, for instance, usally leads to the next top class in comparison to fundamental legal responsibility protection. The extent of protection immediately impacts the monetary dedication in your insurance coverage.

Significance of Working out the Coverage

Totally working out your insurance coverage sooner than buying a brand new automobile is paramount. Studying and working out the coverage main points, together with the protection choices and exclusions, is very important. This step is important to making sure you have got good enough coverage in your new automobile.

Insurance coverage Protection Package deal Prices

The prices of more than a few insurance policy applications for brand spanking new automobiles range considerably relying on components comparable to the automobile’s make, fashion, and price, your riding historical past, and the protection choices decided on. The precise prices of more than a few applications are usally dependent at the automobile and particular person motive force main points.

Desk of Insurance coverage Protection Choices and Premiums

| Protection Choice | Description | Estimated Top class (Instance) |

|---|---|---|

| Legal responsibility Best | Fundamental protection for felony tasks in injuries. | Rp 500,000 – Rp one million in step with 12 months |

| Complete & Collision | Covers harm from more than a few incidents, together with collisions and complete perils. | Rp 1,500,000 – Rp 3,000,000 in step with 12 months |

| Complete, Collision, & Uninsured/Underinsured Motorist | Complete, collision, and coverage in opposition to injuries involving uninsured or underinsured drivers. | Rp 2,000,000 – Rp 4,000,000 in step with 12 months |

Observe: Premiums are examples and might range considerably according to particular person cases. Those figures are for illustrative functions best and will have to now not be taken as definitive monetary steering.

Elements Associated with Insurance coverage Claims and New Vehicles

Marga ni, di naunggap dohononta taringot tu faktor-faktor na mambahen na lambin mahal do asuransi ni mobil baru. Asa iteh ma, songon dia do pengaruh ni sejarah klaim tu harga asuransi, dohot songon dia do proses ni klaim i di mobil baru.Sai tongtong do pambahenan ni asuransi i. Adong do aturan na patut dipatudu, asa marimbang do hak dohot kewajiban ni angka pihak na terlibat.

Di bagasan proses i, dibahen ma penyesuaian-penyesuaian na patut asa marimbang do hak dohot kewajiban.

Have an effect on of Claims Historical past on Insurance coverage Premiums

Sejarah klaim, ima catatan ni klaim-klaim na pernah diadopi, marpengaruh do tu harga asuransi ni mobil baru. Mobil baru na pernah terlibat di klaim, biasanya do dapot harga asuransi na lambin mahal. Hal on terjadi sebab perusahaan asuransi menganggap mobil i marpotensi besar tu klaim di masa depan.

Kinds of Claims and Their Have an effect on

Adong do angka jenis klaim na marbeda-beda, na marpengaruh tu premi asuransi. Klaim kecelakaan, na terjadi sebab tabrakan, biasanya do mambahen harga asuransi lambin mahal. Hal on terjadi sebab kecelakaan berarti risiko na lambin tinggi tu mobil i. Klaim pencurian, khususna, marpengaruh do, sebab mobil baru na mudah dicuri, lambin mahal do premi asuransi.

Claims Processing for New and Older Cars

Proses klaim ni mobil baru dohot mobil na umtua marbeda-beda. Mobil baru, biasanya do dapot proses na lambin kompleks, sebab mobil i lambin baru dohot lambin mahal. Mobil na umtua, proses ni klaim i biasa do lambin sederhana.

Significance of Working out Declare Procedures

Penting do memahami prosedur klaim asuransi sebelum membeli mobil baru. Hal on, membantu menghindari masalah na terjadi di kemudian hari. Patut diingat do, adong do langkah-langkah na patut dipatudu dalam mengajukan klaim, seperti mengisi formulir na lengkap, memfotokopi dokumen na penting, dohot menghubungi perusahaan asuransi.

The way to Document a Declare for a New Automobile

Langkah-langkah mengajukan klaim untuk mobil baru hampir sama dengan mengajukan klaim untuk mobil na umtua. Pertama, hubungi perusahaan asuransi, dan jelaskan kejadian na terjadi. Kemudian, siapkan dokumen-dokumen na dibutuhkan, seperti polis asuransi, bukti kerusakan, dan laporan polisi. Patut diingat do, informasi na akurat dohot lengkap penting dalam mengajukan klaim.

Comparability of Claims and Their Impact on Premiums

| Jenis Klaim | Pengaruh pada Premi |

|---|---|

| Kecelakaan | Premi biasanya naik, tergantung tingkat keparahan kecelakaan. |

| Pencurian | Premi biasanya naik, tergantung jenis mobil dan tingkat risiko pencurian di daerah tersebut. |

| Kerusakan akibat bencana alam | Premi bisa naik atau tetap tergantung pada tingkat kerusakan dan cakupan asuransi. |

| Kerusakan akibat penggunaan yang salah | Premi bisa naik, jika kesalahan yang dilakukan dianggap sebagai kelalaian yang serius. |

Geographic Diversifications in Insurance coverage Prices for New Vehicles

Marga ni, taringot tu ulaon ni asuransi ni mobil baru. Iti mangalangkahon parbedaan harga asuransi antara sada daerah dohot daerah na asing, jala na dob ibahen pengaruh lokasi. Faktor-faktor na mangguruhon parbedaan i boi do ibahen patokan, asa boi diantusi dohot diukur.Geographical permutations in new automobile insurance coverage premiums are influenced via a number of components. Those components come with the superiority of robbery, vandalism, and injuries in numerous areas, the standard of native legislation enforcement, or even the extent of visitors congestion.

Working out those components is a very powerful in comprehending the various insurance coverage prices throughout more than a few places.

Have an effect on of Regional Crime Charges on Insurance coverage Prices

Regional crime charges considerably have an effect on insurance coverage premiums for brand spanking new automobiles. Spaces with upper charges of robbery, vandalism, or injuries normally have upper insurance coverage premiums. It’s because insurance coverage corporations will have to account for a better chance of claims in those places. For example, if a town reviews a spike in automobile thefts, the insurance coverage suppliers will building up the premiums to make amends for the higher chance.

It is a calculated reaction to the increased chance of loss or harm.

Affect of Native Legislation Enforcement on Insurance coverage Premiums

The effectiveness of native legislation enforcement performs a a very powerful position in insurance coverage prices. Spaces with environment friendly legislation enforcement and a powerful observe report of apprehending criminals usally see decrease insurance coverage premiums. The presence of fast reaction and preventative measures reduces the chance of auto robbery or harm, thus reducing the premiums. Conversely, spaces with a loss of efficient legislation enforcement may see upper insurance coverage premiums because of the upper chance of incidents going unpunished.

Impact of Visitors Congestion on Insurance coverage Premiums

Visitors congestion, too, affects insurance coverage premiums. Areas with heavy visitors usally have upper insurance coverage premiums. Top visitors density will increase the possibility of injuries, which results in extra claims. The higher chance of injuries necessitates the next insurance coverage price for drivers in the ones spaces. Insurance coverage corporations issue this higher chance into their calculations.

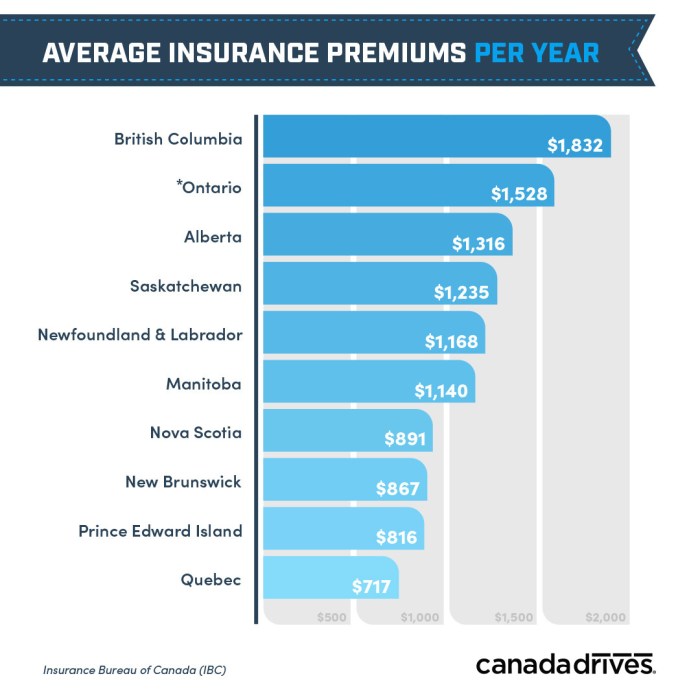

Comparability of Insurance coverage Premiums in Other Areas

| Town/State | Estimated Top class for a 2024 Honda Civic (USD) | Elements Influencing Top class |

|---|---|---|

| New York Town | $1,800 | Top crime fee, excessive visitors density |

| Los Angeles | $1,600 | Top crime fee, excessive visitors density |

| Austin, Texas | $1,200 | Decrease crime fee, average visitors |

| Portland, Oregon | $1,300 | Average crime fee, average visitors |

This desk supplies a comparative evaluate of estimated insurance coverage premiums for a brand new 2024 Honda Civic in numerous towns/states. Observe that those figures are estimates and might range according to particular person riding data and different components. Premiums are a mirrored image of the calculated chance related to every area.

Ultimate Wrap-Up

In conclusion, the solution to “is insurance coverage upper for more recent automobiles?” is not a simple sure or no. A confluence of things, together with the automobile’s traits, the driving force’s report, and the geographical location, all play pivotal roles in figuring out the top class. This research has uncovered the intricate dance between those parts, offering a complete working out of the forces at play.

In the long run, knowledgeable decision-making calls for a radical analysis of all components sooner than making any buying selections.

Fast FAQs

What components affect insurance coverage premiums for brand spanking new automobiles?

Insurance coverage corporations imagine more than a few components, together with the automobile’s make, fashion, security measures, horsepower, engine measurement, or even the kind of automobile (sports activities automobile, sedan, SUV). The automobile’s worth and possible restore prices additionally play a a very powerful position.

How does a motive force’s historical past have an effect on insurance coverage for a brand new automobile?

A motive force’s historical past, together with injuries and violations, considerably affects insurance coverage premiums. A blank riding report may end up in decrease premiums, whilst a historical past of injuries or violations can dramatically building up them. Insurers review this historical past meticulously to evaluate chance.

Are insurance coverage claims treated another way for brand spanking new automobiles in comparison to older fashions?

Claims processing procedures may vary fairly, however the core ideas stay the similar. The worth of the automobile, possible restore prices, and the affect at the general insurance coverage portfolio are regarded as. An in depth working out of the declare procedure is a very powerful.

How do other areas have an effect on new automobile insurance coverage charges?

Geographical location considerably influences insurance coverage prices. Elements like twist of fate charges, crime statistics, and native laws have an effect on the whole chance evaluation. This leads to various premiums throughout other areas.