Are you able to backdate automobile insurance policy? Navigating the complexities of retroactive insurance coverage insurance policies generally is a daunting job, particularly when coping with the acquisition of a used car or different particular instances. This complete information delves into the intricacies of backdating automobile insurance coverage, exploring the prison ramifications, insurance coverage corporate insurance policies, and attainable pitfalls alongside the best way. From working out the idea that to figuring out attainable problems, we purpose to supply a transparent and concise evaluation.

This exploration of backdating automobile insurance policy starts through analyzing the basic ideas of retroactive coverage software. We’re going to read about the particular instances the place backdating may well be permissible, along the possible prison implications. The more than a few strategies used, along the intricacies of insurance coverage corporate procedures and the possible problems that can get up, are all sparsely analyzed.

Figuring out Backdating Automobile Insurance coverage Protection

Backdating automobile insurance policy, whilst from time to time essential, is not a easy procedure. It comes to adjusting the coverage’s efficient date to a previous time, which could have important implications. Figuring out the nuances of backdating is the most important for each shoppers and insurance coverage suppliers.Backdating an insurance plans necessarily way converting the coverage’s get started date to a prior date. This permits protection to be implemented retroactively, ceaselessly for a duration earlier than the coverage used to be in fact bought.

This differs from merely extending an current coverage’s time period.

Eventualities Requiring Backdating

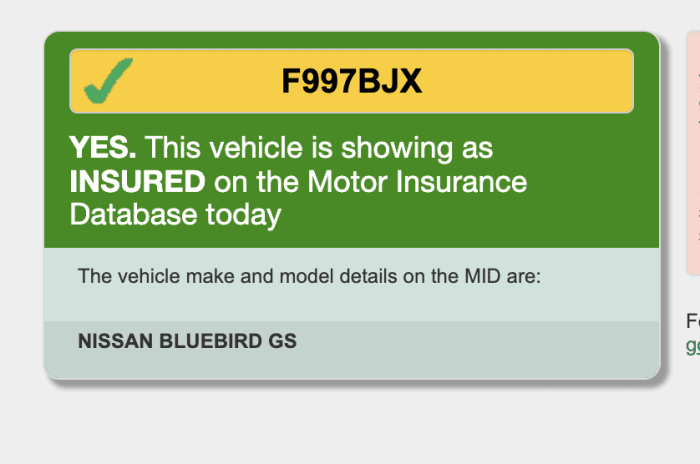

Backdating automobile insurance coverage insurance policies is also essential in particular instances, reminiscent of buying a used car. If a used automobile used to be bought, and the former proprietor didn’t supply evidence of present insurance policy, the brand new proprietor might want to backdate their coverage to the date of acquire to make sure the auto is roofed instantly. This saves the brand new proprietor from gaps in protection and attainable legal responsibility.

Prison Implications of Backdating

Insurance coverage insurance policies are legally binding contracts. Backdating those insurance policies should conform to state regulations. Failure to conform to those rules can result in coverage invalidation. Moreover, it will possibly have an effect on claims procedures and the validity of any attainable prison motion.

Attainable Dangers and Disadvantages of Backdating

Backdating insurance coverage insurance policies carries a number of dangers and drawbacks. At the beginning, misguided or incomplete documentation can result in coverage rejection or cancellation. Secondly, the insurance coverage supplier won’t have the ability to check the car’s standing and previous riding document, affecting the protection and pricing. Thirdly, the method might introduce complexities into claims dealing with, will have to an twist of fate happen inside the backdated duration.

In spite of everything, backdating will not be conceivable in all eventualities, particularly if the coverage used to be no longer written to hide a selected date vary.

Examples of Backdating in Motion

A not unusual instance of backdating comes to the acquisition of a used car. If the former proprietor did not supply evidence of insurance coverage, the brand new proprietor should backdate their coverage to the date of acquire. This saves the brand new proprietor from any gaps in protection. Every other instance is that if a automobile used to be all for an twist of fate and the insurance coverage used to be no longer backdated to hide the duration previous to the twist of fate, the insurance coverage corporate is probably not chargeable for the twist of fate.

In spite of everything, a policyholder might request backdating to hide a selected match or duration, like a duration of non-driving. On the other hand, every case should be reviewed in my opinion and conform to the insurer’s phrases and stipulations.

Strategies for Backdating Automobile Insurance coverage Protection

Securing the correct automobile insurance policy is the most important. Backdating insurance policies generally is a complicated procedure, requiring cautious consideration to element and adherence to precise procedures. Figuring out the more than a few strategies and steps concerned is essential to a easy and correct backdating revel in.Backdating automobile insurance policy is ceaselessly essential for eventualities like retroactive changes, coverage corrections, or to replicate adjustments in protection efficient from a prior date.

Figuring out the strategies and procedures concerned guarantees a easy and correct backdating procedure, fending off attainable problems or delays in protection.

Other Strategies of Backdating

Quite a lot of strategies exist for backdating automobile insurance policy, every with its personal procedures and implications. The most typical strategies contain adjusting current insurance policies or growing new insurance policies to replicate the specified protection date. Figuring out the particular method applied will be certain correct and well timed implementation.

Commonplace Procedures for Backdating Insurance policies

The average procedures all for backdating insurance coverage insurance policies normally come with a radical assessment of the insured’s present coverage, an in depth exam of the asked protection date, and the choice of all related paperwork. A radical assessment guarantees correct calculation of premiums and guarantees compliance with coverage phrases. Insurance coverage firms will generally observe an outlined protocol for backdating, encompassing particular steps and necessities.

Comparability of Backdating Strategies

Other backdating strategies range in complexity and accuracy. Guide backdating, whilst from time to time extra versatile for particular eventualities, is also susceptible to mistakes. The usage of computerized methods, on the other hand, ceaselessly guarantees larger accuracy and potency. Those computerized methods typically cut back handbook intervention, minimizing the danger of human error.

Documentation Necessities for Backdating

Correct documentation is essential for a hit backdating. Crucial paperwork might come with evidence of car possession, motive force’s license, and another supporting paperwork laid out in the insurance coverage corporate. The specified paperwork range in line with the particular state of affairs and the insurance coverage supplier.

Step-by-Step Procedure for Backdating Automobile Insurance coverage

A structured procedure simplifies backdating automobile insurance policy. Here is a basic Artikel:

- Preliminary Session: Touch the insurance coverage corporate and obviously state the specified efficient date for protection. Provide an explanation for the cause of backdating and accumulate any essential data.

- Coverage Overview: The insurance coverage corporate will assessment the present coverage to make sure correct calculation of premiums and adherence to coverage phrases.

- Report Submission: Supply all required paperwork, together with evidence of car possession, motive force’s license, and different related data as laid out in the corporate.

- Top class Calculation: The insurance coverage corporate calculates the premiums in line with the backdated efficient date and the selected protection main points.

- Coverage Modification: The insurance coverage corporate modifies the coverage to replicate the backdated efficient date and any adjustments to the protection.

- Affirmation and Fee: The policyholder receives affirmation of the amended coverage and the up to date top class main points. Fee is made to finalize the backdated protection.

Legality and Rules

Backdating automobile insurance policy can appear to be a easy resolution to economize, however it is the most important to know the prison ramifications. Navigating the complicated internet of state and nationwide rules surrounding this tradition is very important to keep away from expensive consequences and prison hassle. Illegal backdating can result in hefty fines, insurance plans cancellations, or even prison fees in some circumstances.

Prison Panorama of Backdating

The legality of backdating automobile insurance coverage insurance policies varies considerably through jurisdiction. Some states have specific prohibitions in opposition to this tradition, whilst others don’t have any particular regulations addressing it. This loss of uniform legislation ceaselessly creates confusion for shoppers and insurance coverage suppliers alike. Figuring out the particular rules on your house is paramount to creating knowledgeable selections.

State-by-State Rules

Navigating the patchwork of state rules on backdating automobile insurance coverage is difficult. There is no central database that comprehensively main points every state’s regulations in this topic. Insurance coverage suppliers ceaselessly handle inside pointers and compliance procedures, however those don’t seem to be all the time readily to be had to the general public.

| State/Nation | Rules on Backdating | Consequences |

|---|---|---|

| California | Explicitly prohibits backdating insurance policies. | Attainable fines and coverage cancellation. |

| New York | No particular regulations in opposition to backdating however is also thought to be fraud if supposed to misinform. | Civil consequences and prison fees if fraud is concerned. |

| Texas | Rules are much less specific; the point of interest is on fraudulent practices. | Fines and prison motion in line with fraud or deception. |

| United Kingdom | Insurers generally have inside insurance policies prohibiting backdating. | Attainable fines and disciplinary motion in opposition to the insurer or dealer. |

Figuring out Attainable Prison Problems

Spotting attainable prison pitfalls when taking into consideration backdating automobile insurance coverage is the most important. If you are having a look to decrease your insurance coverage prices, imagine exploring respectable possible choices reminiscent of reductions, secure riding systems, or other insurance coverage suppliers.

Consequences for Unlawful Backdating

Consequences for enticing in unlawful backdating practices may also be serious. Insurance coverage firms might cancel insurance policies, levy really extensive fines, and pursue prison motion in opposition to folks or firms concerned. Prison fees are conceivable in circumstances of intentional fraud or deceit. Examples come with circumstances the place backdating is used to keep away from paying premiums or to create a false document of insurance policy for fraudulent functions.

Averting Prison Problems

As an alternative of doubtless unhealthy backdating, imagine choice strategies for saving cash on automobile insurance coverage. Those choices come with the usage of reductions for excellent riding data, keeping up a secure riding historical past, or exploring other insurance coverage suppliers to match charges. Consulting with a prison skilled is all the time really helpful if in case you have questions concerning the legality of backdating on your particular jurisdiction.

Insurance coverage Corporate Insurance policies

Insurance coverage firms have various insurance policies relating to backdating automobile insurance policy. Figuring out those insurance policies is the most important for securing the correct coverage on the proper time. This segment delves into the other approaches insurance coverage firms take, evaluating their practices, and outlining the method for filing a request.Insurance coverage firms make use of numerous strategies for comparing backdating requests. Elements like the kind of protection, the cause of the backdate, and the corporate’s inside pointers affect their selections.

A radical working out of those insurance policies can considerably affect the good fortune of your request.

Other Approaches to Backdating Requests

Insurance coverage firms ceaselessly assess backdating requests in line with numerous elements. Some prioritize the date the policyholder bought the car, whilst others center of attention at the date the policyholder received the essential paperwork, such because the car’s registration. Those differing views spotlight the will for cautious attention of every corporate’s particular procedures.

Comparability of Insurance policies Amongst Suppliers

Insurance coverage firms ceaselessly range of their approaches to backdating. Some firms is also extra versatile than others, in particular for respectable causes. For example, an organization may well be extra accommodating if the backdating request is because of a transformation in instances or an oversight.

Insurance coverage Corporate Insurance policies Desk

| Insurance coverage Corporate | Coverage on Backdating | Conventional Approval Standards | Conventional Denial Standards |

|---|---|---|---|

| Corporate A | Usually versatile, however calls for documented evidence. | Legitimate evidence of car possession at the asked date. | Loss of enough documentation or fraudulent intent. |

| Corporate B | Stricter, that specialize in the date of car acquire. | Evidence of car acquire at the asked date. | Loss of evidence of car acquire at the asked date. |

| Corporate C | Extremely case-specific; calls for detailed rationalization. | Documented causes for wanting backdated protection, like a surprising twist of fate. | Imprecise or unsubstantiated causes, or makes an attempt to retroactively declare damages. |

Filing a Backdating Request

Filing a backdating request to an insurance coverage corporate normally comes to a proper procedure. This generally calls for contacting the corporate immediately and offering all essential documentation. This documentation may come with evidence of car possession, acquire date, or registration data.

Examples of Approval and Denial

Examples of eventualities the place an organization may approve a backdating request come with a buyer buying a car and wanting protection from the acquisition date. Then again, an organization might deny a request if the client tries to backdate protection to assert damages from an twist of fate that took place earlier than the coverage started. Corporations will search for inconsistencies within the data equipped.

Attainable Problems and Answers

Backdating automobile insurance policy, whilst from time to time fascinating, items attainable demanding situations. Figuring out those problems and their answers is the most important for a easy and a hit backdating procedure. This segment delves into not unusual pitfalls and offers sensible methods for navigating them.Navigating the complexities of backdating insurance policy calls for cautious attention of attainable discrepancies and procedural nuances. Thorough preparation and proactive communique along with your insurance coverage supplier are key to mitigating those problems and making sure a a hit end result.

Discrepancies in Dates

Correct date monitoring is paramount in backdating procedures. Faulty or conflicting dates can result in disputes and delays. Insurance coverage firms meticulously observe coverage dates to make sure compliance with rules and correctly calculate premiums.

- Drawback: Inconsistent dates recorded throughout other paperwork (e.g., software bureaucracy, cost data, or coverage paperwork) can result in confusion and disputes all through the backdating procedure.

- Drawback: Lacking or incomplete documentation associated with the coverage’s efficient date can impede the backdating procedure. This ceaselessly necessitates further steps to get to the bottom of the discrepancy.

- Drawback: If the date of acquire of the car does no longer fit the coverage’s efficient date, it can result in delays or rejection of the backdating request.

Coverage Protection Gaps

Insurance coverage insurance policies are designed with particular get started and finish dates. Making an attempt to backdate protection that overlaps with classes missing protection can create important headaches.

- Drawback: If a coverage’s efficient date falls inside a duration the place no protection exists, the backdating request is also denied because of non-compliance with insurance coverage rules.

- Drawback: Insurance policies that have been canceled or lapsed previous to the specified efficient date might result in headaches all through the backdating procedure.

- Answer: Touch the insurance coverage corporate to elucidate the coverage’s gaps in protection and discover choices to fill those gaps with a supplementary coverage or top class adjustment. Reviewing prior coverage paperwork is the most important to make sure no protection gaps exist all through the duration in query.

Verification Demanding situations

Verifying the accuracy of the asked backdating is a essential step. The insurance coverage corporate should verify the validity of the claimed occasions and dates.

- Drawback: Insurance coverage firms might require further verification of the declare, reminiscent of offering supporting paperwork (e.g., car registration, acquire receipts, or prior coverage main points) to validate the request.

- Drawback: In circumstances of discrepancies between the equipped data and the corporate’s data, the request for backdating is also rejected.

- Answer: Get ready complete documentation. Be sure that all essential supporting paperwork, reminiscent of car registration and evidence of acquire, are readily to be had and in excellent order. Take care of correct data of all communications with the insurance coverage corporate.

Commonplace Backdating Problems and Answers

| Factor | Attainable Answer |

|---|---|

| Discrepancies in coverage dates | Supply correct and complete documentation to beef up the asked backdating date. If discrepancies get up, promptly deal with them with the insurance coverage corporate to keep away from delays. |

| Protection gaps | Explain the coverage’s gaps in protection with the insurance coverage corporate. Discover choices for bridging protection gaps via supplementary insurance policies or top class changes. |

| Verification demanding situations | Be sure that all asked paperwork are readily to be had, correct, and whole. Take care of detailed data of all interactions with the insurance coverage corporate. |

Illustrative Examples

Backdating automobile insurance policy generally is a complicated procedure, requiring cautious attention of more than a few elements. Figuring out the nuances of when it is permissible, the strategies concerned, and the possible pitfalls is the most important for a easy and a hit end result. This segment supplies sensible examples as an instance other situations.

Situation Requiring Backdating

A tender motive force, not too long ago approved, bought a automobile. They to begin with underestimated their insurance coverage wishes and opted for a coverage with restricted protection. After a minor twist of fate, they discovered the inadequacy in their coverage and wanted larger legal responsibility protection. Backdating their coverage to the date of acquire would permit them to regulate their protection with out the lapse of insurance coverage, a the most important think about keeping up their riding document.

Technique of Backdating, Are you able to backdate automobile insurance policy

As an instance the method, imagine a situation the place a buyer needs to backdate their automobile insurance policy. The buyer contacts their insurance coverage supplier and explains their want. The insurance coverage corporate evaluations the coverage phrases and stipulations and assesses whether or not backdating is permissible. If authorised, the insurance coverage corporate will modify the top class and protection to replicate the specified retroactive date.

The buyer will obtain up to date coverage paperwork and pay the adjusted top class for the retroactive duration. Essential paperwork reminiscent of motive force’s license, car registration, and twist of fate experiences may well be had to finalize the backdating procedure.

Situation The place Backdating is Now not Imaginable

A motive force bought a coverage with a selected get started date, however due to this fact wanted to backdate it to a previous date. This isn’t permissible if the coverage’s phrases explicitly state that backdating isn’t allowed. If the backdating request falls out of doors the insurance coverage corporate’s permissible time frame, it will be denied. The insurer might also refuse if the coverage used to be in the beginning bought with a selected pre-existing situation exclusion that may were acceptable at the desired retroactive date.

A hit and Unsuccessful Makes an attempt

- A hit Try: A policyholder skilled a vital lower of their top class fee for a selected protection sort after buying a automobile with enhanced security measures. Through backdating their coverage to the date of acquire, they might lock within the decrease fee, which stored them a substantial amount of cash over the coverage time period.

- Unsuccessful Try: A buyer asked to backdate their coverage to a date previous to a reported twist of fate. The insurance coverage corporate denied the request as it violated the coverage’s clause relating to injuries and attainable legal responsibility claims all through the retroactive duration. The insurer known that backdating to a date previous the twist of fate would have doubtlessly created an unfair merit for the client.

The request used to be rejected because of coverage barriers and attainable fraud implications.

- A hit Try: A industry proprietor needed to modify their fleet insurance policy because of a transformation of their industry operations. Backdating the coverage to the date of the operational alternate allowed them to pay the right kind top class quantity and not using a lapse in protection and with none disruption to their day-to-day operations.

Averting Pitfalls

Backdating automobile insurance policy generally is a complicated procedure, fraught with attainable pitfalls. Figuring out those attainable problems and imposing preventative measures is the most important to fending off prison headaches and making sure easy transactions. Moderately imagine the hazards concerned and take proactive steps to safeguard your pursuits.Cautious making plans and adherence to rules are key to fending off problems. Thorough analysis, actual documentation, and transparent communique with the insurance coverage corporate are essential for a a hit backdating procedure.

Figuring out what to anticipate and the best way to care for attainable issues will decrease rigidity and make sure a favorable end result.

Commonplace Pitfalls to Steer clear of

Figuring out the average pitfalls related to backdating automobile insurance policy is the most important for a easy and legally sound procedure. Ignoring those attainable problems can result in expensive mistakes and delays. Proactive identity and mitigation of dangers are crucial for a hit backdating.

- Improper Documentation: Faulty or incomplete documentation is a not unusual pitfall. Be sure that all required bureaucracy, dates, and main points are correct and whole to forestall delays or rejection. Offering actual data and double-checking its accuracy are essential steps.

- Incomplete Protection Data: Failing to incorporate all related information about the protection duration can result in gaps in coverage. Be sure that the coverage correctly displays the specified get started and finish dates of protection to keep away from unexpected instances.

- Coverage Exclusions: Some insurance coverage insurance policies have exclusions or barriers that may have an effect on backdating requests. Figuring out those barriers is very important to forestall long run headaches and make sure the coverage meets your wishes.

- Ignored Points in time: Insurance coverage firms ceaselessly have particular time limits for processing backdating requests. Failure to fulfill those time limits can lead to delays or rejection of the request. Steadily checking and adhering to the corporate’s timelines will assist keep away from such headaches.

Tips on how to Mitigate Dangers

Imposing proactive measures can considerably cut back the danger of encountering issues all through the backdating procedure. Those strategies are designed to make sure a easy transition and compliance with rules.

- Thorough Analysis: Completely researching the particular necessities and rules for backdating on your jurisdiction is essential. Figuring out the native regulations and rules associated with insurance coverage backdating will assist save you any attainable prison problems.

- Transparent Verbal exchange: Keeping up open communique with the insurance coverage corporate during the method is the most important. This proactive communique is helping be certain a easy procedure and deal with any attainable issues promptly.

- Detailed Documentation: Actual documentation of all related data, together with dates, coverage numbers, and supporting paperwork, is very important. A transparent and complete document minimizes the danger of mistakes and delays.

- In the hunt for Skilled Recommendation: Consulting with an insurance coverage skilled or prison professional may give treasured steerage at the particular rules and procedures for backdating on your house. In the hunt for professional recommendation can save you expensive errors.

Attainable Pitfalls and Beneficial Precautions

The next desk highlights attainable pitfalls and really helpful precautions for a easy backdating procedure. Figuring out those facets will can help you mitigate dangers.

| Attainable Pitfall | Beneficial Precautions |

|---|---|

| Improper coverage main points | Double-check all coverage data, together with dates and protection quantities. |

| Ignored time limits | Overview corporate time limits and put up the request inside the specified time frame. |

| Loss of supporting documentation | Acquire all essential paperwork, together with evidence of possession, to beef up the request. |

| Coverage exclusions | Moderately assessment coverage phrases and stipulations to know any barriers on backdating. |

Fighting Commonplace Errors

To keep away from not unusual errors, handle meticulous consideration to element during the backdating procedure. Those preventive steps will decrease the danger of mistakes and make sure a easy transaction.

- Check Coverage Phrases: Moderately assessment your insurance plans’s phrases and stipulations relating to backdating to know any restrictions or barriers. Making sure the coverage lets in backdating is the most important.

- Correct Date Access: Double-check all dates related to the coverage, together with the efficient date and any related milestones. Correct date access is essential to keep away from discrepancies.

- Search Rationalization: If any side of the backdating procedure is unclear, promptly search explanation from the insurance coverage corporate. Proactive explanation will decrease attainable misunderstandings.

- Take care of Data: Stay detailed data of all communications, paperwork, and timelines associated with the backdating request. Keeping up complete data is helping observe growth and deal with any attainable problems.

Finish of Dialogue

In conclusion, backdating automobile insurance policy is a nuanced procedure fraught with attainable prison and logistical demanding situations. Figuring out the prison panorama, the more than a few insurance coverage corporate approaches, and the possible pitfalls is the most important. Whilst backdating is also possible in some eventualities, thorough analysis and cautious attention are crucial. The information’s complete research supplies a transparent roadmap for navigating this complicated matter.

Bear in mind, correct documentation and adherence to rules are essential for a easy and a hit backdating procedure.

FAQ Useful resource: Can You Backdate Automobile Insurance coverage Protection

Can I backdate my automobile insurance coverage if I latterly bought my automobile and purchased a brand new one?

Usually, backdating insurance coverage isn’t simple in such circumstances. Insurance coverage firms generally require a transparent and documented reason for the alternate in car possession. You could want to put up evidence of sale and buy, and the particular regulations range relying at the insurance coverage supplier and jurisdiction.

What documentation is wanted for a backdating request?

The documentation necessities for backdating requests range relying at the insurance coverage corporate and the particular instances. On the other hand, be expecting to supply evidence of possession, the acquisition date, and another related supporting paperwork, reminiscent of a invoice of sale or registration switch.

Are there any particular eventualities the place backdating is illegal?

Sure, insurance coverage firms might refuse to backdate insurance policies if the request is for a duration when the car used to be no longer insured or in circumstances of fraudulent intent. The legality of backdating additionally varies through jurisdiction.

What are the possible consequences for unlawful backdating?

Consequences for unlawful backdating can vary from coverage cancellation and fines to extra critical prison repercussions, relying at the severity of the violation and the jurisdiction. Those consequences can range considerably.