Automobile insurance coverage in fortress lauderdale florida – Automobile insurance coverage in Fortress Lauderdale, Florida, gifts a multifaceted panorama for drivers. Working out the marketplace, insurance policies, and related prices is a very powerful for navigating this complicated terrain. This information delves into the nuances of vehicle insurance coverage within the house, offering a complete evaluation of to be had insurance policies, pricing elements, and regulatory concerns.

From evaluating insurance coverage suppliers and their distinctive choices to exploring the results of native visitors patterns on premiums, this complete useful resource equips citizens with the data had to protected appropriate and cost-effective protection. The information additionally addresses the claims procedure, dispute answer, and particular concerns for quite a lot of car varieties and driving force profiles, providing sensible recommendation for navigating the complexities of Fortress Lauderdale’s insurance coverage panorama.

Evaluate of Automobile Insurance coverage in Fortress Lauderdale, FL

Fortress Lauderdale, Florida, boasts a colourful way of life, however like all bustling town, navigating the auto insurance coverage panorama can really feel a bit of sophisticated. Working out the marketplace, to be had insurance policies, and conventional prices is a very powerful for making knowledgeable selections. This evaluation will supply a transparent image of the auto insurance coverage scene in Fortress Lauderdale.The automobile insurance coverage marketplace in Fortress Lauderdale, Florida, is aggressive, with plenty of insurers vying for purchasers.

Elements like riding information, car sort, and site considerably affect top rate prices. This aggressive atmosphere generally interprets to a variety of choices for policyholders, and in the long run permits customers to match and make a selection essentially the most appropriate protection for his or her wishes.

Commonplace Forms of Automobile Insurance coverage Insurance policies

Quite a lot of kinds of automotive insurance coverage insurance policies are to be had in Fortress Lauderdale, reflecting other wishes and chance profiles. Legal responsibility protection is a elementary requirement in Florida, protective policyholders from monetary duty within the tournament of an twist of fate the place they’re at fault. Collision protection, then again, will pay for damages in your car without reference to who’s at fault.

Complete protection extends past injuries, masking damages from occasions like vandalism, robbery, or weather-related incidents. Uninsured/Underinsured Motorist (UM/UIM) coverage safeguards policyholders towards injuries led to through drivers with out ok insurance coverage.

Standard Prices Related to Automobile Insurance coverage

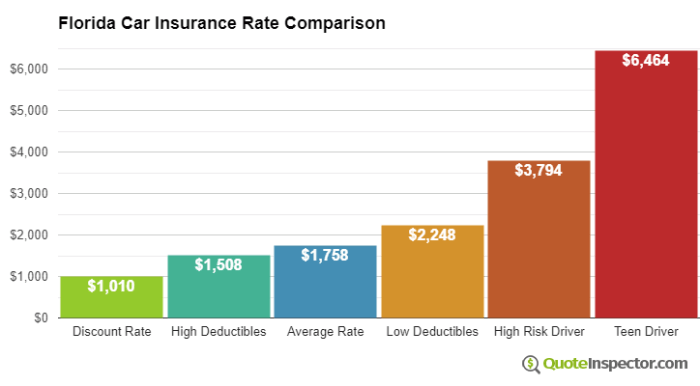

Automobile insurance coverage premiums in Fortress Lauderdale, like in different places, are influenced through a number of elements. Using document is a key determinant; a blank document generally ends up in decrease premiums. Automobile sort performs a task; sports activities automobiles or high-performance cars may command greater premiums because of their perceived greater chance. Location inside of Fortress Lauderdale additionally impacts premiums; spaces with greater twist of fate charges may have correspondingly greater premiums.

The specified protection degree and deductible quantity are a very powerful elements, influencing the overall top rate charge. As an example, the next deductible approach a decrease top rate, however the policyholder assumes better duty for out-of-pocket bills within the tournament of a declare. The present marketplace stipulations, together with the price of claims and to be had reductions, too can play a vital function in pricing.

Insurance coverage Suppliers in Fortress Lauderdale

A lot of insurance coverage suppliers function within the Fortress Lauderdale house, each and every providing a novel set of insurance policies and products and services. Evaluating those suppliers is very important to discovering the most efficient are compatible on your wishes.

| Corporate Title | Buyer Rankings (Instance) | Protection Choices |

|---|---|---|

| State Farm | 4.5 out of five stars (in keeping with buyer evaluations, instance) | Legal responsibility, Collision, Complete, UM/UIM |

| Revolutionary | 4.2 out of five stars (in keeping with buyer evaluations, instance) | Legal responsibility, Collision, Complete, UM/UIM, Reductions for secure riding |

| Geico | 4.0 out of five stars (in keeping with buyer evaluations, instance) | Legal responsibility, Collision, Complete, UM/UIM, Reductions for multi-vehicle insurance policies |

| Allstate | 4.3 out of five stars (in keeping with buyer evaluations, instance) | Legal responsibility, Collision, Complete, UM/UIM, Reductions for bundled products and services |

| Farmers Insurance coverage | 4.4 out of five stars (in keeping with buyer evaluations, instance) | Legal responsibility, Collision, Complete, UM/UIM, Reductions for just right credit score rankings |

Word: Buyer scores are examples and might range. All the time check essentially the most up-to-date knowledge without delay from the insurance coverage supplier. Protection choices might range between suppliers and particular person insurance policies.

Evaluating Insurance coverage Suppliers

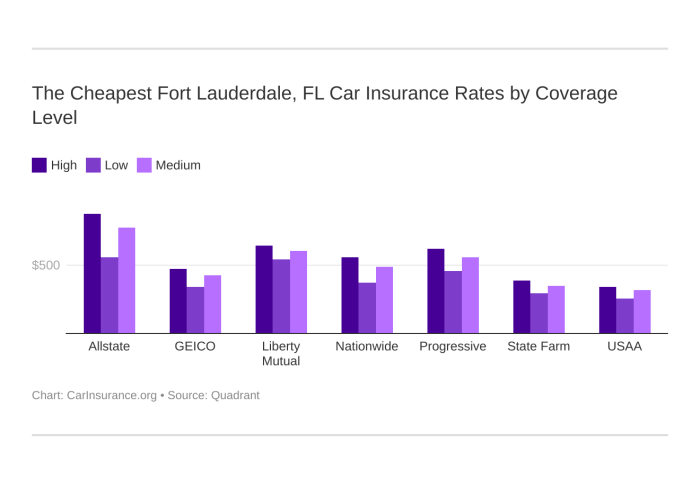

Navigating the auto insurance coverage panorama in Fortress Lauderdale can really feel like a treasure hunt. With such a lot of suppliers vying for your enterprise, working out the nuances of each and every corporate is a very powerful to securing the most efficient imaginable protection at a aggressive worth. Choosing the proper insurer is not just concerning the lowest top rate; it is about discovering an organization you believe to care for your declare easily and relatively must the sudden occur.Evaluating insurance coverage suppliers is not a one-size-fits-all undertaking.

Elements like your riding document, car sort, and site inside of Fortress Lauderdale all play a task within the top rate you can pay. This research delves into the strengths and weaknesses of a number of primary suppliers, serving to you are making an educated resolution adapted in your particular wishes.

Primary Insurance coverage Supplier Comparability

Other insurance coverage suppliers be offering distinctive programs and insurance policies, making it vital to grasp the options and products and services each and every corporate supplies. This comparability considers elements like moderate premiums, reductions, customer support scores, and the declare procedure.

| Insurance coverage Supplier | Reasonable Top class (Estimated) | Reductions Presented | Buyer Carrier Score (Reasonable) | Declare Procedure Main points |

|---|---|---|---|---|

| Revolutionary | $1,500 – $2,000 once a year | Excellent pupil reductions, multi-policy reductions, and secure driving force reductions. | 4.2 out of five stars (in keeping with buyer evaluations) | Revolutionary makes use of a virtual platform for submitting claims, frequently streamlining the method. They provide 24/7 declare fortify and frequently expedite upkeep for licensed claims. |

| State Farm | $1,600 – $2,200 once a year | Multi-policy reductions, defensive riding lessons, and just right pupil reductions. | 4.3 out of five stars (in keeping with buyer evaluations) | State Farm makes use of a complete declare procedure with devoted declare representatives. They’re recognized for a extra customized means, dealing with claims with cautious consideration to element. |

| Geico | $1,400 – $1,900 once a year | Excellent pupil reductions, multi-policy reductions, and reductions for bundling insurance coverage merchandise. | 4.1 out of five stars (in keeping with buyer evaluations) | Geico frequently makes use of on-line declare portals, taking into account fast and simple reporting. They provide a spread of declare fortify channels, from telephone to on-line chat. |

Continuously Bought Coverages in Fortress Lauderdale

Fortress Lauderdale, with its colourful way of life and excessive focus of tourism, frequently necessitates particular protection varieties. Working out those often bought coverages will assist tailor your insurance coverage wishes.

- Collision Protection: That is a very powerful for shielding your car if it is broken in an twist of fate, without reference to who is at fault. The frequency of fender benders in a hectic town like Fortress Lauderdale makes this a vital attention.

- Complete Protection: This protection protects towards damages from perils rather then collisions, corresponding to robbery, vandalism, fireplace, or weather-related incidents. The chance of robbery and vandalism in a densely populated vacationer house like Fortress Lauderdale makes this a regularly bought protection.

- Uninsured/Underinsured Motorist Protection: This is very important if you are fascinated about an twist of fate with a driving force who does not have ok insurance coverage. Fortress Lauderdale’s excessive quantity of visitors and coffee presence of uninsured drivers highlights the significance of this protection.

Declare Procedure for Every Supplier

The declare procedure varies considerably between insurance coverage corporations. A clean and environment friendly declare procedure is important, particularly all through tense occasions.

- Revolutionary: Revolutionary emphasizes virtual claims submitting, providing comfort and velocity. They frequently have devoted declare representatives for customized fortify.

- State Farm: State Farm’s declare procedure is understood for its thoroughness and personalized effect. They supply detailed fortify all through all the procedure.

- Geico: Geico makes use of a spread of virtual declare submitting strategies, making sure ease of reporting. They frequently have quite a lot of channels for declare fortify.

Elements Influencing Insurance coverage Prices in Fortress Lauderdale: Automobile Insurance coverage In Fortress Lauderdale Florida

Navigating the auto insurance coverage panorama in Fortress Lauderdale, a colourful town with its personal distinctive traits, calls for working out the criteria that form premiums. Site visitors patterns, native twist of fate statistics, or even your car sort play a a very powerful function in figuring out your insurance coverage prices. This exploration delves into the important thing components that affect your automotive insurance coverage on this dynamic South Florida town.Fortress Lauderdale’s insurance coverage marketplace displays the wider insurance coverage trade, the place premiums are influenced through a large number of things past merely the geographic location.

A complete working out of those elements empowers you to make knowledgeable selections about your protection and probably decrease your premiums.

Using Information

Using information are a number one determinant in automotive insurance coverage prices. A blank riding document, loose from injuries and violations, generally interprets to decrease premiums. Conversely, injuries or visitors violations, in particular the ones involving critical accidents or reckless riding, can considerably build up premiums. Insurance coverage corporations assess riding historical past to decide the chance profile of each and every driving force. This overview is in keeping with the frequency and severity of previous incidents.

Examples come with dashing tickets, DUI convictions, and even at-fault injuries. The severity and frequency of those occasions closely affect the top rate calculation.

Automobile Kind

The kind of car you force additionally considerably affects your insurance coverage prices. Sports activities automobiles, high-performance cars, and comfort automobiles are usually costlier to insure than same old fashions. That is because of their greater restore prices, attainable for higher-speed injuries, and higher robbery chance in some instances. The worth of the car is a key attention. Upper-value cars frequently have greater premiums to hide attainable losses.

Location

Location in Fortress Lauderdale, as with every town, performs a task in insurance coverage charges. Spaces with greater twist of fate charges or greater crime charges, which may affect car robbery, normally have greater insurance coverage premiums. This correlation stems from the inherent chance related to higher incidents. Explicit places inside of Fortress Lauderdale could have differing chance profiles because of visitors density, street stipulations, or native demographics.

Native Site visitors Patterns and Coincidence Statistics

Fortress Lauderdale’s visitors patterns, along side native twist of fate statistics, without delay affect insurance coverage charges. Prime-accident spaces or spaces with excessive visitors quantity are related to greater premiums. Insurance coverage corporations use information from native twist of fate reviews to evaluate the chance of injuries in particular spaces. This permits them to alter premiums accordingly.

Commonplace Reductions

Insurance coverage corporations often be offering quite a lot of reductions to assist decrease premiums. Examples come with reductions for secure riding techniques, defensive riding lessons, just right pupil reductions, and multi-vehicle reductions. Firms frequently supply those reductions to praise accountable riding behavior and inspire consumers to take proactive steps to scale back twist of fate chance.

Protection Prices Breakdown

Working out the prices related to quite a lot of protection varieties is very important. Legal responsibility protection protects you if you are at fault in an twist of fate. Collision protection will pay for injury in your car without reference to who is at fault. Complete protection covers injury in your car from occasions rather then injuries, corresponding to vandalism, robbery, or herbal screw ups.

| Protection Kind | Description | Have an effect on on Prices |

|---|---|---|

| Legal responsibility | Covers damages to others in an twist of fate. | Typically not up to collision or complete. |

| Collision | Covers injury in your car in an twist of fate, without reference to fault. | Generally is a significant slice of the top rate. |

| Complete | Covers injury in your car from occasions rather then injuries. | Ceaselessly varies in keeping with car sort and price. |

Pointers for Discovering Inexpensive Insurance coverage

Navigating the sector of vehicle insurance coverage in Fortress Lauderdale, FL, can really feel like a treasure hunt. Discovering the most efficient coverage at the most efficient worth calls for a strategic means. This treasure hunt is not about success; it is about working out the panorama and using superb comparability tactics.Discovering inexpensive automotive insurance coverage in Fortress Lauderdale, like many different facets of existence, hinges on proactive analysis and knowledgeable decision-making.

Armed with wisdom and the suitable gear, you’ll be able to unearth essentially the most appropriate coverage on your particular wishes and finances.

Evaluating Quotes Successfully, Automobile insurance coverage in fortress lauderdale florida

Acquiring a couple of quotes from other insurance coverage suppliers is a very powerful. This procedure means that you can examine protection choices and premiums side-by-side. Do not simply depend at the first quote you obtain; discover plenty of choices. This aggressive means guarantees you might be getting essentially the most aggressive charges. As an example, a driving force with a blank riding document and a more moderen, more secure car will most likely to find decrease premiums in comparison to a driving force with a historical past of injuries or an older, much less dependable car.

Working out Coverage Phrases and Stipulations

Completely reviewing coverage phrases and prerequisites is significant. Steer clear of signing up for a coverage and not using a entire working out of the protection, exclusions, and obstacles. The tremendous print frequently comprises main points that may affect your protection considerably. Pay shut consideration to deductibles, coverage limits, and protection exclusions, as those can considerably affect your out-of-pocket bills. As an example, working out the specifics of complete protection and collision protection is important to keep away from surprises when submitting a declare.

Growing a Step-by-Step Information

A structured solution to discovering the suitable automotive insurance coverage can save time and tension. This systematic means comes to a sequence of steps, each and every with its personal significance within the total procedure. This structured means can considerably make stronger the chance of discovering the suitable coverage.

- Assess your wishes and finances: Decide the extent of protection you require in keeping with your car’s price, riding behavior, and fiscal state of affairs. This preliminary step will set the parameters on your seek. As an example, should you force every now and then, you would possibly not want the similar degree of protection as a day-to-day commuter.

- Accumulate knowledge: Assemble information about your car, riding historical past, and any reductions you qualify for. This pre-planning will streamline the quote-gathering procedure.

- Request a couple of quotes: Touch a number of insurance coverage suppliers and procure quotes for identical protection programs. Evaluating quotes from a couple of suppliers is helping make sure you get essentially the most aggressive worth.

- Analyze the quotes sparsely: Review the protection main points, premiums, and coverage phrases of each and every quote. Scrutinize the protection, deductibles, and exclusions. Search for any hidden prices or obstacles.

- Evaluate and make a choice: Make a choice the coverage that best possible meets your wishes and finances, making an allowance for the phrases and prerequisites. Assessment the coverage totally to be sure that it aligns together with your necessities.

- Assessment and make sure: As soon as you might have selected a coverage, evaluation the overall file sparsely. Make certain all main points are correct and consistent with your settlement.

Working out Insurance coverage Protection Choices

Navigating the sector of vehicle insurance coverage can really feel like interpreting a secret code. However worry no longer, intrepid driving force! Working out your protection choices is vital to protective your car and your pockets. This segment delves into the quite a lot of kinds of protection to be had, highlighting their advantages and obstacles, so you’ll be able to make knowledgeable alternatives adapted in your riding behavior and fiscal state of affairs.Insurance coverage insurance policies are designed to hide attainable losses, however they don’t seem to be one-size-fits-all.

The kinds of protection introduced range considerably, and understanding what is integrated on your coverage is a very powerful. This complete evaluation will let you perceive the several types of protection, and the way to select the most efficient choices on your wishes.

Forms of Automobile Insurance coverage Protection

Other protection varieties cope with other dangers. Legal responsibility protection, as an example, protects you should you purpose injury to someone else’s assets or injure any individual in an twist of fate. It is a important part for monetary safety. Different kinds of protection supply broader coverage.

- Legal responsibility Protection: That is essentially the most fundamental form of protection, and it generally covers damages you purpose to others in an twist of fate. It does not duvet your individual car’s damages. As an example, if you are at fault in an twist of fate and purpose $10,000 in damages to some other automotive, your legal responsibility protection would pay as much as the coverage limits for that injury.

- Collision Protection: This protection protects you in case your automotive is broken in an twist of fate, without reference to who’s at fault. Consider a fender bender the place you’re at fault, collision protection can pay for the damages in your automotive, and despite the fact that you might be no longer at fault, collision protection pays for the wear in your automotive.

- Complete Protection: This protection is going past injuries. It protects your car from injury led to through occasions like robbery, vandalism, fireplace, hail, and even falling gadgets. As an example, if a tree falls for your automotive all through a hurricane, complete protection will assist restore or substitute the car.

- Uninsured/Underinsured Motorist Protection: This a very powerful protection steps in if you are fascinated about an twist of fate with a driving force who does not have insurance coverage or does not have sufficient insurance coverage to hide the damages. This protection is very important to give protection to you from monetary damage within the tournament of an twist of fate with a negligent driving force.

Advantages and Obstacles of Every Protection

Working out the benefits and downsides of each and every protection sort is very important for making knowledgeable alternatives.

| Protection Kind | Advantages | Obstacles |

|---|---|---|

| Legal responsibility | Protects you from monetary duty for damages led to to others. | Does not duvet injury in your personal car. |

| Collision | Covers injury in your car in an twist of fate, without reference to fault. | May also be pricey, relying at the coverage limits. |

| Complete | Protects towards quite a lot of non-collision damages, like robbery or vandalism. | Won’t duvet all damages, relying at the coverage’s exclusions. |

| Uninsured/Underinsured Motorist | Protects you if fascinated about an twist of fate with an uninsured or underinsured driving force. | Coverage limits are a very powerful; make sure that they are ok. |

Opting for the Proper Protection

Your personal riding behavior and car price play a vital function in figuring out the fitting protection. Somebody who drives every now and then and owns an older automotive may require much less protection than any individual who commutes day-to-day and drives a luxurious car.

“Imagine your finances and chance tolerance when deciding on your protection.”

A radical working out of your coverage’s exclusions and obstacles is similarly vital. Learn your coverage sparsely and ask questions if anything else is unclear. As an example, sure occasions, corresponding to injury from put on and tear, will not be coated beneath complete insurance coverage.

Native Laws and Rules

Fortress Lauderdale, like any Florida towns, has particular automotive insurance coverage rules designed to give protection to drivers and different street customers. Working out those rules is a very powerful for making sure compliance and fending off attainable consequences. Those regulations, whilst usually in step with state-wide rules, could have nuanced facets adapted to the native riding atmosphere.Navigating the complexities of vehicle insurance coverage regulations can really feel daunting, however working out the fundamentals empowers you to make knowledgeable selections.

This segment clarifies the precise necessities for Fortress Lauderdale, serving to you protected the fitting protection and keep away from pricey errors.

Minimal Protection Necessities

Florida, like many states, mandates a minimal degree of vehicle insurance plans to give protection to drivers and others fascinated about injuries. Assembly those necessities is important for criminal operation. Failure to conform may end up in fines and attainable suspension of your riding privileges. This segment Artikels the minimal necessities acceptable in Fortress Lauderdale.

- Physically Harm Legal responsibility (BIL): Florida calls for no less than $10,000 in line with individual and $20,000 in line with twist of fate for physically harm legal responsibility protection. This implies the insurance coverage corporate will compensate sufferers of an twist of fate for his or her scientific expenses and misplaced wages as much as those limits.

- Assets Harm Legal responsibility (PDL): At least $10,000 in assets injury legal responsibility protection is needed. This covers injury to someone else’s assets, corresponding to their car or different assets, led to through an twist of fate involving your car.

- Uninsured/Underinsured Motorist (UM/UIM): Whilst no longer a minimal requirement, UM/UIM protection is extremely really useful. This saves you in case you are injured in an twist of fate led to through a driving force with inadequate or no insurance coverage. This protection guarantees repayment on your damages in one of these situation.

Distinctive Insurance coverage Necessities Explicit to Fortress Lauderdale

Whilst Florida’s statewide rules shape the root, some native spaces could have particular necessities. In Fortress Lauderdale, whilst there don’t seem to be any distinctive, legally mandated insurance coverage necessities distinct from the state’s total regulations, the excessive quantity of tourism and the original native visitors patterns might impact the superiority of particular coverages. As an example, complete protection, which protects towards injury in your car from occasions like vandalism or storms, is also in particular related in spaces with the next prevalence of those occasions.

Consequences for Violating Laws

Failure to conform to Florida’s minimal insurance coverage necessities can result in critical penalties. Those consequences are designed to inspire compliance and make sure drivers have ok monetary duty in case of an twist of fate.

- Fines: Consequences for violating insurance coverage necessities range, however they are able to vary from considerable fines, probably exceeding a couple of hundred bucks, to extra serious penalties.

- Suspension of Using Privileges: Repeated violations of insurance coverage necessities may end up in the suspension of your driving force’s license. This will considerably affect your talent to shuttle and habits day-to-day actions.

- Prison Motion: In some circumstances, folks might face criminal motion for no longer having the desired insurance coverage. This may result in further prices and headaches.

Claims Procedure and Dispute Solution

Navigating the claims procedure can really feel like navigating a maze, however working out the stairs concerned can ease your worries. Fortress Lauderdale’s automotive insurance coverage claims procedure, whilst various fairly between suppliers, usually follows a identical development. Understanding what to anticipate could make the entire enjoy much less daunting.The graceful dealing with of claims is important to keeping up believe within the insurance coverage trade.

A well-defined procedure guarantees equity and potency for all events concerned, taking into account well timed resolutions and a favorable enjoy.

Usual Claims Procedure

Submitting a declare generally starts with reporting the twist of fate to the police and acquiring a police record. This a very powerful first step paperwork the incident and offers a very powerful main points for the insurance coverage corporations. Then, you should notify your insurance coverage corporate straight away. This advised notification guarantees the insurance coverage corporate can start accumulating vital knowledge and assessing the placement. Be ready to supply information about the twist of fate, together with the time, location, and cases.

Steps in Submitting a Declare and Receiving a Agreement

- File the twist of fate to the police: This step is significant, offering respectable documentation of the incident.

- Notify your insurance coverage corporate: Touch your insurance coverage supplier promptly to begin the claims procedure. Supply all vital main points and documentation.

- Accumulate supporting documentation: This contains the police record, scientific expenses, restore estimates, and some other related paperwork.

- Post your declare: Whole the vital declare bureaucracy, offering correct and detailed knowledge.

- Analysis and Investigation: The insurance coverage corporate will examine the declare, probably contacting witnesses or reviewing the scene.

- Agreement negotiation: The insurance coverage corporate will assess the damages and be offering a agreement quantity. This level frequently comes to negotiation, particularly for complicated or disputed claims.

- Agreement disbursement: As soon as the agreement is agreed upon, the insurance coverage corporate will factor cost, generally within the type of a take a look at or digital switch.

Choices for Dispute Solution

In case your declare is rejected or the agreement quantity is unsatisfactory, a number of dispute answer choices are to be had. Those choices permit for a extra formal procedure to succeed in an even answer.

- Negotiation: Touch your insurance coverage supplier without delay to speak about your considerations and check out to succeed in a mutually agreeable resolution.

- Mediation: A impartial 3rd birthday party, a mediator, is helping facilitate verbal exchange and negotiation between the events concerned.

- Arbitration: A impartial 3rd birthday party, an arbitrator, hears proof and arguments from all sides and makes a binding resolution. That is frequently a quicker and not more formal procedure than litigation.

- Litigation: If all different choices fail, you’ll be able to pursue criminal motion in courtroom. That is essentially the most formal and time-consuming choice.

Time frame for Processing Claims

The time frame for processing claims in Fortress Lauderdale varies relying at the complexity of the declare and the insurance coverage corporate. Easy claims may well be processed inside of a couple of weeks, whilst extra complicated ones may just take a number of months.

“The common declare answer time in Florida is generally between 30 and 60 days.”

Alternatively, those are simply estimates, and particular person instances might fluctuate considerably. Elements such because the severity of the wear, the supply of witnesses, and the complexity of the declare can all affect the time-frame. It’s good to be affected person and proactive in speaking together with your insurance coverage supplier all through the method.

Particular Issues for Explicit Automobiles or Drivers

Cruising down the palm-lined streets of Fortress Lauderdale, you wish to have your journey to be secure, regardless of the sort. This segment dives into the original elements that affect automotive insurance coverage premiums in keeping with your car and private main points, making sure you get the most efficient protection on your wishes.

Insuring Vintage Vehicles

Vintage automobiles, with their antique allure and frequently excessive price, call for specialised insurance coverage concerns. Those cars often require greater premiums because of their rarity and attainable for greater restore prices. Recovery and service retail outlets focusing on vintage automobiles are crucial to grasp the scope of attainable injury and service prices. Some insurers might require further documentation or inspections, probably expanding the whole charge of protection.

Insurance policies for traditional automobiles frequently have particular clauses about recovery, upkeep, and garage, so that you should sparsely evaluation your coverage main points. Protection for traditional automobiles is frequently adapted to their historic importance and price.

Insuring Bikes

Bikes provide a unique set of insurance coverage demanding situations in comparison to same old vehicles. Because of their decrease weight and uncovered nature, bikes are extra at risk of injury in injuries. This greater chance interprets to better premiums for bike house owners. Insurers often issue within the rider’s enjoy and the bike’s options, corresponding to protection apparatus. Insurance coverage suppliers may be offering reductions for riders who entire protection lessons or have a blank riding document.

Insuring Prime-Efficiency Automobiles

Prime-performance cars, with their tough engines and complex options, frequently include greater insurance coverage premiums. The opportunity of extra serious injuries and expensive upkeep contributes to this. Insurance coverage corporations frequently assess the car’s horsepower, adjustments, and total functionality features. Some insurers might be offering specialised insurance policies designed for high-performance automobiles, frequently with added protection choices. As an example, a coverage for a changed sports activities automotive may come with protection for high-performance portions and adjustments.

Younger Drivers

Younger drivers, frequently new to the street, are statistically extra vulnerable to injuries. This greater chance is mirrored in greater insurance coverage premiums. Insurance coverage corporations imagine elements like riding enjoy, riding historical past, and the car’s use. Reductions for just right grades or participation in secure riding techniques can assist scale back those prices.

Industrial Automobile Insurance coverage

Industrial car insurance coverage in Fortress Lauderdale calls for particular concerns. The usage of the car, the kind of trade, and the driving force’s historical past all play a vital function. Vehicles, trucks, and supply cars used for industrial functions require other protection in comparison to private cars. Those insurance policies frequently duvet shipment legal responsibility, car injury, and attainable criminal problems associated with trade operations.

Insurance coverage suppliers might want particular information about the trade, together with the kind of trade, shipment sort, and frequency of use.

Drivers with Coincidence Histories

Drivers with a historical past of injuries face greater insurance coverage premiums. Insurance coverage corporations imagine the quantity and severity of previous injuries when figuring out protection. They may additionally require greater deductibles or a mixture of protection changes to mirror the higher chance. A complete working out of your twist of fate historical past and the main points of each and every incident is important for working out the affect for your insurance coverage.

Rehabilitating your riding document and working out the way it affects your top rate is a very powerful.

Illustrative Instance of Insurance coverage Coverage

Navigating the sector of vehicle insurance coverage can really feel like interpreting a fancy code. However do not be concerned, working out your coverage does not must be a headache. This situation coverage, adapted for Fortress Lauderdale, supplies a transparent image of what your protection may seem like.This situation coverage showcases a commonplace package deal for a driving force in Fortress Lauderdale. Keep in mind, particular person cases and alternatives will impact your premiums and coverages.

Insurance policies don’t seem to be one-size-fits-all. Elements like your riding document, car sort, and site all play a task on your particular insurance coverage wishes.

Coverage Main points

This situation coverage main points the core parts of a complete automotive insurance coverage package deal related to Fortress Lauderdale. The figures offered are illustrative and must no longer be regarded as definitive quotes. Precise premiums and coverages rely on particular person elements.

| Protection Kind | Quantity | Top class (Per 30 days) | Deductible |

|---|---|---|---|

| Legal responsibility Physically Harm | $one million in line with individual, $3,000,000 in line with twist of fate | $45 | $0 |

| Legal responsibility Assets Harm | $250,000 in line with twist of fate | $30 | $0 |

| Collision | $100,000 | $20 | $500 |

| Complete | $100,000 | $15 | $500 |

| Uninsured/Underinsured Motorist Physically Harm | $one million in line with individual, $3,000,000 in line with twist of fate | $10 | $0 |

| Uninsured/Underinsured Motorist Assets Harm | $250,000 in line with twist of fate | $5 | $0 |

| Scientific Bills | $5,000 in line with individual | $8 | $0 |

| Non-public Harm Coverage (PIP) | $10,000 in line with individual | $12 | $0 |

| General Top class | $130 |

Clarification of Protection Quantities

The desk gifts a pattern coverage, outlining other protection quantities and corresponding premiums and deductibles. Legal responsibility protection protects you if you are at fault in an twist of fate. Collision and complete protection give protection to your car if it is broken in an twist of fate or through one thing rather then a collision (like hail or robbery). Uninsured/underinsured motorist protection safeguards you if the opposite driving force is at fault however does not have insurance coverage.

Scientific bills and PIP duvet scientific bills for you and your passengers without reference to fault.

Top class and Deductible Breakdown

Premiums mirror the protection degree. Upper protection quantities usually correlate with greater premiums. Deductibles are the volume you pay out-of-pocket ahead of your insurance coverage kicks in. The next deductible frequently ends up in decrease premiums. The instance coverage demonstrates how those elements affect your total insurance coverage prices.

Concluding Remarks

In conclusion, securing suitable automotive insurance coverage in Fortress Lauderdale, Florida, calls for a radical working out of the marketplace, coverage choices, and native rules. This information has offered a complete research, offering precious insights into the quite a lot of elements influencing premiums, the significance of evaluating suppliers, and the nuances of the claims procedure. Through sparsely making an allowance for the ideas supplied, citizens can with a bit of luck navigate the insurance coverage panorama and make a choice insurance policies adapted to their particular wishes.

Clarifying Questions

What are the minimal automotive insurance coverage necessities in Fortress Lauderdale, Florida?

Florida legislation mandates minimal legal responsibility protection, together with physically harm and assets injury. Explicit quantities range, and drivers must seek the advice of the Florida Division of Freeway Protection and Motor Automobiles for essentially the most up-to-date knowledge.

How do I examine automotive insurance coverage quotes successfully?

Evaluating quotes calls for accumulating knowledge from a couple of suppliers. Use on-line comparability gear or touch suppliers without delay to request quotes, making an allowance for elements like protection, deductibles, and reductions.

What reductions are generally introduced for automotive insurance coverage in Fortress Lauderdale?

Reductions range through supplier however frequently come with secure riding information, multi-policy reductions, anti-theft units, and usage-based techniques. Checking with quite a lot of suppliers is very important to find to be had reductions.

What are the standard prices related to complete automotive insurance coverage in Fortress Lauderdale?

Complete protection protects towards injury no longer led to through injuries, corresponding to vandalism or climate occasions. Prices rely on elements like car price, location, and the selected protection degree. Seek the advice of quite a lot of suppliers for detailed pricing.