Affordable automobile insurance coverage winston salem nc – Affordable automobile insurance coverage Winston-Salem NC is your key to unlocking a smoother, much less nerve-racking using enjoy. Navigating the often-confusing global of insurance coverage suppliers can really feel like a scavenger hunt, however we are right here to be your trusty information, providing insider pointers and tips that can assist you to find the easiest coverage on your wishes. We will dive deep into the nitty-gritty of Winston-Salem’s insurance coverage panorama, uncovering the secrets and techniques to scoring the most efficient charges.

From figuring out the native marketplace dynamics to finding hidden reductions, we will resolve the mysteries in the back of inexpensive insurance coverage. We will display you learn how to examine quotes like a professional and keep away from pricey errors. Get in a position to save lots of giant and pressure worry-free!

Working out the Insurance coverage Marketplace in Winston-Salem, NC

Winston-Salem, NC, like many US towns, has a various automobile insurance coverage marketplace with various charges and suppliers. Working out the standards influencing those charges is essential to securing the most efficient imaginable protection at a good value. This thread dives into the specifics of the Winston-Salem marketplace, inspecting pricing methods, commonplace reductions, and the have an effect on of particular person elements.

Moderate Charges and Not unusual Suppliers

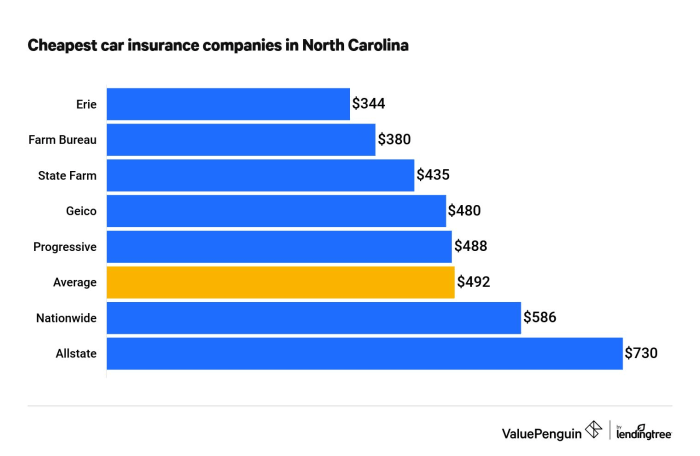

The typical automobile insurance coverage top rate in Winston-Salem, NC, has a tendency to fall inside a spread of $1,200 to $1,800 once a year, relying on particular person cases. This vary is reflective of the regional charge of dwelling and standard menace elements. Main suppliers like State Farm, Geico, and Innovative ceaselessly dominate the marketplace percentage in Winston-Salem. Different respected insurers equivalent to National and Liberty Mutual additionally serve the world, providing similar choices.

Pricing Methods of Main Insurers

Other insurers make use of various pricing methods. State Farm, identified for its intensive community and native presence, usally emphasizes complete protection applications. Geico, however, ceaselessly makes use of a aggressive means, that specialize in decrease premiums via centered reductions. Innovative ceaselessly makes use of a data-driven means, adjusting premiums in keeping with particular person using conduct and menace profiles, equivalent to claims historical past and coincidence data.

To be had Reductions

A large number of reductions are to be had to drivers in Winston-Salem, NC. Those come with reductions for just right scholar drivers, secure using methods, and anti-theft units. Bundling insurance coverage insurance policies (like house and auto) too can lead to doable reductions. Insurers usally publicize those reductions via their web pages and native advertising and marketing fabrics.

Elements Influencing Premiums

A number of elements considerably affect automobile insurance coverage premiums in Winston-Salem, NC. Using historical past, together with previous injuries and site visitors violations, performs a big position. A blank report in most cases interprets to decrease premiums. Car sort, equivalent to a sporty or luxurious type, may additionally have an effect on pricing, as those automobiles are usally perceived as higher-risk. Location inside Winston-Salem itself can affect charges, as some neighborhoods may well be statistically related to greater declare frequencies.

Insurance coverage Supplier Comparability Desk

| Insurance coverage Supplier | Moderate Top rate (USD) | Reductions Introduced |

|---|---|---|

| State Farm | $1,500 | Just right scholar, secure motive force, multi-policy |

| Geico | $1,300 | Protected motive force, multi-policy, anti-theft |

| Innovative | $1,400 | Protected motive force, accident-free, just right scholar |

| National | $1,600 | Multi-policy, just right scholar, defensive using |

| Liberty Mutual | $1,550 | Multi-policy, secure motive force, new automobile |

Figuring out Inexpensive Insurance coverage Choices

Discovering inexpensive automobile insurance coverage in Winston-Salem, NC, is a very powerful for accountable drivers. This comes to figuring out the to be had coverage varieties and aggressive pricing methods. Cautious comparability of protection choices and minimal necessities is secret to meaking an educated resolution.

Price-for-Cash Coverage Sorts

More than a few inexpensive automobile insurance coverage varieties cater to other wishes and budgets in Winston-Salem. Insurance policies that specialize in legal responsibility protection, a elementary coverage, may also be considerably more economical than complete or collision protection. Those be offering elementary coverage in opposition to damages to different drivers or belongings in an coincidence. Different choices would possibly come with non-public harm coverage (PIP), which is helping with scientific expenses and misplaced wages in an coincidence, without reference to fault.

Working out those nuances is important for opting for the most efficient are compatible on your cases.

Insurance coverage Firms with Aggressive Charges

A number of insurance coverage corporations persistently be offering aggressive charges in Winston-Salem. Those corporations usally alter their pricing in keeping with elements like motive force historical past, car sort, and site. Examples come with State Farm, Geico, and Innovative. Direct comparability buying groceries is a very powerful to be sure you’re getting the most efficient imaginable deal.

Coverage Sorts, Protection, and Prices

| Coverage Sort | Protection | Estimated Prices (Winston-Salem, NC) |

|---|---|---|

| Legal responsibility Handiest | Covers damages to other folks or belongings in an coincidence the place you’re at fault. | $400 – $800 according to 12 months |

| Legal responsibility + Collision | Covers damages on your car and different events in an coincidence, even though you’re at fault. | $800 – $1500 according to 12 months |

| Legal responsibility + Collision + Complete | Covers damages on your car from quite a lot of incidents, together with robbery, vandalism, and climate injury, at the side of injuries. | $1000 – $2000+ according to 12 months |

Word: Estimated prices are a normal tenet. Precise prices will range in keeping with particular person elements.

Evaluating Coverage Coverages, Affordable automobile insurance coverage winston salem nc

Legal responsibility protection protects you from monetary duty for damages you purpose to others. Collision protection can pay for injury on your car in an coincidence, without reference to who’s at fault. Complete protection protects your car in opposition to injury from incidents as opposed to collisions, equivalent to robbery, vandalism, or climate occasions. Working out those distinct coverages is important for settling on an acceptable coverage.

Figuring out Minimal Insurance coverage Necessities

The minimal insurance coverage necessities in Winston-Salem, NC, are established by way of state legislation. Those necessities usually contain legal responsibility protection, making sure coverage for the ones you could hurt in an coincidence. Failing to satisfy those minimums may result in prison penalties. All the time test together with your state’s Division of Motor Cars (DMV) for essentially the most up-to-date knowledge.

Methods for Discovering the Lowest Charges

Discovering inexpensive automobile insurance coverage in Winston-Salem, NC, calls for a strategic means. Working out the marketplace panorama and using fantastic comparability strategies are a very powerful for securing the most efficient imaginable charges. By means of actively evaluating quotes and using to be had sources, drivers can considerably cut back their insurance coverage premiums.

Evaluating Automotive Insurance coverage Quotes

Evaluating quotes is prime to discovering the bottom automobile insurance coverage charges. It comes to amassing a couple of quotes from other insurance coverage suppliers, a procedure this is streamlined with the proper equipment and strategies. Immediately contacting insurance coverage corporations and the use of on-line comparability web pages are each viable choices.

Acquiring More than one Quotes

To procure a couple of quotes successfully, use on-line comparability equipment or touch insurance coverage corporations immediately. On-line equipment usually collect quotes from quite a lot of suppliers, permitting a snappy and complete comparability. Immediately contacting insurance coverage suppliers may be fantastic, providing alternatives to talk about particular wishes and doubtlessly negotiate charges. Imagine using comparability web pages to gather quotes from a couple of suppliers concurrently.

Evaluating Protection Choices and Prices

Evaluating protection choices and prices throughout other insurance coverage corporations is very important. Reviewing the main points of each and every coverage, together with legal responsibility protection, collision protection, and complete protection, is a very powerful. Evaluation deductibles and coverage limits to make sure they align with particular person wishes and monetary functions. Other corporations might be offering various ranges of protection at other value issues.

Organizing Quotes from Other Suppliers

A well-organized comparability of quotes is important. A desk layout facilitates a transparent assessment of quite a lot of insurance coverage suppliers and their respective gives. The desk beneath exemplifies this, showcasing protection, top rate, and doable reductions.

| Insurance coverage Supplier | Protection (Legal responsibility, Collision, Complete) | Top rate (Annual) | Reductions (e.g., Just right Driving force, Multi-Automotive) |

|---|---|---|---|

| Innovative | 250/500/100; $1000 deductible | $1,800 | Just right Driving force, Multi-Coverage |

| State Farm | 300/500/100; $500 deductible | $1,950 | Just right Driving force, Bundled House/Auto |

| Geico | 300/500/100; $1000 deductible | $1,750 | Just right Scholar, Multi-Coverage |

Word: Premiums and reductions might range in keeping with particular person cases and using data.

Using On-line Gear and Assets

A large number of on-line equipment and sources streamline the method of discovering affordable automobile insurance coverage in Winston-Salem, NC. Comparability web pages, insurance coverage corporate web pages, and devoted on-line insurance coverage agents facilitate simple quote assortment. Those equipment permit for an immediate and fantastic comparability of quotes. Internet sites and agents be offering options like filtering by way of protection wishes and site, additional improving the quest.

Elements Influencing Insurance coverage Premiums in Winston-Salem, NC

Discovering inexpensive automobile insurance coverage in Winston-Salem, NC, comes to figuring out the standards that have an effect on premiums. Understanding those elements empowers you to make knowledgeable possible choices and doubtlessly decrease your charges. This research explores the important thing demographics, behaviors, and car traits that insurers imagine when calculating your top rate.

Demographic Elements Affecting Premiums

Working out the demographics of Winston-Salem drivers is a very powerful to comprehending how insurance coverage charges are made up our minds. Age, gender, and using historical past are key parts that insurers analyze to evaluate menace. Younger drivers, as an example, are statistically extra at risk of injuries than skilled drivers.

- Age: More youthful drivers usally face greater premiums because of their greater coincidence menace. Insurance coverage corporations assess the likelihood of a tender motive force attractive in dangerous conduct and their inexperience in dealing with a car, thus expanding their menace profile.

- Gender: Traditionally, insurance coverage corporations have famous statistical variations in using conduct between genders. On the other hand, this distinction isn’t universally appropriate and is topic to additional investigation.

- Using Enjoy: The period of time a motive force has held a license is a major factor. Insurance coverage corporations imagine the choice of years and injuries skilled by way of the driving force.

Car Traits Impacting Premiums

The kind of car you pressure can immediately affect your insurance coverage top rate. Elements just like the car’s make, type, 12 months, and security measures play a task in calculating the danger related to proudly owning and working that individual car.

- Car Make and Fashion: Positive makes and fashions are statistically related to greater coincidence charges or greater restore prices. This interprets to better premiums for automobiles perceived as extra at risk of injury or injuries.

- Car 12 months: More recent automobiles usally come provided with complicated security measures, which will affect the top rate. Insurance coverage corporations have in mind the protection options and era within the car.

- Car Price: The next-value car usually has the next top rate because of the potential of better monetary loss within the match of an coincidence or robbery. The worth of the car is a major factor within the menace review.

Using Behaviors and Their Have an effect on

Insurance coverage corporations additionally imagine your using behaviors when figuring out your top rate. Site visitors violations and coincidence historical past are a very powerful parts that immediately have an effect on the top rate quantity.

- Site visitors Violations: Injuries or site visitors violations, like dashing or reckless using, build up your menace profile and result in greater premiums. Every violation carries a weight within the menace review procedure.

- Twist of fate Historical past: A historical past of injuries considerably will increase your insurance coverage top rate. The severity and frequency of injuries are moderately analyzed to resolve the prospective menace you pose.

Correlation Between Elements and Premiums

The next desk illustrates the prospective correlation between various factors and automobile insurance coverage premiums in Winston-Salem, NC. This desk is illustrative and now not an exhaustive listing.

| Issue | Possible Have an effect on on Top rate |

|---|---|

| Younger age | Upper top rate |

| Top-value car | Upper top rate |

| Site visitors violations | Upper top rate |

| Injuries | Upper top rate |

| Just right using report | Decrease top rate |

| Older age (with out a injuries) | Probably decrease top rate |

Guidelines for Saving Cash on Automotive Insurance coverage

Saving on automobile insurance coverage in Winston-Salem, NC, is achievable with sensible methods. Working out the standards influencing premiums and adopting cost-effective measures can considerably cut back your insurance coverage prices. This comes to extra than simply opting for the most affordable coverage; it is about imposing a holistic strategy to accountable using and insurance coverage control.

Bundling Insurance coverage Insurance policies

Bundling your automobile insurance coverage with different insurance coverage insurance policies, like house or renters insurance coverage, usally yields really extensive reductions. Insurance coverage corporations usally praise consumers who consolidate their protection with them. It’s because it reduces administrative prices and will increase buyer loyalty. As an example, when you have each auto and house owners insurance coverage with the similar supplier, you need to see a 5-10% bargain for your automobile insurance coverage top rate.

Price-Saving Methods for Automotive Insurance coverage

Imposing sure methods may end up in decrease automobile insurance coverage premiums. Imagine those cost-saving measures when buying automobile insurance coverage:

- Protected Using Practices: Keeping up a blank using report is a very powerful. Keep away from site visitors violations and handle accountable using behavior. It will decrease your top rate by way of warding off injuries and dashing tickets.

- Elevating Your Deductible: Expanding your deductible can decrease your top rate. On the other hand, be ready to pay a bigger quantity out-of-pocket when you have an coincidence. Imagine your monetary functions when opting for a deductible.

- Examine Quotes from More than one Suppliers: Using on-line comparability web pages can divulge a variety of quotes from quite a lot of insurance coverage corporations. This lets you examine other coverage choices and to find essentially the most appropriate one on your wishes and funds.

- Take Good thing about Reductions: Many insurance coverage suppliers be offering reductions for quite a lot of elements, equivalent to just right scholar reductions, anti-theft units, or secure using classes. Analysis and establish any appropriate reductions that may cut back your top rate.

- Evaluate Your Protection Wishes: Be certain your coverage covers your wishes correctly. Useless protection can inflate your top rate. Evaluate your protection ceaselessly to take away useless choices.

The use of Comparability Internet sites for Quotes

Comparability web pages supply a complete assessment of quite a lot of insurance coverage insurance policies and quotes from a couple of insurers. Those web pages usually be offering a user-friendly interface that lets you enter your main points and obtain custom designed quotes. This option permits you to examine charges and establish essentially the most cost-effective choices with out intensive analysis. As an example, a web page like “Insure.com” permits you to input your using historical past and different knowledge to obtain adapted quotes.

Bettering Using Historical past and Keeping up a Just right Using Report

A blank using report is a very powerful for acquiring favorable automobile insurance coverage charges. A constant historical past of secure using demonstrates accountable conduct, leading to decrease premiums. Focal point on warding off site visitors violations, following site visitors rules, and keeping up a secure using taste. By means of adhering to those pointers, you exhibit your dedication to secure using and your accountable nature.

- Keep away from Injuries and Violations: Top-of-the-line option to handle a just right using report is to keep away from any injuries or site visitors violations. This contains dashing, working crimson lighting, or reckless using.

- Attend Defensive Using Classes: Taking part in defensive using classes can fortify your using talents and data. This may occasionally result in a discount in insurance coverage premiums and make stronger your using report.

- Evaluate Your Using Conduct: Evaluation your using behavior to spot any spaces that want development. This contains adjusting your velocity, being conscious about your atmosphere, and warding off distractions.

- Deal with Car Repairs: Common car repairs can cut back the possibility of mechanical problems that would possibly result in injuries. Be certain your car is in just right running order.

Significance of a Blank Using Report

A blank using report is a major factor influencing automobile insurance coverage premiums in Winston-Salem, NC. Insurance coverage corporations assess using data to judge menace profiles. Keeping up a blank report demonstrates accountable using conduct and decreases the possibility of injuries or violations. A just right using report usually ends up in decrease insurance coverage premiums.

Exploring Reductions and Promotions

Discovering inexpensive automobile insurance coverage in Winston-Salem, NC, usally hinges on leveraging to be had reductions. Insurance coverage corporations be offering quite a lot of incentives to praise secure using behavior and different fascinating buyer behaviors. Working out those methods can considerably cut back your top rate prices.

Not unusual Reductions Introduced by way of Insurance coverage Firms

Insurance coverage corporations in Winston-Salem, NC, ceaselessly be offering a spread of reductions, together with the ones for secure using, defensive using classes, multi-policy holders, and those that handle a blank using report. Those reductions can range considerably between suppliers, making it a very powerful to match choices.

Bargain Techniques in Winston-Salem, NC

- Protected Using Reductions: Many insurers praise drivers with accident-free data or those that exhibit accountable using behavior via telematics methods (tracking using taste by way of a tool). Examples come with decrease premiums for drivers who handle a blank using report for a specified duration or who take part in motive force development methods.

- Multi-Coverage Reductions: Insuring a couple of automobiles or different varieties of insurance coverage (house, existence, and many others.) with the similar corporate can usally lead to reductions. This displays the perceived decrease menace of claims from a buyer base already managing a couple of insurance policies.

- Defensive Using Path Reductions: Finishing a defensive using route may end up in decrease insurance coverage premiums, because it suggests a dedication to secure using practices.

- Scholar Reductions: Scholars, specifically the ones enrolled in accepted establishments, might qualify for scholar reductions. Those methods usally replicate the decrease chance of injuries related to younger, insured drivers.

- Reductions for Positive Car Traits: Insurance coverage suppliers usally be offering reductions for automobiles with complicated security measures, equivalent to airbags or anti-theft programs. This demonstrates the decrease menace of accident-related prices related to such options.

Evaluating Reductions Introduced by way of Other Suppliers

| Insurance coverage Supplier | Bargain Sort | Description |

|---|---|---|

| Corporate A | Protected Using | Reductions for accident-free using data for three years. |

| Corporate A | Multi-Coverage | 10% bargain on all insurance policies if insuring 2 or extra automobiles. |

| Corporate B | Defensive Using | Reductions for finishing an authorized defensive using route. |

| Corporate B | Scholar Bargain | 15% bargain for college students enrolled in a known tutorial establishment. |

| Corporate C | Car Protection Options | Reductions for automobiles provided with anti-theft programs and complicated security measures. |

Word: This desk is for illustrative functions handiest. Precise reductions and eligibility standards might range by way of supplier and particular person cases.

Methods for Maximizing Reductions

- Evaluate All To be had Reductions: Totally evaluate the precise bargain methods introduced by way of quite a lot of insurance coverage corporations to spot the ones appropriate on your scenario. This comes to a cautious comparability throughout suppliers.

- Deal with a Blank Using Report: Keep away from injuries and site visitors violations to qualify for essentially the most vital secure using reductions. That is usally essentially the most significant component influencing premiums.

- Whole Defensive Using Classes: Join in an authorized defensive using route to exhibit a dedication to secure using practices, which might result in a bargain.

- Mix Insurance policies: If you happen to insure a couple of automobiles or different varieties of insurance coverage with the similar corporate, imagine the prospective multi-policy reductions.

- Evaluate Eligibility Standards: Moderately read about the eligibility necessities for each and every bargain to be sure you meet the important standards. This prevents unhappiness should you fail to qualify for a bargain.

The Price of Protected Using Conduct

Protected using behavior immediately have an effect on insurance coverage premiums. Drivers with blank data and a demonstrated dedication to secure practices usally qualify for vital reductions.

“A dedication to secure using interprets immediately to decrease insurance coverage prices.”

This immediately displays the danger review of insurance coverage suppliers. Drivers with a historical past of injuries or violations are noticed as the next menace, main to better premiums.

Remaining Notes

In conclusion, securing affordable automobile insurance coverage in Winston-Salem NC is achievable with just a little of savvy analysis and a splash of resolution. By means of figuring out the native marketplace, evaluating quotes successfully, and maximizing to be had reductions, you’ll be able to considerably cut back your insurance coverage premiums. Take into accout, a little bit effort is going far against monetary freedom at the highway. Glad using!

Key Questions Responded: Affordable Automotive Insurance coverage Winston Salem Nc

What is the reasonable charge of vehicle insurance coverage in Winston-Salem, NC?

Moderate charges differ in keeping with quite a lot of elements, however a coarse estimate usually falls between $1,200-$2,000 once a year.

What reductions are often to be had?

Many insurers be offering reductions for secure drivers, scholars, bundling insurance policies, and extra. Remember to inquire about all to be had choices.

How can I examine quotes from other insurance coverage corporations?

On-line comparability web pages are your absolute best pals. They collect quotes from a couple of suppliers in a single position, saving you precious effort and time.

What if I’ve a deficient using report?

Whilst a less-than-perfect report would possibly imply greater premiums, it isn’t the top of the arena. Store round, and understand that reductions might nonetheless be to be had, and insurers are usally versatile to find an answer that works for each events.