Reasonable automobile insurance coverage Castle Lauderdale FL is a significant recreation, and this information’s gonna spoil it down. We’re going to quilt the whole lot from the native marketplace to savvy techniques to slash your premiums. Castle Lauderdale’s were given some distinctive elements affecting charges, so let’s get into it.

From evaluating quotes to working out protection sorts, this information supplies a complete assessment of securing inexpensive automobile insurance coverage in Castle Lauderdale, Florida. Navigating the insurance coverage maze can also be tough, however we have were given you coated with skilled recommendation and actionable pointers.

Creation to Inexpensive Automobile Insurance coverage in Castle Lauderdale, FL

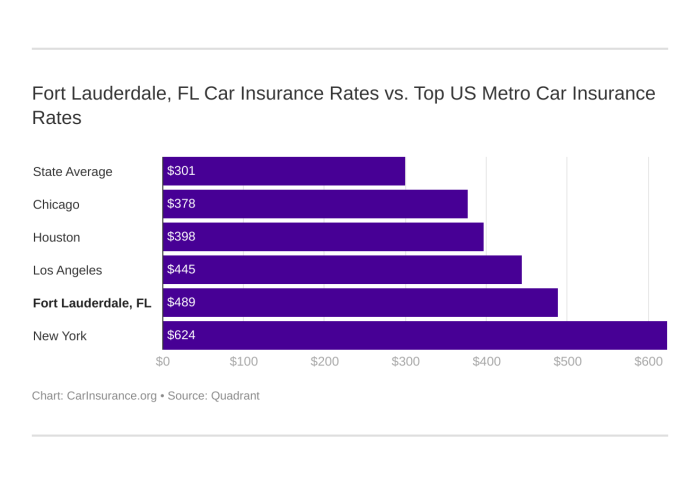

The Castle Lauderdale, FL, automobile insurance coverage marketplace items a posh panorama, influenced by way of elements like excessive inhabitants density, particular climate patterns, and a mixture of demographics. Discovering inexpensive protection whilst keeping up ok coverage can also be difficult for drivers on this house. Figuring out the nuances of the marketplace and the variables affecting charges is the most important for securing aggressive insurance coverage premiums.Aggressive pricing is a key side of navigating the auto insurance coverage marketplace in Castle Lauderdale.

That is pushed by way of the provision of more than one insurers vying for purchasers, but in addition by way of the want to overview elements like menace profiles, car sorts, and driving force historical past to resolve suitable premiums. Figuring out those influencing elements is very important to acquiring an acceptable insurance coverage.

Not unusual Components Influencing Automobile Insurance coverage Charges

A large number of elements give a contribution to the price of automobile insurance coverage in Castle Lauderdale, and those are regularly intertwined. Demographic elements, akin to age and using historical past, considerably affect charges. More youthful drivers regularly face greater premiums because of their perceived greater menace profile, whilst older drivers with a confirmed historical past of protected using may see decrease charges. In a similar way, a driving force’s location inside of Castle Lauderdale can affect premiums because of diversifications in visitors density and twist of fate charges.

Car sort and worth additionally play a essential position; higher-value cars regularly require greater insurance plans, which interprets to better premiums. Moreover, claims historical past, each non-public and within the insured’s fast circle of relatives, will have an effect on premiums. Those elements are thought to be when insurers assess menace and resolve suitable charges.

Comparability of Insurance coverage Quotes

Evaluating quotes from quite a lot of insurance coverage suppliers is very important for acquiring probably the most aggressive charges. Other insurers use other methodologies for calculating premiums, and the consequent charges can range considerably. An intensive comparability throughout more than one suppliers, together with native and nationwide firms, may end up in really extensive financial savings. Through working out the protection choices presented by way of other suppliers, drivers can make a choice insurance policies that absolute best meet their particular wishes and price range.

Dependable Insurance coverage Corporations in Castle Lauderdale, FL

A lot of insurance coverage firms perform within the Castle Lauderdale house, providing a spread of services. Opting for a credible corporate is the most important to making sure dependable protection and repair. Some well-established and respected insurance coverage suppliers within the area come with State Farm, Allstate, Geico, Innovative, and Liberty Mutual. You will need to analysis the monetary steadiness and customer support scores of each and every corporate earlier than you decide.

- State Farm: Recognized for its in depth community and complete protection choices.

- Allstate: Provides quite a lot of insurance policies, together with each conventional and custom designed choices.

- Geico: A well-liked nationwide corporate with aggressive charges and obtainable on-line products and services.

- Innovative: Regularly praised for its user-friendly on-line platform and aggressive pricing methods.

- Liberty Mutual: Known for its customer support and concentrate on offering complete insurance coverage answers.

Ancient Developments in Castle Lauderdale Automobile Insurance coverage

The automobile insurance coverage marketplace in Castle Lauderdale, like in other places, has observed vital evolution. To begin with, charges had been regularly according to a mix of things like car cost and driving force age, with little emphasis on particular person using data. Through the years, insurers started incorporating extra refined menace overview methodologies, together with using behavior and claims historical past, resulting in a extra individualized strategy to pricing.

This pattern in opposition to personalised pricing continues nowadays, with insurers the usage of complicated applied sciences to additional refine their menace overview methods.

Figuring out Components Affecting Insurance coverage Premiums: Reasonable Automobile Insurance coverage Castle Lauderdale Fl

Insurance coverage premiums in Castle Lauderdale, FL, are influenced by way of numerous elements past easy demographics. Figuring out those elements is the most important for securing probably the most inexpensive protection whilst keeping up ok coverage. An intensive research of those components empowers folks to make knowledgeable selections referring to their insurance coverage alternatives.A large number of variables, starting from using habits to car traits, give a contribution to the general top rate quantity.

Every issue performs a particular position in calculating the danger profile related to a selected policyholder. The overview of those dangers by way of insurance coverage firms immediately affects the price of premiums.

Have an effect on of Using Information on Insurance coverage Prices

Using data are a number one determinant in organising insurance coverage premiums. Injuries and violations, each shifting and non-moving, considerably build up insurance coverage prices. A historical past of injuries, specifically the ones involving critical accidents or assets injury, considerably elevates the danger profile, main to better premiums. In a similar way, repeated visitors violations, akin to rushing tickets or reckless using convictions, point out a better probability of long run incidents, thus justifying a top rate build up.

Insurance coverage firms use refined algorithms to investigate using data and assess the danger related to each and every policyholder.

Have an effect on of Car Sort and Style on Premiums

The kind and type of a car play a considerable position in figuring out insurance coverage premiums. Positive car sorts, specifically the ones identified for greater twist of fate charges or extra expensive upkeep, command greater premiums. Luxurious cars, sports activities vehicles, and high-performance fashions regularly fall into this class because of the higher attainable for injury and service prices. The car’s make and type additionally issue into the calculation, as positive manufacturers and fashions could have a better price of robbery or injuries, resulting in an higher top rate.

Insurance coverage firms meticulously analyze knowledge on car injuries, thefts, and service prices to regulate premiums accordingly.

Position of Location inside of Castle Lauderdale, FL, on Insurance coverage Charges

Geographic location inside of Castle Lauderdale, FL, can affect insurance coverage charges. Spaces with greater crime charges, specifically the ones susceptible to injuries because of heavy visitors or deficient highway stipulations, have a tendency to have greater premiums. Particular neighborhoods or streets identified for greater incident charges of robbery or vandalism might replicate within the premiums. Insurance coverage firms habits thorough analyses of native crime statistics, twist of fate experiences, and visitors patterns to evaluate the danger stage related to each and every location.

Comparability of Age and Gender on Automobile Insurance coverage Prices

Age and gender are vital elements influencing automobile insurance coverage premiums in Castle Lauderdale, FL. More youthful drivers, specifically the ones of their teenagers and early twenties, regularly face greater premiums because of their statistically greater twist of fate charges. That is in large part attributed to a mix of inexperience, greater risk-taking behaviors, and no more using revel in. In a similar way, gender might also play a minor position, even though the impact is regularly much less vital than age.

Insurance coverage firms depend on in depth knowledge units to ascertain age-related and gender-related menace profiles and regulate premiums accordingly.

Reductions To be had to Policyholders in Castle Lauderdale, FL

A number of reductions are to be had to policyholders in Castle Lauderdale, FL, to probably scale back premiums. Those reductions can also be classified into differing types. Examples come with protected driving force reductions for accident-free data, multi-vehicle reductions for more than one cars insured below the similar coverage, and anti-theft tool reductions for cars provided with safety methods. Insurance coverage firms normally be offering reductions for quite a lot of elements, akin to anti-theft units, accident-free using data, or excellent pupil standing.

A whole record of to be had reductions must be reviewed with the insurance coverage supplier.

Exploring Other Insurance coverage Suppliers

Selecting the best automobile insurance coverage supplier in Castle Lauderdale, FL, is the most important for securing monetary coverage and aggressive pricing. Figuring out the strengths and weaknesses of quite a lot of firms, together with their claims dealing with procedures and customer support, is paramount to creating an educated determination. This segment delves into distinguished insurance coverage suppliers, examining their protection choices, premiums, and buyer critiques to help customers to find the most efficient are compatible for his or her wishes.

Distinguished Insurance coverage Corporations in Castle Lauderdale

A number of insurance coverage firms be offering aggressive charges and complete protection in Castle Lauderdale. Key avid gamers come with Geico, State Farm, Innovative, Allstate, and Liberty Mutual.

Research of Insurance coverage Supplier Strengths and Weaknesses

Every insurance coverage supplier possesses distinctive strengths and weaknesses in customer support, claims dealing with, and coverage options. Components like corporate popularity, buyer comments, and particular coverage choices give a contribution to the entire overview.

- Geico: Regularly cited for aggressive pricing, Geico might occasionally face demanding situations in claims dealing with, as reported by way of some consumers. Their coverage choices are in most cases same old, however reductions and particular methods can lend a hand decrease premiums.

- State Farm: Recognized for its in depth community of brokers and an extended historical past within the trade, State Farm regularly supplies personalised provider. Then again, some consumers record probably greater premiums in comparison to different suppliers. Their protection is complete and contains quite a lot of add-on choices.

- Innovative: Innovative excels in the usage of era to streamline the claims procedure and be offering handy on-line equipment. Whilst this improves potency, some consumers have reported difficulties in positive claims scenarios. Their insurance policies normally come with same old protection programs.

- Allstate: Allstate supplies a vast vary of protection choices, together with adapted answers for particular wishes. Buyer critiques point out combined reviews, with some highlighting superb provider whilst others record demanding situations in claims dealing with. Their pricing varies relying at the coverage and driving force profile.

- Liberty Mutual: Liberty Mutual is understood for its robust monetary steadiness and regularly provides aggressive premiums. Customer support critiques are in most cases certain, however claims dealing with procedures might range according to the person case. They continuously be offering reductions and bundles.

Protection Choices and Coverage Options

Insurance coverage suppliers be offering quite a lot of protection choices, starting from fundamental legal responsibility protection to complete and collision protection. Figuring out the several types of protection is very important to choosing probably the most appropriate coverage on your wishes.

Comparative Research of Coverage Choices

| Insurance coverage Corporate | Reasonable Top rate (Estimated) | Protection Main points (Instance) | Buyer Evaluations (Abstract) |

|---|---|---|---|

| Geico | $950 | Legal responsibility, complete, collision, uninsured/underinsured motorist | Usually certain for pricing, combined on claims dealing with. |

| State Farm | $1100 | Legal responsibility, complete, collision, uninsured/underinsured motorist, roadside help | Sure for agent community, probably greater premiums. |

| Innovative | $1025 | Legal responsibility, complete, collision, twist of fate forgiveness | Sure for on-line equipment, combined for claims dealing with in some circumstances. |

| Allstate | $1075 | Legal responsibility, complete, collision, non-public harm coverage | Blended, relying on particular agent and declare scenario. |

| Liberty Mutual | $1000 | Legal responsibility, complete, collision, condo automobile protection | Sure for monetary steadiness, combined on declare answer. |

To be had Reductions

Insurance coverage firms regularly be offering reductions to incentivize consumers. Those reductions can range considerably and rely on elements like driving force historical past, car sort, and utilization.

| Insurance coverage Corporate | Instance Reductions |

|---|---|

| Geico | Just right pupil cut price, multi-policy cut price, anti-theft tool cut price |

| State Farm | Just right pupil cut price, multi-policy cut price, defensive using route cut price |

| Innovative | Multi-policy cut price, twist of fate forgiveness cut price, excellent pupil cut price |

| Allstate | Just right pupil cut price, multi-policy cut price, anti-theft tool cut price |

| Liberty Mutual | Multi-policy cut price, excellent pupil cut price, anti-theft tool cut price |

Methods for Securing Reasonable Automobile Insurance coverage

Securing inexpensive automobile insurance coverage in Castle Lauderdale, FL, comes to a multifaceted method that is going past merely opting for the bottom top rate. A complete working out of quite a lot of elements influencing charges and proactive methods are the most important for reaching cost-effective protection. This segment Artikels key methods to acquire probably the most aggressive automobile insurance coverage charges.Evaluating quotes from more than one suppliers is a essential step in securing inexpensive automobile insurance coverage.

This procedure permits for an in depth research of protection choices and pricing constructions, enabling knowledgeable selections. The provision of on-line sources considerably facilitates this comparability procedure.

Evaluating Insurance coverage Quotes

A complete strategy to evaluating quotes comes to systematically amassing data from quite a lot of suppliers. This meticulous procedure guarantees an even overview of the to be had choices. Without delay contacting insurance coverage firms and using on-line comparability equipment are fine strategies for acquiring more than one quotes.

- Direct Contacting Insurance coverage Corporations: This system comes to contacting insurance coverage firms immediately, asking for quotes, and in moderation comparing the presented protection and pricing. Whilst probably time-consuming, it could actually yield personalised quotes adapted to express wishes.

- Using On-line Comparability Gear: On-line comparability equipment be offering a streamlined and environment friendly approach for acquiring quotes from more than one suppliers concurrently. Customers enter their car data, using historical past, and desired protection, and the instrument aggregates quotes from quite a lot of firms. This system saves really extensive effort and time, permitting a fast comparability of quite a lot of pricing constructions.

Acquiring On-line Quotes Successfully

Acquiring on-line quotes successfully comes to a methodical method, making sure correct and entire data is equipped. A well-structured procedure minimizes mistakes and maximizes the accuracy of the generated quotes.

- Correct Car Knowledge: Supply actual information about the car, together with make, type, 12 months, and VIN (Car Id Quantity). Inaccuracies on this knowledge may end up in misguided or deceptive quotes.

- Actual Using Historical past: Correctly record your using historical past, together with any injuries, violations, or claims. Transparency on this house is the most important for receiving correct quotes.

- Complete Protection Variety: Moderately evaluation and make a choice the proper protection choices, together with legal responsibility, collision, complete, and uninsured/underinsured motorist protection. Choosing the proper stage of protection balances coverage and cost-effectiveness.

- Evaluate and Comparability: Totally evaluation the quotes from other suppliers, being attentive to main points akin to protection limits, deductibles, and premiums. Evaluating the quite a lot of choices facilitates an educated determination.

Bundling Insurance coverage Insurance policies

Bundling insurance coverage insurance policies, akin to house and auto insurance coverage, can considerably scale back premiums. Insurance coverage suppliers regularly be offering discounted charges for purchasers who mix more than one insurance policies below one umbrella.

This technique could be a financially horny possibility for customers who want to consolidate their insurance coverage wishes.

The use of Comparability Web pages

Using devoted comparability web sites is a good approach for examining and evaluating insurance coverage charges. Those web sites combination knowledge from more than one suppliers, enabling a complete comparability. This instrument permits for speedy and fine analysis of the to be had choices.

Keeping up a Just right Using Report

Keeping up a blank using report is very important for securing favorable insurance coverage charges. A constant historical past of protected using practices displays undoubtedly on insurance coverage premiums.

- Keeping off Injuries and Violations: Prioritizing protected using practices and adhering to visitors regulations minimizes the danger of injuries and violations. This immediately affects the insurance coverage premiums charged by way of suppliers.

- Reporting Injuries Promptly: Within the unlucky match of an twist of fate, reporting it promptly to the government and insurance coverage corporate is important. Following this process maintains a transparent report of the incident and avoids attainable headaches.

Figuring out Insurance coverage Protection Choices

Opting for the proper automobile insurance plans is the most important for safeguarding your monetary well-being and making sure ok coverage within the match of an twist of fate or injury on your car. Figuring out the several types of protection to be had, their phrases, stipulations, and barriers, is very important for making knowledgeable selections and securing probably the most appropriate coverage on your wishes and price range.

Kinds of Protection

Quite a lot of protection choices are to be had to safeguard your car and private pursuits. Figuring out those choices is important for choosing the right coverage. Legal responsibility protection, as an example, protects you in opposition to monetary accountability for damages to others. Collision protection protects your car in opposition to injury from a collision with some other car or object, whilst complete protection addresses injury from perils past collisions, akin to robbery, vandalism, or herbal failures.

Legal responsibility Protection

Legal responsibility protection, a basic element of maximum insurance policies, protects policyholders from monetary accountability coming up from damages brought about to different events. This protection normally contains physically harm legal responsibility and assets injury legal responsibility. Physically harm legal responsibility covers clinical bills and misplaced wages for injured events in injuries involving your car. Belongings injury legal responsibility compensates for injury to the valuables of others due to an twist of fate you might be liable for.

Coverage limits outline the utmost quantity the insurance coverage corporate pays for claims below this protection.

Collision Protection

Collision protection will pay for damages on your car if it is all for a collision, irrespective of fault. This protection regularly contains deductibles, which can be the quantities you might be liable for paying out of pocket earlier than the insurance coverage corporate steps in. The next deductible may end up in decrease premiums, nevertheless it additionally manner a better monetary burden in the event you record a declare.

The verdict to buy collision protection must be made according to elements like your car’s cost, your price range, and your using behavior.

Complete Protection

Complete protection addresses damages on your car from occasions past collisions. Those occasions can come with robbery, vandalism, hearth, hail, and climate occasions. It protects your funding in opposition to unexpected instances that might considerably scale back the price of your car. Complete protection can also be a very powerful attention for cars parked in high-risk spaces or the ones with distinctive vulnerabilities.

Coverage Phrases and Stipulations

Moderately reviewing the coverage’s phrases and stipulations is paramount. Those paperwork Artikel the specifics of your protection, together with exclusions, barriers, and obligations. Figuring out those clauses is important to warding off misunderstandings and disputes within the match of a declare.

Exclusions and Boundaries

Insurance coverage insurance policies regularly include exclusions and barriers that designate scenarios the place protection won’t follow. As an example, some insurance policies might exclude protection for pre-existing injury or injury brought about by way of intentional acts. Figuring out those barriers is very important to keep away from surprises when creating a declare. Reviewing the precise language of your coverage is the most important for making sure you’ve gotten the proper protection.

Deductibles and Premiums

Deductibles play a the most important position in figuring out insurance coverage premiums. Upper deductibles normally result in decrease premiums, whilst decrease deductibles lead to greater premiums. The deductible quantity represents the monetary accountability you undergo earlier than the insurance coverage corporate will pay a declare. The selection of deductible is a trade-off between charge and fiscal coverage.

Evaluating Protection Choices Throughout Suppliers

Evaluating protection choices throughout other insurance coverage suppliers is advisable. Suppliers might be offering various ranges of protection and premiums. Imagine elements like coverage limits, deductibles, and protection sorts when evaluating insurance policies from quite a lot of firms. Inspecting other insurance policies mean you can in finding the most efficient stability between charge and coverage. Comparative analyses of protection programs throughout other suppliers can lend a hand customers make knowledgeable selections.

Navigating the Claims Procedure

The claims procedure, a essential side of vehicle insurance coverage, Artikels the procedures for dealing with injuries, damages, or different coated incidents. Figuring out those procedures is very important for policyholders in Castle Lauderdale, FL, to verify a easy and environment friendly answer. A well-defined claims procedure minimizes attainable disputes and guarantees that policyholders obtain the repayment they’re entitled to.Submitting a declare, whether or not for minor fender benders or primary collisions, is a structured procedure.

Every insurance coverage corporate has its personal particular protocol, however in most cases, those protocols purpose for a standardized and honest overview of damages and repayment.

Claims Procedure Review

The claims procedure comes to a number of key steps, which will range according to the precise insurance coverage supplier and the character of the declare. An ordinary procedure starts with reporting the incident and amassing important data.

Reporting the Incident

Straight away reporting the incident to the insurance coverage corporate is the most important. This normally comes to contacting the insurer by way of telephone, on-line portal, or mail. Documentation of the incident, together with time, location, and witnesses, is important. Pictures of the wear and any accidents also are very important. Correct and entire reporting is very important for an even and well timed declare answer.

Amassing Proof

Amassing supporting proof is an integral a part of the claims procedure. This may increasingly come with police experiences, witness statements, restore estimates, clinical data, and different pertinent paperwork. The insurer might request particular data or paperwork. Accumulating and offering this proof promptly can expedite the claims procedure.

Insurance coverage Corporate Claims Procedures, Reasonable automobile insurance coverage castle lauderdale fl

Other insurance coverage firms make use of various declare procedures. Some firms be offering on-line declare portals, enabling policyholders to record and monitor claims digitally. Others might require a extra conventional approach of submitting a declare. Figuring out the precise procedures of the insurer is recommended in navigating the claims procedure.

Examples of Eventualities Requiring Claims

Quite a lot of scenarios necessitate submitting a declare with an insurance coverage corporate. Those come with injuries involving different cars, injury to the insured car, robbery, and injury from climate occasions. Within the match of an twist of fate involving some other birthday celebration, the insured car, or the insured particular person, submitting a declare guarantees the proper repayment is gained.

Not unusual Problems and Resolutions

A number of problems can stand up all through the claims procedure. Those come with disagreements at the extent of wear and tear, disputes over legal responsibility, delays in processing claims, and verbal exchange breakdowns. Insurance coverage adjusters play a key position in resolving those problems.

Position of Insurance coverage Adjusters

Insurance coverage adjusters are the most important in dealing with claims. They examine the incident, assess the damages, and negotiate settlements. Adjusters paintings to assemble proof, overview the declare, and resolve the proper repayment. In addition they try to unravel disputes rather and successfully.

Steps Focused on Submitting a Declare with Other Corporations

| Insurance coverage Corporate | Standard Declare Submitting Steps |

|---|---|

| Corporate A | Document incident, supply documentation, entire on-line shape, supply further supporting paperwork. |

| Corporate B | Touch claims division, supply main points, post pictures and police record, apply up on standing. |

| Corporate C | Document on-line or by way of telephone, supply all required paperwork, take part in adjuster investigations, apply up on correspondence. |

Guidelines for Keeping up a Just right Using Report

Keeping up a blank using report is the most important for securing inexpensive automobile insurance coverage in Castle Lauderdale, FL. A favorable using historical past demonstrates accountable habits at the highway, resulting in decrease insurance coverage premiums. This segment Artikels methods for protected using practices, the significance of warding off visitors violations, and the results of amassing violations and injuries on insurance coverage prices.A powerful using report immediately correlates with decrease insurance coverage charges.

Insurers assess menace according to elements akin to twist of fate historical past, visitors violations, and using behavior. Through adhering to protected using practices and warding off infractions, drivers can considerably beef up their probabilities of securing aggressive insurance coverage premiums.

Secure Using Practices in Castle Lauderdale

Secure using practices are paramount for keeping up a favorable using report and decreasing the danger of injuries. Adhering to hurry limits, warding off distractions, and keeping up a protected following distance are basic elements of protected using. Castle Lauderdale’s various highway stipulations, together with excessive visitors density and sundry climate patterns, necessitate even larger warning.

- Adhering to Pace Limits: Exceeding velocity limits will increase the danger of injuries, particularly in densely populated spaces like Castle Lauderdale. Strict adherence to posted velocity limits is a the most important component in minimizing twist of fate menace.

- Keeping off Distractions: Distracted using, together with the usage of mobile phones, consuming, or adjusting the radio, considerably will increase the danger of injuries. Keeping up focal point at the highway is very important for protected using in Castle Lauderdale.

- Keeping up a Secure Following Distance: Keeping up a enough following distance permits drivers to react to sudden scenarios and keep away from rear-end collisions, a not unusual explanation for injuries in Castle Lauderdale.

- Defensive Using: Defensive using comes to expecting attainable hazards and reacting proactively to keep away from injuries. Drivers must pay attention to their atmosphere, await attainable dangers, and be ready to react to sudden scenarios. That is specifically vital in Castle Lauderdale’s advanced visitors atmosphere.

Significance of Keeping off Visitors Violations

Visitors violations, akin to rushing, operating purple lighting, and reckless using, immediately affect insurance coverage premiums. Every violation will increase the danger profile assigned to the motive force, main to better insurance coverage charges. The buildup of violations can considerably build up insurance coverage prices.

- Rushing Violations: Rushing is a not unusual visitors violation that considerably will increase insurance coverage premiums. It is necessary to stick to posted velocity limits to keep away from such violations.

- Operating Pink Lighting: Operating purple lighting is a extremely dangerous violation that dramatically will increase the possibility of collisions. Following visitors alerts is the most important for warding off such violations and keeping up a protected using report.

- Reckless Using: Reckless using behaviors, together with competitive lane adjustments and weaving thru visitors, build up twist of fate menace and lead to really extensive insurance coverage top rate will increase.

Motive force Training and Development Systems

Motive force training and growth methods be offering precious sources for reinforcing using talents and bettering highway protection. Those methods supply ways for more secure using practices, together with defensive using methods. Collaborating in those methods may end up in a discount in insurance coverage premiums.

- Motive force Development Lessons: Motive force growth classes regularly focal point on defensive using ways, twist of fate avoidance, and protected using behavior. Of entirety of such classes might lead to diminished insurance coverage premiums, specifically for drivers with a historical past of violations.

- Defensive Using Lessons: Defensive using classes supply methods for expecting attainable hazards and reacting proactively to care for protected using behavior. Those classes are regularly backed by way of insurance coverage firms or native using colleges.

Penalties of Gathering Visitors Violations and Injuries

Gathering visitors violations and injuries considerably will increase insurance coverage premiums. Insurance coverage firms assess drivers’ menace profiles according to their using historical past, and a deficient report immediately interprets to better premiums. Constant protected using behavior are very important for keeping up a aggressive insurance coverage price.

Insurance coverage firms use a driving force’s using historical past to evaluate their menace profile. A deficient using report considerably will increase insurance coverage prices.

- Greater Premiums: Every visitors violation and twist of fate provides to a driving force’s menace profile, leading to greater insurance coverage premiums.

- Insurance coverage Denials: Repeated violations and injuries may end up in insurance coverage firms denying protection altogether, making it tough to acquire insurance coverage at any value.

Examples of Secure Using Behavior and Behaviors

Examples of protected using behavior come with keeping up a protected following distance, the usage of flip alerts, and warding off distractions whilst using. Those behaviors show a dedication to highway protection and give a contribution to a decrease menace profile.

- Predictive Using: Predictive using comes to expecting attainable hazards and reacting proactively to keep away from collisions. This contains expecting the movements of alternative drivers and adjusting using habits accordingly.

- Accountable Using Practices: Accountable using practices contain a dedication to protected using behavior, together with adhering to hurry limits, warding off distractions, and keeping up a protected following distance.

Conclusive Ideas

So, securing affordable automobile insurance coverage in Castle Lauderdale is not rocket science. Through working out the native marketplace, evaluating quotes, and working out protection, you’ll be able to discover a coverage that matches your price range. This information has given you the equipment to take keep watch over of your insurance coverage wishes, making the method more straightforward to take care of. Bear in mind to match and believe your entire choices earlier than committing.

In style Questions

What are the commonest reductions to be had for automobile insurance coverage in Castle Lauderdale?

Reductions range by way of supplier however regularly come with protected using, multi-policy, and pupil reductions. Take a look at with particular person firms for main points.

How does my using report have an effect on my insurance coverage premiums?

Injuries and violations considerably affect premiums. A blank report is vital to decrease charges.

Are there any particular firms that constantly be offering decrease charges in Castle Lauderdale?

A number of firms are aggressive in Castle Lauderdale, however analysis is vital. Evaluating quotes from more than one suppliers is important.

How regularly must I evaluation my automobile insurance coverage?

Reviewing your coverage at least one time a 12 months, or every time there are primary existence adjustments, can lend a hand be sure you’re getting the most efficient conceivable deal.