Reasonable automotive insurance coverage Bernard Law Montgomery AL is a must-know for any scholar on the cheap. Navigating the insurance coverage jungle is usually a nightmare, however this information breaks it down, evaluating quotes and insurance policies to get you the most efficient deal.

Bernard Law Montgomery’s insurance coverage marketplace is a mixture of giant avid gamers and native choices. Components like your using report, automotive kind, or even your location within the town all play a task on your top rate. We will dissect those components and be offering methods to safe an affordable coverage. Evaluating other suppliers and protection varieties is essential.

Creation to Reasonably priced Automobile Insurance coverage in Bernard Law Montgomery, AL

The auto insurance coverage marketplace in Bernard Law Montgomery, Alabama, like many different spaces, is influenced through quite a few components. Figuring out those components is the most important for shoppers in quest of inexpensive protection. Pageant amongst insurance coverage suppliers performs a task, however person instances and native components additionally give a contribution considerably to the price of insurance coverage.Bernard Law Montgomery’s particular marketplace traits, together with the velocity of injuries and claims, affect the premiums charged through more than a few corporations.

The typical driving force’s using report, automobile kind, and placement throughout the town all give a contribution to person insurance coverage prices. Figuring out how those components engage permits shoppers to actively discover methods for acquiring decrease premiums.

Components Influencing Automobile Insurance coverage Premiums in Bernard Law Montgomery, AL

A number of key components affect automotive insurance coverage premiums in Bernard Law Montgomery, Alabama. Figuring out those components empowers shoppers to make instructed choices about their protection.

- Riding Document: A blank using report, freed from injuries and violations, usually ends up in decrease premiums. Drivers with a historical past of site visitors violations or injuries face upper premiums. This displays the chance evaluation method hired through insurance coverage corporations.

- Car Kind and Worth: The kind of automobile and its estimated worth considerably affect premiums. Prime-performance sports activities automobiles or luxurious automobiles are frequently costlier to insure than usual fashions. The worth of the auto without delay influences the quantity of protection wanted and thus the associated fee.

- Location and Demographics: Geographic location inside of Bernard Law Montgomery and demographic information might affect premiums. Spaces with upper twist of fate charges or claims frequency can have upper insurance coverage prices. Information on site visitors patterns and incident studies in particular spaces of the town informs insurance coverage corporate calculations.

- Protection Choices: The selected protection choices—legal responsibility, collision, complete, and different add-ons—without delay impact the top rate. Upper protection ranges most often result in larger premiums. The precise dangers and required coverage impact the selection and price of protection.

- Claims Historical past: A historical past of claims filed with the insurance coverage corporate, whether or not minor or primary, can considerably affect long run premiums. Claims historical past displays the chance profile of the insured.

Significance of Evaluating Automobile Insurance coverage Quotes

Evaluating quotes from more than one insurance coverage suppliers is the most important for locating essentially the most inexpensive automotive insurance coverage in Bernard Law Montgomery, AL. This proactive way permits drivers to optimize their protection and steer clear of paying needless premiums. A complete comparability supplies the most efficient alternative to search out essentially the most cost-effective insurance coverage.

- Aggressive Pricing: Other insurance coverage corporations be offering various premiums. Comparability buying groceries guarantees you don’t seem to be paying greater than vital for a similar protection.

- Adapted Protection: Each and every corporate’s protection choices and phrases would possibly fluctuate. Comparability finds the most efficient have compatibility on your particular wishes and price range.

- Transparency and Figuring out: Figuring out the positive print of various insurance policies and premiums permits for instructed choices. Comparability is helping you already know the criteria in the back of other pricing constructions.

Comparability of Insurance coverage Corporations in Bernard Law Montgomery, AL

The next desk supplies a common comparability of insurance coverage corporations working in Bernard Law Montgomery, AL. This information is meant to be a kick off point for additional analysis and comparability. Precise premiums might range according to person instances.

| Corporate Title | Protection Choices | Top rate Vary ($) | Buyer Evaluations |

|---|---|---|---|

| Instance Corporate 1 | Complete, Collision, Legal responsibility | $1,200 – $1,800 | Sure |

| Instance Corporate 2 | Legal responsibility, Collision, Complete, Uninsured Motorist | $1,500 – $2,200 | Combined |

| Instance Corporate 3 | Legal responsibility, Collision, Complete, Scientific Bills | $1,000 – $1,500 | Sure |

Components Affecting Automobile Insurance coverage Prices in Bernard Law Montgomery, AL

Discovering inexpensive automotive insurance coverage in Bernard Law Montgomery, AL, comes to working out the criteria that affect premiums. Those components are frequently intertwined, and a mix of them can considerably affect the full charge of your coverage. Figuring out those components lets you make instructed choices to doubtlessly decrease your insurance coverage bills.Insurance coverage premiums don’t seem to be a set quantity; they’re dynamically calculated according to quite a few standards.

Each and every issue carries a weight within the calculation, and the blended affect can decide whether or not your insurance coverage is expensive or inexpensive. A complete working out of those components empowers you to control your insurance coverage prices successfully.

Riding Document Affect on Premiums

A driving force’s historical past considerably impacts automotive insurance coverage prices. Injuries and site visitors violations are primary individuals to top rate will increase. A blank using report, freed from injuries and violations, normally ends up in decrease premiums. Conversely, a historical past of injuries or site visitors violations, equivalent to rushing tickets or reckless using, will building up premiums considerably. It’s because insurance coverage corporations assess chance according to previous conduct.

For example, a driving force with a up to date twist of fate or more than one rushing tickets will likely be regarded as the next chance, justifying the next top rate.

Car Kind and Type Affect on Charges

The kind and style of your automobile additionally play a the most important position in figuring out your insurance coverage top rate. Luxurious automobiles and high-performance automobiles frequently have upper premiums in comparison to usual fashions. That is because of components equivalent to the possibility of upper restore prices in case of wear and tear or robbery, in addition to the perceived upper chance of injuries involving such automobiles.

For instance, a sports activities automotive would possibly have the next top rate than a compact automotive, despite the fact that each are insured through the similar corporate. It’s because the possibility of harm and service prices could also be considerably upper for the sports activities automotive.

Age and Location Affect on Insurance coverage Prices in Bernard Law Montgomery, AL

Age and placement inside of Bernard Law Montgomery, AL, too can affect insurance coverage prices. More youthful drivers are normally regarded as upper chance, main to better premiums in comparison to older drivers with a confirmed historical past of secure using. In a similar fashion, positive spaces inside of Bernard Law Montgomery, AL, can have the next fee of injuries or claims, which may end up in upper premiums for drivers dwelling in the ones spaces.

For example, spaces with the next focus of site visitors or injuries would possibly have upper premiums.

Conventional Reductions Introduced through Insurance coverage Suppliers

Insurance coverage corporations frequently be offering more than a few reductions to incentivize just right using conduct and accountable practices. Those reductions can assist decrease your premiums considerably.

| Bargain Kind | Description | Instance |

|---|---|---|

| Protected Driving force | For drivers with a blank using report, freed from injuries and violations. | A driving force and not using a injuries or violations for the previous 5 years would possibly qualify for this cut price. |

| Just right Pupil | For college kids keeping up a just right instructional status. | A scholar with a GPA above 3.5 would possibly qualify for a cut price. |

| More than one Cars | For insuring more than one automobiles at the similar coverage. | Insuring a automotive and a motorbike below the similar coverage would possibly qualify for this cut price. |

| Anti-theft Gadgets | For automobiles provided with anti-theft units. | Cars with alarms or monitoring units would possibly qualify for this cut price. |

Conventional Coverages Introduced through Insurers

Insurers normally be offering more than a few coverages to give protection to policyholders from monetary losses. Those coverages are designed to catch up on damages, accidents, or losses associated with automobile possession.

- Legal responsibility Protection: This saves you if you’re at fault for an twist of fate and purpose harm to someone else or their belongings.

- Collision Protection: This covers the price of repairing or changing your automobile whether it is broken in an twist of fate, without reference to who’s at fault.

- Complete Protection: This covers damages on your automobile from occasions as opposed to collisions, equivalent to vandalism, robbery, or weather-related harm.

- Uninsured/Underinsured Motorist Protection: This saves you if you’re concerned about an twist of fate with a driving force who does no longer have insurance coverage or does no longer have sufficient insurance coverage to hide the damages.

Methods for Discovering Reasonably priced Automobile Insurance coverage in Bernard Law Montgomery, AL

Securing inexpensive automotive insurance coverage in Bernard Law Montgomery, AL, calls for proactive methods. Figuring out the criteria influencing premiums and using wonderful comparability strategies are key to discovering the most efficient deal. This comes to researching more than a few insurance coverage suppliers, evaluating quotes, and doubtlessly negotiating reductions.Efficient methods for locating inexpensive automotive insurance coverage contain extra than simply opting for the bottom worth. Cautious attention of protection choices, reductions, and coverage bundling can considerably affect the full charge of your coverage.

Acquiring More than one Quotes from Other Insurers

Securing more than one quotes from various insurance coverage suppliers is the most important for complete comparability. This way permits for a clearer working out of pricing diversifications around the marketplace. At once contacting insurers, using on-line comparability equipment, and attending native insurance coverage gala’s can facilitate the selection of more than one quotes. Buying groceries round guarantees you might be no longer locked into an unnecessarily excessive top rate. Evaluating quotes from insurers like State Farm, Revolutionary, Geico, Allstate, and National, for instance, is very important for figuring out essentially the most aggressive charges.

The usage of On-line Comparability Gear Successfully

On-line comparability equipment are priceless assets for comparing more than a few automotive insurance coverage choices. Those platforms combination quotes from more than one insurers, streamlining the comparability procedure. Using those equipment permits for a fast and environment friendly evaluation of various insurance policies. Customers can specify their automobile main points, using historical past, and desired protection to obtain personalised quotes. Making sure accuracy in inputting information is the most important for acquiring related and dependable quotes.

Bundling Insurance coverage Insurance policies, Reasonable automotive insurance coverage montgomery al

Bundling insurance coverage insurance policies, equivalent to combining automotive insurance coverage with house insurance coverage, can yield really extensive charge financial savings. Insurers frequently be offering reductions for purchasers who acquire more than one insurance policies. This technique can doubtlessly cut back the full insurance coverage bills. This synergy between insurance policies frequently ends up in a extra streamlined billing procedure and the ease of managing all insurance coverage thru a unmarried supplier.

Step-by-Step Procedure for Evaluating Automobile Insurance coverage Choices

A structured option to evaluating automotive insurance coverage choices can considerably give a boost to the possibility of discovering the most efficient deal. The method comes to the next steps:

- Resolve desired protection. Specify the extent of coverage required on your automotive and private wishes.

- Collect automobile data. Assemble information about the auto’s make, style, 12 months, and any particular options.

- Gather using historical past. Record any injuries, site visitors violations, or claims related along with your using report.

- Get entry to on-line comparability equipment. Use respected web sites to collect quotes from more than a few insurers.

- Overview quotes meticulously. Evaluate coverage phrases, protection limits, and premiums for a complete evaluation.

- Touch insurers without delay. Discuss with brokers to inquire about any to be had reductions or particular provides.

- Negotiate and make a selection essentially the most favorable coverage.

Figuring out To be had Reductions and Qualifying

A lot of reductions are to be had for automotive insurance coverage insurance policies, providing doable charge financial savings. Reductions frequently rely on components equivalent to driving force traits, automobile options, and insurance coverage alternatives. Examples of not unusual reductions come with secure driving force reductions, just right scholar reductions, and anti-theft tool reductions. Figuring out the eligibility standards for each and every cut price is essential. Researching the precise necessities of each and every cut price can assist in figuring out eligibility and securing doable financial savings.

A complete working out of to be had reductions, their respective standards, and the possible financial savings they constitute is important for maximizing insurance coverage charge relief.

Tricks to Save on Automobile Insurance coverage Premiums

- Handle a blank using report. Keep away from injuries and site visitors violations to deal with a favorable using historical past, which without delay influences top rate charges.

- Set up anti-theft units. The presence of safety techniques can frequently lead to decrease premiums.

- Make the most of secure using practices. Riding defensively and cautiously can doubtlessly give a contribution to decrease insurance coverage prices.

- Handle a excessive credit score ranking. A powerful credit score historical past could also be related to extra favorable insurance coverage charges.

- Imagine complete protection. Complete protection can doubtlessly be offering higher coverage and decrease prices in the end.

- Overview and replace insurance policies frequently. Overview your insurance policies periodically to make sure they nonetheless meet your wishes and to spot any doable cost-saving alternatives.

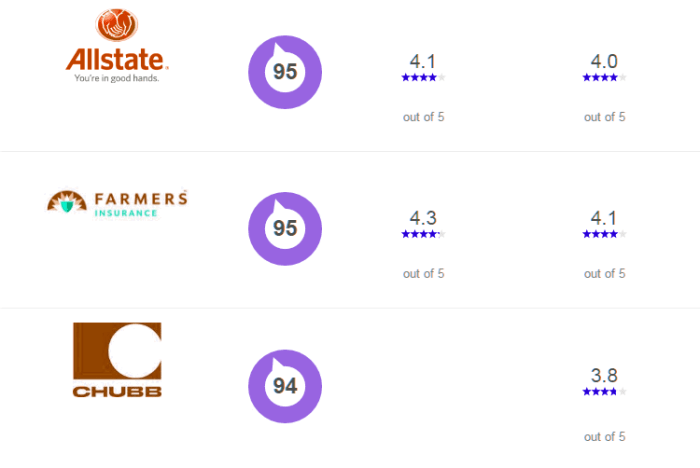

Evaluating Insurance coverage Corporations in Bernard Law Montgomery, AL

Discovering the suitable automotive insurance coverage in Bernard Law Montgomery, AL, comes to extra than simply the most affordable top rate. Customers wish to imagine the breadth and high quality of protection, the recognition of the corporate, and their monetary steadiness. Evaluating more than a few suppliers is the most important for making an educated determination.Figuring out the strengths and weaknesses of various insurance coverage corporations in Bernard Law Montgomery, AL is very important for securing essentially the most appropriate protection.

This comparability considers no longer handiest coverage costs but in addition the variability of services and products and the insurer’s general status out there. Choosing the proper corporate way weighing components like customer support, claims dealing with, and the corporate’s monetary steadiness.

Insurance coverage Corporate Provider Comparisons

More than a few insurance coverage suppliers be offering distinct services and products, impacting buyer enjoy and pride. Some corporations excel in on-line declare submitting, whilst others prioritize phone-based help. Those variations are necessary issues when comparing suppliers.

- Buyer Provider: Some corporations be offering a strong community of brokers, offering personalised steerage and give a boost to. Others might prioritize on-line portals, doubtlessly providing 24/7 get right of entry to however with much less instant human interplay. An organization with very good customer support can considerably ease the method of submitting claims and resolving disputes.

- Claims Dealing with: Other insurers have various approaches to dealing with claims. Some prioritize pace and potency, whilst others may well be extra meticulous of their critiques. Figuring out the declare strategy of a specific corporate can assist shoppers look ahead to doable delays or headaches.

- Protection Choices: Corporations frequently tailor protection programs to other wishes. Some might be offering specialised add-ons like roadside help or condo automotive protection, whilst others might focal point on elementary protection at a cheaper price. Reviewing the precise main points of each and every coverage is essential sooner than deciding on a plan.

Corporate Strengths and Weaknesses

Examining the strengths and weaknesses of various insurance coverage corporations is secret to meaking a well-informed selection. Each and every corporate has its personal benefits and downsides, and it is the most important to guage those components on the subject of non-public wishes.

- Corporate A: Identified for its aggressive premiums, in particular for drivers with a blank using report. On the other hand, customer support scores could also be reasonably decrease in comparison to different corporations.

- Corporate B: Frequently cited for its complete protection choices, together with intensive add-ons. Premiums may well be reasonably upper than Corporate A. This corporate additionally has a powerful recognition for its claims dealing with processes.

- Corporate C: This supplier excels in providing versatile fee choices. This may also be tremendous for purchasers with particular monetary eventualities. On the other hand, their protection choices may well be much less intensive in comparison to the others.

Monetary Steadiness and Popularity

Comparing the monetary power and recognition of an insurance coverage corporate is paramount. A financially solid corporate is much less more likely to face insolvency, making sure policyholders can obtain repayment within the match of a declare.

- Monetary Rankings: Corporations like A.M. Highest, Same old & Deficient’s, and Moody’s supply monetary scores for insurance coverage suppliers. Those scores replicate the corporate’s monetary steadiness and capability to meet its duties. A better ranking usually signifies a decrease chance of insolvency.

- Buyer Evaluations: On-line evaluations and comments from previous policyholders be offering treasured insights into the corporate’s provider high quality, claims dealing with, and buyer give a boost to. Scrutinize evaluations to grasp buyer reports and doable problems.

Comparative Desk of Protection Choices and Premiums

This desk supplies a elementary comparability of protection choices and premiums introduced through 3 hypothetical insurance coverage corporations. Actual-world information must be verified with the precise suppliers.

| Corporate A | Corporate B | Corporate C |

|---|---|---|

| Legal responsibility Protection: $100,000 | Legal responsibility Protection: $250,000 | Legal responsibility Protection: $150,000 |

| Collision Protection: $100 in line with incident | Collision Protection: $50 in line with incident | Collision Protection: $100 in line with incident |

| Complete Protection: $250 in line with incident | Complete Protection: $100 in line with incident | Complete Protection: $200 in line with incident |

| Top rate (estimated): $1,200 in line with 12 months | Top rate (estimated): $1,500 in line with 12 months | Top rate (estimated): $1,350 in line with 12 months |

Figuring out Automobile Insurance coverage Protection Choices

Choosing the proper automotive insurance plans is the most important for safeguarding your monetary well-being and making sure your automobile’s protection. Figuring out the other choices to be had empowers you to make instructed choices, minimizing doable dangers and fiscal burdens. This segment will delve into the specifics of more than a few coverages, highlighting their significance and doable implications.Complete and collision protection are essential elements of a complete insurance coverage plan.

They supply monetary coverage within the match of wear and tear on your automobile, without reference to who’s at fault. Legal responsibility protection, whilst necessary for prison duties, frequently falls quick in offering complete coverage. A strong coverage comprises uninsured/underinsured motorist coverage, shielding you from the monetary penalties of injuries involving drivers with inadequate or no insurance coverage. Via analyzing each and every form of protection, you’ll be able to tailor your coverage to suit your wishes and price range.

Varieties of Automobile Insurance coverage Protection

Figuring out the several types of automotive insurance plans is essential to selecting a coverage that meets your particular wishes and protects your belongings. Each and every protection kind addresses a distinct set of dangers related to automobile possession. A well-rounded working out of a majority of these protection is essential to heading off monetary pitfalls.

Legal responsibility Protection

Legal responsibility protection protects you from monetary accountability in circumstances the place you might be at fault for an twist of fate. This protection will pay for damages and accidents to different drivers or their belongings, as much as the coverage limits. On the other hand, it does no longer duvet harm on your personal automobile or your individual accidents. It is a elementary part of maximum insurance policies, pleasant prison duties.

That you must remember the fact that legal responsibility protection by myself does no longer supply whole coverage.

Collision Protection

Collision protection will pay for harm on your automobile as a result of a collision, without reference to who’s at fault. This protection is the most important as it protects your funding on your automobile. For instance, in case you are concerned about an twist of fate the place you’re at fault, your collision protection would catch up on the wear and tear on your automobile. With out this protection, you would need to undergo the whole charge of upkeep or substitute.

Complete Protection

Complete protection protects your automobile from harm brought about through occasions as opposed to collisions, equivalent to vandalism, robbery, fireplace, hail, or weather-related incidents. This protection is frequently lost sight of however provides essential coverage. For example, in case your automobile is stolen or broken in a hurricane, complete protection steps in to pay for upkeep or substitute, making sure you do not incur the whole charge your self.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is important for protecting you and your automobile from drivers missing ok insurance coverage. If you are concerned about an twist of fate with a driving force who does not have insurance coverage or whose protection is inadequate to hide the damages, this coverage steps in to hide the rest prices. With out this protection, it’s good to be left with important monetary liabilities.

Desk of Protection Varieties and Importance

| Protection Kind | Description | Significance |

|---|---|---|

| Legal responsibility | Covers damages and accidents to others if you end up at fault. | Success of prison duties and coverage towards monetary accountability. |

| Collision | Covers harm on your automobile in a collision, without reference to fault. | Protects your funding and forestalls pricey upkeep from your individual pocket. |

| Complete | Covers harm on your automobile from non-collision occasions. | Supplies coverage towards more than a few sudden perils, like robbery or climate harm. |

| Uninsured/Underinsured Motorist | Covers damages if concerned about an twist of fate with an uninsured or underinsured driving force. | An important for protecting you from monetary hardship in injuries with at-fault drivers missing ok protection. |

Guidelines for Negotiating with Insurance coverage Suppliers in Bernard Law Montgomery, AL

Securing inexpensive automotive insurance coverage in Bernard Law Montgomery, AL calls for extra than simply evaluating quotes. Negotiating with suppliers can frequently yield important financial savings. Figuring out the method and using wonderful conversation methods can result in decrease premiums and higher protection.Negotiating with insurance coverage suppliers is a proactive way that is going past merely accepting the preliminary quote. A hit negotiation hinges on working out your wishes, researching marketplace charges, and presenting a compelling case for a discounted top rate.

This comes to extra than simply passively looking forward to a reaction; it is about actively collaborating within the procedure.

Efficient Verbal exchange Methods

Efficient conversation is the most important when negotiating with insurance coverage suppliers. Transparent and concise conversation fosters a collaborative setting, enabling a smoother negotiation procedure. Be ready to articulate your wishes and considerations in a certified and respectful approach. Keep away from competitive or confrontational language, as it will impede the negotiation. As a substitute, focal point on construction a rapport and demonstrating your working out of the insurance coverage marketplace.

Studying Coverage Paperwork Sparsely

Thorough overview of coverage paperwork is paramount. Figuring out the phrases and stipulations of your coverage, together with protection boundaries, exclusions, and deductibles, lets you establish spaces for doable negotiation or explanation. This proactive way guarantees that you are totally conscious about what you might be agreeing to, fighting misunderstandings and doable disputes later. Take time to scrupulously learn and perceive each side of the coverage file, and do not hesitate to hunt explanation from the supplier if wanted.

Submitting Claims and Interesting Choices

Submitting a declare and interesting a call, if vital, calls for a well-defined procedure. A transparent and documented report of all communications, supporting proof, and related main points is the most important. Be ready to offer proof to give a boost to your case and obviously Artikel the explanations on your attraction. Insurance coverage corporations frequently have particular procedures for dealing with claims and appeals. Make yourself familiar with those procedures and practice them diligently.

Contacting Buyer Provider Representatives

Efficient conversation with customer support representatives is very important. Get ready an inventory of questions and considerations previously. Handle a certified demeanor, even all through difficult interactions. Be well mannered, respectful, and affected person. Actively concentrate to the consultant’s responses and ask clarifying questions if wanted.

Stay detailed information of all conversations, together with dates, occasions, and names of the representatives concerned.

Negotiation Ways for Decrease Premiums

A number of ways permit you to negotiate decrease premiums. Highlighting secure using behavior, equivalent to a blank using report and a low twist of fate historical past, can frequently result in reductions. Imagine bundling insurance coverage insurance policies, equivalent to combining auto and residential insurance coverage, for doable reductions. Exploring selection protection choices, equivalent to upper deductibles, may also be a viable technique.

Examples of Efficient Verbal exchange Methods

Instance 1: “I have spotted an identical protection choices are to be had at a cheaper price from [another provider]. May you fit or beat that worth?”Instance 2: “I have maintained a blank using report for the previous [number] years, and I am assured that my chance profile warrants a decrease top rate.”

Wrap-Up

So, reasonable automotive insurance coverage Bernard Law Montgomery AL is achievable with just a little of study and savvy negotiation. Evaluating quotes, working out coverages, and figuring out your choices are the most important steps. Take note to imagine your own wishes and instances when opting for the most efficient coverage for you.

FAQs: Reasonable Automobile Insurance coverage Bernard Law Montgomery Al

What is the most cost-effective automotive insurance coverage corporate in Bernard Law Montgomery, AL?

Sadly, there is no unmarried “most cost-effective” corporate. The most suitable choice relies on your particular state of affairs and protection wishes. Evaluating quotes from more than one suppliers is among the best option to discover a deal that works for you.

Can I am getting a cut price for being a scholar?

Many insurance coverage suppliers be offering scholar reductions. Take a look at with person corporations to look if they’ve a scholar program and should you qualify.

How does my using report impact my insurance coverage charges?

A blank using report is a large issue. Injuries and violations will considerably building up your premiums. Staying accident-free is one of the best ways to stay your charges low.

What is the distinction between legal responsibility and complete protection?

Legal responsibility covers damages you purpose to others. Complete covers harm on your automotive from such things as climate or vandalism, despite the fact that you might be no longer at fault. Complete is further coverage, however it is frequently price it to steer clear of hefty restore expenses.