Does trip insurance coverage quilt automotive rent? Working out your protection is an important for a clean go back and forth. This complete information dives deep into the intricacies of trip insurance coverage insurance policies, analyzing inclusions, exclusions, and the particular cases surrounding automotive apartment protection. We’re going to discover the nuances of quite a lot of coverage varieties, not unusual situations, and world issues.

From complete insurance policies to elementary plans, we will explain how other ranges of protection affect automotive rent incidents. We’re going to additionally element the declare procedure and required documentation, making sure you might be totally ready for any doable problems whilst for your travels.

Scope of Commute Insurance coverage Protection

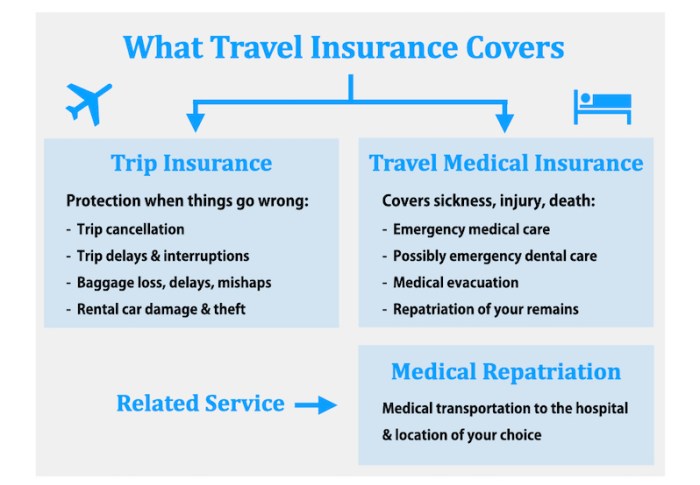

Commute insurance coverage insurance policies are designed to offer protection to vacationers from unexpected cases all the way through their journeys. Working out the particular protection introduced is an important for making knowledgeable choices and making sure good enough coverage. A complete working out of the coverage’s phrases and stipulations is important, particularly relating to sides like automotive rent.Conventional trip insurance coverage insurance policies be offering a spread of coverages, aiming to handle doable monetary losses or disruptions.

Those insurance policies steadily lengthen past the standard go back and forth cancellation or scientific emergencies. The specifics range extensively in keeping with the supplier and the selected plan.

Normal Protection Spaces

Commute insurance coverage insurance policies usually quilt a spread of scenarios, together with go back and forth cancellations, scientific bills, misplaced baggage, and trip delays. Those are same old inclusions. Insurance policies can vary considerably within the extent and boundaries of protection.

Not unusual Inclusions and Exclusions

Not unusual inclusions steadily surround scientific emergencies, misplaced or broken luggage, and go back and forth cancellations because of unexpected occasions. Exclusions, then again, may pertain to pre-existing scientific prerequisites, positive forms of sports activities actions, or intentional acts. Insurance policies might exclude particular scenarios, akin to damages to apartment vehicles brought about by means of the policyholder’s negligence.

Other Varieties of Commute Insurance coverage Plans

Commute insurance coverage range considerably, from elementary plans to complete applications. Fundamental plans may be offering restricted protection for particular occasions, whilst complete plans steadily quilt a broader spectrum of cases. The level of auto rent protection can vary considerably between those plans. A elementary plan may exclude or restrict protection for injuries involving a rented automotive, whilst a complete plan may be offering extra complete coverage.

Automotive Rent Protection in Commute Insurance coverage Insurance policies

Automotive rent protection is a vital facet of trip insurance coverage. It is an important to know the particular phrases and stipulations relating to protection for injuries, injury, robbery, or different incidents associated with the rented car. Explicit clauses steadily delineate the level of protection and the policyholder’s duties in case of an incident.

Phrases and Prerequisites Associated with Automotive Rent Protection

Phrases and stipulations associated with automotive rent protection are steadily complicated and require cautious overview. Explicit phrases might Artikel the cases underneath which the insurance coverage will quilt damages or losses to the apartment automotive. Deductibles and protection limits are essential sides of the coverage. As an example, a coverage may quilt injury as much as a specific amount, with the policyholder accountable for the remainder value.

Comparability of Commute Insurance coverage Insurance policies Relating to Automotive Rent Protection

| Coverage Sort | Automotive Rent Protection | Exclusions |

|---|---|---|

| Fundamental | Restricted protection, steadily except injuries or injury. | Injuries, injury, robbery, or incidents brought about by means of negligence; pre-existing prerequisites of the policyholder. |

| Complete | In depth protection for injuries, injury, robbery, and different incidents associated with automotive rent. | Intentional acts, damages brought about by means of reckless riding or critical pre-existing prerequisites of the policyholder. |

Automotive Rent Protection Specifics

Commute insurance coverage insurance policies steadily come with protection for automotive rent, however the specifics can range considerably. Working out the main points of your coverage is an important to figuring out what is lined and what is no longer. This segment will delve into the other scenarios the place automotive rent protection could be precipitated, not unusual situations the place protection applies or does not follow, and the declare procedure.Automotive rent protection underneath trip insurance coverage is not a blanket coverage for each conceivable incident.

Insurance policies usually Artikel particular scenarios that fall underneath the umbrella of protection. Working out those parameters guarantees you don’t seem to be stuck off guard when an sudden match arises whilst the use of a apartment automotive.

Scenarios Triggering Automotive Rent Protection

Commute insurance coverage insurance policies ceaselessly quilt automotive rent incidents, akin to injuries, robbery, or injury. Protection is in most cases precipitated when a lined match without delay affects the apartment car, inflicting monetary loss to the policyholder. The coverage’s phrases and stipulations are paramount in figuring out the precise scenarios lined.

Not unusual Eventualities The place Protection Applies

Numerous scenarios can cause automotive rent protection. As an example, if you’re fascinated by a automotive twist of fate the place the opposite birthday celebration is at fault, and your car is broken consequently, your insurance coverage may quilt the restore prices. Robbery of the apartment car is every other not unusual match which may be lined. Additionally, injury brought about by means of unexpected occasions, like a unexpected hurricane, could be lined, relying at the coverage’s phrases.

The coverage’s exclusions are simply as an important because the inclusions, as those scenarios steadily decide if protection is acceptable.

Not unusual Eventualities The place Protection May No longer Follow

There are cases the place automotive rent protection underneath trip insurance coverage won’t follow. Injury brought about by means of pre-existing prerequisites at the car, akin to a pre-existing scratch, might not be lined. In a similar way, injury because of reckless riding, vandalism, or intentional acts for your section would most likely be excluded. It is an important to study the particular exclusions indexed on your coverage report.

Various Ranges of Automotive Rent Protection

Commute insurance coverage insurance policies be offering various ranges of auto rent protection. Fundamental protection steadily specializes in legal responsibility, protecting damages you reason to others. Extra complete protection, then again, extends to hide damages on your car and doable bills. You’ll want to perceive the particular protection your coverage supplies to totally recognize the extent of coverage.

Declare Procedure for Automotive Rent Damages

Submitting a declare for automotive rent damages underneath trip insurance coverage follows a particular process. It is an important to touch your insurer once conceivable after the incident. Documentation, together with police stories (if acceptable), restore estimates, and apartment settlement copies, is very important. The declare procedure can range, so it is recommended to refer on your coverage paperwork for detailed steps.

Desk of Declare Procedures for Automotive Rent Incidents

| Incident Sort | Protection Main points | Declare Procedure |

|---|---|---|

| Twist of fate (different birthday celebration at fault) | In most cases covers damages to the apartment car. | Accumulate police file, insurance coverage main points of the opposite birthday celebration, and service estimates. Touch insurer promptly. |

| Robbery | Steadily covers the entire substitute value of the car. | Accumulate police file, apartment settlement, and any supporting documentation. Document a declare with the insurer. |

| Injury (no longer because of twist of fate or robbery) | Will depend on the particular reason and coverage phrases. | Accumulate documentation, akin to pictures of the wear and tear, and speak to the insurer. |

Exclusions and Obstacles

Commute insurance coverage, whilst providing treasured coverage all the way through your go back and forth, does not quilt the whole lot. Working out the exclusions and obstacles particular to automotive rent protection is an important to keep away from unhappiness if one thing is going mistaken. This segment main points not unusual scenarios the place your insurance plans won’t supply help, serving to you are making knowledgeable choices about your go back and forth.

Not unusual Exclusions

Commute insurance coverage insurance policies steadily have exclusions associated with automotive rent, protective the insurer from over the top claims. Working out those obstacles lets you higher plan your go back and forth and price range accordingly. You’ll want to moderately overview your coverage report for particular phrases and stipulations.

- Pre-existing Injury: If the apartment automotive has pre-existing injury or defects no longer disclosed on the time of apartment, your trip insurance coverage won’t quilt upkeep or replacements. This can be a not unusual exclusion. As an example, if a scratch or dent used to be provide ahead of you took the car, it’s most likely no longer lined.

- Reckless Riding: Acts of reckless riding, akin to dashing, competitive maneuvers, or riding drunk or medication, can void protection for damages brought about by means of those movements. A motive force who engages in reckless habits may face denial of a declare, even though the twist of fate leads to injury to the apartment automotive.

- Injury from Customary Put on and Tear: Commute insurance coverage in most cases does not quilt injury from commonplace put on and tear on a apartment automotive. This comprises minor scratches, dents, or different minor injury that may happen all the way through common use. As an example, a small scratch at the bumper from parking will not be lined.

- Injury from Acts of Nature: Insurance coverage insurance policies most often do not quilt damages brought about by means of herbal screw ups or excessive climate occasions. As an example, if a typhoon damages the auto, your trip insurance coverage won’t quilt the restore prices.

Obstacles and Deductibles

Even though an incident is roofed, your trip insurance coverage can have obstacles or deductibles related to automotive rent claims. Those components affect the volume you’re going to obtain and the method you’ll have to apply to make a declare.

- Deductibles: Maximum trip insurance coverage insurance policies come with a deductible, which is the volume you should pay out-of-pocket ahead of the insurer starts to hide the declare. The volume of the deductible varies a great deal by means of coverage.

- Protection Limits: Insurance coverage insurance policies steadily have most protection quantities for automotive rent incidents. Which means that if the damages exceed the coverage limits, you’ll have to hide the surplus quantity your self. As an example, a coverage might restrict the utmost payout for a apartment automotive twist of fate to a particular buck quantity.

Pre-Present Prerequisites

Pre-existing prerequisites of the apartment automotive can affect protection. If the wear and tear used to be already provide ahead of you took the auto, your trip insurance coverage is much less prone to quilt the restore prices.

- Hidden Injury: If the auto has hidden injury, the apartment corporate or insurance coverage corporate may deny the declare if it is not obviously disclosed on the time of apartment.

- Put on and Tear: Customary put on and tear isn’t lined. If part of the auto is already worn, any injury or substitute might not be lined by means of trip insurance coverage.

Not unusual Exclusions and Obstacles Desk

| Exclusion Class | Rationalization | Instance |

|---|---|---|

| Pre-existing Injury | Injury provide ahead of the apartment length starts. | A scratch at the automotive’s bumper that wasn’t reported all the way through apartment. |

| Reckless Riding | Riding in a way that demonstrates a omit for protection. | Riding underneath the affect or at over the top speeds. |

| Customary Put on and Tear | Injury from common use and ageing. | Minor scratches or dents from on a regular basis use. |

| Acts of Nature | Injury brought about by means of herbal screw ups. | Injury from a flood or typhoon. |

| Deductibles | Quantity you pay out-of-pocket ahead of insurance plans applies. | A $500 deductible on a automotive rent declare. |

World Concerns: Does Commute Insurance coverage Duvet Automotive Rent

Navigating the complexities of world automotive rent protection calls for a willing working out of various laws and insurance policies throughout other international locations. This working out is an important for vacationers to verify good enough coverage and keep away from unexpected bills all the way through their trips. World trip insurance coverage insurance policies steadily come with provisions for automotive rent, however the specifics can vary considerably, impacting the extent of protection introduced.World automotive rent protection isn’t a one-size-fits-all proposition.

The level of coverage supplied by means of trip insurance coverage for automotive rent can differ significantly relying at the vacation spot. Native regulations and laws, riding requirements, or even the particular insurance coverage insurance policies of the apartment firms all play a component in shaping the protection. Vacationers must diligently analysis the nuances of protection within the international locations they plan to seek advice from.

Permutations in Automotive Rent Protection Throughout Areas

Other international locations have various requirements for automotive rent protection. As an example, some international locations might mandate particular insurance coverage necessities for renters, whilst others won’t. This distinction in native laws considerably influences the protection introduced by means of world trip insurance coverage.

Comparability of Automotive Rent Protection Insurance policies for World Locations

The level of auto rent protection varies considerably relying at the vacation spot. A coverage bought for a go back and forth to america may vary significantly from one for a go back and forth to Europe. Components like native regulations, apartment corporate insurance policies, and the particular trip insurance coverage supplier all give a contribution to the differences.

Position of Native Regulations and Laws on Commute Insurance coverage Protection for Automotive Rent

Native regulations and laws in a vacation spot nation play a essential function in shaping trip insurance plans for automotive rent. For example, positive international locations may require renters to have particular forms of insurance coverage past what a regular world coverage supplies. Vacationers should perceive and conform to those laws. Moreover, the regulations governing legal responsibility in case of injuries or injury too can range extensively, affecting the level of protection introduced.

How Commute Insurance coverage Insurance policies Adapt to Other World Riding Laws

Commute insurance coverage insurance policies steadily adapt to house world riding laws. As an example, a coverage may regulate protection if the traveler intends to power in international locations with other requirements or laws for riding licenses and insurance coverage. Explicit clauses inside the coverage might cope with the usage of a global riding allow or the desired degree of insurance coverage wanted within the area.

Desk Demonstrating Variations in Automotive Rent Protection Insurance policies Throughout More than a few Areas

| Area | Protection Main points | Explicit Laws |

|---|---|---|

| United States | Typically complete protection for injury and legal responsibility. Apartment firms steadily require supplemental insurance coverage. | Various state regulations relating to minimal insurance coverage necessities for renters. |

| Eu Union | Protection steadily comprises legal responsibility and injury, however particular exclusions might follow. Supplemental insurance coverage could also be required relying at the apartment corporate and nation. | EU-wide laws on automotive insurance coverage, despite the fact that nationwide regulations can nonetheless impact specifics. |

| Southeast Asia | Protection may also be variable, with some insurance policies together with extra complete coverage. Native laws can require further insurance coverage. | Riding laws can vary considerably between international locations within the area, affecting the forms of protection required. |

| Australia | Typically excellent protection for injury and legal responsibility. Apartment firms in most cases require complete insurance coverage. | Stricter laws relating to insurance coverage and riding requirements. |

Documentation and Evidence

Right kind documentation is an important for a a hit automotive rent declare underneath trip insurance coverage. This segment main points the very important forms required, emphasizing the significance of record-keeping to verify a clean declare procedure. Correct and whole documentation considerably will increase the probabilities of a declare being authorized and processed successfully.Keeping up meticulous information of your automotive rent preparations and any incidents is important.

This comprises apartment agreements, receipts, and any communique with the apartment corporate. Detailed notes concerning the situation of the car upon pickup and go back, along side pictures or movies documenting any pre-existing injury or scratches, are strongly beneficial. This documentation serves as concrete proof to your declare.

Required Documentation for Automotive Rent Claims

Thorough documentation is very important to give a boost to a declare for damages or robbery associated with a apartment automotive. This comprises complete information of the apartment settlement, any pre-existing injury, and any incidents going on all the way through the apartment length. The documentation must obviously determine the character and extent of the wear and tear or loss, offering an entire image of the cases.

Significance of Keeping up Information, Does trip insurance coverage quilt automotive rent

Keeping up correct information of auto rent preparations is paramount. This comprises the apartment settlement, any pre-existing injury stories, and incident stories filed with the apartment corporate. This complete record-keeping supplies an in depth historical past of the car’s situation ahead of and after use, enabling a transparent and actual declare. Keeping up information guarantees the declare procedure proceeds easily and successfully.

As an example, in case you realize a scratch at the automotive ahead of riding, {a photograph} and a notice within the apartment settlement will give a boost to your declare.

Acquiring Evidence of Injury or Robbery

Acquiring evidence of wear and tear or robbery is significant for a a hit declare. This comes to documenting the wear and tear or loss the use of pictures, movies, or written statements from witnesses. Footage must obviously display the level and site of the wear and tear. Touch the apartment corporate in an instant in case you stumble upon any issues all the way through the apartment length. Their stories, along your individual documentation, can give very important proof.

If a robbery happens, file it to the police in an instant.

Examples of Supporting Paperwork

Examples of paperwork that may give a boost to a automotive rent declare come with the apartment settlement, receipts for the apartment, injury stories filed with the apartment corporate, police stories in instances of robbery or injuries, and pictures or movies documenting any pre-existing injury or injury sustained all the way through the apartment length. Copies of any communique with the apartment corporate in regards to the incident must even be incorporated.

Desk of Required Documentation

| Record Sort | Description | Significance |

|---|---|---|

| Apartment Settlement | The contract outlining the phrases of the apartment, together with the car’s situation at pickup. | Supplies main points of the settlement, an important for organising the preliminary situation of the car. |

| Receipts | Evidence of cost for the apartment. | Demonstrates the apartment transaction and confirms the apartment settlement. |

| Injury Reviews (Apartment Corporate) | Any pre-existing injury stories and stories filed all the way through the apartment length. | Establishes the car’s situation ahead of and after use. |

| Police Reviews (if acceptable) | Reviews filed in case of robbery or injuries. | Supplies legitimate documentation of the incident. |

| Images/Movies | Visible documentation of pre-existing injury, injury incurred all the way through the apartment, or the scene of an incident. | Supplies an important visible proof of the wear and tear or incident. |

Final Level

In conclusion, figuring out if trip insurance coverage covers automotive rent calls for an intensive working out of coverage specifics. Believe the kind of coverage, doable situations, and world diversifications. This information supplies a roadmap to navigating this essential facet of trip insurance coverage, equipping you with the information to make knowledgeable choices and offer protection to your pursuits. Take into accout to study your coverage moderately and seek advice from your insurer if in case you have any questions or issues.

Most sensible FAQs

Does trip insurance coverage quilt injury to a apartment automotive brought about by means of a pre-existing situation?

Typically, no. Pre-existing injury to the apartment car is usually excluded from protection.

What documentation is had to document a declare for a broken apartment automotive?

You’ll be able to want evidence of apartment settlement, police file (if acceptable), footage of the wear and tear, and another supporting paperwork asked by means of your insurer.

Does trip insurance coverage quilt robbery of a apartment automotive?

Protection for robbery of a apartment automotive will depend on the particular coverage. Some insurance policies might quilt robbery, whilst others can have exclusions.

How does reckless riding impact apartment automotive protection underneath trip insurance coverage?

Reckless riding is sort of at all times an exclusion. Insurance policies steadily have specific clauses outlining scenarios the place protection is voided because of irresponsible movements.