Automobile insurance coverage in Rock Hill is a very powerful for drivers. This information breaks down the native marketplace, serving to you already know charges, suppliers, and rules. We’re going to discover the whole thing from coverage varieties and reductions to claims processes and the way your riding behavior have an effect on premiums. Get the lowdown on Rock Hill automotive insurance coverage and make knowledgeable choices.

Navigating the sector of auto insurance coverage can really feel overwhelming, particularly in a brand new house like Rock Hill. This complete information targets to demystify the method, empowering you in finding the most productive coverage that matches your wishes and price range. We’re going to quilt the whole thing from the fundamentals to the nuances, making sure you might be well-equipped to make the fitting selection.

Assessment of Automobile Insurance coverage in Rock Hill

Rock Hill, South Carolina, boasts a aggressive automotive insurance coverage marketplace, with a number of suppliers vying for purchasers. Working out the nuances of this marketplace is a very powerful for citizens searching for the most productive protection at an excellent value. Components like riding historical past, car kind, and site all play a job in figuring out insurance coverage premiums. This review supplies a complete working out of auto insurance coverage in Rock Hill.

Components Influencing Automobile Insurance coverage Premiums, Automobile insurance coverage in rock hill

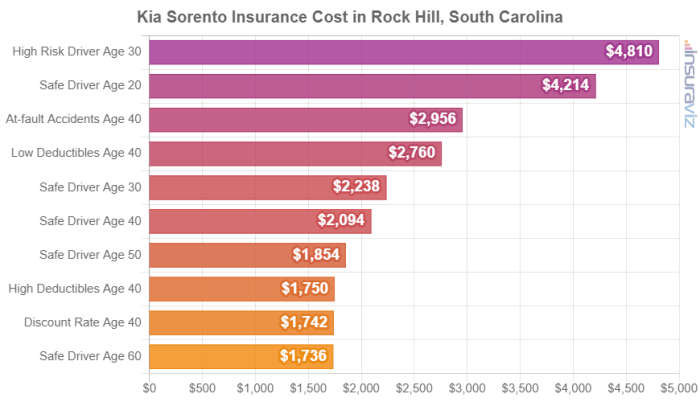

More than a few elements affect the price of automotive insurance coverage in Rock Hill. Those come with the motive force’s age and riding document, the kind and price of the car, and the site of place of abode. Upper possibility profiles, akin to more youthful drivers with little riding enjoy or the ones with a historical past of injuries, in most cases face upper premiums. In a similar fashion, high-value automobiles steadily command upper premiums because of their larger doable for loss or injury.

The positioning in Rock Hill itself too can play a job, as some spaces would possibly have upper charges of injuries or robbery.

Commonplace Varieties of Automobile Insurance coverage Insurance policies

Citizens in Rock Hill have get right of entry to to a variety of auto insurance coverage insurance policies. Legal responsibility protection is a elementary kind, protective in opposition to damages incurred through others in an coincidence. Collision protection protects in opposition to damages to the insured car, without reference to who’s at fault. Complete protection is going additional, encompassing incidents past collisions, akin to vandalism, robbery, or weather-related injury.

Uninsured/Underinsured Motorist protection protects policyholders from drivers with out good enough insurance coverage. Every kind gives various levels of monetary coverage and concerns will have to be made in regards to the explicit wishes of the motive force.

Insurance coverage Suppliers in Rock Hill

| Corporate Identify | Touch Information | Description |

|---|---|---|

| State Farm | (800) 842-2237 (or consult with their web page) | A big nationwide supplier with a huge vary of insurance coverage merchandise, steadily providing aggressive charges. Identified for his or her intensive community of brokers. |

| Geico | (800) 841-3262 (or consult with their web page) | A big participant within the auto insurance coverage marketplace, most often recognized for aggressive charges and easy on-line products and services. |

| Modern | (800) 776-4737 (or consult with their web page) | A national insurance coverage supplier that specialize in technology-driven answers and a customer-centric means. Their virtual platform is steadily praised. |

| Allstate | (800) 225-2662 (or consult with their web page) | Every other well-established national supplier, recognized for a big selection of insurance coverage merchandise and a considerable community of brokers. |

| Liberty Mutual | (800) 225-2662 (or consult with their web page) | A credible insurer recognized for its customer support and concentrate on serving to shoppers arrange their insurance coverage wishes. |

Evaluating Insurance coverage Suppliers

Navigating the panorama of auto insurance coverage in Rock Hill can really feel overwhelming. Other firms be offering various pricing buildings, coverage options, and protection choices. Working out those nuances is a very powerful for securing the most productive conceivable coverage in your car at a aggressive value. This research will dissect the pricing methods of main gamers, assess their strengths and weaknesses in accordance with visitor comments, and spotlight key coverage variations to empower knowledgeable decision-making.

Pricing Methods of Main Insurance coverage Corporations

More than a few elements affect automotive insurance coverage premiums, together with the motive force’s age, riding document, car kind, and site. Main insurance coverage suppliers steadily make use of other methods to draw and retain shoppers. Some might emphasize low base charges, whilst others center of attention on bundled products and services or loyalty systems.

- Modern: Identified for its aggressive charges and online-centric means, Modern steadily makes use of a dynamic pricing type that adjusts in accordance with particular person riding conduct and utilization patterns. This steadily leads to probably decrease premiums for protected drivers however will not be as favorable for drivers with a less-than-perfect document.

- Geico: Geico steadily objectives more youthful drivers and households with inexpensive charges, every now and then providing reductions for a couple of automobiles or bundled products and services like renters insurance coverage. They are going to have a moderately other solution to coincidence forgiveness systems.

- State Farm: State Farm is known for its complete protection choices and intensive community of brokers. Their pricing steadily displays their complete carrier, probably leading to upper premiums in comparison to different choices, however steadily with the benefit of customized steerage and strong visitor toughen.

Strengths and Weaknesses In line with Buyer Evaluations

Buyer evaluations and scores supply precious insights into the strengths and weaknesses of various insurance coverage suppliers. An organization with many certain evaluations referring to claims dealing with and customer support might end up fine in case of injuries or coverage disputes.

- Modern: Consumers steadily reward Modern’s user-friendly on-line platform and aggressive charges. On the other hand, some evaluations point out doable problems with customer support responsiveness, particularly all over claims processing.

- Geico: Geico receives favorable comments for its inexpensive charges and simple on-line control. On the other hand, some shoppers record demanding situations with working out advanced coverage phrases or navigating their claims procedure.

- State Farm: State Farm is ceaselessly lauded for its intensive community of brokers and complete toughen, together with customized steerage and probably faster claims processing. On the other hand, some shoppers would possibly to find their charges upper in comparison to different choices.

Coverage Function Comparisons

Coverage options like coincidence forgiveness, roadside help, and condominium automotive protection range considerably between suppliers. Cautious attention of those options can affect the total cost of a coverage.

- Coincidence Forgiveness: This selection can lend a hand drivers steer clear of really extensive fee will increase after an coincidence, which generally is a really extensive get advantages for protected drivers who might enjoy an coincidence. Suppliers range within the explicit standards and alertness processes.

- Roadside Help: This carrier gives necessary toughen in case of breakdowns, flat tires, or different emergencies. The level and high quality of roadside help can vary considerably amongst suppliers.

- Condominium Automobile Protection: Condominium automotive protection supplies transient transportation in case your car is broken or unavailable because of an coincidence or restore. The length and price of condominium protection can range considerably.

Protection Choices and Prices

Evaluating protection choices for complete and collision insurance coverage is a very powerful for figuring out probably the most suitable degree of coverage. The price of protection steadily displays the extent of coverage and the prospective possibility elements.

| Insurance coverage Supplier | Complete Protection (Instance) | Collision Protection (Instance) |

|---|---|---|

| Modern | $500 deductible, $100/month | $500 deductible, $150/month |

| Geico | $250 deductible, $80/month | $250 deductible, $120/month |

| State Farm | $1000 deductible, $120/month | $1000 deductible, $180/month |

Word: Those figures are examples and might range in accordance with particular person cases. The desk illustrates the prospective value distinction between more than a few suppliers for identical protection choices. All the time test specifics with the respective suppliers.

Working out Native Laws

Navigating the intricate global of auto insurance coverage can really feel overwhelming, particularly when native rules come into play. Working out the particular laws and necessities in Rock Hill, South Carolina, is a very powerful for securing the fitting protection and keeping off doable consequences. This phase delves into the specifics of auto insurance coverage rules within the house, outlining minimal legal responsibility necessities, coverage acquisition procedures, and any contemporary legislative adjustments.Rock Hill, like different localities, has established rules to make sure motive force protection and monetary accountability at the roads.

Those rules offer protection to each drivers and the neighborhood at huge. A transparent working out of those rules permits drivers to make knowledgeable choices about their insurance coverage wishes, in the long run contributing to a more secure riding atmosphere.

Minimal Legal responsibility Insurance coverage Necessities

South Carolina, encompassing Rock Hill, mandates a minimal degree of legal responsibility insurance policy for all drivers. Failure to handle this minimal protection may end up in consequences, together with fines or even suspension of riding privileges. The minimal legal responsibility protection necessities, as of our ultimate evaluation, are detailed underneath.

- Physically Harm Legal responsibility: No less than $25,000 consistent with particular person and $50,000 consistent with coincidence is in most cases required. This protection protects folks injured in an coincidence involving your car, overlaying scientific bills and misplaced wages.

- Assets Harm Legal responsibility: No less than $25,000 is most often required. This protection compensates the landlord of broken belongings because of an coincidence involving your car.

Coverage Acquisition Procedures

Securing a automotive insurance coverage in Rock Hill in most cases comes to a number of steps. Drivers can follow for protection without delay with insurance coverage suppliers within the area, both via an area agent or on-line. The method steadily comprises offering essential documentation, together with motive force’s license knowledge, car main points, and cost strategies. Contacting a couple of suppliers and evaluating quotes is a very powerful to be sure you are acquiring the most productive conceivable protection in your wishes.

- Documentation Required: Insurance coverage suppliers generally require documentation like evidence of car possession, motive force’s license, and car registration. In some circumstances, they might also request details about any prior injuries or visitors violations.

- Quote Comparability: You could examine quotes from a couple of insurance coverage suppliers to seek out the most productive protection at a aggressive value. This will also be finished on-line or via an area insurance coverage agent. Components like riding historical past, car kind, and protection choices will affect the general quote.

Contemporary Legislative Adjustments

Staying up to date on any contemporary legislative adjustments impacting automotive insurance coverage is a very powerful. Those adjustments can have an effect on premiums, protection choices, and the total panorama of auto insurance coverage within the house. Sadly, with no explicit date for the evaluation, we can’t definitively listing contemporary adjustments impacting Rock Hill. For probably the most present knowledge, drivers are instructed to seek the advice of the South Carolina Division of Insurance coverage or touch an authorized insurance coverage agent in Rock Hill.

Protection Choices and Reductions

Navigating the sector of auto insurance coverage can really feel like interpreting a fancy code. Working out the more than a few protection choices and to be had reductions is essential to securing the most productive conceivable coverage in your car and monetary well-being. Rock Hill citizens, like drivers in all places, desire a transparent working out of the several types of insurance coverage to make knowledgeable possible choices.The precise automotive insurance coverage protects you from monetary smash in case of an coincidence or injury in your car.

Selecting the proper protection and reductions can considerably cut back your insurance coverage prices, supplying you with extra cost in your top class.

Protection Choices

Other protection choices cater to various wishes and possibility profiles. Legal responsibility protection protects you from monetary accountability for those who purpose injury to someone else or their belongings in an coincidence. Collision protection compensates you for injury in your car led to through a collision, without reference to who’s at fault. Complete protection protects you from injury in your car from occasions rather then collisions, akin to vandalism, fireplace, or climate.

Working out the bounds of every protection is a very powerful. A complete coverage steadily supplies extra coverage, however comes with the next top class.

- Legal responsibility protection protects you from monetary accountability in case you are at fault in an coincidence and purpose injury to someone else or their belongings. That is generally a compulsory protection, various on the subject of minimal necessities through state rules.

- Collision protection can pay for maintenance or alternative of your car whether it is broken in an coincidence, without reference to who’s at fault. This protection is vital for shielding your funding on your car.

- Complete protection protects your car from injury from occasions rather then collisions, akin to vandalism, fireplace, robbery, or hail injury. This protection gives huge coverage in opposition to unexpected occasions.

Reductions To be had in Rock Hill

Rock Hill citizens can leverage more than a few reductions to scale back their insurance coverage premiums. Those reductions can considerably decrease your insurance coverage prices.

- Multi-policy reductions: Bundling your automotive insurance coverage with different insurance coverage merchandise (e.g., house or renters insurance coverage) from the similar supplier can steadily result in vital financial savings. This technique is extremely advisable for decreasing total insurance coverage prices.

- Just right pupil reductions: In case you are a pupil with a excellent instructional document, you could be eligible for a bargain for your automotive insurance coverage. Those reductions are designed to praise accountable conduct and inspire protection.

- Protected riding reductions: Some insurance coverage firms praise drivers who handle a blank riding document with reductions on their premiums. A blank riding document is a precious asset within the insurance coverage marketplace.

- Anti-theft software reductions: Putting in anti-theft gadgets on your car can cut back the danger of robbery and steadily qualify you for reductions for your premiums. This proactive measure contributes to the aid of insurance coverage prices.

Making use of for and Receiving Reductions

The method for making use of for and receiving reductions varies relying at the insurance coverage supplier. Typically, you wish to have to give you the essential documentation to toughen your eligibility for the bargain. This may increasingly come with evidence of excellent grades, a blank riding document, or documentation of the put in anti-theft software.

Protection Price Comparability

| Protection Kind | Description | Estimated Price (Instance) |

|---|---|---|

| Legal responsibility | Protects in opposition to injury to others | $100 – $500 consistent with 12 months |

| Collision | Covers injury in your automotive in an coincidence | $200 – $800 consistent with 12 months |

| Complete | Covers injury from occasions rather then collisions | $150 – $600 consistent with 12 months |

Word: Estimated prices are examples and might range in accordance with particular person cases, riding historical past, and insurance coverage supplier.

Claims Procedure and Sources

Navigating the claims procedure will also be traumatic, particularly after an coincidence. Working out the stairs concerned and having readily to be had sources could make the method considerably smoother. This phase main points the everyday claims procedure in Rock Hill, South Carolina, in conjunction with a very powerful touch knowledge for related businesses.

Standard Claims Procedure

The claims procedure in most cases starts with reporting the coincidence in your insurance coverage corporate. This comes to offering information about the incident, together with the date, time, location, and an outline of the occasions. You will have to additionally download statements from any witnesses and accumulate proof akin to images of the wear and tear in your car. Documentation is a very powerful, because it paperwork the foundation for comparing the declare.

Steps Serious about Submitting a Declare

- Record the Coincidence: Instantly notify your insurance coverage corporate. Supply information about the coincidence, together with the date, time, location, and an outline of the incident. That is generally finished over the telephone, via a web based portal, or by means of mail.

- Acquire Proof: Accumulate footage of the wear and tear in your car, and any visual injury to the opposite birthday celebration’s car. Download touch knowledge for witnesses, if any. If conceivable, download a police record. A police record isn’t at all times essential, however it may be very useful within the declare procedure.

- Publish Required Paperwork: Supply your insurance coverage corporate with the essential bureaucracy. This comprises your insurance coverage main points, your motive force’s license, and evidence of possession of the car. They’re going to most likely information you during the explicit paperwork wanted.

- Valuation and Evaluation: The insurance coverage corporate will overview the wear and tear in your car and decide the quantity of repayment due. This procedure can contain an inspection of your car through an unbiased adjuster.

- Agreement Negotiation: As soon as the quantity of repayment is made up our minds, the insurance coverage corporate will negotiate a agreement with you. If you don’t consider the agreement quantity, you’ll be able to dispute the declare and search additional negotiation.

- Declare Answer: As soon as the agreement is finalized, the insurance coverage corporate will prepare for the essential maintenance in your car, or supply cost for the wear and tear. All the time stay detailed information of all verbal exchange and transactions.

Related Companies in Rock Hill

- South Carolina Division of Motor Cars (DMV): The DMV supplies knowledge on car registration, motive force’s license, and linked issues. They’re a very powerful for making sure your documentation is correct and compliant with state rules.

- South Carolina Division of Client Affairs: This company is chargeable for client coverage. They supply sources and steerage for resolving disputes with insurance coverage firms. They’re a precious useful resource for recourse if the claims procedure isn’t treated quite or successfully.

Flowchart of Claims Procedure

A flowchart would visually constitute the stairs in a declare procedure. On the other hand, an in depth rationalization of the stairs concerned is supplied above. A visible assist would upload readability to the method, however it isn’t very important for working out the method.

Protection and Riding Conduct

Your riding behavior considerably affect your automotive insurance coverage premiums in Rock Hill. A protected riding document demonstrates accountable conduct, resulting in decrease charges. Insurance coverage firms use this data to evaluate possibility and regulate premiums accordingly.Protected riding behavior don’t seem to be almost about keeping off injuries; additionally they come with proactive measures that cut back your chance of being excited by one. Working out the correlation between riding conduct and insurance coverage prices empowers you to make knowledgeable possible choices that may prevent cash.

Affect of Protected Riding Conduct on Premiums

Protected riding behavior are without delay correlated to decrease automotive insurance coverage premiums. Insurance coverage firms praise drivers who display a historical past of accountable riding. This interprets to decrease premiums, reflecting a discounted possibility of claims. Insurance coverage firms use more than a few elements to decide possibility, together with coincidence historical past, visitors violations, or even riding conduct.

Correlation Between Riding Information and Insurance coverage Charges

Riding information are a number one consider figuring out insurance coverage charges. A blank riding document, freed from injuries and violations, indicates a decrease possibility profile to the insurance coverage corporate. This certain document without delay interprets to decrease premiums. Conversely, a document with injuries or violations in most cases leads to upper premiums, because it signifies the next possibility of long run claims.

As an example, a motive force with a historical past of rushing tickets or reckless riding will most likely face upper premiums in comparison to a motive force with a blank document.

Significance of Keeping up a Blank Riding Document

Keeping up a blank riding document is a very powerful for securing decrease automotive insurance coverage premiums in Rock Hill. A spotless document demonstrates accountable riding conduct and decreased possibility to the insurance coverage corporate. This interprets into vital financial savings for your per 30 days premiums. Moreover, a blank document can probably open doorways to reductions and higher insurance coverage choices one day.

Examples of Protected Riding Practices

Imposing protected riding practices can give a contribution to decrease insurance coverage premiums. Those practices surround more than a few facets of accountable riding:

- Defensive Riding Ways: Expecting doable hazards, keeping up a protected following distance, and adapting to converting highway stipulations. Those proactive measures cut back the chance of injuries, which is a major factor in figuring out insurance coverage charges.

- Heading off Distracted Riding: Concentrating only on riding, keeping off mobile phone use, and maintaining the car arranged to steer clear of distractions. Distracted riding is a number one explanation for injuries and an element regarded as through insurance coverage firms when assessing possibility.

- Following Visitors Regulations: Adhering to hurry limits, looking at visitors indicators, and keeping off unlawful maneuvers like working pink lighting fixtures or prevent indicators. Those practices are elementary to protected riding and lend a hand handle a blank riding document, which in flip contributes to decrease insurance coverage premiums.

- Common Car Repairs: Making sure your car is in excellent running order, together with regimen inspections, tire power exams, and right kind fluid ranges. A well-maintained car is much less susceptible to mechanical screw ups, contributing to more secure riding and a greater riding document.

By way of enforcing those protected riding practices, you’ll be able to display accountable conduct and probably cut back your automotive insurance coverage premiums in Rock Hill.

Guidelines for Opting for the Proper Coverage: Automobile Insurance coverage In Rock Hill

Navigating the sector of auto insurance coverage can really feel overwhelming, particularly in a various marketplace like Rock Hill. Working out the nuances of various insurance policies and suppliers is a very powerful for securing the most productive conceivable protection at an excellent value. This phase gives sensible steerage on selecting the proper automotive insurance coverage in your explicit wishes and cases.

Evaluating Insurance policies in Rock Hill

A essential step in securing the fitting automotive insurance coverage is evaluating choices from more than a few suppliers. Rock Hill boasts a variety of insurance coverage firms, every with its personal pricing construction, protection choices, and customer support approaches. Without delay evaluating insurance policies means that you can determine the most productive have compatibility in accordance with elements like premiums, add-on coverages, and visitor delight scores. Failure to match can result in paying greater than essential for identical protection.

Steps in Opting for a Coverage

Opting for a coverage that aligns with your personal wishes comes to a scientific means. Start through assessing your present riding behavior, car kind, and monetary scenario. Subsequent, decide your most well-liked protection ranges, together with legal responsibility, collision, and complete. Completely analysis insurance coverage suppliers in Rock Hill, taking into account their monetary steadiness, claims dealing with recognition, and visitor evaluations. In the end, examine quotes from a couple of suppliers to spot probably the most cost-effective possibility whilst keeping up good enough protection.

Comparing Insurance policies

Comparing insurance policies calls for a structured tick list to make sure a complete comparability. Imagine elements like coverage limits, deductibles, and any add-on coverages. Assess the insurer’s monetary steadiness and claims historical past, checking for regulatory compliance and certain visitor comments. Examine reductions to be had, akin to the ones for protected riding or accident-free information. Working out the coverage’s superb print is very important to steer clear of surprises later.

A well-structured tick list can save you overlooking a very powerful main points and result in an educated resolution.

- Coverage Limits: Working out the monetary caps for more than a few coverages is necessary. Imagine the worth of your car and doable legal responsibility exposures.

- Deductibles: Evaluation the quantity you can want to pay out-of-pocket ahead of insurance policy kicks in. The next deductible can result in decrease premiums, however you can want to consider doable prices if an coincidence happens.

- Upload-on Coverages: Examine not obligatory coverages like roadside help, condominium automotive compensation, and uninsured/underinsured motorist coverage.

- Monetary Balance: Analysis the insurer’s monetary power and steadiness. A financially solid insurer is much more likely to fulfill its duties in case of a declare.

- Claims Historical past: Read about the insurer’s claims dealing with recognition and visitor evaluations to gauge its responsiveness and potency in settling claims.

- Reductions: Search for to be had reductions, akin to the ones for excellent riding information or explicit car varieties.

- Coverage Advantageous Print: Moderately evaluation the coverage’s phrases and prerequisites to steer clear of misunderstandings or surprising exclusions.

Coverage Comparability Desk

This desk supplies a template for evaluating insurance policies in accordance with key options, pricing, and visitor scores. Understand that scores might range through supply and will have to be regarded as along different elements.

| Coverage Function | Pricing | Buyer Scores |

|---|---|---|

| Legal responsibility Protection | $1,200 yearly | 4.5 out of five stars (in accordance with 100 evaluations) |

| Collision Protection | $500 yearly | 4.2 out of five stars (in accordance with 50 evaluations) |

| Complete Protection | $300 yearly | 4.6 out of five stars (in accordance with 75 evaluations) |

| Uninsured/Underinsured Motorist Coverage | $150 yearly | 4.4 out of five stars (in accordance with 25 evaluations) |

| Roadside Help | $100 yearly | 4.7 out of five stars (in accordance with 100 evaluations) |

Monetary Concerns

Navigating the monetary facets of auto insurance coverage is a very powerful for accountable possession in Rock Hill. Working out how premiums are calculated, and the more than a few methods to control prices, empowers drivers to make knowledgeable choices. This phase delves into budgeting for premiums, the affect of car cost, cost-saving methods, and the artwork of top class negotiation.Budgeting for automotive insurance coverage premiums calls for cautious making plans and integration into your total monetary technique.

A set portion of your per 30 days price range allotted particularly for insurance coverage can be certain constant protection and steer clear of surprising monetary pressure. The regularity of those bills additionally is helping with long-term monetary making plans.

Budgeting for Automobile Insurance coverage Premiums

Making a devoted price range line merchandise for automotive insurance coverage premiums is very important for monetary steadiness. This permits for proactive making plans and avoids surprising monetary burdens. Monitor your bills to pinpoint spaces for doable financial savings and allocate budget accordingly.

Dating Between Insurance coverage Prices and Car Worth

Car cost without delay correlates with insurance coverage premiums. Upper-value automobiles in most cases command upper premiums because of the larger doable for loss or injury. It is a usual trade follow. For example, a luxurious sports activities automotive will most likely have the next top class than a fundamental economic system automotive, even with identical protection ranges.

Methods for Saving Cash on Automobile Insurance coverage

A number of methods can lend a hand cut back automotive insurance coverage prices. Bundling insurance coverage insurance policies (e.g., house and auto) steadily leads to discounted charges. Keeping up a protected riding document, demonstrated through a blank riding historical past, is steadily rewarded with decrease premiums. Deciding on decrease protection choices, akin to liability-only insurance policies, might cut back prices. Expanding your deductible, even if exposing you to the next out-of-pocket charge within the tournament of a declare, can result in decrease premiums.

Tips about Negotiating Automobile Insurance coverage Premiums

Negotiating insurance coverage premiums comes to evaluating quotes from other suppliers. Buying groceries round and evaluating quotes from more than a few firms can result in really extensive financial savings. Inquire about reductions for excellent drivers, protected riding, or explicit options of your car. Be ready to give your riding document and any main points that would possibly qualify you for particular reductions. Evaluation your coverage continuously to be sure you aren’t paying greater than essential for the protection you require.

Closure

In conclusion, securing the fitting automotive insurance coverage in Rock Hill is a great monetary transfer. By way of working out the native marketplace, evaluating suppliers, and realizing your protection choices, you’ll be able to offer protection to your self and your car. Take note to imagine elements like riding behavior, reductions, and price range to make a choice the most productive coverage. This information serves as a kick off point in your analysis, serving to you optimistically navigate the sector of auto insurance coverage in Rock Hill.

FAQs

What’s the minimal legal responsibility insurance coverage required in Rock Hill?

State rules dictate the minimal legal responsibility protection required. Test the South Carolina Division of Motor Cars web page for probably the most up-to-date knowledge.

How do I to find inexpensive automotive insurance coverage in Rock Hill?

Examine quotes from a couple of suppliers, imagine reductions (like multi-policy or excellent pupil), and discover other protection choices to seek out the most productive steadiness of coverage and price.

What are some commonplace reductions for automotive insurance coverage in Rock Hill?

Reductions can range through supplier, however commonplace choices come with multi-policy reductions, protected motive force reductions, and reductions for excellent scholars.

How can I report a declare with my automotive insurance coverage corporate in Rock Hill?

Every corporate has its personal procedure. Normally, you can want to record the coincidence, collect essential documentation (like police reviews), and practice the stairs Artikeld on your coverage.