Reasonable South Dakota automobile insurance coverage is a an important attention for drivers within the state. Navigating the quite a lot of components impacting premiums and working out to be had reductions can considerably decrease your prices. This complete information supplies insights into the South Dakota automobile insurance coverage marketplace, serving to you in finding the most efficient offers and be sure to’re adequately safe.

We’re going to discover the typical sorts of protection, examine insurance coverage suppliers, and speak about methods for negotiating decrease charges. Figuring out the state’s rules and your riding document’s have an effect on on premiums is vital to securing inexpensive protection. Discover ways to maximize financial savings and make knowledgeable selections to offer protection to your price range.

Evaluate of South Dakota Automobile Insurance coverage

South Dakota’s automobile insurance coverage marketplace is just a little of a combined bag, mate. Premiums can range wildly relying on a couple of key components, however normally, you’ll be able to in finding some first rate offers if the place to seem. The charges are influenced by way of such things as your riding historical past, the kind of automobile you power, or even the place you reside throughout the state.

Figuring out those components is vital to getting the most efficient imaginable worth.

Elements Influencing Automobile Insurance coverage Premiums in South Dakota

South Dakota’s automobile insurance coverage premiums are suffering from a variety of components. Those come with the driving force’s age and historical past, the automobile’s make and fashion (together with its security features), the positioning of place of dwelling, or even the kind of automobile use (e.g., commuting vs. weekend riding). Claims historical past additionally performs an enormous position, with a historical past of injuries or violations main to raised premiums.

Not unusual Sorts of Automobile Insurance coverage Protection in South Dakota

South Dakota, like many states, mandates positive minimal protection ranges for legal responsibility insurance coverage. On the other hand, drivers frequently go for further protection to offer protection to themselves and their belongings. The most typical sorts of protection come with legal responsibility insurance coverage (protecting injury to others), collision protection (protective your automobile in opposition to injury from an twist of fate), and complete protection (protecting damages from occasions rather than injuries, akin to vandalism or climate).

Including uninsured/underinsured motorist protection could also be an important for added coverage if anyone with out enough insurance coverage reasons an twist of fate.

Reasonable Automobile Insurance coverage Charges in South Dakota

| Protection Kind | Reasonable Price (Instance – Estimated) |

|---|---|

| Legal responsibility Handiest (Minimal Protection) | $800 – $1,200 in line with 12 months |

| Legal responsibility + Collision + Complete | $1,500 – $2,500 in line with 12 months |

| Legal responsibility + Collision + Complete + Uninsured/Underinsured Motorist | $1,800 – $3,000 in line with 12 months |

Notice: Those areestimated* moderate charges. Exact charges will range a great deal in line with person cases. Elements like riding document, automobile kind, and placement will all play a job within the ultimate worth.

Figuring out Reasonable Insurance coverage Choices

Looked after throughout the South Dakota insurance coverage scene, we now have discovered some forged techniques to bag your self a cut price. Dodging the ones scam premiums ain’t rocket science, nevertheless it does want just a little of technology. Realizing the ropes, you’ll be able to get a excellent deal and steer clear of being stung by way of sneaky insurance policies.Discovering the precise insurance coverage is not just in regards to the lowest worth; it is about discovering a coverage that matches your wishes and riding behavior.

Imagine components like your automobile kind, riding document, and placement throughout the state, as those play an enormous position in shaping your premiums.

Comparability Internet sites: Your Insurance coverage-Discovering Tremendous Software

Comparability web pages are your secret weapon within the struggle for inexpensive automobile insurance coverage. They act like a one-stop store, permitting you to check quotes from more than one suppliers without delay. This protects you the effort of removing each and every insurer personally. The usage of comparability web pages allows you to see side-by-side how other firms’ insurance policies stack up, serving to you pick out the most efficient are compatible.

Insurance coverage Supplier Comparability: Native vs. Nationwide

South Dakota has a mixture of nationwide insurance coverage giants and locally-based avid gamers. Nationwide firms frequently have economies of scale, doubtlessly resulting in decrease charges. At the turn facet, native suppliers may be offering extra personalised carrier, realizing the particular quirks of the state’s riding panorama. Evaluating each varieties can divulge hidden bargains.

Reductions: Sweetening the Deal

Insurance coverage firms dish out reductions for quite a lot of causes. Those can come with protected riding information, anti-theft gadgets, and even more than one insurance policies with the similar corporate. Reductions could be a game-changer when looking to nail down a excellent fee.

| Bargain Kind | Description | Instance |

|---|---|---|

| Secure Riding | In line with your riding historical past and document. | Coincidence-free drivers can frequently get a bargain. |

| A couple of Insurance policies | Having a couple of coverage with the similar corporate. | Insuring your automobile and residential with the similar supplier. |

| Anti-theft Tool | Putting in an anti-theft software in your automobile. | Alarm methods or monitoring gadgets. |

| Pupil Bargain | If you’re a pupil. | Applies to scholars with a excellent riding document. |

| Bundling (house & auto) | Combining auto and residential insurance coverage with the similar corporate. | One-stop store for your entire insurance coverage wishes. |

Insurance coverage Corporate Monetary Energy: A Take a look at the Books

An organization’s monetary power is an important. Insurers want to be solid and in a position to pay claims, and that’s the reason necessary to your peace of thoughts. Rankings from businesses like A.M. Absolute best or Usual & Deficient’s be offering insights into the monetary balance of insurance coverage firms. A powerful monetary status suggests the insurer is much less prone to disappear when you wish to have them.

Elements Affecting South Dakota Automobile Insurance coverage Prices

Proper, so you are tryna’ get the most efficient deal on automobile insurance coverage within the Black Hills, or anyplace you are founded in South Dakota. Figuring out the standards that form your premiums is vital to baggin’ a good worth. Call to mind it like this: the extra your profile aligns with the dangerous motive force profile, the upper the associated fee.South Dakota automobile insurance coverage, like some other, ain’t as regards to your postcode.

A complete heap of alternative issues, out of your riding historical past for your trip itself, can considerably have an effect on your charges. It is all about assessing your chance profile, so let’s spoil it down.

Riding Information and Insurance coverage Premiums

Your riding historical past is an enormous think about figuring out your insurance coverage prices. Injuries, dashing tickets, and at-fault collisions all sign the next chance to insurers. Every incident, particularly the ones with severe accidents, may imply a hefty hike to your premiums. As an example, a motive force with a blank slate will normally pay lower than anyone with a historical past of more than one visitors violations.

Insurers use this knowledge to evaluate your chance of submitting a declare. A blank document, like a pristine document in a sport, is vital to keepin’ the ones charges low.

Car Kind and Age Impacting Prices

The kind of automobile you power too can have an effect on your insurance coverage prices. Sports activities automobiles and high-performance automobiles frequently have upper premiums in comparison to sedans or hatchbacks. The automobile’s age is some other issue. Older automobiles, in particular those who don’t seem to be maintained effectively, have a tendency to be dearer to fix or change. Insurers weigh this chance when environment your charges.

Because of this in case you are rocking a antique trip or a supercar, you could be lookin’ at the next top rate than when you have been in a elementary circle of relatives automobile.

Location’s Affect on Insurance coverage Charges, Reasonable south dakota automobile insurance coverage

Location inside South Dakota too can affect your insurance coverage premiums. Spaces with upper crime charges or twist of fate frequencies frequently have upper charges. It’s because insurers imagine the chance related to a specific location. Spaces with the next focus of drivers, like city facilities, might also have upper premiums. It is a severe issue, as a location with the next chance will value you extra.

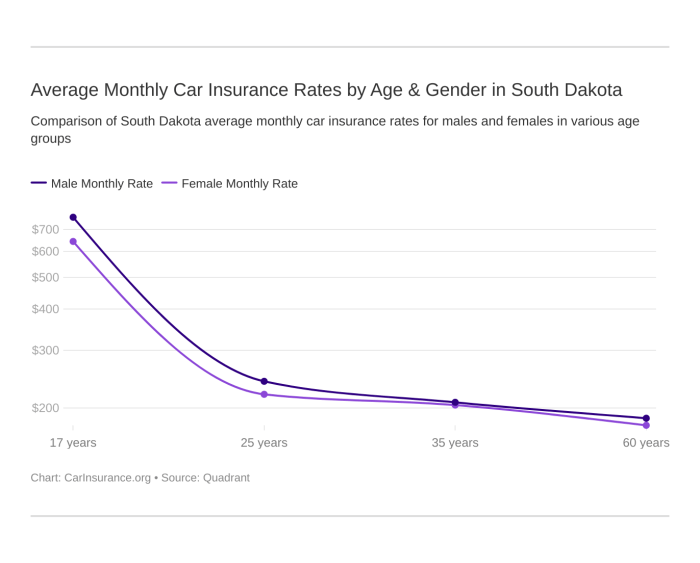

Age and Gender Affecting Premiums

Insurance coverage firms additionally imagine your age and gender when environment your premiums. More youthful drivers, statistically, are interested in extra injuries than older drivers. This upper chance ends up in upper premiums for more youthful drivers. Gender, whilst now not a major factor in South Dakota, continues to be thought to be by way of some insurers in positive spaces. It is not a large deal, however insurers frequently issue it into their exams.

Have an effect on of Every Issue on Top rate Prices (Illustrative Desk)

| Issue | Have an effect on on Top rate Prices |

|---|---|

| Blank Riding Document | Decrease premiums |

| Prime-Efficiency Car | Upper premiums |

| Older Car | Doubtlessly upper premiums |

| Prime-Crime House | Upper premiums |

| More youthful Motive force | Upper premiums |

Pointers for Negotiating Decrease Charges

Snagging a killer deal on South Dakota automobile insurance coverage ain’t rocket science, nevertheless it does take just a little of technology. Realizing the ropes and enjoying your playing cards proper can land you a significant bargain, saving you some severe dosh. It is all about working out the sport and realizing what levers to drag.

Methods for Decrease Premiums

Insurance coverage firms frequently use numerous components to calculate premiums. Figuring out those components will give you a tactical merit when negotiating. Elements like your riding historical past, the kind of automobile you power, and your location all play an element. Proactively addressing those components may end up in considerable financial savings. As an example, a blank riding document is a significant asset within the sport of insurance coverage negotiations.

Keeping up a Just right Riding Document

A spotless riding document is king on the subject of securing decrease insurance coverage charges. This implies fending off injuries and visitors violations. Constant protected riding behavior display accountable behaviour to the insurance coverage corporate, which is able to translate to vital financial savings. Each level in your document can have an effect on your charges, so staying accident-free is vital. Keep away from dangerous riding behaviours, and you can most probably see a noticeable drop to your premiums.

Advantages of Bundling Insurance policies

Bundling your insurance coverage insurance policies, akin to house and auto insurance coverage, frequently unlocks reductions. Insurance coverage firms frequently praise consumers who consolidate their insurance coverage wishes beneath one roof. This streamlined manner may end up in vital value discounts. The blended financial savings could make an actual distinction for your base line. A bundle deal can provide you with extra cost and prevent cash.

Inquiries to Ask Insurance coverage Brokers

Do not be shy about asking questions. Proactive engagement along with your insurance coverage agent can divulge hidden financial savings alternatives. Inquire about reductions for protected riding, multi-policy bundles, or some other to be had incentives. Figuring out the other choices allow you to to barter successfully and in finding the most efficient deal to your wishes. Be ready to invite about explicit reductions and discover other protection choices to peer what could be adapted to your person scenario.

- What reductions are to be had for protected drivers?

- Are there any multi-policy reductions to be had?

- What are the phrases and prerequisites of each and every bargain?

- How does my riding document have an effect on my charges?

- Are there any reductions for explicit automobile varieties or security features?

Comparability of Bundled vs. Particular person Insurance policies

Bundling insurance policies can frequently supply vital financial savings in comparison to buying person insurance policies. It is a confirmed technique. The next desk illustrates a possible comparability.

| Coverage Kind | Estimated Annual Top rate (USD) |

|---|---|

| Particular person Auto Insurance coverage | 1500 |

| Bundled Auto and House Insurance coverage | 1200 |

Figuring out Protection Choices

Looked after throughout the jargon, this phase breaks down the other insurance coverage coverages to be had to your wheels, highlighting the an important bits to stay your trip protected and your pockets satisfied. Navigating those choices can really feel like navigating a maze, however we’re going to map it out for you, so you are now not misplaced in a sea of bureaucracy.

Legal responsibility Protection Choices

Legal responsibility protection protects you when you purpose injury or damage to anyone else. Other ranges of legal responsibility quilt other quantities of attainable payouts. Usual insurance policies frequently be offering a minimal degree, however imagine expanding protection to be sure to’re ready for larger claims. As an example, a high-value declare may exceed your elementary coverage prohibit, leaving you individually liable.

- Physically Damage Legal responsibility: Covers clinical bills and misplaced wages for the injured birthday party, as much as the coverage limits. This is very important in case you are interested in an twist of fate the place anyone will get harm.

- Belongings Harm Legal responsibility: Covers injury you purpose to someone else’s assets, akin to their automobile or area. This safeguards you from hefty restore expenses.

Complete and Collision Protection

Those coverages step in when injury occurs for your automobile, without reference to who is at fault.

- Complete Protection: This protection protects in opposition to non-collision incidents, akin to robbery, vandalism, hearth, hail, or climate injury. Call to mind it as your all-encompassing defend in opposition to unexpected occasions.

- Collision Protection: Covers injury for your automobile in case you are interested in a collision, without reference to who is at fault. That is essential for changing or repairing your automobile in case you are in a crash.

Uninsured/Underinsured Motorist Coverage

What occurs if the opposite motive force in an twist of fate has no insurance coverage or inadequate protection? This protection kicks in that will help you recuperate damages.

- Uninsured/Underinsured Motorist Coverage: Protects you and your passengers in case you are interested in an twist of fate with an uninsured or underinsured motive force. This prevents you from shouldering the monetary burden if the opposite birthday party’s protection is inadequate.

Non-public Damage Coverage (PIP)

PIP protection is designed to deal with your individual accidents and clinical bills without reference to who is at fault in an twist of fate.

- Non-public Damage Coverage (PIP): Covers clinical bills, misplaced wages, and different bills associated with accidents sustained in an twist of fate, even though you are the at-fault motive force. That is an important for fast clinical consideration and restoration prices.

Protection Choices Comparability

| Protection | Execs | Cons |

|---|---|---|

| Legal responsibility | Elementary coverage, frequently required by way of legislation | Restricted coverage to your personal automobile; does not quilt your accidents |

| Complete | Covers quite a lot of damages past collisions | Can have upper premiums than different coverages |

| Collision | Covers injury for your automobile in a collision, without reference to fault | Can have upper premiums than different coverages |

| Uninsured/Underinsured Motorist | Protects you from injuries with at-fault drivers with out ok insurance coverage | Further value, however a an important safeguard |

| Non-public Damage Coverage (PIP) | Covers clinical bills and misplaced wages for you and your passengers without reference to fault | Won’t quilt ache and struggling past clinical prices |

Insurance coverage Supplier Comparisons

Navigating the murky waters of South Dakota automobile insurance coverage? Realizing which supplier’s a excellent are compatible to your wishes is an important. It is not as regards to the most affordable quote; it is about discovering an organization you’ll be able to agree with to take care of claims easily and slightly. Choosing the proper insurance coverage supplier is vital to a enjoyable enjoy.

Supplier Recognition and Buyer Critiques

Buyer opinions are a goldmine of insights into an organization’s carrier high quality. Studying opinions on impartial platforms, and without delay at the suppliers’ web pages, can provide you with a way of ways they deal with their consumers. Sure comments frequently highlights fast declare settlements, useful customer support reps, and clear conversation. Conversely, adverse opinions may divulge problems with delays, unhelpful body of workers, or complicated declare processes.

Claims Dealing with Processes

The way in which an organization handles claims is a significant factor to your total enjoy. A streamlined procedure, with transparent conversation and well timed settlements, will prevent a headache if the worst occurs. Some firms be offering on-line declare portals, making the method more uncomplicated. Researching how suppliers take care of other declare varieties, from minor fender benders to general losses, is very important.

This perception lets in for a greater working out in their potency and responsiveness.

Monetary Balance

Monetary balance is paramount. An organization’s monetary power signifies its skill to pay out claims, even throughout tricky occasions. Search for firms with a robust monitor document and a forged popularity for monetary duty. A credible score company’s review may give purpose details about an organization’s monetary balance.

Supplier Comparability Desk

This desk supplies a concise assessment of various insurance coverage suppliers in South Dakota, evaluating their rankings, buyer opinions, and moderate claims dealing with occasions. It is a snapshot that will help you make an educated determination.

| Insurance coverage Supplier | Score (e.g., A.M. Absolute best) | Buyer Critiques (Reasonable Score/General Sentiment) | Reasonable Declare Dealing with Time (Days) |

|---|---|---|---|

| Instance Ins Co 1 | A+ | 4.5/5 – Most commonly certain, highlighting fast declare processing | 7 |

| Instance Ins Co 2 | A | 4.0/5 – Combined opinions, some proceedings about customer support | 10 |

| Instance Ins Co 3 | B+ | 3.8/5 – Relatively adverse sentiment, some considerations about declare dealing with | 14 |

| Instance Ins Co 4 | A- | 4.7/5 – Extraordinarily certain, emphasizes superb customer support and environment friendly claims dealing with | 5 |

Notice: Rankings and occasions are examples and would possibly range. At all times test with the supplier without delay for essentially the most present knowledge.

Inspecting South Dakota Insurance coverage Regulations

South Dakota’s automobile insurance coverage scene ain’t precisely a jungle, however it is gotta be navigated proper. Figuring out the foundations is vital to steer clear of any nasty surprises, like a hefty high-quality or a refusal of your declare. Realizing the dos and don’ts, plus the hoops you gotta leap thru, will prevent a ton of tension and attainable bother.

Obligatory Protection Necessities

South Dakota, like maximum states, calls for a undeniable degree of coverage for drivers and different highway customers. Failure to satisfy those requirements may end up in severe penalties. This phase lays out the crucial protection you are legally obliged to have.

- Physically damage legal responsibility (BI): This covers accidents you purpose to other folks in an twist of fate. It is like a security web for the ones harmed in a crash you are answerable for.

- Belongings injury legal responsibility (PD): This saves the opposite motive force’s automobile or assets in case you are at fault. It covers the price of maintenance or substitute.

- Uninsured/Underinsured Motorist (UM/UIM) protection: This safeguards you and your passengers in case you are hit by way of anyone with insufficient or no insurance coverage. It steps in when the opposite motive force’s coverage is not sufficient to hide all of the damages.

Particular Laws for Automobile Insurance coverage

South Dakota’s insurance coverage regulations Artikel the specifics of what is required and the way it is enforced. Those rules be sure equity and offer protection to everybody at the highway.

- Minimal Protection Limits: South Dakota units minimal protection quantities for BI and PD legal responsibility. You’ll be able to want to be sure your coverage meets those requirements or face prison repercussions.

- Evidence of Insurance coverage: You might be legally required to hold evidence of insurance coverage. This normally comes to showing a sound insurance coverage card or a identical record.

- Monetary Accountability Regulations: Those regulations purpose to forestall reckless riding by way of requiring drivers to end up they may be able to pay for damages they purpose. Failing to stick to those regulations may end up in your license being suspended or your automobile impounded.

Implications of Non-Compliance

Ignoring South Dakota’s insurance coverage rules may end up in vital penalties. It is best to steer clear of those pitfalls.

- Suspension of Riding License: Non-compliance may end up in your riding license being suspended, which means you’ll be able to’t perform a automobile legally.

- Car Impoundment: In some instances, your automobile could be impounded in case you are discovered to be riding with out correct insurance coverage.

- Monetary Consequences: Fines and different monetary consequences are frequently imposed for violating insurance coverage rules.

State’s Insurance coverage Shopper Coverage Company

South Dakota has a devoted company to seem after the pursuits of insurance coverage shoppers. This frame is essential in making sure equity and combating fraudulent practices.

South Dakota’s Division of Insurance coverage is answerable for implementing insurance coverage rules and protective shoppers from unfair practices. They supply sources and knowledge that will help you navigate the insurance coverage procedure successfully.

Key South Dakota Insurance coverage Regulations Abstract

| Regulation | Description |

|---|---|

| Minimal Legal responsibility Protection | South Dakota mandates minimal quantities of Physically Damage and Belongings Harm legal responsibility protection. |

| Evidence of Insurance coverage | Drivers will have to raise evidence of insurance coverage, most often within the type of a card or certificates. |

| Monetary Accountability Regulations | Those regulations be sure drivers can financially atone for damages brought about in injuries. |

| Uninsured/Underinsured Motorist Protection | This protection protects you in case you are interested in an twist of fate with an uninsured or underinsured motive force. |

Illustrative Situations: Reasonable South Dakota Automobile Insurance coverage

Navigating the murky waters of South Dakota automobile insurance coverage ain’t simple, however working out how various factors play out could make an actual distinction to your pocket. Realizing what to anticipate out of your riding document, automobile, location, and protection possible choices is vital to securing a good fee. This phase breaks down some commonplace situations that will help you plan forward.Various factors considerably have an effect on your automobile insurance coverage premiums.

Those examples display how quite a lot of scenarios can have an effect on the price of your coverage.

Riding Document Affects on Premiums

A blank riding document is a significant factor in securing a low top rate. A historical past of injuries or violations, on the other hand, will building up your charges significantly.

- A motive force with a blank document, no visitors violations, and a spotless riding historical past, will normally benefit from the lowest premiums.

- A motive force with a minor dashing price ticket or a parking violation will most probably see a slight building up of their top rate, regardless that now not essentially a catastrophic one.

- Drivers with more than one injuries or at-fault collisions will face considerably upper premiums because of the larger chance of claims and payouts.

- Youngster drivers with restricted enjoy at the highway frequently pay extra because of their upper chance profile. Insurance coverage firms frequently require further protection, which can inevitably inflate the fee.

Car Kind Influences on Charges

The kind of automobile you power without delay affects your insurance coverage prices. Prime-performance automobiles and comfort automobiles most often include upper premiums.

- A elementary, compact sedan will most often have decrease premiums than a high-performance sports activities automobile or a luxurious SUV.

- Prime-value automobiles frequently require upper premiums to replicate the opportunity of upper declare payouts.

- Older, much less dependable automobiles might also include upper premiums, in particular if they don’t seem to be well-maintained. Deficient automobile upkeep can give a contribution to raised restore prices in case of injuries.

- Electrical automobiles (EVs) normally have decrease premiums than gasoline-powered automobiles in lots of spaces, because of their decrease twist of fate chance and doubtlessly decreased restore prices.

Location Affects on Insurance coverage Prices

Your location performs a vital position to your insurance coverage charges. Spaces with upper crime charges or twist of fate frequencies normally have upper premiums.

- Spaces with upper charges of robbery or vandalism most often have upper premiums.

- Rural spaces may have decrease charges than densely populated city spaces because of fewer injuries.

- Spaces with upper charges of serious climate, akin to hailstorms or flooding, might also see upper premiums.

- Particular neighbourhoods inside a town too can see permutations in premiums because of native components.

Protection Choices Have an effect on on Charges

The protection choices you select considerably have an effect on your top rate. Complete and collision protection can upload considerable prices.

- A elementary liability-only coverage is normally the most affordable choice however provides the least coverage.

- Including complete protection for injury from such things as climate or vandalism will building up your premiums.

- Collision protection, which covers injury from an twist of fate, provides much more to the associated fee.

- Uninsured/underinsured motorist protection is an important for cover in opposition to injuries involving drivers with out insurance coverage.

Case Research on Lowering Premiums

Enforcing positive methods can considerably scale back your insurance coverage prices. Imagine those examples:

- Bundling your auto insurance coverage with different insurance policies (like householders or renters) frequently results in reductions.

- Keeping up a excellent riding document and fending off injuries or violations will stay your charges decrease.

- Elevating your deductible can frequently scale back your per thirty days premiums.

- Opting for a decrease protection degree, akin to the next deductible, can decrease your per thirty days top rate.

Ultimate Phrase

In conclusion, securing reasonable South Dakota automobile insurance coverage comes to a mixture of working out the marketplace, comparing your wishes, and proactively in quest of reductions. Via evaluating suppliers, inspecting protection choices, and keeping up a excellent riding document, you’ll be able to considerably scale back your insurance coverage prices. This information has provided you with the data to navigate the complexities of South Dakota automobile insurance coverage and in finding the most efficient imaginable protection to your wishes.

Consumer Queries

What are the everyday components that affect automobile insurance coverage premiums in South Dakota?

Elements like your riding document (together with injuries and violations), the kind and age of your automobile, your location inside South Dakota, your age and gender, and the selected protection choices all have an effect on your top rate.

What are some commonplace reductions presented by way of insurance coverage suppliers in South Dakota?

Many suppliers be offering reductions for protected riding, bundling more than one insurance policies, having excellent credit score, and for positive automobile varieties or options. You should definitely ask about explicit reductions from each and every supplier you are taking into consideration.

What are the necessary protection necessities in South Dakota?

South Dakota calls for legal responsibility insurance coverage, which protects you from monetary duty when you purpose an twist of fate. Test with the South Dakota Division of Insurance coverage for explicit main points on present necessities.

How can I examine other insurance coverage suppliers in South Dakota?

On-line comparability equipment and internet sites are superb sources to check other suppliers and their charges. You’ll be able to additionally request quotes without delay from insurance coverage firms within the state.