Reasonable automobile insurance coverage Tyler TX is an important for budget-conscious drivers within the house. Navigating the aggressive insurance coverage marketplace calls for cautious analysis and working out of native components. This complete information will assist you to in finding the most efficient charges and protection adapted in your wishes.

Tyler, TX’s automobile insurance coverage panorama gifts a mix of aggressive suppliers and particular components influencing charges. Figuring out those parts is vital to securing reasonably priced protection.

Assessment of Reasonable Automotive Insurance coverage in Tyler, TX

Yo, Tyler, TX, is the place the sport is on for inexpensive automobile insurance coverage! It is a lovely aggressive marketplace, so that you gotta know the performs to attain a candy deal. Other firms are droppin’ other costs, and components like your riding file and the kind of trip you roll in are large recreation changers.Getting the fitting protection is vital, fam.

You want to know the other choices to remember to’re secure. This information breaks down the fundamentals that will help you navigate the insurance coverage jungle.

Elements Affecting Automotive Insurance coverage Charges in Tyler, TX

Tyler’s automobile insurance coverage charges don’t seem to be simply randomly thrown in combination. They are according to a number of key components that affect the associated fee. Your own state of affairs performs a significant position, like your age, riding historical past, or even the place you are living within the town.

- Demographics: Age, location inside Tyler, and riding historical past considerably affect charges. More youthful drivers, for instance, steadily face upper premiums because of statistically upper twist of fate charges. In a similar fashion, sure neighborhoods would possibly have a better focus of injuries, resulting in greater prices for citizens in the ones spaces.

- Coincidence Historical past: Should you’ve had fender-benders or primary injuries previously, your insurance coverage premiums will probably be upper. Insurance coverage firms have a look at your previous riding file to evaluate your menace as a motive force.

- Car Sort: The kind of automobile you pressure too can have an effect on your insurance coverage prices. Prime-performance sports activities automobiles or luxurious automobiles generally tend to have upper premiums in comparison to extra usual fashions. It’s because those automobiles are steadily fascinated about costlier upkeep or injuries, which will increase the chance for the insurance coverage corporate.

Sorts of Automotive Insurance coverage To be had in Tyler, TX

Tyler provides a variety of insurance coverage choices to suit other wishes. You gotta make a choice the protection that is proper on your state of affairs.

- Legal responsibility Insurance coverage: That is the minimal protection required through regulation. It protects you if you are at fault in an twist of fate and purpose harm to somebody else’s assets or accidents. It does not quilt your individual damages.

- Collision Insurance coverage: This protection kicks in in case your automobile will get broken in an twist of fate, irrespective of who is at fault. It will pay for upkeep or substitute of your automobile.

- Complete Insurance coverage: This saves your automobile from issues but even so injuries, like vandalism, robbery, hearth, or climate harm. It covers your automobile although you are now not fascinated about a collision.

- Uninsured/Underinsured Motorist Protection: This protection protects you if you are in an twist of fate with somebody who does not have insurance coverage or does not have sufficient protection to hide the damages. It is a must-have in Tyler, because it supplies further monetary coverage.

Comparability of Insurance coverage Suppliers in Tyler, TX

Here is a fast have a look at some insurance coverage firms working in Tyler, TX. This desk supplies examples and is not an exhaustive checklist.

| Insurance coverage Supplier | Protection Choices | Pricing (Instance) | Buyer Opinions (Instance) |

|---|---|---|---|

| State Farm | Legal responsibility, Collision, Complete, Uninsured/Underinsured Motorist | $1500-$2500 according to yr (relying on motive force profile) | Typically certain, however some stories of lengthy wait occasions for claims |

| Innovative | Legal responsibility, Collision, Complete, Uninsured/Underinsured Motorist | $1200-$2000 according to yr (relying on motive force profile) | Most commonly certain opinions, famous for on-line gear and straightforwardness of declare procedure |

| Geico | Legal responsibility, Collision, Complete, Uninsured/Underinsured Motorist | $1300-$2200 according to yr (relying on motive force profile) | Excellent customer support ratings, however some proceedings about loss of customized provider |

| Allstate | Legal responsibility, Collision, Complete, Uninsured/Underinsured Motorist | $1400-$2400 according to yr (relying on motive force profile) | Blended opinions, some certain stories with claims, others point out excessive premiums |

Elements Affecting Automotive Insurance coverage Prices in Tyler, TX

Yo, peeps! Automotive insurance coverage in Tyler, TX, ain’t no comic story. It is a entire recreation, and figuring out the foundations is vital to getting a candy deal. Out of your riding historical past in your trip’s specifications, heaps of things play a job in how a lot you pay. Let’s wreck it down, so you’ll be able to rating the most affordable price conceivable.Figuring out those components permits you to make good alternatives to get the most efficient deal on insurance coverage.

It is like searching for the hottest kicks – you need the most efficient worth on your dollar.

Using Report

Your riding historical past is a significant factor. Tickets, injuries, or even rushing—all of it provides up. A blank slate method decrease charges. Call to mind it like a credit score rating on your riding. A just right file assists in keeping your premiums low.

A file suffering from violations, and you are looking at a steeper ticket.

Car Sort

The kind of automobile you pressure issues. Prime-performance sports activities automobiles or pricey luxurious fashions most often price extra to insure. That is as a result of they are much more likely to be broken or stolen. Call to mind it like this: a vintage muscle automobile, or a super-charged sports activities automobile, draws extra consideration, which makes it a extra tempting goal for thieves. Insurance coverage firms issue within the chance of wear or robbery when surroundings your charges.

So, a elementary sedan or a competent compact will steadily get you a greater deal.

Location

The place you are living in Tyler, TX, too can affect your charges. Sure spaces would possibly have a better prevalence of injuries or robbery, so insurance coverage premiums might be upper in the ones spots. Take into accounts it like this: a high traffic house, or a space with extra reported crimes, will most probably have upper charges in comparison to a quieter community.

Moderate Charges in Tyler, TX vs. Different Texas Towns

Evaluating Tyler, TX’s moderate charges to different Texas towns can also be tough. No unmarried, definitive resolution exists. It will depend on a ton of things, like the particular automobiles, motive force profiles, and protection alternatives. On the other hand, Tyler’s charges most often fall someplace within the center in comparison to different Texas towns. Typically, larger metropolitan spaces steadily have upper charges than smaller cities.

Doing a little research on native insurance coverage businesses in Tyler and neighboring towns help you evaluate charges and in finding the most efficient deal.

Reductions and Promotions

Reductions and promotions are your secret guns for decrease premiums. A complete bunch of reductions are available in the market. Making the most of those financial savings could make a large distinction for your per thirty days bills. Call to mind it like this: an insurance coverage corporate will praise secure drivers, or drivers who take protection lessons, with reductions.

To be had Reductions in Tyler, TX

| Bargain Sort | Description | Eligibility Standards | Estimated Financial savings |

|---|---|---|---|

| Protected Driving force Bargain | For drivers with a blank riding file. | No injuries or violations inside a particular duration. | 10-20% |

| Defensive Using Route Bargain | Finishing a defensive riding route. | Evidence of entirety of a route. | 5-15% |

| Multi-Coverage Bargain | Bundling a couple of insurance policies (e.g., house and auto). | Insuring a couple of automobiles or insurance policies with the similar corporate. | 5-10% |

| Excellent Scholar Bargain | For college kids with a just right instructional file. | Evidence of enrollment and just right grades. | 5-10% |

| Anti-theft Tool Bargain | Putting in anti-theft gadgets to your automobile. | Evidence of set up of authorized anti-theft gadgets. | 5-10% |

Pointers for Discovering Inexpensive Automotive Insurance coverage in Tyler, TX: Reasonable Automotive Insurance coverage Tyler Tx

Yo, homies, tryna avoid wasting coin on automobile insurance coverage in Tyler? It is a overall grind, however we will wreck it down so you’ll be able to get the most efficient deal. Insurance coverage ain’t affordable, however we will make it much less of a ache within the neck.Discovering the fitting automobile insurance coverage in Tyler, TX, is like attempting to find the very best deal on the mall – you gotta store round and evaluate costs.

Other firms have other charges, so that you gotta do your homework. It is all about getting the most efficient conceivable deal on your state of affairs.

Evaluating Automotive Insurance coverage Quotes

Evaluating quotes from quite a lot of insurance coverage suppliers is vital to getting the bottom conceivable price. This procedure permits you to see what other firms be offering and make a choice the person who suits your wishes and finances. It is a an important step in securing the most efficient conceivable protection.

- Test a couple of insurers: Do not simply depend on one corporate. Succeed in out to a minimum of 3 or 4 other suppliers to look their quotes. You’ll be able to get a clearer image of the marketplace price and establish the most efficient worth.

- Use on-line comparability gear: Internet sites devoted to evaluating insurance coverage quotes can prevent a ton of time. They collect charges from quite a lot of suppliers, so you’ll be able to simply see side-by-side comparisons. It is like having a super-powered comparability client.

- Request customized quotes: Do not be afraid to invite for custom designed quotes. You’ll be able to tailor the protection and deductibles in your particular wishes and state of affairs. A personalised quote guarantees that you are getting the precise protection you wish to have.

Discovering the Highest Offers

Getting the most efficient deal on automobile insurance coverage is like discovering a hidden gem – it takes a bit of digging and technique. Search for reductions, discover package choices, and believe elevating your deductibles if you’ll be able to find the money for it.

- Search for reductions: Many firms be offering reductions for just right drivers, secure riding conduct, or even for proudly owning a undeniable form of automobile. Test with every supplier to look when you qualify for any reductions. They are steadily hidden gem stones, so it will pay to invite!

- Believe bundling: Bundling your automobile insurance coverage with different insurance policies, like house insurance coverage, steadily ends up in vital financial savings. It is like getting a gaggle bargain, and you can save a gorgeous penny.

- Store round at other occasions: Insurance coverage charges can range, so do not be afraid to test charges at other occasions of the yr. It is like checking the inventory marketplace – timing issues!

The usage of On-line Equipment and Sources

On-line gear and assets are your absolute best pals in the case of evaluating automobile insurance coverage quotes. They supply simple get admission to to a couple of suppliers and streamline the method. It is like having a virtual buying groceries mall proper at your fingertips.

- Use on-line comparability web sites: Those websites mixture quotes from quite a lot of insurance coverage firms, making it tremendous simple to match. They are like a one-stop store for locating the most efficient offers.

- Use corporate web sites immediately: Many insurance coverage firms have their very own web sites the place you’ll be able to get customized quotes. It is like going instantly to the supply for the most efficient offers.

- Learn opinions and evaluate buyer stories: Studying opinions help you know how other firms maintain claims and customer support. This help you make an educated choice.

Bundling Insurance coverage Insurance policies

Bundling your automobile insurance coverage with different insurance policies, like house or renters insurance coverage, can steadily result in vital financial savings. It is like getting a gaggle bargain on your insurance coverage wishes.

- Mix automobile, house, and renters insurance coverage: It is a standard technique that may cut back your total insurance coverage prices. It is like having a staff bargain for all of your insurance coverage wishes.

Respected Automotive Insurance coverage Firms in Tyler, TX

Discovering a credible corporate is essential to be sure to’re getting the most efficient protection at an even worth. Those firms have a confirmed monitor file of offering high quality provider.

- State Farm: A well known and revered insurance coverage supplier.

- Innovative: A well known corporate with a historical past of aggressive charges.

- Geico: Some other primary participant within the insurance coverage marketplace, recognized for his or her wide selection of protection choices.

- Allstate: A complete insurance coverage corporate with a just right recognition.

- National: A unswerving insurance coverage supplier with quite a lot of reductions and choices.

Insurance coverage Firms Serving Tyler, TX

Yo, Tyler, TX, peep this! Insurance coverage firms are a significant deal for drivers, and figuring out your choices is vital to getting the most efficient charges. Whether or not you are a fresh grad or a seasoned motive force, discovering reasonably priced protection is a should.

Insurance coverage Firms Working in Tyler, TX

Tyler, TX, has a host of insurance coverage firms serving the realm. Understanding who is within the recreation is helping you store round and in finding the most efficient have compatibility. Those firms be offering quite a lot of programs to fit other wishes and budgets.

- State Farm: A large within the insurance coverage recreation, State Farm is understood for its popular presence and wide selection of insurance policies. They provide the entirety from automobile insurance coverage to house insurance coverage, steadily with just right customer support and a cast recognition.

- Geico: Some other primary participant, Geico is standard for its aggressive charges and handy on-line products and services. They steadily promote it via catchy advertisements, so you may have most definitely heard of them.

- Innovative: Innovative is every other large identify, recognized for its leading edge technique to insurance coverage. They infrequently be offering particular offers or reductions, making them price making an allowance for.

- Allstate: Allstate has been round for some time and gives quite a lot of protection choices. They could have a bit of of a extra conventional method when compared to a couple different firms.

- Farmers Insurance coverage: Farmers Insurance coverage is a great selection if you are on the lookout for native protection. They are steadily well-established within the communities they serve.

Monetary Steadiness and Recognition

Insurance coverage firms’ monetary steadiness is an important. You need an organization that is financially sound so they may be able to pay out claims when you wish to have them. Search for firms with robust scores from unbiased businesses. This is helping make sure that they may be able to maintain any claims that would possibly rise up.

Comparability of Services and products Introduced

Other firms be offering other products and services. Some center of attention on on-line products and services, others prioritize customized buyer interactions. Take into accounts what is essential to you – simple on-line get admission to or direct help? Evaluate the options and advantages presented through every corporate to compare your wishes. Some could have extra complete protection choices or particular add-ons.

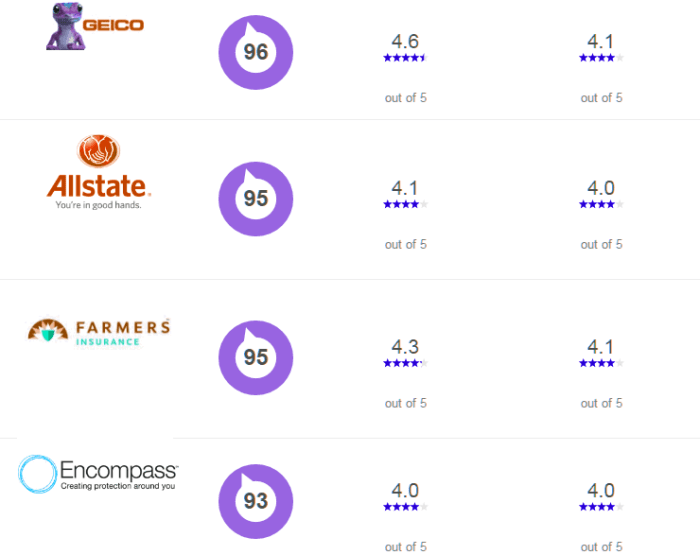

Buyer Carrier Rankings and Opinions

Here is a have a look at some best insurance coverage firms and their customer support, according to to be had knowledge. Buyer opinions and scores provide you with an concept of the whole revel in.

| Insurance coverage Corporate | Buyer Carrier Ranking | Buyer Opinions (Instance) | Claims Dealing with Time (Instance) |

|---|---|---|---|

| State Farm | 4.2 out of five stars | “Pleasant and useful brokers.” | 7 days |

| Geico | 3.8 out of five stars | “Simple on-line claims procedure.” | 5 days |

| Innovative | 4.0 out of five stars | “Speedy reaction time.” | 6 days |

| Allstate | 3.9 out of five stars | “Useful with complicated eventualities.” | 8 days |

| Farmers Insurance coverage | 4.1 out of five stars | “Native brokers are nice.” | 7 days |

Notice: Rankings and evaluate examples are hypothetical and for illustrative functions most effective. Exact effects might range.

Particular Protection Choices in Tyler, TX

Yo, homies, lemme wreck down the various kinds of automobile insurance coverage you’ll be able to get in Tyler, TX. This ain’t no recreation, that is your trip’s protection web. Understanding your choices is vital to getting the most efficient deal and preserving your wheels rolling easy.Automotive insurance coverage ain’t only one dimension suits all. Other plans quilt various things, and the extent of protection you wish to have will depend on your state of affairs.

Take into accounts what you need to offer protection to and what sort of you are keen to pay. Figuring out the other coverages and deductibles is an important for making the fitting selection.

Not unusual Protection Choices, Reasonable automobile insurance coverage tyler tx

Insurance coverage firms in Tyler, TX, normally be offering a regular set of coverages. Those give protection to you from quite a lot of eventualities, from fender benders to overall losses. The proper protection combo assists in keeping your pockets and your automobile secure.

- Legal responsibility Protection: That is the naked minimal. It protects you if you are at fault in an twist of fate and purpose harm to someone else or their assets. Call to mind it as your criminal protect when you reduce to rubble at the highway.

- Collision Protection: This kicks in in case your automobile will get wrecked, irrespective of who is at fault. It will pay for the wear in your personal automobile. It is a must-have when you wanna stay your trip in just right form.

- Complete Protection: That is like your automobile’s all-around coverage. It covers harm from such things as climate occasions, vandalism, and even falling gadgets. This additional layer is a brilliant thought when you park in sketchy spots or are living in a dangerous house.

- Uninsured/Underinsured Motorist Protection: That is an important. It steps in if you are hit through somebody who does not have sufficient insurance coverage or no insurance coverage in any respect. It is a game-changer when you get totaled through a low-budget motive force.

Implications of Protection Ranges and Deductibles

Other protection ranges and deductibles immediately affect your top rate. The next stage of protection most often method a better top rate. Deductibles, the quantity you pay out-of-pocket earlier than insurance coverage kicks in, additionally play a job. Decrease deductibles imply decrease per thirty days bills however upper premiums.

A decrease deductible method you’ll be able to pay much less out of pocket if one thing occurs, however you’ll be able to most probably pay extra every month for the insurance coverage. The next deductible method you’ll be able to pay extra out-of-pocket, however your per thirty days bills shall be decrease.

Instance Protection Applications

Here is a desk showcasing other protection programs and their approximate prices. Those are simply examples; your exact prices will range according to your particular state of affairs.

| Protection Package deal | Description | Value (Instance) | Advisable for… |

|---|---|---|---|

| Elementary Legal responsibility | Covers harm to others if you are at fault. | $100/month | Scholars with older automobiles and no primary belongings. |

| Complete Protection (Legal responsibility, Collision, Complete) | Covers harm to others, your automobile, and your automobile from quite a lot of reasons. | $250/month | Any person with a more moderen automobile or a large number of belongings who desires whole coverage. |

| Enhanced Protection (Legal responsibility, Collision, Complete, Uninsured/Underinsured) | Covers all above, plus coverage in opposition to uninsured drivers. | $350/month | Drivers who’re in high-risk spaces or have a large number of belongings, or are interested in getting hit through a uninsured motive force. |

Navigating the Claims Procedure in Tyler, TX

Yo, so that you wrecked your trip in Tyler? Do not panic, fam! Navigating the insurance coverage declare procedure can really feel like a maze, however it is means more uncomplicated than you suppose. This breakdown will stroll you in the course of the steps, not unusual eventualities, and the significance of staying arranged.The declare procedure is principally a sequence of steps to get your trip mounted and your pockets again heading in the right direction after a automobile twist of fate.

Each and every insurance coverage corporate has its personal procedure, however all of them most often practice an identical tips. Figuring out those tips will assist you to keep cool and picked up all through the entire procedure.

Steps Excited about Submitting a Automotive Insurance coverage Declare

Submitting a declare most often begins with a telephone name or on-line file. You’ll be able to want your coverage main points, the twist of fate file, and any witness knowledge. This preliminary file is helping the insurance coverage corporate collect the important knowledge to evaluate the wear and resolve the following steps. Subsequent, you’ll be able to want to supply supporting documentation, like scientific information, police stories, and footage of the wear.

The insurance coverage corporate will then examine the declare and come to a decision at the reimbursement. This will come with upkeep, substitute prices, or different monetary help.

Not unusual Declare Situations and Dealing with

A fender bender with minor harm is normally treated hastily. The insurance coverage corporate will most probably approve upkeep immediately with a mechanic, and you’ll be able to be to your means. On the other hand, a extra severe twist of fate would possibly contain a police file, scientific consideration, and extra documentation. In those eventualities, the insurance coverage corporate might ship an adjuster to evaluate the wear, behavior interviews, and overview the whole instances.

For overall loss claims, the insurance coverage corporate will overview the automobile’s worth and be offering a agreement according to marketplace costs and different components.

Significance of Documentation and Conversation

Documentation is vital! Stay all of your receipts, footage, and communique information. This is helping to solidify your declare and guarantees the entirety is clear. Transparent communique with the insurance coverage adjuster is an important. Be well mannered, respectful, and supply all asked knowledge promptly. In case you have questions or issues, ask them in an instant.

A just right courting with the adjuster can expedite the claims procedure.

Standard Time frame for Processing Claims

The time frame for processing claims varies, relying at the complexity of the case. Minor injuries can also be resolved in a couple of weeks, whilst extra severe incidents would possibly take a number of months. Be affected person and proactive in following up with the insurance coverage corporate. If you are undecided in regards to the standing of your declare, do not hesitate to invite for updates. You’ll be able to monitor the growth on-line or over the telephone.

Closing Recap

Discovering affordable automobile insurance coverage in Tyler, TX, comes to evaluating quotes, working out protection choices, and spotting native components. This information supplies actionable steps to search out the fitting coverage on your finances and wishes. Take note to entirely analysis suppliers and believe components like your riding file and automobile kind.

FAQ Compilation

What are the most typical reductions to be had for automobile insurance coverage in Tyler, TX?

Many insurers be offering reductions for secure riding, a couple of automobiles, pupil standing, and bundling insurance policies. Test with person suppliers for particular main points and eligibility.

How do I evaluate automobile insurance coverage quotes successfully?

Use on-line comparability gear and request quotes from a couple of suppliers. Believe components like protection limits and deductibles when making comparisons.

What are the standard declare processing occasions in Tyler, TX?

Processing occasions range through insurance coverage corporate. Be expecting a variety of processing occasions, and at all times take care of transparent communique along with your insurer.

What components affect automobile insurance coverage charges in Tyler, TX?

Using file, automobile kind, location, and demographics are all key components in figuring out charges. Elements like injuries or visitors violations can considerably have an effect on premiums.