Are you able to cancel a declare on automotive insurance coverage? This information breaks down the dos and don’ts of declare cancellations, from figuring out insurance policies to navigating the criminal sides. Get the interior scoop on the entirety from minor fender benders to general losses, and learn the way all of it impacts your coverage.

Cancelling a automotive insurance coverage declare can also be difficult, however understanding the foundations can prevent a global of complications. This detailed breakdown will stroll you via all of the procedure, protecting the entirety from the preliminary steps to the prospective affect to your long term premiums. So, buckle up and get in a position to dive into the sector of auto insurance coverage declare cancellations!

Figuring out Cancellation Insurance policies

Cancelling a automotive insurance coverage declare is not at all times easy. Insurance policies range, and the power to cancel a declare is determined by the cases and the insurance coverage corporate’s explicit procedures. This phase main points the standards occupied with cancelling a automotive insurance coverage declare, together with the various kinds of claims that could be matter to cancellation.Declare cancellation insurance policies are designed to give protection to each the insurance coverage corporate and the policyholder.

The insurance coverage corporate desires to verify truthful reimbursement for damages and save you fraudulent claims. The policyholder desires to steer clear of needless monetary burdens and make sure they obtain suitable reimbursement.

Sorts of Automobile Insurance coverage Claims

Several types of automotive insurance coverage claims have various cancellation insurance policies. Those come with minor injury, main injury, and general loss claims. Injuries and different incidents main to wreck or lack of a automobile also are coated by means of explicit insurance policies.

Components Influencing Cancellation

A number of elements can affect the power to cancel a automotive insurance coverage declare. Those come with the character of the wear, the period of time elapsed for the reason that declare used to be filed, and any statements or movements taken by means of the policyholder that may affect the declare’s validity. Moreover, any proof offered all over the declare investigation can impact whether or not a declare can also be cancelled.

The insurance coverage corporate’s inner procedures and the precise coverage prerequisites also are important elements.

Not unusual Causes for Declare Cancellation

Insurance coverage firms may cancel a declare for more than a few causes. Those come with finding discrepancies within the data supplied by means of the policyholder, inconsistencies within the proof offered, or if the wear used to be indirectly brought about by means of the development described. A loss of cooperation with the insurance coverage corporate all over the declare procedure, reminiscent of failure to offer required paperwork or attend important conferences, too can result in declare cancellation.

In some circumstances, a declare could be cancelled if the policyholder is located to have engaged in fraudulent actions associated with the declare.

Declare Cancellation Insurance policies Abstract

| Declare Sort | Cancellation Coverage Assessment |

|---|---|

| Minor Injury | Normally more straightforward to cancel if the wear is minor and does not require vital maintenance. The insurance coverage corporate may require additional proof to substantiate the wear’s extent and nature prior to cancelling. |

| Primary Injury/Partial Loss | Cancellation is extra complicated and dependent at the specifics of the wear and the insurance coverage corporate’s coverage. Important maintenance, proof of wear, and the level of the loss all play the most important roles. |

| General Loss | Cancellation of a complete loss declare is normally harder because of the automobile’s vital injury or whole destruction. Components just like the situation of the automobile, appraisal reviews, and the level of the loss are all vital. |

| Coincidence Claims | Cancellation insurance policies for twist of fate claims rely closely at the twist of fate’s cases, the main points supplied by means of the policyholder, and the proof offered. Any discrepancies within the reported occasions or inconsistencies within the proof may lead to cancellation. |

Procedures for Declare Cancellation: Can You Cancel A Declare On Automobile Insurance coverage

Cancelling a automotive insurance coverage declare is not at all times easy. Figuring out the precise procedures and required paperwork can prevent time and frustration. This phase Artikels the stairs occupied with cancelling a declare, from beginning the request to the overall affirmation. Figuring out those procedures is the most important for making sure a clean and environment friendly procedure.

Declare Cancellation Steps

Cancelling a declare in most cases comes to a number of steps, every requiring explicit movements from each the claimant and the insurance coverage supplier. A transparent figuring out of those steps will lend a hand steer clear of delays and make sure the cancellation is processed as it should be.

- Begin the Cancellation Request: Touch your insurance coverage supplier immediately to officially request the cancellation of your declare. Supply all related declare main points, such because the declare quantity, coverage quantity, and the cause of cancellation. This preliminary step units the method in movement. Be ready to offer supporting data if wanted.

- Collect Essential Paperwork: Your insurance coverage supplier might require explicit paperwork to procedure the cancellation. Those may come with the unique declare document, supporting documentation for the cancellation, and any related clinical information or restore invoices, relying at the cases of the declare.

- Evaluation and Approval: Your insurance coverage supplier will evaluate your request and supporting documentation. This step guarantees that the cancellation aligns with their insurance policies and procedures. Chances are you’ll obtain a affirmation or additional requests for rationalization or further paperwork.

- Declare Cancellation Affirmation: As soon as your request is authorized, the insurance coverage supplier will factor a proper affirmation of the declare cancellation. This affirmation report in most cases accommodates the cancellation date and different related main points.

Timeline for Processing Requests

The time frame for processing declare cancellation requests can range in accordance with the complexity of the declare and the insurance coverage supplier’s inner procedures. Be expecting some processing time. In some circumstances, a prolong could be because of the will for additional info from you.

For regimen claims, cancellation requests could be processed inside of a couple of industry days. Extra complicated claims involving criminal court cases or vital disputes may just take longer. You need to test together with your insurance coverage supplier for his or her explicit processing timelines and speak to them immediately to speak about any attainable delays or considerations.

Verbal exchange Channels

Contacting your insurance coverage supplier is the most important during the declare cancellation procedure. A number of channels are to be had for verbal exchange, together with telephone calls, emails, and on-line portals.

- Telephone: Direct telephone touch permits for fast verbal exchange and rationalization of any questions or considerations you could have.

- E-mail: Emails are appropriate for formal verbal exchange and documentation of the cancellation request. At all times retain copies of all correspondence.

- On-line Portal: Many insurance coverage suppliers be offering on-line portals for managing claims and policy-related issues. Those portals might come with devoted sections for declare cancellation requests.

Cancellation Process Abstract

This desk summarizes the stairs occupied with cancelling a automotive insurance coverage declare, together with estimated points in time and speak to data.

| Step | Description | Cut-off date | Touch Data |

|---|---|---|---|

| Begin Cancellation Request | Touch your insurance coverage supplier to request cancellation | Straight away | Insurance coverage supplier’s customer support quantity |

| Collect Essential Paperwork | Collect required paperwork for cancellation | Inside of 24-48 hours of request | Insurance coverage supplier’s customer support quantity or site |

| Evaluation and Approval | Insurance coverage supplier evaluations your request | 1-3 industry days (relying on complexity) | Insurance coverage supplier’s customer support quantity or site |

| Declare Cancellation Affirmation | Obtain affirmation of cancellation | 2-5 industry days (relying on complexity) | Insurance coverage supplier’s customer support quantity or site |

Causes for Declare Cancellation

Getting your automotive insurance coverage declare authorized can really feel like a hurdle race. Figuring out the the reason why a declare may get rejected or cancelled help you steer clear of commonplace pitfalls and reinforce your possibilities of a clean procedure. Figuring out those elements empowers you to verify your declare is as robust as imaginable from the beginning.

Not unusual Causes for Declare Rejection

Insurance coverage firms have explicit standards for approving claims. They wish to be sure that the reported incident and the claimed damages are reputable and align with the information. Mistakes within the reporting procedure, or inconsistencies within the proof, can result in declare rejection. In lots of circumstances, it isn’t an issue of dishonesty, however somewhat a loss of readability or completeness within the declare.

- Faulty or Incomplete Data: Offering incorrect main points, like flawed dates, occasions, or descriptions of the twist of fate, can cause a declare evaluate. This contains lacking the most important data, like witness statements or police reviews.

- Proof Problems: If the proof does not toughen the declare, the insurer may reject it. This is usually a loss of footage, poor-quality documentation, or conflicting statements from witnesses.

- Suspicious Cases: Some claims elevate pink flags because of atypical cases. For instance, a declare for injury that turns out disproportionate to the reported twist of fate or a loss of supporting documentation can spark an investigation.

The Position of Fraud in Declare Cancellation

Fraudulent claims are a major factor for insurance coverage firms. They affect all of the gadget, expanding premiums for everybody. Insurance coverage firms have powerful techniques to discover and examine suspicious actions. Fraud can take many paperwork, from falsifying injury reviews to exaggerating the level of the loss.

- Falsification of Data: Intentionally mendacity concerning the cases of an twist of fate or the level of wear is a transparent type of fraud. This contains fabricating proof or developing false documentation.

- Intent to Defraud: Insurance coverage firms are skilled to spot claims that could be designed to milk the gadget. A declare and not using a supporting proof or a extremely suspicious narrative can elevate suspicions.

- Claiming for Non-Existent Injury: Intentionally claiming injury that by no means came about, although it sort of feels minor, can also be regarded as fraud. This contains exaggerating injury to get a better payout.

Significance of Accuracy in Declare Data

Accuracy is essential to a clean declare procedure. Offering actual main points and making sure all supporting documentation is proper minimizes the danger of delays or rejections. Transparent verbal exchange and right kind record-keeping are very important during all of the declare procedure.

- Verification of Data: Insurance coverage firms test the ideas you supply, continuously via unbiased investigations. Correct main points from the beginning a great deal simplify the verification procedure.

- Supporting Documentation: Having right kind supporting documentation, like police reviews, witness statements, and pictures, is important for a a hit declare. Transparent documentation minimizes the danger of misunderstandings.

- Transparent and Concise Statements: Offering transparent and concise statements in regards to the incident and the wear is necessary. An in depth and easy account makes it more straightforward for the insurance coverage corporate to grasp and procedure your declare.

Examples of Ineligible Claims for Cancellation

Insurance coverage firms have established tips for declare eligibility. Some scenarios may consequence within the declare being deemed ineligible for cancellation. Those scenarios continuously contain a loss of compliance or the supply of false data.

- Failure to Conform to Coverage Phrases: If the incident does now not meet the coverage’s protection prerequisites, it can be ineligible. This would come with using underneath the affect or attractive in dangerous actions.

- Non-Compliance with Declare Reporting Procedures: In the event you fail to practice the declare reporting procedures Artikeld to your coverage, the declare could be rejected. This contains lacking points in time or now not offering required paperwork.

- Misrepresentation of Information: Intentionally offering misguided data to inflate a declare is a transparent violation of coverage phrases and can result in the declare’s cancellation.

Causes for Declare Cancellation Categorization, Are you able to cancel a declare on automotive insurance coverage

Figuring out the other classes of causes for declare cancellation help you steer clear of problems. The desk underneath supplies a breakdown of commonplace classes and examples.

| Class | Description | Instance |

|---|---|---|

| False Data | Offering misguided or fabricated information about the twist of fate or injury. | Claiming injury that did not happen, or falsifying witness statements. |

| Misrepresentation | Presenting a false image of the location to acquire a better payout. | Exaggerating the level of wear, or misrepresenting the cases of the twist of fate. |

| Non-Compliance | Failing to fulfill the necessities of the insurance coverage, like offering lacking paperwork or lacking points in time. | Failing to offer required documentation inside the stipulated time frame. |

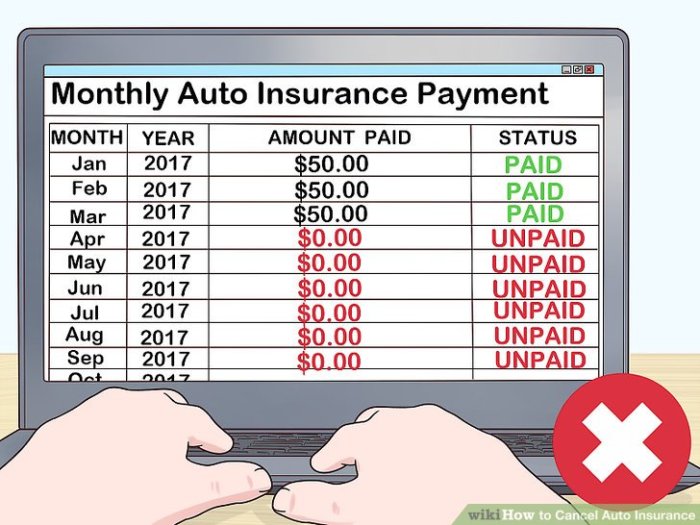

Affect of Cancellation on Coverage

Cancelling a declare, whilst every now and then important, may have vital repercussions on your insurance coverage. Figuring out those attainable results is the most important to creating knowledgeable selections. This phase main points how cancelling a declare affects your insurance coverage list and long term premiums.Cancelling a declare prior to it is totally resolved continuously creates a mark to your insurance coverage historical past. Insurance coverage firms use this knowledge to evaluate possibility and regulate your long term premiums.

This is not at all times a adverse consequence, however it is important to concentrate on the imaginable penalties.

Results on Insurance coverage Document

Cancelling a declare, although you later make a decision you need to pursue it once more, leaves a list of the cancellation. Insurance coverage firms take care of detailed information of claims, together with those who had been canceled. This list is continuously a part of the underwriting procedure while you observe for brand new insurance policies or renew your present one. Which means your cancellation historical past can affect long term insurance coverage selections.

Affect on Long term Premiums

Cancellation of a declare can every now and then impact long term insurance coverage premiums. Insurance coverage firms use ancient knowledge, together with declare cancellation charges, to resolve possibility profiles and set premiums. Whilst some cancellations may now not considerably affect premiums, others may just result in will increase. The level of the affect is determined by elements like the kind of declare, the explanations for cancellation, and your total insurance coverage historical past.

Examples of Unfavorable Affects

Cancelling a declare in advance can result in adverse penalties, specifically if the declare pertains to an important match. For instance, cancelling a declare associated with a big twist of fate may result in greater premiums someday. In a similar way, cancelling a declare for injury on your automobile may just doubtlessly make long term protection costlier or much less complete.

Penalties of Cancellation Sooner than Ultimate Solution

Cancelling a declare prior to its ultimate answer may have numerous penalties. It is going to save you you from receiving the advantages you might be entitled to, reminiscent of reimbursement for damages or maintenance. Moreover, it could create a adverse influence at the insurance coverage corporate, doubtlessly impacting long term claims or renewal programs. Crucially, if the cancellation arises from cases the place you had been to start with eligible for protection, it’s essential lose out on the ones advantages.

Desk Illustrating Affect on Premiums and Protection

| Situation | Affect on Top rate | Affect on Protection |

|---|---|---|

| Cancelling a minor fender bender declare | Probably minimum affect on top rate. | No vital exchange to protection. |

| Cancelling a declare for a big twist of fate, deemed your fault. | Most probably building up in top rate. | Probably lowered protection choices. |

| Cancelling a declare for a robbery, however later deciding to pursue criminal motion. | Probably greater top rate. | Doable lack of protection advantages. |

Felony Issues

Cancelling a automotive insurance coverage declare may have criminal implications, so figuring out your rights and obligations is the most important. This phase main points the prospective criminal ramifications and the stairs you must take to navigate the method safely and successfully. Figuring out the criminal panorama surrounding declare cancellations is helping you steer clear of attainable problems and protects your pursuits.The criminal sides of cancelling a declare don’t seem to be easy.

Insurance coverage insurance policies, state laws, and the precise cases of the declare all play a job in figuring out the validity and implications of cancellation. You might want to to concentrate on those nuances prior to making any selections.

Felony Implications of Declare Cancellation

Declare cancellation can cause criminal duties and repercussions. Insurance coverage firms have explicit procedures and necessities they should practice when dealing with declare cancellations. Figuring out those processes and attainable criminal demanding situations is necessary for each the policyholder and the insurer. Violating those procedures may just result in criminal problems.

Policyholder Rights Referring to Declare Cancellation

Policyholders have rights relating to cancelling a declare. Those rights continuously contain the fitting to learn of the cancellation procedures and the explanations for the cancellation. The policyholder has the fitting to problem the cancellation in the event that they imagine it is unjustified or in violation in their rights underneath the coverage or appropriate rules. Policyholders must in moderation evaluate their coverage paperwork for main points on their rights and obligations.

Eventualities Requiring Felony Intervention for Declare Cancellation

Sure scenarios might necessitate criminal intervention to get to the bottom of declare cancellation disputes. For example, if the insurance coverage corporate refuses to procedure a sound declare or cancels a declare with out right kind justification, criminal motion could be important. This would additionally happen if the insurer misrepresents data or violates contractual duties. Examples of those scenarios come with misrepresentation of information, breach of contract, or denial of a sound declare.

It is very important to seek advice from criminal suggest to grasp in case your case warrants criminal intervention.

Position of Insurance coverage Laws in Declare Cancellation

Insurance coverage laws play a the most important function in governing declare cancellation procedures. Those laws are designed to give protection to shoppers and make sure truthful practices within the insurance coverage trade. State and federal rules normally Artikel explicit tips for cancelling claims, together with the desired notification classes, causes for cancellation, and appeals processes. Those laws lend a hand take care of a degree of transparency and equity within the declare dealing with procedure.

Desk: Felony Sides of Declare Cancellation

| Side | Description | Related Regulations/Laws |

|---|---|---|

| Policyholder Rights | Proper to learn, proper to attraction, proper to truthful remedy. | State insurance coverage codes, explicit coverage provisions. |

| Insurance coverage Corporate Responsibilities | Following right kind procedures, offering justification, keeping up transparency. | State insurance coverage codes, federal client coverage rules. |

| Causes for Cancellation | Legitimate causes (e.g., fraud, subject material misrepresentation) vs. invalid causes (e.g., policyholder’s exchange of thoughts). | State insurance coverage codes, coverage phrases. |

| Dispute Solution | Negotiation, mediation, arbitration, litigation. | State rules on dispute answer, contractual clauses. |

Illustrative Situations

Declare cancellation is not at all times a simple procedure. Figuring out the precise cases surrounding a declare is the most important in figuring out its attainable for cancellation. Several types of insurance coverage insurance policies and injury situations impact the cancellation procedures.

A success Declare Cancellation

A buyer, Sarah, reported a minor scratch on her automotive bumper, coated underneath complete insurance coverage. The wear used to be simply repairable and did not considerably impact the automobile’s price. After assessing the location, the insurance coverage corporate decided {that a} declare wasn’t important. They contacted Sarah to tell her of this, providing the way to cancel the declare. Sarah accredited, and the declare used to be effectively canceled, fending off any longer processing or prices related to it.

Declare Cancellation No longer Conceivable

Believe a state of affairs the place John’s automotive used to be totaled in a collision. The wear used to be intensive, requiring whole substitute of the automobile. A declare used to be filed and assessed. On this case, cancellation of the declare would not be imaginable. The level of the wear and the need of a complete substitute declare makes cancellation extremely incredible.

The insurance coverage corporate has already initiated the declare procedure and can’t merely undo it.

Declare Cancellation Procedure: Hail Injury

For hail injury claims, the cancellation procedure normally comes to the insurance coverage corporate examining the automobile. If the wear is deemed minor and simply repairable, the corporate may be offering a restore estimate or just regulate the declare to mirror the true injury quantity. If the restore value is considerably less than to start with estimated, the corporate can doubtlessly cancel the declare, and the client might not be charged for the declare.

If the wear is deemed insignificant after the inspection, the declare could also be canceled. If the client refuses the restore, the declare cannot be canceled because the declare has already been assessed.

Declare Cancellation Procedure: Legal responsibility Insurance coverage

Legal responsibility insurance coverage claims, involving injury to some other celebration’s automobile, in most cases contain negotiations and settlements. If the wear is minor and the events agree on a answer out of doors of formal declare processing, the declare could be canceled. Alternatively, if a proper declare is initiated, cancellation is not likely except the events mutually conform to void the declare. The complexity of legal responsibility claims continuously makes cancellation tricky.

Declare Cancellation Situations and Results

| Situation | Doable Result |

|---|---|

| Minor injury to a automotive, simply repairable | Declare cancellation is imaginable if the wear is deemed insignificant after inspection. |

| General lack of a automobile in a collision | Declare cancellation is very not likely; a substitute declare is important. |

| Hail injury, minor and repairable | Declare cancellation is imaginable if the restore value is considerably less than the preliminary estimate. |

| Legal responsibility declare, minor injury, events agree on answer | Declare cancellation is imaginable if each events conform to a answer out of doors formal declare processing. |

| Legal responsibility declare, formal declare initiated, dispute unresolved | Declare cancellation is very not likely. |

Remaining Phrase

Briefly, canceling a automotive insurance coverage declare is not at all times a simple procedure. Figuring out the insurance policies, procedures, and attainable penalties is essential. This complete information has with a bit of luck provided you with the information to make knowledgeable selections relating to your declare. Take into account, in quest of skilled recommendation is at all times advisable when coping with complicated insurance coverage issues. Excellent success!

Q&A

Can I cancel a declare if I have already paid the deductible?

Most probably now not. Continuously, as soon as a deductible is paid, the declare is regarded as processed, making cancellation much less most probably.

What if I modified my thoughts concerning the declare?

The power to cancel a declare continuously is determined by the precise insurance coverage and the cases of the declare.

How lengthy does it take to cancel a declare?

Cancellation timelines range a great deal relying at the insurance coverage corporate and the character of the declare.

Will cancelling a declare impact my credit score ranking?

Usually, cancelling a declare would possibly not immediately affect your credit score ranking.