Does Amazon be offering automobile insurance coverage? This inquiry probes the opportunity of Amazon to go into the auto insurance coverage marketplace, analyzing the logistical, monetary, and aggressive implications of this kind of transfer. Amazon’s huge e-commerce presence, coupled with its increasing portfolio of products and services, raises intriguing questions on its doable to disrupt the normal insurance coverage trade. An in depth research of Amazon’s current features, doable partnerships, and aggressive panorama might be undertaken to decide the chance of such a ramification.

The possible access of Amazon into the auto insurance coverage marketplace is a vital building with far-reaching implications. Working out the criteria using this doable transfer, and the possible affect on shoppers and current insurers, is the most important for a complete figuring out of the evolving panorama of the insurance coverage trade. This research will discover the more than a few sides of this chance, from the technological infrastructure Amazon may leverage to the felony and regulatory hurdles it will face.

Advent to Amazon and Insurance coverage

Amazon, a world behemoth, has revolutionized retail and continues to amplify its achieve past e-commerce. Its huge community, data-driven insights, and customer-centric method have made it a dominant power in more than a few sectors. This exploration delves into the opportunity of Amazon to mission into the advanced international of auto insurance coverage, analyzing its current features and the demanding situations it will face.Amazon’s present industry type facilities on its huge on-line market and success community.

It operates a complicated logistics device, dealing with a large quantity of transactions and merchandise, developing a huge database of user conduct. This knowledge, coupled with its mastery of know-how, supplies a singular alternative for innovation in various fields, together with insurance coverage. Past e-commerce, Amazon has diverse into cloud computing (AWS), virtual streaming (Top Video), or even grocery supply, demonstrating a dedication to increasing its affect past its preliminary focal point.

Amazon’s Current Choices Past E-commerce

Amazon’s ventures past e-commerce spotlight its ambition to leverage its know-how and infrastructure for a lot of products and services. This diversification underscores its dedication to turning into a complete supplier of user items and products and services. Examples come with Amazon Internet Services and products (AWS), offering cloud computing answers, and Amazon Top Video, a vital participant within the streaming leisure marketplace. Amazon’s grocery supply carrier, Amazon Contemporary, is every other instance of its increasing portfolio.

Those various ventures expose Amazon’s willingness to spend money on new markets and adapt to evolving user calls for.

Evaluate of the Insurance coverage Trade

The insurance coverage trade is a vital sector, characterised by way of advanced rules and established avid gamers. This can be a closely regulated trade that calls for stringent compliance and intensive underwriting processes. Automotive insurance coverage, particularly, comes to assessing chance, calculating premiums, and managing claims. A number of elements impact the pricing, akin to the motive force’s historical past, car sort, and placement. This makes it a marketplace with important established avid gamers and complicated processes.

Attainable for Amazon to Input the Automotive Insurance coverage Marketplace

Amazon’s doable access into the auto insurance coverage marketplace isn’t with out advantage. Its huge visitor base, robust information analytics features, and current logistics infrastructure may be offering benefits in streamlining the method. Information-driven pricing, adapted to particular person driving force profiles, and enhanced customer support by means of its current platform might be important elements in attracting shoppers. Alternatively, navigating the complexities of insurance coverage rules and development agree with with shoppers might be the most important demanding situations.

Aggressive Benefits and Disadvantages

Amazon’s aggressive benefits, if it enters the marketplace, may stem from its huge visitor base, its current cost infrastructure, and its information analytics features. This is able to permit them to supply extremely personalised and environment friendly carrier. Alternatively, important demanding situations come with navigating the intricate regulatory panorama of the insurance coverage trade and development agree with amongst shoppers. Current insurance coverage corporations have established reputations and visitor relationships that may want to be triumph over.

Comparability of Amazon’s Present Services and products and Insurance coverage Choices

| Amazon’s Present Services and products | Insurance coverage Choices |

|---|---|

| Amazon Top, providing more than a few products and services like streaming, grocery supply, and extra | Automotive insurance coverage insurance policies with more than a few protection choices |

| Amazon Internet Services and products (AWS), offering cloud computing products and services | Chance evaluation and underwriting processes |

| Huge community of success facilities and logistics | Claims control and customer support |

This desk highlights the possible overlap and contrasts between Amazon’s present industry type and the necessities of the insurance coverage trade. The desk suggests Amazon may leverage its current strengths to go into the auto insurance coverage marketplace, nevertheless it additionally unearths important hurdles to conquer.

Current Insurance coverage Partnerships and Methods

Amazon, a titan in e-commerce, may seamlessly combine automobile insurance coverage choices into its huge ecosystem. This might leverage Amazon’s current infrastructure, visitor base, and cost processing features, doubtlessly making a compelling and handy insurance coverage revel in. By way of forging strategic partnerships and using leading edge methods, Amazon can place itself as a relied on supplier of complete automobile insurance coverage answers.Amazon’s current infrastructure, together with its powerful logistics community and cost methods, items a vital alternative to streamline the auto insurance coverage procedure.

Consider a long term the place shoppers should buy automobile insurance coverage, organize their insurance policies, or even agenda maintenance thru a unified Amazon platform, all seamlessly built-in with their current accounts. This unified revel in would now not best save time but additionally cut back friction, improving visitor pride.

Insurance coverage Supplier Partnerships

Amazon may spouse with established insurance coverage corporations to supply a various vary of auto insurance coverage merchandise. This collaborative method would leverage the experience and sources of seasoned insurance coverage suppliers whilst taking advantage of Amazon’s huge visitor base and environment friendly on-line platform. As an example, a partnership may contain providing bundled insurance coverage applications with Amazon’s auto equipment or products and services, making a value-added proposition for patrons.

Such collaborations may prolong to unique reductions or promotions, reaping benefits each events.

Leveraging Current Infrastructure

Amazon’s logistics community, cost processing features, and visitor information might be the most important for handing over environment friendly and adapted insurance coverage answers. Actual-time car information, gathered thru partnerships or thru customer-provided data, may permit for personalised insurance coverage premiums in response to using conduct or car traits. This knowledge-driven method may result in extra aggressive pricing and a extra personalised visitor revel in.

Integration Strategies

Integrating insurance coverage products and services into the Amazon platform may contain more than a few strategies, from devoted insurance coverage portals to seamless integration inside the current buying groceries revel in. A devoted insurance coverage portal would supply a complete and user-friendly platform for patrons to discover other insurance policies and evaluate costs. In the meantime, integrating insurance coverage products and services immediately into the Amazon market would make all of the procedure much more streamlined, doubtlessly lowering administrative overhead and making improvements to visitor revel in.

Gross sales Methods: Direct vs. Partnerships

Amazon may make use of an instantaneous gross sales type, providing its personal insurance coverage merchandise, or go for partnerships with current insurance coverage corporations. An instantaneous gross sales type may give Amazon better keep watch over over pricing and branding, whilst partnerships may permit for a broader vary of protection choices and established popularity. As an example, Amazon may be offering a elementary automobile insurance coverage plan thru an instantaneous type, whilst partnering with established insurance coverage suppliers for complete protection.

Hindrances to Partnerships

Organising partnerships with insurance coverage corporations might stumble upon regulatory hurdles and contractual complexities. Insurance coverage rules and compliance necessities may range considerably throughout more than a few areas, requiring intensive due diligence and doable diversifications within the insurance coverage merchandise. Moreover, integrating other insurance coverage methods into Amazon’s platform may provide technical demanding situations, requiring cautious making plans and execution.

Insurance coverage Fashions: Direct vs. Partnerships

| Insurance coverage Style | Execs | Cons |

|---|---|---|

| Direct Gross sales | Higher keep watch over over pricing, branding, and visitor revel in. Attainable for upper benefit margins. | Calls for really extensive funding in insurance coverage infrastructure and experience. Attainable demanding situations in assembly regulatory necessities. |

| Partnerships | Leverages established experience and sources of insurance coverage suppliers. Get right of entry to to a much broader vary of protection choices. Diminished preliminary funding. | Much less keep watch over over pricing and branding. Attainable conflicts in emblem symbol. Dependence on companions’ efficiency and compliance. |

Buyer Wishes and Marketplace Research

Navigating the advanced international of auto insurance coverage can really feel like a minefield. Shoppers crave simplicity, transparency, and price for his or her hard earned cash. This phase delves into the precise personal tastes and expectancies of the objective demographic, examining the present marketplace panorama, and exploring the possible affect of Amazon coming into this enviornment.Working out visitor personal tastes is essential to crafting a stupendous and aggressive automobile insurance coverage providing.

From the will for user-friendly on-line platforms to a complete suite of protection choices, this research supplies a radical evaluation of the criteria that power visitor choices.

Buyer Personal tastes for Automotive Insurance coverage

Buyer expectancies within the automobile insurance coverage marketplace are multifaceted. Drivers prioritize aggressive pricing, powerful protection choices, and a unbroken revel in all over the coverage lifecycle. Ease of get admission to, virtual gear for managing insurance policies, and transparent verbal exchange also are the most important components for a favorable visitor adventure. A customized method, providing adapted protection and pricing in response to particular person chance profiles, is an increasing number of wanted.

Current Insurance coverage Choices within the Marketplace, Does amazon be offering automobile insurance coverage

A plethora of insurance coverage choices cater to various wishes and personal tastes. Conventional insurers, akin to State Farm, Geico, and Allstate, be offering complete applications with various ranges of protection and pricing. Specialised insurers cater to express demographics or area of interest markets, akin to younger drivers or the ones with high-value automobiles. Direct-to-consumer suppliers, like Lemonade, leverage know-how to streamline the method and be offering aggressive charges.

The marketplace gives a large spectrum of choices, reflecting the various wishes and budgets of auto house owners.

Attainable Call for for Amazon Automotive Insurance coverage

Amazon’s popularity for potency and customer-centric method may generate important call for for its automobile insurance coverage providing. Leveraging its huge information and know-how infrastructure, Amazon may doubtlessly be offering personalised pricing, streamlined processes, and leading edge options. The present visitor base, already conversant in Amazon’s products and services, may well be specifically receptive to a brand new insurance coverage product. A compelling cost proposition, coupled with the logo’s agree with and reliability, may power adoption.

Have an effect on on Current Insurance coverage Corporations

The access of Amazon into the auto insurance coverage marketplace would indisputably affect current avid gamers. The possibility of greater pageant and leading edge pricing fashions may steered established corporations to conform and innovate to take care of marketplace proportion. Amazon’s scale and data-driven method may disrupt the normal insurance coverage type. The ensuing aggressive atmosphere would most probably get advantages shoppers, pushing for progressed products and services and decrease premiums.

Pricing Methods for Amazon Automotive Insurance coverage

A number of pricing methods might be hired by way of Amazon to draw shoppers. Using information analytics to evaluate chance profiles may lead to personalised premiums. Bundling insurance coverage with different Amazon products and services, like automobile loans or financing, may create a stupendous bundle deal. Providing tiered protection choices, permitting shoppers to make a choice the extent of coverage they want, is every other doable method.

Amazon’s pricing technique would want to be aggressive, clear, and aligned with visitor expectancies.

Abstract of Buyer Personal tastes

| Facet | Prime Precedence | Medium Precedence | Low Precedence |

|---|---|---|---|

| Worth | Sure | Sure | No |

| Protection | Sure | Sure | No |

| Comfort | Sure | Sure | No |

| Buyer Carrier | Sure | Sure | No |

| Transparency | Sure | Sure | No |

Technological Functions and Infrastructure

Amazon’s extraordinary technological prowess gives a compelling basis for revolutionizing the auto insurance coverage panorama. Consider a device the place seamless information integration, refined analytics, and powerful safety paintings in absolute best team spirit to create a extra environment friendly and customer-centric revel in. This is not only a dream; it is a tangible chance, fueled by way of Amazon’s current strengths and leading edge method.Amazon’s huge cloud computing infrastructure, AWS (Amazon Internet Services and products), is a important element in development a scalable and dependable insurance coverage platform.

This infrastructure supplies the vital computing energy, garage capability, and safety features to deal with huge volumes of information and transactions, crucial for a world insurance coverage supplier. The versatility and scalability of AWS permit for dynamic changes to satisfy evolving calls for, making sure the platform stays powerful and responsive.

Amazon’s Cloud Computing Functions

AWS, a globally known chief in cloud computing, gives a complete suite of products and services that underpin a complicated insurance coverage platform. Those products and services supply scalable computing sources, powerful information garage, and protected verbal exchange channels. Moreover, AWS’s controlled products and services considerably cut back operational overhead, permitting insurance coverage suppliers to concentrate on core industry targets. The platform’s safety features, adhering to stringent trade requirements, safeguard delicate visitor information.

Information Analytics for Customized Automotive Insurance coverage

Amazon’s information analytics features, mixed with huge datasets, permit a extremely personalised automobile insurance coverage revel in. By way of examining using patterns, car utilization, and twist of fate historical past, Amazon can broaden chance profiles for particular person drivers. This permits for dynamic pricing fashions, offering extra correct and adapted premiums. Believe the opportunity of predictive modeling, the place doable dangers are known earlier than they materialize, enabling proactive chance control methods.

Examples of such analytics in different sectors display exceptional luck in lowering losses and making improvements to potency.

Safety Measures for Delicate Buyer Information

Protective delicate visitor information is paramount within the insurance coverage trade. Amazon employs a multi-layered safety method, encompassing encryption, get admission to controls, and common safety audits. This proactive method guarantees compliance with trade rules like GDPR and guarantees the very best ranges of information coverage. Complex risk detection methods and incident reaction protocols additional give a boost to safety features. The implementation of robust authentication protocols and steady tracking are key to keeping up information integrity and fighting unauthorized get admission to.

Technological Benefits of Amazon in Insurance coverage

| Facet | Amazon’s Merit |

|---|---|

| Scalability | AWS’s scalable infrastructure comprises fluctuating calls for, making sure constant efficiency. |

| Information Safety | Tough safety features and compliance with trade requirements offer protection to delicate visitor information. |

| Information Analytics | Subtle analytics permit for personalised pricing and chance evaluation, resulting in extra environment friendly and focused insurance coverage merchandise. |

| Value Potency | AWS’s pay-as-you-go type reduces infrastructure prices and optimizes operational potency. |

| Innovation | Amazon’s leading edge method and technological prowess permit for the advance of state of the art insurance coverage answers. |

Prison and Regulatory Concerns

Navigating the intricate international of insurance coverage calls for a deep figuring out of the felony and regulatory landscapes. Amazon, with its international achieve, should meticulously believe the precise felony frameworks governing insurance coverage in more than a few areas to make sure a clean and compliant access into this sector. This cautious attention is the most important for development agree with and fostering sure visitor relationships.The insurance coverage trade is extremely regulated, and the specifics range significantly between jurisdictions.

This necessitates a nuanced method to compliance that prioritizes figuring out and adhering to the principles and rules in each and every marketplace.

Prison Frameworks Governing Insurance coverage

Other areas have distinctive felony frameworks governing insurance coverage merchandise. Those frameworks identify the elemental rules and requirements for insurance coverage operations, encompassing spaces akin to coverage design, pricing, claims dealing with, and user coverage. As an example, the USA has a decentralized device with state-level rules, while the EU has a extra unified method with harmonized directives. This variety necessitates a deep figuring out of each and every jurisdiction’s distinctive felony necessities to make sure compliance.

Regulatory Necessities for Providing Automotive Insurance coverage

Providing automobile insurance coverage necessitates adherence to strict regulatory necessities. Those necessities duvet a extensive spectrum of sides, from the licensing and authorization processes to the precise phrases and prerequisites of insurance coverage insurance policies. Additionally they come with conditions referring to monetary solvency, capital adequacy, and operational transparency. Assembly those necessities calls for a powerful compliance framework to make sure the graceful functioning of the insurance coverage operations.

Information Privateness Rules and Implications

Information privateness rules, akin to GDPR in Europe and CCPA in California, considerably affect how Amazon handles visitor information. Those rules identify strict tips on information assortment, garage, and use, hard powerful safety features to give protection to delicate data. A powerful information coverage technique is very important to take care of visitor agree with and keep away from doable felony problems. Compliance with those rules isn’t simply a technical workout; this can be a basic facet of establishing agree with and self assurance with shoppers.

Attainable Compliance Demanding situations for Amazon

Amazon’s access into the insurance coverage sector items a number of compliance demanding situations. The complexity of navigating other felony frameworks and regulatory necessities throughout a large number of jurisdictions is a vital hurdle. Moreover, integrating insurance coverage operations with Amazon’s current infrastructure and technological methods calls for cautious making plans and execution to keep away from doable conflicts or disruptions.

Desk of Prison Necessities Throughout Other Jurisdictions

| Jurisdiction | Licensing Necessities | Capital Necessities | Information Privateness Rules |

|---|---|---|---|

| United States (California) | State-specific licenses required | Range by way of state, incessantly really extensive | CCPA and different state-level rules |

| United Kingdom | FCA authorization | Strict capital necessities | GDPR compliance |

| Germany | BAFIN approval | Important capital necessities | GDPR compliance |

| Japan | Explicit insurance coverage company approval | Prime capital necessities | Explicit information privateness rules |

This desk supplies a simplified evaluation. Explicit necessities range significantly inside of each and every jurisdiction. An in depth evaluation of each and every marketplace is the most important for a success compliance.

Attainable Trade Fashions and Income Streams

Amazon, famend for its extraordinary visitor focal point and technological prowess, has the possible to revolutionize the auto insurance coverage marketplace. This phase explores various industry fashions and earnings streams, highlighting the leading edge approaches Amazon may undertake to offer complete and aggressive insurance coverage answers. The possibility of integration with Amazon’s current ecosystem might be key to luck.

Quite a lot of Trade Fashions for Amazon Automotive Insurance coverage

Amazon can pursue a number of distinct industry fashions for automobile insurance coverage, starting from direct-to-consumer choices to partnerships with current suppliers. An instantaneous type would permit Amazon to leverage its huge visitor base and knowledge to tailor insurance policies to particular person wishes, whilst a partnership type may leverage current infrastructure and experience. The secret is to discover a type that maximizes potency and visitor pride.

Income Fashions

Amazon can generate earnings thru a number of fashions, each and every with its personal strengths and doable demanding situations. Premiums, a standard method, contain charging shoppers in response to elements like chance profile, using historical past, and car sort. Commissions, the place Amazon receives a proportion of premiums from third-party suppliers, can be offering a sooner access level to the marketplace. Subscription-based fashions, doubtlessly tied to different Amazon products and services, can be offering bundled advantages and habitual earnings streams.

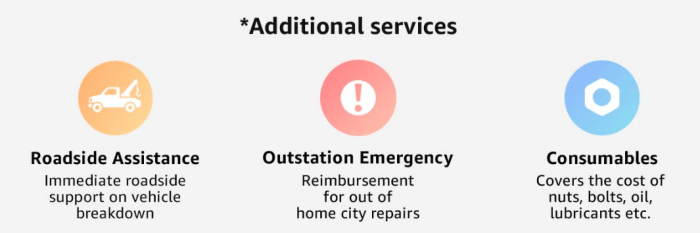

Additionally, Amazon may discover value-added products and services like roadside help or car upkeep reductions, supplementing top class earnings.

Pricing Methods

Pricing methods are the most important for attracting and maintaining shoppers. Amazon can be offering tiered pricing plans in response to elements like using conduct (assessed thru telematics), car sort, and placement. Aggressive pricing is essential, and Amazon can use information analytics to fine-tune premiums to replicate particular person chance profiles. Bundling automobile insurance coverage with different Amazon products and services, like auto loans or upkeep plans, may create sexy applications and building up visitor cost.

Moreover, introductory reductions and loyalty techniques may incentivize shoppers to make a choice Amazon automobile insurance coverage.

Buyer Acquisition Methods

Attracting shoppers to a brand new insurance coverage product calls for a multifaceted method. Amazon can leverage its intensive advertising channels, together with focused promoting on its platform and partnerships with different related products and services. Buyer testimonials and sure opinions are crucial, fostering agree with and credibility. Strategic collaborations with car dealerships and financing companions can considerably amplify achieve. Moreover, a powerful on-line platform, intuitive for patrons to check and buy insurance policies, might be the most important.

Comparability of Attainable Income Fashions

| Income Style | Description | Anticipated Profitability | Attainable Demanding situations |

|---|---|---|---|

| Top rate-based | Without delay accumulating premiums from shoppers | Prime doable for long-term profitability, depending on environment friendly chance evaluation | Calls for really extensive funding in information analytics and chance control |

| Fee-based | Partnering with current suppliers and receiving commissions | Reasonable profitability to begin with, doubtlessly expanding over the years | Calls for negotiation and managing relationships with third-party suppliers |

| Subscription-based | Bundling insurance coverage with different products and services | Prime habitual earnings doable | Calls for creating sexy cost propositions and managing visitor expectancies |

Aggressive Panorama and Differentiation

Amazon’s foray into the auto insurance coverage marketplace items a compelling alternative, however the panorama is fiercely aggressive. Working out the prevailing avid gamers and Amazon’s doable benefits is the most important to assessing its possibilities. This phase delves into the prevailing pageant, highlighting Amazon’s doable aggressive edge and the way it can carve a singular place on this established sector.

Current Competition

The automobile insurance coverage marketplace is ruled by way of established avid gamers, each and every with a definite method. Huge insurance coverage corporations like State Farm, Geico, Allstate, and Innovative have constructed intensive networks and emblem popularity over a long time. Direct-to-consumer insurers like Lemonade and Metromile have disrupted the normal type with technology-driven platforms, whilst startups that specialize in particular niches also are rising. Each and every of those competition employs other methods, specializing in elements like pricing, customer support, and technological integration.

Amazon’s Attainable Aggressive Benefits

Amazon possesses a singular set of strengths that might translate into important benefits within the automobile insurance coverage marketplace. Its huge visitor base, refined information research features, and established logistics infrastructure place it to supply extremely personalised insurance coverage merchandise and streamlined declare processes. Amazon’s current e-commerce infrastructure might be leveraged to offer a unbroken visitor adventure, from coverage acquire to assert agreement.

Differentiation Methods

Amazon can differentiate itself by way of leveraging its current strengths to create a customer-centric automobile insurance coverage revel in. One doable technique is to supply bundled insurance coverage merchandise, combining automobile insurance coverage with different Amazon products and services like auto portions or roadside help. Every other method comes to the usage of information analytics to create extremely personalised pricing and protection choices, tailoring insurance policies to particular person using behavior and chance profiles.

Amazon too can enforce complicated technological answers for declare processing, doubtlessly lowering declare agreement occasions and making improvements to total visitor pride.

Comparability with Competition

| Function | Amazon Attainable | State Farm | Geico | Lemonade ||——————-|———————-|——————–|———————|———————-|| Buyer Base | Huge, Current | Huge, Established | Huge, Established | Rising, Centered || Information Analytics | Subtle, In depth | Reasonable | Reasonable | Rising, Centered || Era | Chopping-Edge, Seamless | Reasonable | Reasonable | Rising, Leading edge|| Pricing | Customized, Information-Pushed | Conventional | Conventional | Aggressive, Algorithmic || Declare Procedure | Streamlined, Automatic | Conventional | Conventional | Environment friendly, Virtual |

Amazon’s Strengths and Differentiation

Amazon’s talent to leverage its huge visitor information, mixed with its established logistics and technological prowess, gives a singular method to automobile insurance coverage. Not like conventional insurers, Amazon can use its information to create extremely personalised insurance policies, doubtlessly resulting in important price financial savings for patrons. Additional, its e-commerce platform may give a unbroken visitor revel in, from coverage acquire to assert agreement, thereby improving visitor pride.

This mixture of strengths, when performed successfully, may supply a compelling cost proposition within the aggressive automobile insurance coverage marketplace.

Consequence Abstract: Does Amazon Be offering Automotive Insurance coverage

In conclusion, the opportunity of Amazon to supply automobile insurance coverage items a posh interaction of alternatives and demanding situations. Whilst Amazon possesses important technological and logistical benefits, navigating the intricate regulatory panorama and setting up agree with inside the highly-regulated insurance coverage trade might be the most important. Without equal luck of such an enterprise hinges on Amazon’s talent to conform its current industry type and leverage its strengths to successfully compete in a mature marketplace.

The longer term trajectory of this doable building depends upon a lot of elements, together with marketplace reaction, regulatory approvals, and the methods followed by way of Amazon and its competition.

Very important Questionnaire

Does Amazon recently be offering any insurance coverage merchandise?

No, Amazon does now not recently be offering automobile insurance coverage immediately.

What are some doable advantages of Amazon providing automobile insurance coverage?

Attainable advantages come with greater visitor comfort, doubtlessly decrease costs because of Amazon’s scale and potency, and leading edge use of information analytics for chance evaluation.

What are some doable demanding situations for Amazon in coming into the auto insurance coverage marketplace?

Demanding situations come with navigating advanced regulatory environments, setting up agree with with shoppers familiar with conventional insurance coverage fashions, and complying with information privateness rules.

How may Amazon leverage its current infrastructure for automobile insurance coverage choices?

Amazon’s huge technological infrastructure, together with cloud computing and knowledge analytics features, might be leveraged to create a streamlined and environment friendly automobile insurance coverage platform.