How a lot is automobile insurance coverage in South Carolina monthly? Navigating the state’s insurance coverage panorama can really feel like a maze, however worry now not, intrepid drivers! This information unveils the secrets and techniques to interpreting South Carolina’s per 30 days automobile insurance coverage prices, from the standards that have an effect on your top rate to savvy methods for saving. Get in a position to release the code to reasonably priced automobile insurance coverage.

We’re going to discover the important thing variables influencing your charges, like your using historical past and car kind, plus delve into the common prices throughout other demographics. Plus, we will discover insider tricks to lower prices and spotlight the professionals and cons of more than a few insurance coverage suppliers. Buckle up, as a result of this journey to working out South Carolina automobile insurance coverage is ready to get attention-grabbing!

Components Affecting Automobile Insurance coverage Prices in South Carolina

Navigating the arena of auto insurance coverage can really feel like interpreting a posh code. Working out the standards that affect premiums in South Carolina is an important for making knowledgeable choices and securing the most efficient conceivable charges. Realizing what components play a task empowers you to take regulate of your insurance coverage prices.Automobile insurance coverage premiums in South Carolina, like many different states, aren’t a hard and fast quantity.

They’re dynamic and calculated according to numerous parts that at once have an effect on menace evaluate. Insurance coverage firms meticulously evaluation every side to decide the best top rate for every policyholder. This comes to having a look at your using historical past, the car itself, your location, and your age. Past those elementary components, explicit South Carolina rules and the way other insurance coverage firms interpret them additionally play a vital position.

Using Historical past

Using historical past is a important part in figuring out your automobile insurance coverage top rate. A blank using document, with out a injuries or violations, in most cases interprets to decrease premiums. Conversely, injuries, site visitors violations, or claims will generally lead to upper premiums. This displays the insurance coverage corporate’s evaluate of your menace profile as a motive force. As an example, a motive force with a couple of dashing tickets will most likely pay greater than a motive force with out a violations.

Automobile Sort

The kind of car you force considerably affects your insurance coverage prices. Sure cars are inherently dearer to insure than others because of their perceived menace of wear or robbery. Sports activities vehicles, luxurious cars, and high-performance fashions steadily elevate upper premiums in comparison to usual sedans or compact vehicles. That is as a result of components like the possibility of upper restore prices and the perceived desirability of the car to thieves.

Location

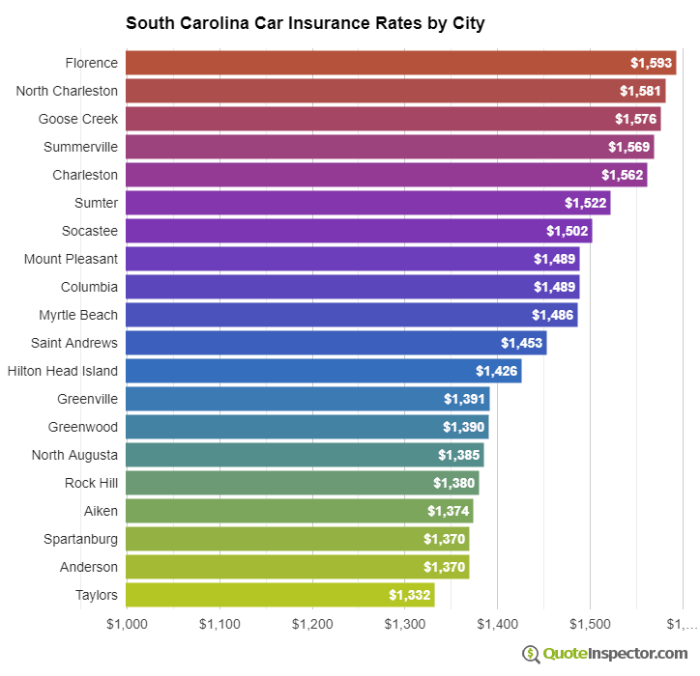

Your location in South Carolina too can impact your automobile insurance coverage charges. Spaces with upper crime charges or a better focus of injuries steadily see upper premiums. For example, a motive force dwelling in a town recognized for high-speed using or injuries might pay extra in comparison to a motive force in a extra rural space with a decrease incident fee.

This displays the insurance coverage corporate’s analysis of menace according to the precise demographics and traits of the realm.

Age of Motive force

The age of the motive force is a key consider figuring out insurance coverage premiums. More youthful drivers are in most cases regarded as upper menace and due to this fact pay upper premiums. That is because of their inexperience and, doubtlessly, a better probability of injuries. This can be a not unusual follow throughout more than a few insurance coverage markets, and South Carolina isn’t any exception. Alternatively, as drivers acquire revel in and a blank using document, their premiums usually lower.

Have an effect on of South Carolina Laws

South Carolina rules, like obligatory minimal legal responsibility protection necessities or explicit rules relating to uninsured motorists, not directly impact insurance coverage charges. Those rules affect the extent of menace related to other drivers and cars. The state’s necessities for protection quantities and kinds at once have an effect on the price of insurance coverage for people.

Insurance coverage Corporate Permutations

Other insurance coverage firms in South Carolina might assess those components another way. Their menace evaluate fashions, pricing methods, and inside procedures may range. Which means that a motive force with a equivalent profile may download other premiums from other firms. As an example, Corporate A may weigh dashing tickets extra closely than Corporate B.

| Issue | Description | Have an effect on on Top class |

|---|---|---|

| Using Historical past | Quantity and severity of injuries and violations | Upper menace, upper top rate; blank document, decrease top rate |

| Automobile Sort | Type, make, 12 months, and lines of the automobile | Upper price/functionality, upper top rate; usual fashions, decrease top rate |

| Location | Crime charges, twist of fate frequency, and demographics of the realm | Prime-risk spaces, upper top rate; low-risk spaces, decrease top rate |

| Age of Motive force | Enjoy degree and using historical past of the motive force | More youthful drivers, upper top rate; older drivers with revel in, decrease top rate |

Moderate Automobile Insurance coverage Prices in South Carolina

Navigating the arena of auto insurance coverage can really feel like a maze, particularly in a state like South Carolina, with its distinctive mix of demographics and using prerequisites. Working out the common prices permit you to finances successfully and store for the most efficient conceivable charges.

Components comparable to your car kind, age, using document, or even the precise insurance coverage corporate all play a an important position in figuring out your per 30 days top rate. This phase will delve into the everyday per 30 days automobile insurance coverage prices throughout more than a few demographics in South Carolina, offering a clearer image of what you could be expecting to pay.

Moderate Per thirty days Prices Throughout Demographics

South Carolina’s automobile insurance coverage panorama displays a spread of reasonable per 30 days prices relying on components past simply the car itself. Age and using revel in considerably affect premiums, as more youthful drivers in most cases face upper charges in comparison to extra skilled drivers. Likewise, drivers with a blank using document steadily experience decrease charges in comparison to the ones with previous injuries or violations.

Moderate Per thirty days Charges by way of Automobile Sort

The kind of car you force additionally affects your insurance coverage prices. Sedans, in most cases lighter and not more robust than SUVs or vans, generally tend to have decrease premiums. That is steadily because of the decrease menace of wear in injuries. Higher cars, like SUVs and vans, generally tend to hold a better restore charge, resulting in correspondingly upper insurance coverage premiums.

| Automobile Sort | Moderate Per thirty days Price |

|---|---|

| Sedan | $50-$100 |

| SUV | $60-$120 |

| Truck | $70-$150 |

Word: Those are approximate levels and will range very much according to different components comparable to the precise make and style of the car, add-ons or particular apparatus, and the insurance coverage corporate.

Moderate Per thirty days Charges In keeping with Motive force Age and Enjoy

A significant component influencing your per 30 days top rate is your age and using revel in. More youthful drivers steadily have upper premiums as a result of they’re statistically extra at risk of injuries than older, extra skilled drivers. The insurance coverage firms take this into consideration to evaluate the chance they’re assuming along with your coverage.

As an example, a tender motive force with restricted revel in may pay $150-$250 monthly, whilst a extra skilled motive force of their 30s or 40s may pay $75-$150 monthly. The space in prices will also be considerable, highlighting the significance of establishing a robust using document and doubtlessly in search of reductions.

Comparability of Moderate Prices Between Insurance coverage Corporations

Insurance coverage firms in South Carolina be offering numerous plans with other options and prices. Some firms may emphasize complete protection, whilst others may focal point on decrease premiums. Evaluating quotes from a couple of firms is an important for purchasing the most efficient price on your protection wishes.

A comparability of reasonable per 30 days charges from a couple of main insurance coverage suppliers in South Carolina would expose a distinction of their pricing. This distinction may well be because of their menace evaluate and pricing methods. Components like corporate recognition, customer support, and coverage options are different key concerns to have in mind when settling on an insurance coverage supplier.

Methods to Scale back Automobile Insurance coverage Prices in South Carolina

Savvy South Carolina drivers can considerably scale back their automobile insurance coverage premiums by way of imposing sensible methods. Working out the standards influencing prices, and taking proactive steps to give a boost to your using document and protection possible choices, can result in considerable financial savings. Those methods, adapted to the South Carolina marketplace, empower you to regulate your insurance coverage bills.Bettering your using document is a key consider reducing your automobile insurance coverage premiums.

A blank using historical past demonstrates accountable habits at the street, which insurers price.

Keeping up a Blank Using Document

A spotless using document is paramount in securing favorable automobile insurance coverage charges. Heading off injuries and site visitors violations is an important. South Carolina, like many states, makes use of some extent device to evaluate using historical past. Issues gather for violations, comparable to dashing tickets, reckless using, and shifting violations. The next level overall at once correlates with upper insurance coverage premiums.

Proactively fending off those infractions is very important for keeping up a good using document and making sure decrease insurance coverage prices. Continuously reviewing your using document for any amassed issues is advisable to handle any attainable problems promptly.

Taking Defensive Using Lessons

Defensive using classes supply treasured talents and data to reinforce your using conduct and scale back the chance of injuries. Finishing a licensed defensive using path in South Carolina can steadily result in vital reductions on automobile insurance coverage premiums. Those classes focal point on spotting and fending off attainable hazards, growing higher judgment, and bettering response instances. Collaborating in such classes demonstrates your dedication to protected using practices, which insurers acknowledge as a favorable issue when figuring out insurance coverage charges.

This proactive means now not most effective lowers your insurance coverage premiums but additionally contributes to a more secure using setting.

Taking into consideration Including a Protection Tool

Putting in protection gadgets to your car, comparable to an anti-theft device or complicated security features, is usually a sensible method to scale back your automobile insurance coverage prices. Insurers steadily supply reductions for cars provided with such options, spotting the improved protection they provide. As an example, in case you upload an anti-theft tool in your automobile, your insurance coverage corporate may be offering a bargain to your premiums.

This demonstrates a dedication to car safety and might lead to decrease insurance coverage premiums.

Opting for the Proper Insurance coverage Protection

In moderation choosing the right insurance policy is an important to minimizing automobile insurance coverage prices. Complete protection, whilst providing broader coverage, might build up premiums. Working out the precise dangers to your space and private using conduct will mean you can decide the best protection. For example, drivers dwelling in high-theft spaces may have the benefit of upper complete protection. Choosing the proper steadiness of protection and price is very important.

Reductions Presented by way of Insurance coverage Suppliers in South Carolina

Insurance coverage suppliers in South Carolina steadily be offering more than a few reductions for explicit movements or car traits. Those reductions can range relying at the supplier. As an example, some suppliers be offering reductions for just right pupil drivers, protected motive force methods, or for having a car with complicated security features. By means of profiting from to be had reductions, you’ll doubtlessly save vital cash to your automobile insurance coverage premiums.

Movements Drivers Can Take to Decrease Their Premiums

- Care for a blank using document: Steer clear of site visitors violations and injuries to stay your insurance coverage prices low. This can be a elementary side of accountable using and a significant component in keeping up a good using document.

- Take a defensive using path: Give a boost to your using talents and data to cut back the chance of injuries. Many insurers be offering reductions for drivers who whole defensive using classes.

- Believe including a security tool: Set up anti-theft programs or complicated security features to your car. Insurers steadily supply reductions for cars with such options.

Comparability of Insurance coverage Suppliers in South Carolina: How A lot Is Automobile Insurance coverage In South Carolina In line with Month

Navigating the automobile insurance coverage panorama in South Carolina can really feel like a treasure hunt. Other firms be offering various ranges of protection and pricing, making the decision-making procedure relatively advanced. Working out the methods hired by way of key suppliers is an important to discovering the most efficient have compatibility on your wishes and finances.

Evaluating Pricing Methods, How a lot is automobile insurance coverage in south carolina monthly

Insurance coverage firms in South Carolina make use of numerous pricing methods, reflecting components like menace evaluate, marketplace pageant, and benefit margins. Some suppliers focal point on aggressive elementary programs, whilst others emphasize complete protection with add-on choices. This variability lets in drivers to tailor their protection to express necessities and monetary eventualities.

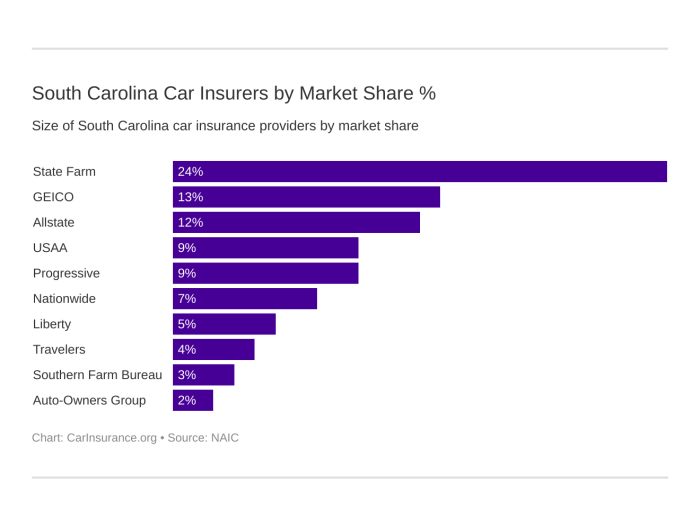

Figuring out Corporations Identified for Aggressive Pricing

A number of insurers in South Carolina are recognized for his or her aggressive pricing. Those firms steadily leverage economies of scale, environment friendly claims processing, and cutting edge applied sciences to stay prices low for policyholders. Components like motive force historical past, car kind, and geographic location additionally affect pricing. For example, drivers with a blank using document steadily qualify for decrease premiums.

Comparing Buyer Provider Popularity

Customer support performs a very important position within the insurance coverage revel in. Corporations recognized for superb customer support steadily obtain certain comments from policyholders. That is particularly essential all through declare processes, the place transparent communique and well timed answer are paramount. Recommended reaction instances, useful fortify representatives, and easy communique are hallmarks of a robust customer support recognition.

Comparative Research of Insurance coverage Suppliers

This desk supplies a comparative review of key insurance coverage suppliers in South Carolina, highlighting their pricing methods and customer support rankings.

| Insurance coverage Supplier | Pricing Technique | Buyer Provider Ranking |

|---|---|---|

| Corporate A | Makes a speciality of bundled reductions and gives aggressive charges for younger drivers with just right using data. Continuously makes use of on-line gear for simple coverage control. | 4.5 out of five stars according to buyer opinions, with robust emphasis on on-line fortify and fast claims answer. |

| Corporate B | Emphasizes complete protection programs with customizable add-ons, and steadily goals households and drivers with a couple of cars. Provides reductions for twist of fate prevention classes. | 4.2 out of five stars according to opinions, with a robust recognition for in-person fortify and customized carrier, particularly all through advanced declare processes. |

| Corporate C | Identified for aggressive elementary protection programs, preferrred for drivers in search of cost-effective insurance coverage. Continuously makes use of virtual gear for coverage control and on-line declare reporting. | 4.0 out of five stars according to opinions, with constantly certain comments relating to on-line fortify, environment friendly claims processing, and easy coverage knowledge. |

Illustrative Case Research for South Carolina Insurance coverage Prices

Navigating the arena of auto insurance coverage can really feel like interpreting a posh code. Working out how more than a few components affect your premiums is vital to securing the most efficient conceivable charges in South Carolina. Those case research will remove darkness from how other eventualities impact insurance coverage prices, providing sensible insights into accountable using and sensible monetary choices.Those examples exhibit how numerous components, from using historical past to car kind, have an effect on your per 30 days top rate.

By means of analyzing those eventualities, you’ll be able to acquire a clearer image of tips on how to doubtlessly decrease your insurance coverage prices and make knowledgeable possible choices to offer protection to your price range.

Have an effect on of Using Document on Premiums

A pristine using document is a treasured asset in terms of automobile insurance coverage in South Carolina. A blank using historical past demonstrates accountable habits at the street, which insurance coverage firms steadily praise with decrease premiums.

- A motive force with out a injuries or site visitors violations will most likely obtain a decrease top rate than a motive force with a historical past of dashing tickets or at-fault injuries. It is because a blank document signifies a decrease menace of long run claims, permitting insurers to provide extra favorable charges.

- As an example, imagine two drivers with equivalent cars and protection ranges. Motive force A has a blank document, whilst Motive force B has a up to date dashing price ticket. Motive force A’s premiums might be considerably decrease because of their demonstrably protected using conduct.

Affect of Automobile Sort and Options on Prices

The make, style, and lines of your car play a vital position in figuring out your insurance coverage top rate. Sure cars are extra at risk of harm or robbery, main to better insurance coverage prices.

- Prime-performance sports activities vehicles or luxurious cars steadily include upper insurance coverage premiums in comparison to extra usual cars. The perceived upper menace of wear or robbery contributes to those increased prices.

- Security measures, comparable to anti-theft gadgets, airbags, and digital steadiness regulate, can considerably affect premiums. Automobiles provided with complicated security features generally tend to have decrease premiums, reflecting their decreased menace of injuries.

Have an effect on of Location and Protection on Insurance coverage Premiums

Your location in South Carolina and the kind of protection you select too can have an effect on your per 30 days premiums.

- Spaces with upper charges of injuries or robbery could have correspondingly upper insurance coverage charges. That is because of the greater menace of claims in the ones spaces, which insurers issue into their pricing fashions.

- Opting for complete protection, which protects towards harm in your car from more than a few occasions, might build up your premiums. Alternatively, this sort of protection may give vital monetary coverage in case of an twist of fate or different unexpected cases.

Price-Saving Measures for South Carolina Drivers

A number of methods can assist drivers in South Carolina scale back their automobile insurance coverage prices.

- Bundling Insurance coverage Insurance policies: Combining your auto insurance coverage with house owners or renters insurance coverage can occasionally result in reductions.

- Elevating Your Deductible: Expanding your deductible can steadily lead to a decrease top rate, however be ready to pay a better out-of-pocket charge within the match of an twist of fate.

- Taking a Defensive Using Path: Finishing a defensive using path can reveal accountable using conduct and steadily lead to decreased premiums.

- Store Round for Quotes: Evaluating quotes from a couple of insurance coverage suppliers is an important. This permits you to to find the most efficient conceivable charges adapted in your explicit wishes.

Final Level

So, there you’ve gotten it – a complete take a look at how a lot automobile insurance coverage prices in South Carolina monthly. We have exposed the an important components that form your premiums, out of your using document in your car. Armed with this information, you are higher provided to buy the most efficient offers and to find the easiest insurance coverage plan to suit your finances and wishes.

Now, move forth and protected your wheels!

FAQs

What is the reasonable automobile insurance coverage charge for a tender motive force in South Carolina?

Younger drivers steadily face upper premiums because of perceived upper menace. The precise quantity varies considerably relying on components like the precise insurance coverage corporate, car kind, and site. Alternatively, be expecting to pay greater than the common, and store round to search out probably the most aggressive charges.

Are there reductions to be had for just right drivers in South Carolina?

Completely! Many insurers be offering reductions for protected drivers, those that whole defensive using classes, and people who deal with a blank using document. Examine your choices with other suppliers to look which reductions practice to you.

How does my car impact my insurance coverage charge in South Carolina?

The kind of car you force performs a considerable position. Prime-performance vehicles and comfort cars steadily draw in upper premiums in comparison to usual fashions. That is because of components just like the perceived menace of wear and robbery, in addition to the price of upkeep. Be sure you issue this into your finances when evaluating other insurance coverage choices.