Reasonable automotive insurance coverage Modesto CA is a an important attention for drivers within the house. Navigating the various insurance coverage marketplace may also be daunting, however figuring out the standards affecting premiums and to be had reductions assist you to in finding the most productive coverage. This complete information explores the panorama of inexpensive automotive insurance coverage in Modesto, offering insights into protection choices, supplier comparisons, and methods for securing financial savings.

Discovering inexpensive automotive insurance coverage in Modesto comes to extra than simply evaluating costs. Elements like your using document, automobile kind, and placement all play a job. This information delves into the specifics, providing actionable pointers and sources to empower you on your seek for the appropriate coverage.

Evaluate of Reasonable Automobile Insurance coverage in Modesto, CA

The Modesto, CA, automotive insurance coverage marketplace is aggressive, providing a spread of choices for drivers in search of inexpensive protection. Then again, navigating the more than a few insurance policies and figuring out the standards impacting premiums is an important for securing the most productive deal. This evaluate will explain the marketplace dynamics and assist shoppers make knowledgeable choices.The price of automotive insurance coverage in Modesto, CA, is influenced by way of a posh interaction of things.

Those elements, mentioned intimately under, are an important for figuring out the best way to safe inexpensive protection.

Elements Influencing Automobile Insurance coverage Premiums

A number of elements considerably have an effect on automotive insurance coverage premiums in Modesto, CA. Those elements range significantly and should be thought to be when comparing more than a few insurance coverage choices. Age, using document, and automobile kind all play a crucial position in top rate calculation.

- Riding Historical past: A blank using document is a significant component in acquiring inexpensive insurance coverage. Injuries, site visitors violations, and at-fault incidents considerably building up premiums. As an example, a driving force with a historical past of rushing tickets will most likely pay greater than a driving force and not using a violations. In a similar way, a driving force with a historical past of injuries could have upper premiums.

- Demographics: Demographics akin to age, gender, and placement additionally affect insurance coverage prices. More youthful drivers typically pay upper premiums because of statistically upper twist of fate charges. Location-specific elements akin to high-crime spaces or accident-prone roadways too can have an effect on insurance coverage charges.

- Car Sort: The kind of automobile a driving force owns affects insurance coverage prices. Top-performance automobiles or the ones with the next robbery threat steadily have upper premiums. That is true since the upper charge of restore or alternative portions steadily results in upper premiums. As an example, a sports activities automotive is prone to have upper premiums than a regular sedan.

- Protection Choices: The extent of protection decided on without delay impacts the top rate. Complete protection (for harm no longer brought about by way of injuries) and collision protection (for harm brought about by way of injuries) are examples of protection choices that may affect the overall top rate. Drivers should moderately assessment their wishes and finances to resolve the fitting stage of protection.

Conventional Protection Choices for Reasonably priced Automobile Insurance coverage

Reasonably priced automotive insurance coverage in Modesto, CA, steadily contains the very important coverages required by way of regulation. Drivers should keep in mind of the extent of protection wanted to give protection to themselves and their belongings. Then again, there are alternatives to scale back prices whilst keeping up very important coverage.

- Legal responsibility Protection: That is the minimal protection required by way of regulation and protects you in case you are at fault in an twist of fate. It covers damages to the opposite celebration’s automobile and accidents to them.

- Collision Protection: This protection can pay for damages in your automobile irrespective of who’s at fault. It is a an important a part of a complete insurance plans and is also essential relying on monetary elements and legal responsibility.

- Complete Protection: This covers harm in your automobile from non-collision incidents, akin to vandalism, robbery, or weather-related occasions. Whilst no longer all the time essential, complete protection gives further monetary coverage.

Comparability of Reasonable Automobile Insurance coverage Varieties

A comparability desk highlights the important thing variations between more than a few insurance coverage sorts. Choosing the proper form of insurance coverage is dependent upon person wishes and threat tolerance.

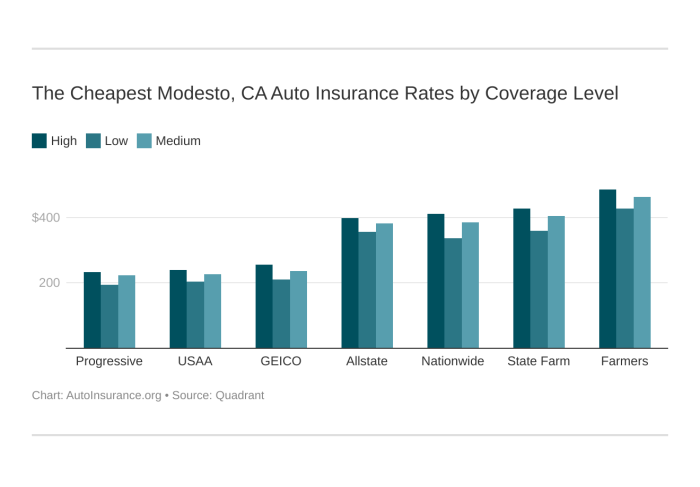

Evaluating Insurance coverage Suppliers in Modesto, CA

Choosing the proper automotive insurance coverage supplier in Modesto, CA is an important for monetary coverage and peace of thoughts. Working out the more than a few choices and their strengths and weaknesses empowers you to make an educated determination. A radical comparability of key suppliers is very important to spot the most productive have compatibility to your particular wishes and finances.Navigating the insurance coverage marketplace can really feel overwhelming, with a large number of firms vying for what you are promoting.

This phase will delve right into a comparability of most sensible suppliers in Modesto, highlighting their protection applications, pricing buildings, and customer support reputations. This in-depth research will let you make an educated determination.

Most sensible Insurance coverage Suppliers in Modesto, CA

A number of insurance coverage suppliers perform in Modesto, providing various ranges of carrier and pricing. Figuring out the highest contenders out there is an important for an intensive comparability. Key avid gamers steadily come with national firms, regional giants, and native companies, every with its personal technique to pricing and customer support. According to marketplace percentage, popularity, and availability within the house, probably the most maximum outstanding suppliers usually are State Farm, Geico, and Revolutionary.

Protection Applications and Pricing Buildings

Insurance coverage suppliers in Modesto be offering a spread of protection applications. Working out those applications is necessary for choosing the right coverage. A complete comparability of those applications calls for inspecting legal responsibility protection, collision protection, complete protection, and doubtlessly further protection choices akin to uninsured/underinsured motorist protection. Value comparisons will have to account for deductibles, coverage limits, and any reductions that could be to be had.

Policyholders will have to additionally imagine the precise wishes in their automobile and using historical past when assessing other protection applications.

Buyer Carrier Popularity

Customer support performs a crucial position within the insurance coverage purchasing revel in. A supplier’s popularity for responsiveness, potency, and dealing with claims successfully can considerably affect your selection. Critiques, rankings, and testimonials from earlier consumers be offering treasured insights right into a supplier’s customer support features. Sure comments steadily issues to easy declare processes, instructed verbal exchange, and a determination to resolving buyer problems.

Comparability Desk

| Supplier | Strengths | Weaknesses | Buyer Carrier |

|---|---|---|---|

| State Farm | Sturdy emblem popularity, intensive community, wide variety of protection choices, steadily aggressive pricing. | Doable for paperwork in declare processes, occasionally perceived as much less aware of buyer wishes than smaller suppliers. | In most cases thought to be dependable, with a well-established presence. Then again, buyer opinions counsel room for development in instant reaction time. |

| Geico | Recognized for aggressive pricing, user-friendly on-line platform, steadily excellent for younger drivers or the ones with excellent using information. | Would possibly be offering much less complete protection applications in comparison to a few competition, occasionally perceived as missing customized carrier. | Customer support rankings range; some document sure reviews with on-line platforms, whilst others specific frustration with telephone interactions. |

| Revolutionary | Aggressive pricing, cutting edge on-line gear, and steadily gives excellent reductions, particularly for secure drivers. | Restricted native presence in comparison to a few competition, doubtlessly much less customized carrier. | In most cases rated definitely for on-line buyer strengthen and potency in claims processing, however some consumers have reported demanding situations with telephone help. |

| (Non-compulsory: Upload a fourth/5th supplier in keeping with native marketplace knowledge) |

Reductions and Financial savings Methods for Reasonable Automobile Insurance coverage

Securing inexpensive automotive insurance coverage in Modesto, CA calls for a proactive way, and strategically leveraging to be had reductions is an important. Working out the more than a few bargain alternatives and enforcing high quality financial savings methods can considerably cut back your insurance coverage premiums. This phase main points to be had reductions, the best way to safe them, and examples related to Modesto drivers.Maximizing reductions is a confirmed approach for acquiring decrease automotive insurance coverage premiums.

Cautious attention of your using historical past, automobile traits, and way of life alternatives can liberate important financial savings. Via figuring out the nuances of every bargain, Modesto drivers could make knowledgeable choices to reduce their insurance coverage prices.

Reductions To be had for Modesto Drivers

A lot of reductions are to be had to Modesto drivers, steadily in keeping with elements akin to using document, automobile options, and way of life alternatives. Working out those reductions is vital to acquiring the most productive conceivable charges.

- Secure Riding Historical past: Insurance coverage firms incessantly be offering reductions to drivers with a blank using document, demonstrating accountable habits at the street. This features a loss of injuries and site visitors violations. As an example, a driving force and not using a injuries or violations for 5 years would possibly qualify for a fifteen% bargain.

- Defensive Riding Classes: Finishing defensive using classes can show a dedication to secure using practices, steadily leading to discounted premiums. Those classes equip drivers with methods to steer clear of injuries and care for secure using conduct.

- Car Options: Insurance coverage firms steadily supply reductions for automobiles with security measures like anti-theft units, airbags, and complicated braking methods. A automobile provided with more than one security measures would possibly qualify for a mixed bargain, doubtlessly lowering premiums by way of 10% or extra.

- Bundling Insurance coverage Insurance policies: Bundling more than one insurance coverage insurance policies, akin to house and auto insurance coverage, with the similar supplier, can steadily yield a mixed bargain. This technique is recommended for Modesto citizens who hang more than a few insurance coverage insurance policies. Combining auto and house owners insurance coverage with the similar supplier would possibly lead to a 5-10% relief.

- Just right Pupil Standing: Insurers incessantly be offering reductions to scholars enrolled in a highschool or faculty. This displays the decrease threat profile of younger drivers actively engaged in instructional interests.

Learn how to Safe Reductions and Financial savings

Proactively in search of and claiming to be had reductions is an important for minimizing automotive insurance coverage premiums. Insurers be offering more than a few reductions, and drivers want to be diligent in figuring out and making use of for them.

- Overview Insurance coverage Insurance policies Frequently: Frequently reviewing your insurance plans is very important to spot any doable reductions you could be eligible for. Insurance coverage suppliers incessantly replace their reductions, and drivers will have to test for any adjustments or newly added choices.

- Evaluate Insurance coverage Quotes: Evaluating quotes from more than one insurance coverage suppliers is very important for acquiring the most productive conceivable charges. Other suppliers be offering more than a few reductions, and evaluating quotes lets in drivers to spot and leverage the ones reductions.

- Care for a Blank Riding Document: A spotless using document is a key consider acquiring decrease insurance coverage premiums. Steer clear of injuries and site visitors violations to care for eligibility for safe-driving reductions.

- Set up Protection Options: Believe putting in security measures on your automobile to doubtlessly qualify for reductions. This demonstrates a proactive technique to protection and would possibly lead to decrease premiums.

Insurance coverage Reductions According to Motive force Profile and Car Options

Motive force profiles and automobile traits steadily affect insurance coverage reductions. Those elements give a contribution to the whole threat overview by way of insurance coverage suppliers.

- Age and Revel in: More youthful drivers typically have upper premiums because of their upper threat profile. As drivers acquire revel in and show accountable habits, premiums in most cases lower.

- Marital Standing: Married drivers steadily obtain reductions, reflecting a decrease threat profile in comparison to unmarried drivers. That is steadily attributed to shared duties and a extra solid way of life.

- Car Protection Rankings: Automobiles with upper protection rankings steadily qualify for reductions, reflecting the diminished threat related to more secure automobiles. Vehicles with complicated security measures are prone to have decrease premiums.

Evaluating and Contrasting Cut price Alternatives

Evaluating and contrasting bargain alternatives lets in drivers to make knowledgeable choices referring to their insurance coverage insurance policies. Drivers will have to moderately analyze the phrases and prerequisites of every bargain to resolve which of them are maximum recommended.

| Cut price Class | Description | Instance |

|---|---|---|

| Secure Riding Historical past | Reductions in keeping with accident-free using information. | 5-15% bargain for drivers and not using a injuries or violations for a undeniable length. |

| Defensive Riding Classes | Reductions for finishing defensive using classes. | 5-10% bargain for effectively finishing a defensive using direction. |

| Car Options | Reductions for automobiles with complicated security measures. | 3-7% bargain for automobiles provided with anti-theft methods, airbags, and complicated braking methods. |

| Bundling Insurance coverage Insurance policies | Reductions for bundling more than one insurance coverage insurance policies. | 5-10% bargain for bundling auto and residential insurance coverage insurance policies. |

| Just right Pupil Standing | Reductions for college kids actively pursuing training. | 2-5% bargain for college kids enrolled in highschool or faculty. |

Elements Affecting Automobile Insurance coverage Prices in Modesto: Reasonable Automobile Insurance coverage Modesto Ca

Automobile insurance coverage premiums in Modesto, CA, are influenced by way of a posh interaction of things, and figuring out those elements is an important for securing inexpensive protection. The town’s particular traits, together with site visitors patterns and demographics, give a contribution to the whole threat overview that insurers use to resolve charges. This overview without delay affects the price of your coverage.Insurers meticulously analyze more than a few knowledge issues to determine charges, making knowledgeable choices about pricing.

This knowledge-driven way targets to steadiness affordability with threat control, a procedure crucial to keeping up a solid insurance coverage marketplace.

Visitors Injuries and Insurance coverage Premiums

Visitors injuries considerably have an effect on automotive insurance coverage charges in Modesto. The next frequency of injuries in a selected house results in higher premiums for all drivers in that house. It is because insurers should account for the increased threat of claims. Injuries, whether or not minor or main, give a contribution to the next total declare charge for the insurance coverage corporate, which is mirrored within the charges.Modesto, like different city spaces, reviews fluctuations in twist of fate charges.

Information from the California Division of Motor Automobiles (DMV) presentations a correlation between twist of fate frequency and insurance coverage premiums. As an example, spaces with upper charges of rear-end collisions would possibly see premiums building up for all drivers. This displays the upper likelihood of claims coming up from that particular form of twist of fate. In a similar way, an building up in injuries involving particular sorts of automobiles (e.g., older style automobiles) may additionally result in upper charges for the ones automobile sorts.

Car Sort and Options Affecting Insurance coverage Prices

The kind and contours of a automobile play a pivotal position in figuring out insurance coverage prices. It is because positive automobiles are inherently dearer to fix or substitute than others. Luxurious automobiles, for instance, incessantly contain upper restore prices because of their complicated elements and specialised portions. This interprets to raised premiums for house owners of such automobiles.Moreover, automobiles with complicated security measures, like airbags and anti-lock brakes, typically lead to decrease premiums.

This displays the diminished threat of injuries and accidents related to those options. Insurers use knowledge research to resolve how more than a few automobile sorts and contours have an effect on declare frequencies and severity.

Motive force Age and Revel in and Insurance coverage Prices

Motive force age and revel in are important elements in figuring out automotive insurance coverage premiums. More youthful drivers, in most cases, are assigned upper premiums because of their perceived upper twist of fate threat in comparison to older, extra skilled drivers. This upper threat is steadily attributed to inexperience, which would possibly result in extra common injuries.In a similar way, drivers with a historical past of site visitors violations, akin to rushing tickets or DUI convictions, face upper premiums.

Those violations show a development of dangerous using habits, which raises the insurer’s overview of threat. Insurers make the most of knowledge to spot traits and patterns in twist of fate charges and declare histories for various age teams and driving force revel in ranges.

Float Chart: Injuries’ Impact on Insurance coverage Premiums

Sources and Gear for Discovering Reasonable Automobile Insurance coverage

Securing inexpensive automotive insurance coverage in Modesto, CA, calls for strategic use of readily to be had sources. Comparability gear supply a formidable benefit, permitting drivers to impulsively analyze more than a few insurance policies and establish essentially the most cost-effective choices. A proactive way, coupled with cautious analysis, is vital to attaining optimum financial savings.

On-line Comparability Gear

On-line comparability gear are indispensable for locating aggressive automotive insurance coverage quotes. Those platforms mixture knowledge from more than one insurance coverage suppliers, enabling a complete evaluate of to be had insurance policies. This streamlined way saves important effort and time in comparison to manually contacting every supplier. Crucially, those gear empower drivers to check options and costs, facilitating knowledgeable choices.

Advantages and Boundaries of Comparability Gear

Using comparability gear yields a large number of benefits. They furnish a wide spectrum of quotes, enabling drivers to spot doable financial savings. The gear are steadily user-friendly, making an allowance for simple navigation and coverage variety. Then again, boundaries exist. The introduced quotes would possibly no longer surround all to be had reductions or particular gives.

Drivers should stay vigilant, cross-referencing quotes and contacting insurers without delay to make sure they are not lacking out on doubtlessly higher offers. In essence, comparability gear supply a place to begin however do not ensure without equal highest conceivable value.

Efficient Use of Comparability Gear

To leverage comparability gear successfully, drivers will have to supply correct details about their automobile, using historical past, and protection wishes. This meticulous way guarantees exact quote era. Moderately scrutinize the main points of every quote, paying explicit consideration to protection limits, deductibles, and related charges. Do not hesitate to touch insurers without delay for explanation on particular facets of the coverage. Via using a methodical way, drivers can reach a extremely aggressive insurance coverage charge.

Navigating the Modesto Automobile Insurance coverage Marketplace

The Modesto automotive insurance coverage marketplace, like others, items nuances. Drivers will have to take note of native elements that would possibly affect premiums, akin to site visitors patterns or twist of fate charges. Familiarizing themselves with those elements lets in for a extra knowledgeable overview of doable coverage prices. Moreover, keeping up a good using document, fending off site visitors violations, and demonstrating accountable using conduct can considerably have an effect on insurance coverage premiums.

Staying knowledgeable and actively collaborating within the procedure is very important to securing essentially the most favorable insurance coverage charges.

Comparability of On-line Automobile Insurance coverage Comparability Gear, Reasonable automotive insurance coverage modesto ca

| Software | Options | Professionals | Cons |

|---|---|---|---|

| Insurify | Intensive community of insurers, user-friendly interface, customized suggestions. | Wide selection of quotes, simple comparability, doubtlessly identifies hidden reductions. | Would possibly not all the time be offering absolutely the lowest value, some options require a subscription. |

| Policygenius | Complete protection choices, easy quote procedure, devoted buyer strengthen. | In-depth coverage explanations, help with more than a few protection wishes, readily to be had strengthen. | Restricted number of insurers in comparison to a few competition, is probably not supreme for extraordinarily particular wishes. |

| Insure.com | Supplies more than one insurer quotes, highlights financial savings alternatives, lets in for speedy coverage comparability. | Simple-to-understand comparability charts, handy options, doable for important financial savings. | Accuracy of displayed knowledge would possibly range rather, is probably not your best choice for complicated coverage necessities. |

Pointers for Opting for the Proper Automobile Insurance coverage Coverage

Choosing the proper automotive insurance plans is an important for shielding your monetary well-being and making sure peace of thoughts. A poorly decided on coverage can go away you prone to important monetary burdens within the tournament of an twist of fate or different coated incident. Working out the nuances of various insurance policies and moderately taking into consideration your particular wishes is paramount.Settling on a automotive insurance plans that adequately addresses your dangers and finances calls for cautious attention.

This comes to comparing your using historical past, automobile kind, and placement, and evaluating more than a few insurance coverage suppliers’ choices. A radical figuring out of protection choices and exclusions is very important to steer clear of surprising gaps in coverage.

Elements to Believe When Settling on a Coverage

Cautious analysis of more than a few elements is important for choosing the right automotive insurance plans. Those elements come with your using document, the worth of your automobile, and the precise protection you require. Working out your own wishes and personal tastes along side to be had choices will result in essentially the most appropriate coverage.

- Riding Document: A blank using document in most cases ends up in decrease premiums. Injuries or site visitors violations considerably building up insurance coverage prices. Ancient knowledge to your using conduct will have an effect on your insurance coverage charge.

- Car Sort and Worth: Luxurious automobiles or high-performance automobiles steadily command upper insurance coverage premiums because of their upper restore prices. In a similar way, the worth of your automobile affects the volume of protection chances are you’ll want.

- Protection Wishes: Believe the extent of protection you wish to have in keeping with your monetary state of affairs and the possible dangers related together with your way of life and using conduct. Complete protection, collision protection, and legal responsibility protection all give a contribution to the whole charge.

- Deductibles: The next deductible in most cases results in decrease premiums. Then again, be ready to pay a bigger quantity out-of-pocket within the tournament of a declare. Working out the trade-off between premiums and doable out-of-pocket prices is very important.

- Location: Spaces with upper charges of injuries or site visitors incidents steadily have upper insurance coverage premiums. Your location performs an important position in figuring out your insurance coverage charges.

Significance of Studying Coverage Paperwork Moderately

Thorough evaluate of coverage paperwork is very important for fending off long run disputes and making sure you already know the phrases and prerequisites. A cursory look may end up in surprising prices or protection gaps.

- Working out Coverage Language: Coverage paperwork steadily use complicated prison terminology. Taking the time to grasp the language is an important to steer clear of misinterpretations. Search explanation if essential.

- Reviewing Protection Limits: Test that the protection limits align together with your wishes and monetary state of affairs. Make sure to have enough protection to give protection to your self within the tournament of an important loss.

- Figuring out Exclusions: Moderately evaluate the coverage exclusions to grasp what occasions or scenarios don’t seem to be coated. This is helping you look ahead to doable gaps in protection.

Working out and Evaluating Protection Choices

Evaluating other protection choices is necessary for making an educated determination. This procedure calls for a scientific technique to assessment more than a few coverage options and their implications.

- Legal responsibility Protection: This covers damages you motive to others in an twist of fate. Working out the other legal responsibility limits is vital.

- Collision Protection: This covers damages in your automobile irrespective of who’s at fault.

- Complete Protection: This covers damages in your automobile brought about by way of occasions as opposed to collisions, akin to robbery, vandalism, or climate occasions.

Working out Coverage Exclusions

Working out coverage exclusions is an important to steer clear of surprising gaps in protection. Those clauses Artikel the precise scenarios or cases no longer coated by way of the coverage.

- Pre-existing Stipulations: Some insurance policies would possibly exclude protection for pre-existing stipulations. A radical figuring out of those exclusions is an important.

- Explicit Actions: Positive actions, like racing or collaborating in high-risk sports activities, could be excluded from protection.

- Car Use: Explicit makes use of of the automobile, like the usage of it for business functions, may not be coated. It is a an important house to grasp.

Tick list for Reviewing Automobile Insurance coverage Insurance policies

A tick list for reviewing automotive insurance coverage insurance policies can assist streamline the method and make sure complete analysis.

- Protection Limits: Overview the protection quantities for legal responsibility, collision, and complete.

- Deductibles: Evaluate deductible quantities throughout other insurance policies.

- Exclusions: Moderately evaluate the checklist of exclusions to spot doable gaps in protection.

- Coverage Duration: Test the coverage period and renewal dates.

- Coverage Prices: Evaluate the whole charge of various insurance policies.

Result Abstract

In conclusion, securing affordable automotive insurance coverage in Modesto calls for a proactive way. Via figuring out the important thing elements influencing prices, evaluating suppliers, and exploring to be had reductions, you’ll be able to discover a coverage that meets your wishes with out breaking the financial institution. This information supplies a place to begin, and using on-line sources and in search of skilled recommendation can additional refine your seek for essentially the most appropriate automotive insurance coverage in Modesto, CA.

Questions and Solutions

What’s the moderate charge of vehicle insurance coverage in Modesto, CA?

Moderate prices range considerably relying on elements like using document, automobile kind, and protection alternatives. Contacting native insurance coverage brokers or the usage of on-line comparability gear is beneficial to get a customized estimate.

What reductions are in most cases to be had for Modesto drivers?

Reductions steadily come with the ones for secure using, more than one automobiles, excellent scholar standing, and likely automobile options. Explicit main points are dependent at the insurer.

How does my using document have an effect on my automotive insurance coverage top rate in Modesto?

A blank using document in most cases results in decrease premiums. Injuries or violations can considerably building up your charges. Constant secure using practices are an important.

Can I in finding automotive insurance coverage comparability gear on-line for Modesto?

Sure, a number of web sites be offering gear to check quotes from more than a few insurers in Modesto. Use those gear to get more than one quotes and establish doable financial savings.