Reasonable vehicle insurance coverage Newark NJ is a must have for drivers within the space. Discovering the most productive charges can really feel overwhelming, however this information breaks down easy methods to get inexpensive protection. We’re going to discover the Newark NJ vehicle insurance coverage marketplace, speak about influencing elements, and be offering methods for locating nice offers.

Newark, NJ, like many city spaces, has a singular vehicle insurance coverage panorama. Premiums can range in accordance with elements like your using document, vehicle kind, and placement inside the town. Working out those elements and the use of comparability gear permit you to get the most productive imaginable charges.

Advent to Newark NJ Automotive Insurance coverage: Reasonable Automotive Insurance coverage Newark Nj

Newark, NJ, like many city spaces, items a singular vehicle insurance coverage panorama. Components like visitors density, coincidence charges, and the price of dwelling affect the pricing construction. Working out those nuances is the most important for drivers in search of probably the most appropriate and inexpensive protection choices.Standard vehicle insurance coverage prices in Newark, NJ, are influenced via quite a lot of elements. Those come with using historical past, car kind, protection picks, and the driving force’s age and placement.

As an example, drivers with a blank using document most often have decrease premiums in comparison to the ones with a historical past of injuries or violations. The price of insuring a high-performance sports activities vehicle continuously exceeds that of a elementary sedan. Moreover, complete protection choices, together with collision and uninsured/underinsured motorist coverage, have a tendency to extend the whole top class.

Not unusual Insurance coverage Suppliers in Newark, NJ

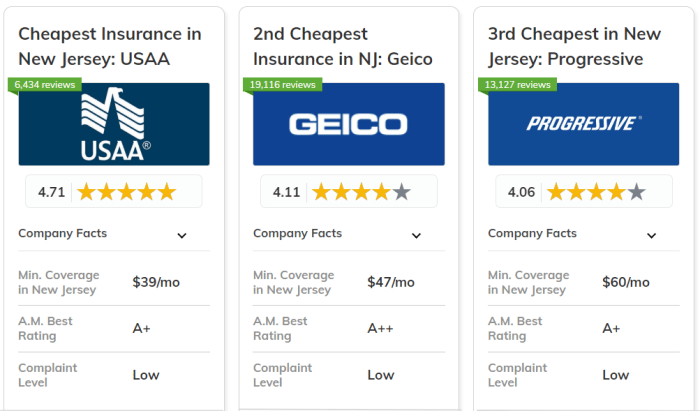

A number of well known insurance coverage firms serve the Newark, NJ, space. Those firms be offering quite a lot of protection programs and customer support approaches. Components like monetary balance, recognition, and the supply of explicit protection varieties give a contribution to a motive force’s selection.

Comparability of Main Insurance coverage Firms

The next desk compares 3 main insurance coverage firms working in Newark, NJ, in accordance with reasonable premiums, buyer opinions, and protection choices. Knowledge for premiums and opinions are estimated in accordance with trade averages and buyer comments. Exact premiums and opinions might range relying on person cases.

| Corporate | Reasonable Top class | Buyer Opinions | Protection Choices |

|---|---|---|---|

| Innovative | $1,500 | Normally sure, highlighting ease of on-line get right of entry to and aggressive charges. Some studies point out occasional customer support demanding situations. | Complete protection, together with legal responsibility, collision, complete, uninsured/underinsured motorist, and non-compulsory add-ons. |

| State Farm | $1,750 | Well known for robust customer support, in particular in claims dealing with. Premiums could also be somewhat upper than competition because of the tough protection choices. | Intensive protection choices, together with legal responsibility, collision, complete, uninsured/underinsured motorist, and supplemental protections equivalent to roadside help and condominium vehicle protection. |

| Allstate | $1,600 | Sure opinions referring to affordability and a extensive vary of protection choices. Some feedback point out a somewhat slower claims procedure in comparison to competition. | Aggressive protection package deal together with legal responsibility, collision, complete, uninsured/underinsured motorist, and quite a lot of supplemental coverages. |

Components Influencing Reasonable Automotive Insurance coverage

Securing inexpensive vehicle insurance coverage in Newark, NJ, calls for working out the important thing elements that affect premiums. This comes to inspecting quite a lot of sides of your using profile, car traits, and placement, together with the supply of precious reductions and systems. Working out those elements empowers you to make advised choices and doubtlessly decrease your insurance coverage prices.

Riding File

A blank using document is a major factor in acquiring decrease vehicle insurance coverage charges. Insurance coverage firms assess your using historical past, together with any injuries, visitors violations, or claims filed. A historical past freed from main infractions most often interprets to decrease premiums. Constant protected using behavior, equivalent to warding off rushing and distracted using, at once give a contribution to keeping up a positive using document and due to this fact, extra inexpensive insurance coverage.

Car Sort

The kind of car you force considerably affects your insurance coverage premiums. Prime-performance automobiles and comfort automobiles continuously raise the next possibility of wear and tear or robbery, leading to upper insurance coverage prices. Conversely, older, elementary fashions most often have decrease insurance coverage premiums. Insurance coverage firms believe elements just like the car’s make, style, 12 months, and security measures when calculating premiums.

Location

Your location inside Newark, NJ, performs a job on your insurance coverage charges. Spaces with upper crime charges or the next frequency of injuries have a tendency to have upper insurance coverage premiums. Insurance coverage firms analyze native information to evaluate possibility ranges and modify premiums accordingly. Components equivalent to visitors density and coincidence statistics in explicit neighborhoods affect the insurance coverage prices.

Reductions and Particular Methods

Quite a lot of reductions and particular systems can considerably cut back your vehicle insurance coverage premiums. Those reductions are continuously to be had to drivers who show protected using behavior, monetary duty, or adherence to positive standards. Profiting from those reductions can result in considerable financial savings.

| Cut price Sort | Description | Possible Financial savings (Instance) |

|---|---|---|

| Secure Motive force | Demonstrating a constant historical past of protected using, loose from injuries and violations, continuously via a verifiable duration of no claims. | $150-$500 in line with 12 months |

| Just right Scholar | Enrolling in or keeping up a excellent educational document in highschool or faculty can qualify you for this cut price. | $50-$200 in line with 12 months |

| Multi-Automotive Coverage | Proudly owning more than one automobiles and insuring them with the similar corporate continuously ends up in bundled reductions. | $75-$300 in line with 12 months |

| Defensive Riding Route | Finishing a defensive using direction can strengthen your using abilities and cut back your possibility profile, doubtlessly resulting in decrease premiums. | $50-$150 in line with 12 months |

| Bundled Insurance coverage (House/Auto) | Insuring your house and auto with the similar supplier can continuously result in bundled reductions. | $100-$400 in line with 12 months |

Discovering Inexpensive Insurance coverage Choices

Securing inexpensive vehicle insurance coverage in Newark, NJ, calls for proactive analysis and comparability. Working out the quite a lot of methods to be had empowers you to make advised choices and doubtlessly lower your expenses. Navigating the insurance coverage panorama can really feel daunting, however with the suitable way, discovering an appropriate coverage inside your funds is achievable.Discovering the most productive vehicle insurance coverage charges in Newark, NJ, comes to using a multi-faceted way.

This contains using on-line gear, exploring dealer services and products, and working out the standards that affect pricing. The method comes to accumulating knowledge from more than one resources to search out probably the most fine deal.

Other Methods for Discovering Reasonable Automotive Insurance coverage

A number of methods permit you to in finding reasonable vehicle insurance coverage in Newark. Using on-line comparability gear is the most important, as they permit for a fast assessment of charges from more than one suppliers. Immediately contacting insurance coverage firms can yield personalised quotes, however comparability gear continuously supply a broader assessment. Moreover, exploring dealer services and products can also be really helpful, as they act as intermediaries, doubtlessly negotiating favorable phrases in your behalf.

This will save effort and time.

On-line Comparability Gear and Dealer Products and services

On-line comparability gear supply a streamlined method to examine insurance coverage quotes. Those gear collect information from quite a lot of insurers, permitting you to look a spread of costs and protection choices. Dealer services and products act as intermediaries, offering a personalised carrier. They may be able to examine charges from a large number of firms, doubtlessly figuring out probably the most cost-effective resolution. The provision of those assets means that you can make well-informed choices.

Examples of Web sites Devoted to Evaluating Automotive Insurance coverage Charges

A lot of web sites focus on evaluating vehicle insurance coverage charges. Those web sites most often acquire information from quite a lot of insurance coverage suppliers, enabling you to match quotes briefly. Examples come with Insurify, Policygenius, and others. Those assets empower customers to discover choices from more than one firms and procure custom designed value estimates.

Comparability Software Assessment

“Instance comparability software used to be simple to make use of and supplied a number of choices. I used to be ready to briefly examine quotes from more than one firms and discover a appropriate coverage.”

This evaluation highlights the convenience of use and complete nature of positive comparability gear. Those gear are designed to make the method of evaluating vehicle insurance coverage quotes environment friendly and simple. Using those assets can considerably simplify the quest procedure and doubtlessly result in charge financial savings.

Working out Protection Choices

Navigating the sector of auto insurance coverage can really feel overwhelming, particularly when confronted with quite a lot of protection choices. Working out those choices is the most important for securing the suitable coverage to your car and monetary well-being. Choosing the proper protection stage balances your wishes together with your funds, and this segment will delve into the specifics of legal responsibility, collision, and complete protection.Opting for the right protection ranges comes to a cautious balancing act.

Upper protection ranges generally translate to raised premiums, however additionally they supply higher monetary coverage in case of an coincidence or injury for your car. Conversely, decrease protection ranges might lower your expenses prematurely, however may just depart you financially uncovered within the match of an coincidence.

Other Sorts of Automotive Insurance coverage Protection

Several types of vehicle insurance policy cater to quite a lot of dangers related to car possession. Those coverages be offering various levels of coverage, impacting your insurance coverage premiums. Working out the distinctions between those choices is very important for making advised choices.

Legal responsibility Protection

Legal responsibility protection is a elementary element of any vehicle insurance plans. It protects you from monetary duty if you happen to motive an coincidence and are legally answerable for damages to someone else or their assets. This protection will pay for damages to the opposite birthday party’s car and scientific bills incurred via them, as much as the coverage limits.

Collision Protection

Collision protection comes into play in case your car is broken in an coincidence, irrespective of who’s at fault. It covers upkeep or substitute of your car, compensating you for the price of the wear. This protection is very important for safeguarding your funding on your vehicle.

Complete Protection

Complete protection is going past injuries. It safeguards your car towards non-collision incidents, equivalent to robbery, vandalism, fireplace, hail, or climate injury. It supplies a monetary protection web, protecting the restore or substitute prices of your car in those unexpected cases.

Comparability of Protection Ranges and Premiums

The number of protection stage considerably influences your insurance coverage premiums. Upper protection ranges typically result in upper premiums, reflecting the larger monetary coverage they supply. A complete coverage, encompassing legal responsibility, collision, and complete protection, will continuously command the next top class than a coverage with handiest legal responsibility protection.

Abstract of Protection Choices, Reasonable vehicle insurance coverage newark nj

| Protection Sort | Description | Instance Price |

|---|---|---|

| Legal responsibility | Protects you from monetary duty if you happen to motive an coincidence and are legally answerable for damages to someone else or their assets. | $100-$500 monthly |

| Collision | Covers upkeep or substitute of your car whether it is broken in an coincidence, irrespective of who’s at fault. | $50-$200 monthly |

| Complete | Covers your car towards non-collision incidents, equivalent to robbery, vandalism, fireplace, hail, or climate injury. | $25-$150 monthly |

Pointers for Negotiating with Insurance coverage Firms

Securing inexpensive vehicle insurance coverage in Newark, NJ continuously comes to extra than simply evaluating quotes. Negotiation with insurance coverage suppliers generally is a precious software for acquiring higher charges. Working out the methods and ways concerned can considerably affect your premiums.Efficient negotiation is not about disagreement, however about presenting your case persuasively and highlighting elements that may favorably affect your charges. By means of working out the insurance coverage corporate’s viewpoint and presenting related knowledge, you’ll be able to build up your possibilities of a positive end result.

Methods for Efficient Negotiation

Negotiating with insurance coverage firms calls for a proactive way. Collecting details about your using historical past, car specifics, and any to be had reductions is the most important. This permits you to provide a compelling case that aligns together with your cases. Working out your insurance coverage supplier’s pricing fashions and not unusual cut price alternatives can additional beef up your negotiation.

Verbal exchange Ways Throughout Negotiations

Transparent and concise conversation is vital right through negotiations. Care for a qualified and respectful demeanor right through the interplay. Keep away from competitive or confrontational language. As an alternative, focal point on presenting your case logically and highlighting related main points. Use examples let’s say your issues.

As an example, when you’ve got a blank using document, emphasizing this will be really helpful.

Significance of Reviewing the Positive Print

Thorough evaluation of the coverage’s effective print is very important. This comes to working out the phrases and stipulations, protection limits, and any exclusions. Many hidden charges and clauses are continuously buried within the coverage paperwork. Cautious scrutiny of the coverage’s language can save you misunderstandings and doable long term disputes.

Inquiries to Ask Throughout Coverage Assessment

A complete evaluation of your insurance plans must come with an inventory of sparsely crafted questions. Those questions must goal the most important sides of the coverage, equivalent to protection main points, exclusions, and doable add-ons.

- What reductions are to be had, and the way can I qualify for them?

- What are the precise phrases and stipulations related to the coverage?

- What’s the procedure for submitting a declare, and what are the related prices?

- What are the protection limits for quite a lot of incidents (e.g., injuries, robbery, vandalism)?

- How continuously can I be expecting coverage updates and revisions?

- What are the precise standards for top class changes, and the way can I attraction a price build up?

- Are there any hidden charges or further fees no longer explicitly discussed within the coverage report?

Finish of Dialogue

In conclusion, securing reasonable vehicle insurance coverage in Newark NJ comes to analysis, comparability, and doubtlessly negotiation. By means of working out the marketplace, elements impacting charges, and using to be had gear, you’ll be able to considerably cut back your insurance coverage prices. Bear in mind to scrupulously evaluation protection choices and do not hesitate to invite inquiries to be sure to have the suitable coverage.

FAQ

What is the reasonable vehicle insurance coverage charge in Newark, NJ?

Sadly, there is no unmarried reasonable. Prices rely on elements like your using document, car kind, and protection choices. Use comparability gear to get personalised quotes.

What reductions are to be had for vehicle insurance coverage in Newark?

Many insurance coverage firms be offering reductions for protected using, excellent pupil standing, and multi-car insurance policies. Take a look at with person suppliers for main points.

How can I examine vehicle insurance coverage quotes on-line?

A number of web sites focus on evaluating insurance coverage quotes. Input your main points and obtain quotes from quite a lot of firms to search out the most productive deal.

What’s the distinction between legal responsibility, collision, and complete protection?

Legal responsibility protection protects you in case you are at fault in an coincidence. Collision protection will pay for injury for your car, irrespective of who is at fault. Complete protection covers injury from such things as vandalism or climate occasions.