Illinois tax meals rules have a vital affect on customers, companies, and the state’s income. This information supplies an summary of the present tax rules, their affect on customers, the income generated, comparisons to different states, and doable long term adjustments.

Working out the complexities of Illinois tax meals is a very powerful for making knowledgeable choices about meals purchases, trade operations, and coverage adjustments.

Illinois Tax Meals Rules

The Illinois tax rules for meals are designed to generate income for the state govt. The tax rules are complicated and will also be obscure. This text will supply an summary of the present tax rules for meals in Illinois, together with examples of meals pieces which are taxed and non-taxed, in addition to any fresh adjustments or updates to the tax rules.

Taxed Meals Pieces

Maximum meals pieces bought in Illinois are matter to the state’s gross sales tax of 6.25%. This comprises meals bought at grocery retail outlets, eating places, and comfort retail outlets. On the other hand, there are some exceptions to the gross sales tax on meals. Those exceptions come with:

- Meals bought with meals stamps

- Meals bought by means of charitable organizations

- Meals bought for instant intake at the premises of the vendor

Non-Taxed Meals Pieces

There are a variety of meals pieces that don’t seem to be matter to the gross sales tax in Illinois. This stuff come with:

- Groceries

- Prescribed drugs

- Child meals

- Dog food

Fresh Adjustments to the Tax Rules

There were no fresh adjustments to the tax rules for meals in Illinois.

Have an effect on of Meals Taxes on Shoppers

Meals taxes in Illinois have a vital affect on customers, in particular low-income families. Those taxes disproportionately impact positive teams and will pose demanding situations to meals safety.

One of the most primary affects of meals taxes is the larger value of groceries. When meals is taxed, customers pay extra for crucial pieces, corresponding to culmination, greens, and dairy merchandise. This may pressure family budgets and make it tricky for households to find the money for wholesome and nutritious meals.

Disproportionate Have an effect on on Low-Source of revenue Families

Low-income families are disproportionately suffering from meals taxes. Those families steadily spend a bigger proportion in their revenue on meals, so any building up in meals costs may have a vital affect on their talent to find the money for different prerequisites, corresponding to housing, transportation, and healthcare.

Methods to Mitigate Have an effect on

There are a number of methods that may be applied to mitigate the affect of meals taxes on low-income families. Those come with:

- Tax exemptions: Exempting positive meals pieces from taxation, corresponding to fruit and veggies, can assist cut back the price of groceries for low-income families.

- Subsidies: Offering subsidies for meals purchases can assist offset the price of meals taxes for low-income families.

- SNAP advantages: Increasing SNAP (Supplemental Diet Help Program) advantages can give further help to low-income families in buying meals.

Earnings Generated from Meals Taxes

Meals taxes are a vital income for the state of Illinois. In fiscal 12 months 2023, meals taxes generated roughly $1.9 billion, accounting for six.5% of the state’s overall tax income.

The income generated from meals taxes is allotted to quite a lot of state methods, together with schooling, healthcare, and infrastructure. A portion of the income may be used to fund tax aid methods for low-income households.

Doable for Choice Resources of Earnings

There are a number of doable choice resources of income that might exchange meals taxes. Those come with:

- Gross sales tax on non-food pieces

- Source of revenue tax

- Assets tax

Every of those choice resources of income has its personal benefits and drawbacks. Gross sales tax on non-food pieces can be a broader tax that will generate extra income than meals taxes. On the other hand, it might even be extra regressive, that means that it might disproportionately affect low-income households.

Source of revenue tax is a revolutionary tax that will generate much less income than meals taxes. On the other hand, it might be extra equitable, that means that it might be extra lightly dispensed throughout all revenue ranges.

Assets tax is an area tax that will generate income for native governments. On the other hand, this is a regressive tax that will disproportionately affect low-income households.

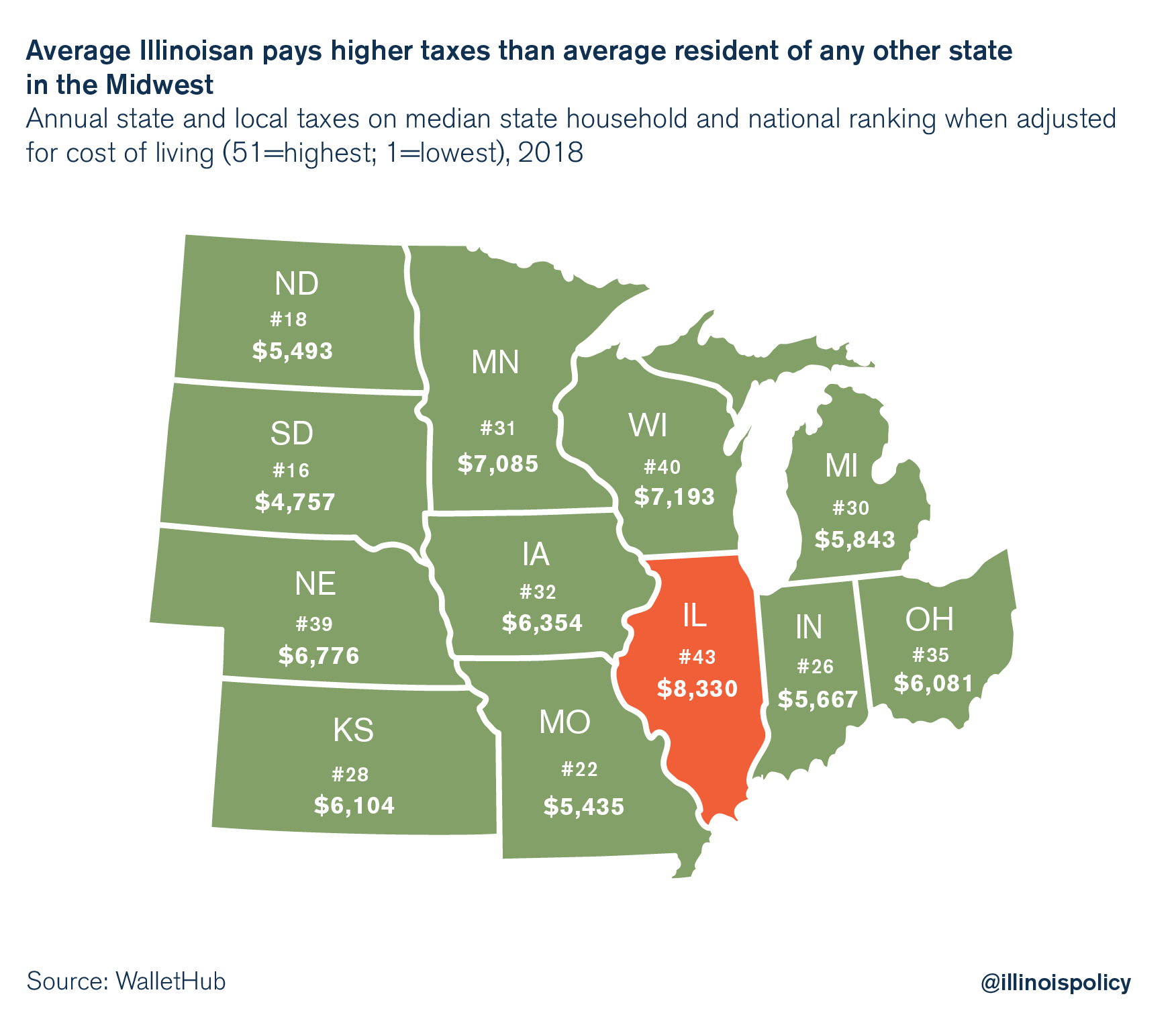

Comparability to Different States

Illinois’ meals tax rules vary from the ones of its neighboring states in numerous tactics. Those variations may have a vital affect on customers and companies.

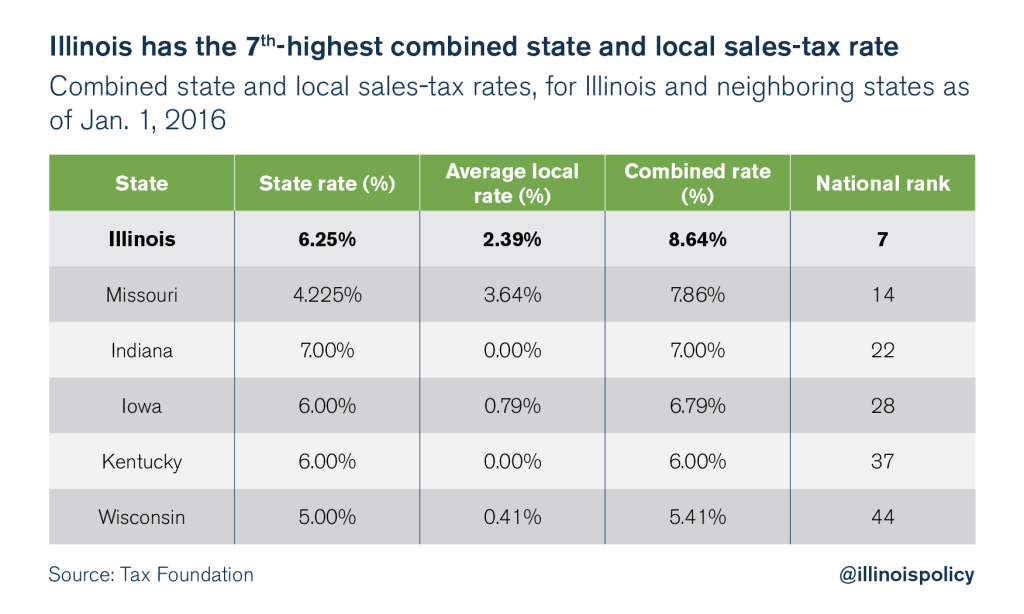

Tax Charges

Illinois has a reasonably prime meals tax price in comparison to its neighbors. The state’s common gross sales tax price is 6.25%, and meals is matter to the total price. Which means that customers in Illinois pay extra for meals than customers in maximum neighboring states.

Exemptions

Illinois has plenty of exemptions to its meals tax. Those exemptions come with:

- Groceries

- Meals bought with meals stamps

- Meals served at eating places with lower than $10 million in annual gross sales

Those exemptions assist to scale back the affect of the meals tax on low-income households and small companies.

Have an effect on on Shoppers and Companies

The diversities in meals tax rules between Illinois and its neighboring states may have a vital affect on customers and companies.

Shoppers in Illinois pay extra for meals than customers in maximum neighboring states. This is a vital burden for low-income households.

Companies in Illinois is also at a aggressive drawback in comparison to companies in neighboring states with decrease meals tax charges. It is because companies in Illinois will have to go on the price of the meals tax to their consumers.

Long term of Meals Taxes in Illinois: Illinois Tax Meals

The way forward for meals taxes in Illinois is unsure, as there are a number of doable adjustments or reforms that may be applied. Those adjustments may well be pushed by means of various components, together with the state’s price range state of affairs, the political local weather, and the evolving panorama of the meals business.

One doable alternate is the removing of the gross sales tax on meals. This might be a vital alternate, as it might cut back the price of meals for customers and doubtlessly stimulate the financial system. On the other hand, it might additionally cut back the volume of income generated by means of the state, which might result in cuts in govt services and products.

Any other doable alternate is the implementation of a graduated meals tax. This kind of tax would practice a better tax price to dangerous meals, corresponding to sugary beverages and processed snacks. This may assist to enhance the well being of Illinois citizens and cut back the state’s healthcare prices.

On the other hand, it may be noticed as unfair to low-income households, who spend a bigger share in their revenue on meals.

Stakeholders Concerned within the Debate over Meals Taxes, Illinois tax meals

There are a selection of stakeholders concerned within the debate over meals taxes in Illinois. Those stakeholders come with:

- Shoppers: Shoppers are without equal payers of meals taxes, and they’ve a vested pastime in making sure that those taxes are honest and cheap.

- Companies: Companies that promote meals also are suffering from meals taxes. Those companies will have to gather and remit the tax to the state, and so they may additionally go on the price of the tax to customers.

- Govt: The federal government of Illinois is accountable for accumulating and spending the income generated by means of meals taxes. The federal government has an pastime in making sure that meals taxes are producing enough income to satisfy the state’s wishes.

- Public well being advocates: Public well being advocates are involved concerning the affect of meals taxes at the well being of Illinois citizens. They consider that meals taxes can be utilized to deter the intake of dangerous meals and advertise the intake of wholesome meals.

Political and Financial Elements that may Affect the Long term of Meals Taxes in Illinois

The way forward for meals taxes in Illinois can be influenced by means of various political and financial components. Those components come with:

- The state’s price range state of affairs: The state’s price range state of affairs will play a significant function in figuring out the way forward for meals taxes. If the state is going through the cheap deficit, it can be much more likely to boost meals taxes as a way to generate further income.

- The political local weather: The political local weather in Illinois may even affect the way forward for meals taxes. If there’s a sturdy public outcry in opposition to meals taxes, the state legislature is also much less more likely to lift them.

- The evolving panorama of the meals business: The evolving panorama of the meals business may even impact the way forward for meals taxes. Because the meals business adjustments, the state would possibly want to alter its meals tax rules as a way to stay up.

Regularly Requested Questions

What meals pieces are taxed in Illinois?

Ready meals, eating place foods, and groceries are matter to gross sales tax in Illinois.

How a lot is the gross sales tax on meals in Illinois?

The state gross sales tax price is 6.25%, and native taxes can upload an extra 1-2%.

Are there any exemptions to the meals gross sales tax in Illinois?

Sure, positive meals pieces corresponding to contemporary culmination, greens, and bread are exempt from gross sales tax.