Automobile insurance coverage New Braunfels TX is an important for drivers within the house. Working out your choices and the way charges are decided is essential to discovering the most productive protection. This information dives into the native automotive insurance coverage marketplace, evaluating moderate premiums, not unusual components influencing charges, and best suppliers.

Navigating the complexities of vehicle insurance coverage can really feel overwhelming, however this complete useful resource simplifies the method. We discover the criteria impacting premiums, from riding data to car sort, and spotlight particular protection choices like legal responsibility, collision, and complete. The comparability tables supply readability, making knowledgeable choices more straightforward.

Evaluation of Automobile Insurance coverage in New Braunfels, TX

The relentless pursuit of protection at the roads of New Braunfels, TX, calls for a strong and dependable automotive insurance coverage technique. Navigating the intricate panorama of insurance coverage suppliers calls for a prepared working out of the marketplace dynamics and person wishes. This review delves into the specifics of vehicle insurance coverage in New Braunfels, highlighting an important components and providing a comparative research to different Texas towns.The New Braunfels automotive insurance coverage marketplace is characterised by means of a aggressive panorama, providing quite a lot of choices to fit various wishes and budgets.

Premiums in New Braunfels, whilst regularly influenced by means of native components, most often align with the wider Texas moderate, probably appearing diversifications in line with particular riding profiles and car varieties.

Moderate Automobile Insurance coverage Premiums

Premiums in New Braunfels, TX, have a tendency to be relatively above the state moderate, influenced by means of components such because the native demographics and visitors patterns. This, alternatively, is a basic statement; actual figures can range significantly in line with particular components like riding document, car sort, and selected protection choices. For instance, a motive force with a blank document and a more recent, extra fuel-efficient car may enjoy decrease premiums in comparison to a motive force with a historical past of injuries and an older, much less fuel-efficient automotive.

A comparability to Austin or San Antonio, main Texas towns, may display a an identical top class vary, with slight diversifications in line with person scenarios.

Components Influencing Automobile Insurance coverage Charges

A number of key components give a contribution to the calculation of vehicle insurance coverage premiums in New Braunfels, TX. Those come with the motive force’s age and riding historical past, which considerably affect menace review. A more youthful motive force, for instance, most often carries the next menace profile and because of this faces larger premiums. Moreover, the car sort, its make and type, performs an important function, as some automobiles are perceived as extra at risk of injuries or robbery.

The extent of protection selected, from complete to legal responsibility, without delay affects the top class quantity. Location inside of New Braunfels additionally performs an element, as some spaces could have larger coincidence charges or particular dangers, similar to proximity to highways.

Forms of Automobile Insurance coverage Protection

Complete and collision protection be offering coverage in opposition to injury to the car, regardless of fault. Legal responsibility protection, a an important part of vehicle insurance coverage, protects in opposition to monetary duty within the match of an coincidence involving injury to someone else or assets. Uninsured/underinsured motorist protection safeguards policyholders in opposition to injuries brought about by means of drivers with out enough insurance coverage. Moreover, clinical bills protection addresses the clinical bills of the ones injured in an coincidence, irrespective of fault.

Those choices, adapted to express wishes and instances, supply a complete protection internet for drivers in New Braunfels, TX.

Insurance coverage Supplier Comparability

| Insurance coverage Supplier | Buyer Opinions (Moderate Score) | Monetary Score (A.M. Easiest) | Premiums (Estimated Moderate) |

|---|---|---|---|

| State Farm | 4.5 out of five stars | A++ | $1,500-$2,000 in keeping with 12 months |

| Revolutionary | 4.2 out of five stars | A+ | $1,300-$1,800 in keeping with 12 months |

| Geico | 4.0 out of five stars | A+ | $1,200-$1,700 in keeping with 12 months |

| Allstate | 3.8 out of five stars | A | $1,400-$1,900 in keeping with 12 months |

| Farmers Insurance coverage | 4.3 out of five stars | A++ | $1,450-$1,950 in keeping with 12 months |

Word: Those figures are estimations and would possibly range in line with person instances.

This desk supplies a snapshot of shopper comments and fiscal balance of key insurance coverage suppliers in New Braunfels. A radical research must imagine further components like customer support responsiveness, declare dealing with procedures, and particular coverage choices prior to making a last resolution.

Components Affecting Automobile Insurance coverage Charges in New Braunfels, TX: Automobile Insurance coverage New Braunfels Tx

The labyrinthine global of vehicle insurance coverage premiums regularly leaves drivers bewildered. Working out the forces that form those prices is an important for securing essentially the most favorable charges in New Braunfels, TX. From riding behavior to car specs, a myriad of things give a contribution to the overall price ticket. This intricate internet calls for cautious attention to navigate the complexities of the insurance coverage panorama.The price of automotive insurance coverage in New Braunfels, TX, isn’t a static determine.

As a substitute, it is a dynamic equation, responding to quite a lot of influences that vary from the motive force’s non-public traits to the car itself. A radical comprehension of those variables empowers drivers to make knowledgeable choices and protected essentially the most appropriate protection.

Using Information and Insurance coverage Premiums

Using data are a number one determinant in automotive insurance coverage charges. A historical past of injuries or visitors violations considerably affects premiums. Injuries involving vital assets injury or accidents regularly lead to really extensive will increase. In a similar way, common dashing tickets or reckless riding convictions can result in larger premiums. It is because insurers assess the chance of a motive force inflicting long term incidents in line with their previous efficiency.

A blank riding document, devoid of injuries or violations, most often interprets to decrease premiums, because it alerts a decrease chance of long term claims.

Automobile Kind and Type Affect on Insurance coverage Prices

The sort and type of a car without delay affect insurance coverage premiums. Sure automobiles, because of their design, are extra at risk of injury and robbery. Sports activities automobiles, for instance, often command larger premiums in comparison to compact sedans, reflecting the greater menace related to their efficiency traits. Top-value automobiles, similar to luxurious fashions or unique automobiles, are regularly costlier to insure on account of the upper possible for monetary loss in case of robbery or injury.

Insurers assess the chance in line with the car’s traits and marketplace price.

Age and Gender Affect on Automobile Insurance coverage Premiums

Age and gender are not unusual components that affect automotive insurance coverage premiums. More youthful drivers, regularly perceived as higher-risk, most often pay extra for insurance coverage in comparison to older drivers. That is because of statistics appearing the next frequency of injuries amongst more youthful drivers. In a similar way, insurance coverage corporations regularly imagine gender as an element. This attention is in large part in line with ancient coincidence charges and riding behaviors.

The affect of those components is matter to diversifications amongst insurance coverage suppliers.

Claims Historical past and Insurance coverage Charges

A motive force’s claims historical past is a crucial consider figuring out insurance coverage premiums. Folks with a historical past of submitting a couple of claims or really extensive injury claims face considerably larger premiums. It is because insurers view a top selection of claims as a hallmark of greater menace. Previous claims can result in top class will increase, on occasion really extensive, that persist for a number of years.

Comparability of Legal responsibility, Collision, and Complete Insurance coverage

Legal responsibility insurance coverage covers damages inflicted on others in an coincidence. Collision insurance coverage covers damages to the insured car irrespective of fault. Complete insurance coverage covers damages brought about by means of occasions rather then collision, similar to vandalism or climate occasions. Legal responsibility insurance coverage is most often the minimal required by means of legislation, while collision and complete supply broader coverage. Collision and complete insurance coverage prices range relying at the car’s price and the protection limits selected.

Desk: Using-Comparable Components and Insurance coverage Top class Affect

| Using Issue | Possible Affect on Insurance coverage Premiums |

|---|---|

| Injuries | Important will increase, regularly continual for years |

| Site visitors Violations (e.g., dashing, reckless riding) | Upper premiums because of greater menace review |

| Blank Using Report | Decrease premiums, reflecting lowered menace |

| Automobile Kind (e.g., sports activities automotive, luxurious type) | Upper premiums because of greater menace of wear or robbery |

| Age of Motive force | More youthful drivers most often pay larger premiums |

| Claims Historical past | Upper premiums with a couple of or really extensive claims |

Most sensible Insurance coverage Suppliers in New Braunfels, TX

The panorama of vehicle insurance coverage in New Braunfels, TX, is a battleground of competing giants, each and every vying for a work of the marketplace pie. Navigating this advanced enviornment calls for working out the strengths and weaknesses of each and every main participant. Shopper pleasure, monetary balance, and claims dealing with are crucial components to imagine.The marketplace is saturated with insurers, each and every with its personal set of insurance policies and pricing buildings.

Working out the recognition, monetary safety, and customer support of the main suppliers in New Braunfels is paramount for making an educated resolution. This analysis considers no longer simplest their marketed charges but in addition their observe document in dealing with claims and addressing buyer considerations.

Fashionable Automobile Insurance coverage Suppliers

The preferred automotive insurance coverage suppliers in New Braunfels, TX, are regularly the ones with intensive nationwide achieve and a powerful presence within the area. Those corporations have established a recognizable emblem and are extensively marketed. Components similar to competitive advertising and marketing campaigns and established buyer bases give a contribution to their reputation.

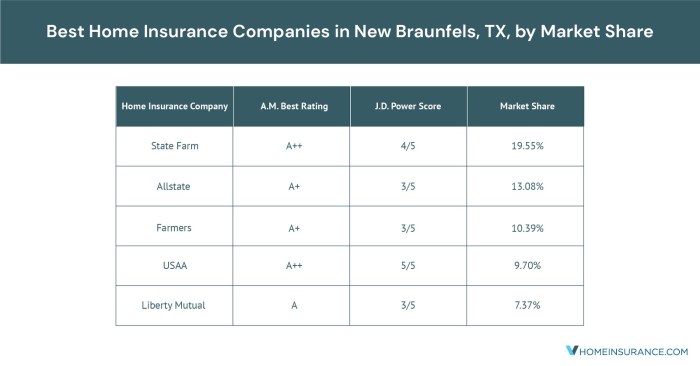

Monetary Steadiness of Most sensible Suppliers

Assessing the monetary balance of insurance coverage corporations is an important. An organization’s monetary energy without delay affects its skill to satisfy its tasks, together with paying claims. Insurers with robust rankings from unbiased companies, like A.M. Easiest, exhibit their dedication to monetary soundness. A financially tough corporate can higher climate financial downturns and deal with the power to pay out claims.

Buyer Carrier Scores

Customer support performs a pivotal function within the total enjoy. A supplier with top buyer pleasure rankings regularly shows responsiveness, potency, and a dedication to resolving problems temporarily and successfully. Sure evaluations and testimonials from previous shoppers are precious signs of an organization’s customer support prowess.

Claims Dealing with Procedures

An organization’s claims dealing with procedures could make or wreck the buyer enjoy. A easy and effective procedure can alleviate rigidity right through a difficult time. Transparency, transparent conversation, and instructed responses are very important elements of a good claims enjoy. The corporate’s recognition for well timed and truthful declare settlements is a key indicator of its dedication to buyer pleasure.

Comparability of Insurance coverage Corporations

| Insurance coverage Corporate | Professionals | Cons |

|---|---|---|

| Corporate A | Aggressive charges, wide variety of protection choices, robust on-line presence. | Every so often sluggish declare processing, combined customer support evaluations. |

| Corporate B | Superb customer support recognition, fast declare agreement, robust monetary status. | Quite larger premiums when put next to a few competition, restricted protection choices in some spaces. |

| Corporate C | Well known emblem, established community of brokers, complete coverage choices. | Customer support can range, possible for larger premiums in sure spaces. |

This desk supplies a snapshot comparability. It is vital to investigate each and every corporate totally and imagine person wishes and instances prior to you decide. Explicit scenarios would possibly modify the professionals and cons for each and every supplier. Believe components like car sort, riding historical past, and desired protection ranges when comparing choices.

Explicit Protection Choices in New Braunfels, TX

Navigating the labyrinth of vehicle insurance coverage choices can really feel daunting, however working out the specifics of each and every protection sort is an important for securing the correct coverage. A complete snatch of those main points guarantees you are no longer simply paying for insurance coverage, however safeguarding your monetary well-being and peace of thoughts. The fitting protection can imply the adaptation between a manageable restore invoice and a crippling monetary burden.

Legal responsibility Protection: The Basis of Coverage

Legal responsibility protection acts because the bedrock of your insurance plans. It safeguards you financially if you are discovered at fault for inflicting an coincidence, overlaying damages to the opposite celebration’s car and accidents sustained by means of them. This coverage is paramount, as an important coincidence can result in really extensive monetary duty with out right kind protection. With out legal responsibility insurance coverage, it is advisable be held in my view answerable for the opposite celebration’s damages, probably dealing with vital monetary hardship.

A not unusual state of affairs comes to a motive force rear-ending some other car – legal responsibility protection would then step in to maintain the monetary ramifications.

Collision and Complete Protection: Past the Fundamentals

Collision protection kicks in when your car is broken in a collision, irrespective of who’s at fault. That is crucial as a result of despite the fact that you are no longer answerable for the coincidence, your car nonetheless wishes restore. Complete protection, alternatively, steps in to hide damages from occasions rather then collisions, similar to hail injury, robbery, or vandalism.

In New Braunfels, Texas, hailstorms are a not unusual incidence, emphasizing the significance of complete protection to give protection to your funding.

Uninsured/Underinsured Motorist Protection: A Protect Towards the Unexpected

Uninsured/underinsured motorist protection is a crucial protection internet. In case you are occupied with an coincidence with a motive force missing or with inadequate insurance coverage, this protection steps in to compensate you in your losses. Believe a state of affairs the place a motive force with out insurance coverage reasons an coincidence, resulting in intensive injury on your car and accidents. This protection would give you the important price range for upkeep and clinical bills.

This coverage is significant for peace of thoughts and fiscal safety in unexpected instances.

Private Harm Coverage (PIP): Protective Your Smartly-being

Private Harm Coverage (PIP) protection is particularly designed to deal with the clinical bills and misplaced wages incurred by means of you or your passengers in an coincidence. That is an important as a result of accidents can result in intensive clinical expenses, and misplaced wages can affect your skill to earn source of revenue. PIP protection is very important for dealing with those facets of an coincidence.

Protection Choices in New Braunfels, TX: A Comparative Evaluation

| Protection Kind | Definition | Instance Eventualities |

|---|---|---|

| Legal responsibility Protection | Covers damages and accidents brought about to others in an coincidence the place you might be at fault. | Rear-ending some other car, inflicting injury to a pedestrian whilst riding. |

| Collision Protection | Covers damages on your car in an coincidence, irrespective of fault. | Your car is broken in a collision, despite the fact that the opposite motive force is at fault. |

| Complete Protection | Covers damages on your car from occasions rather then collisions, similar to robbery, vandalism, or hail injury. | Your car is broken by means of hail, or stolen. |

| Uninsured/Underinsured Motorist Protection | Covers damages and accidents sustained if occupied with an coincidence with an uninsured or underinsured motive force. | An uninsured motive force reasons an coincidence leading to injury on your car and accidents. |

| Private Harm Coverage (PIP) | Covers clinical bills and misplaced wages for you and your passengers in an coincidence. | You maintain accidents in an coincidence and incur clinical expenses; you pass over paintings because of the coincidence. |

Guidelines for Discovering Reasonably priced Automobile Insurance coverage in New Braunfels, TX

Unveiling the labyrinthine global of vehicle insurance coverage can really feel daunting, however armed with strategic perception, securing inexpensive protection in New Braunfels, TX, turns into a tangible fact. Navigating the myriad choices and hidden reductions can prevent vital sums, remodeling your per thirty days price range from a supply of rigidity to a manageable expense.Mastering the artwork of comparability buying groceries, harnessing to be had reductions, and strategically negotiating your charges are an important steps achieve your monetary targets.

Working out the dynamics of your riding document and proactive steps to enhance it could actually liberate additional financial savings, probably making your insurance coverage premiums a trifling fraction of what they to start with gave the impression.

Evaluating Quotes from Other Insurance coverage Corporations

Thorough comparability buying groceries is paramount. Don’t accept the primary quote you obtain. Solicit quotes from a couple of insurance coverage suppliers, leveraging on-line comparability gear and without delay contacting corporations. This multifaceted way guarantees you might be offered with a complete spectrum of charges and protection choices. Through meticulously evaluating those choices, you’ll determine essentially the most appropriate protection on the best value.

Believe components similar to protection limits, deductibles, and add-on choices.

Acquiring Reductions on Automobile Insurance coverage Premiums

A wealth of reductions awaits the savvy client. Many insurers be offering reductions for secure riding, defensive riding classes, and excellent pupil standing. Believe for those who qualify for any of those reductions. Insurance coverage corporations regularly have particular necessities for eligibility. Through diligently investigating and pleasing the necessities, you’ll liberate vital discounts to your insurance coverage premiums.

Moreover, bundling your auto insurance coverage with different insurance policies, similar to house or existence insurance coverage, regularly yields really extensive financial savings.

Methods for Negotiating Automobile Insurance coverage Charges, Automobile insurance coverage new braunfels tx

Negotiation is a formidable instrument. Whilst no longer at all times assured, discussing your top class with an insurance coverage agent can on occasion yield favorable effects. Highlighting any sure adjustments to your riding document or way of life, similar to a up to date accident-free length or a lower in riding frequency, would possibly incentivize the insurer to regulate your charges downward. This calls for transparent conversation and a concise presentation of your case.

Bettering Your Using Report to Decrease Insurance coverage Prices

Keeping up a pristine riding document is key to securing inexpensive automotive insurance coverage. Steer clear of visitors violations and deal with a blank riding historical past. Through diligently watching visitors regulations and practising secure riding behavior, you’ll dramatically enhance your probabilities of receiving favorable insurance coverage charges. A blank riding document regularly interprets to really extensive discounts to your top class. This meticulous way to riding fosters a robust, demonstrable document, in the long run impacting your insurance coverage prices.

Possible Financial savings Methods

- Thorough Comparability Buying groceries: Make the most of on-line comparability gear and call a couple of insurance coverage suppliers to spot essentially the most aggressive charges and complete protection.

- Maximize Reductions: Analysis and leverage to be had reductions, together with secure motive force reductions, defensive riding classes, and multi-policy bundling.

- Negotiate Charges: Actively keep in touch along with your insurance coverage agent and provide any enhancements to your riding document or way of life to probably negotiate decrease charges.

- Take care of a Blank Using Report: Prioritize secure riding practices and steer clear of visitors violations to make sure a blank riding historical past, which without delay affects insurance coverage prices.

- Evaluate and Alter Protection: Continuously evaluation your protection wishes and regulate your coverage accordingly to steer clear of useless prices.

Native Assets for Automobile Insurance coverage in New Braunfels, TX

Navigating the labyrinthine global of vehicle insurance coverage can really feel daunting, particularly in a posh marketplace like New Braunfels. However empowered customers armed with native wisdom and savvy sources can dramatically enhance their probabilities of securing essentially the most appropriate and inexpensive coverage. This segment unveils priceless native sources to empower your insurance coverage adventure.

Figuring out Native Insurance coverage Brokers or Agents

New Braunfels boasts a community of devoted insurance coverage brokers and agents who perceive the original wishes and instances of the group. Those pros are in detail acquainted with native visitors patterns, coincidence statistics, and the particular insurance coverage rules affecting drivers within the house. Their deep working out interprets into adapted recommendation and customized insurance policies.

Advantages of Operating with Native Brokers in New Braunfels, TX

Partnering with an area agent supplies get admission to to specialised experience and a personalised way. Native brokers possess a complete working out of the native marketplace, regularly having established relationships with insurance coverage corporations, making them simpler negotiators. Their insights at the particular dangers and rewards of riding in New Braunfels supply an important merit.

Availability of Shopper Assets for Evaluating Insurance coverage Insurance policies

Thankfully, customers in New Braunfels have get admission to to tough on-line gear and comparability internet sites that simplify the method of comparing quite a lot of insurance coverage insurance policies. Those sources permit drivers to match premiums, protection choices, and endorsements introduced by means of other suppliers, facilitating knowledgeable choices.

Native Insurance coverage Advocacy Teams or Organizations

Whilst formal insurance coverage advocacy teams could be much less prevalent in New Braunfels, native client coverage companies and advocacy teams can be offering priceless strengthen in navigating the complexities of insurance coverage claims or disputes.

Touch Knowledge for Insurance coverage Brokers/Agents in New Braunfels, TX

Sadly, because of the dynamic nature of the insurance coverage business and the sheer quantity of insurance coverage brokers/agents working in New Braunfels, offering a complete listing of touch knowledge isn’t possible on this layout. A simpler way for locating native brokers could be to make use of on-line serps (similar to Google) to seek for “insurance coverage brokers New Braunfels, TX” or seek the advice of native trade directories.

Without delay contacting the insurance coverage corporations themselves could also be an approach to discover.

| Agent/Dealer Identify | Telephone Quantity | Site |

|---|---|---|

| (Instance Agent 1) | (512) 123-4567 | exampleagent1.com |

| (Instance Agent 2) | (512) 987-6543 | exampleagent2.com |

| (Instance Agent 3) | (512) 555-1212 | exampleagent3.com |

Ultimate Wrap-Up

In conclusion, securing the correct automotive insurance coverage in New Braunfels, TX, calls for cautious attention of things like your riding historical past, car, and desired protection. Evaluating quotes, working out reductions, and probably operating with native brokers are all an important steps to find inexpensive and complete coverage. This information supplies a basis for making good choices and discovering the most productive insurance coverage are compatible in your wishes.

Very important FAQs

What’s the moderate price of vehicle insurance coverage in New Braunfels, TX?

Moderate premiums range relying on components like riding document and protection possible choices. Then again, you’ll regularly to find averages compared to different Texas towns in to be had sources.

What reductions are to be had for automotive insurance coverage in New Braunfels, TX?

Reductions regularly come with the ones for secure riding, a couple of automobiles, and excellent pupil standing. Explicit reductions range between insurance coverage suppliers.

How can I to find native insurance coverage brokers in New Braunfels, TX?

On-line searches, native trade directories, and referrals from pals or circle of relatives can attach you with native insurance coverage brokers in New Braunfels, TX. You’ll be able to additionally to find touch knowledge in devoted insurance coverage directories.

What are the average components that impact automotive insurance coverage charges in New Braunfels, TX?

Using document, car sort, age, gender, and claims historical past all considerably affect automotive insurance coverage charges in New Braunfels, TX. Additionally, the quantity of protection you select will affect the associated fee.