Perfect automotive insurance coverage claims procedure in massachusetts is the most important for a easy restoration after an coincidence. This information dives deep into the Massachusetts claims procedure, from preliminary reporting to ultimate agreement, making sure you already know your rights and choices. We will evaluate insurance coverage firms, element crucial steps, and cope with possible declare denials, empowering you to navigate the method with a bit of luck and successfully.

This complete useful resource will duvet the entirety from figuring out your coverage to figuring out your rights. We will be able to analyze quite a lot of insurance coverage firms and discover choice dispute answer choices that will help you make knowledgeable choices and succeed in a positive end result.

Assessment of Massachusetts Automotive Insurance coverage Claims

Navigating the automobile insurance coverage claims procedure in Massachusetts can really feel daunting, however figuring out the stairs concerned empowers you to take care of your declare successfully. This information Artikels the everyday procedure, from preliminary touch to ultimate agreement, making sure a easy revel in. Realizing the typical varieties of claims and related laws additional simplifies the process.The Massachusetts automotive insurance coverage claims procedure, whilst various in accordance with the precise instances, normally follows a structured trail.

Working out those steps will let you unravel your declare successfully and keep away from possible headaches. This evaluate supplies a complete information to the claims procedure, protecting the most important sides like submitting procedures, not unusual declare varieties, and related laws.

Conventional Claims Procedure in Massachusetts

The everyday claims procedure in Massachusetts comes to a number of key steps. First, you wish to have to touch your insurance coverage corporate to file the coincidence. Documenting the incident totally, together with main points of the coincidence, accidents, and damages, is significant. Subsequent, your insurance coverage corporate will examine the declare, which might contain contacting witnesses, reviewing police studies, and assessing the damages. Following the investigation, your insurer will decide the level of your protection and the quantity of repayment you might be entitled to.

In the end, the declare will probably be settled consistent with the phrases Artikeld on your coverage.

Commonplace Kinds of Automotive Insurance coverage Claims

Massachusetts automotive insurance coverage insurance policies usually duvet quite a lot of varieties of claims. Belongings injury claims are prevalent, involving damages in your automobile or some other birthday party’s automobile. Physically harm claims rise up from accidents sustained by way of you or some other birthday party within the coincidence. Uninsured/underinsured motorist claims give protection to you if the at-fault motive force lacks enough protection. Collision and complete claims cope with injury in your automobile because of injuries or non-collision occasions, respectively.

Laws and Rules Governing Claims

Massachusetts has particular laws and regulations governing automotive insurance coverage claims. Those laws ensure that honest and constant dealing with of claims. The state mandates minimal legal responsibility protection quantities, which you should imagine when opting for a coverage. Laws additionally dictate the procedures for reporting injuries and submitting claims, together with closing dates for submitting. Moreover, Massachusetts regulations govern using unbiased adjusters and the method of mediation.

Working out those laws is helping ensure that an excellent declare answer.

Timeline for Other Declare Varieties

| Declare Sort | Conventional Timeline (in days/weeks) | Clarification |

|---|---|---|

| Belongings Injury (minor) | 10-20 | Claims involving minor damages to cars, usually resolved briefly. |

| Belongings Injury (primary) | 20-40 | Extra intensive damages require extra time for exams, maintenance, and approvals. |

| Physically Damage | 30-60+ | Figuring out legal responsibility, clinical bills, and long-term results extends the time frame. |

| Uninsured/Underinsured Motorist | 20-50 | Investigation time and the want to examine the loss of protection or inadequate protection of the at-fault motive force. |

Those timelines are estimations. The real time taken to unravel a declare is dependent upon elements just like the complexity of the case, the supply of documentation, and the insurance coverage corporate’s procedures. A well timed answer is the most important for a easy claims procedure.

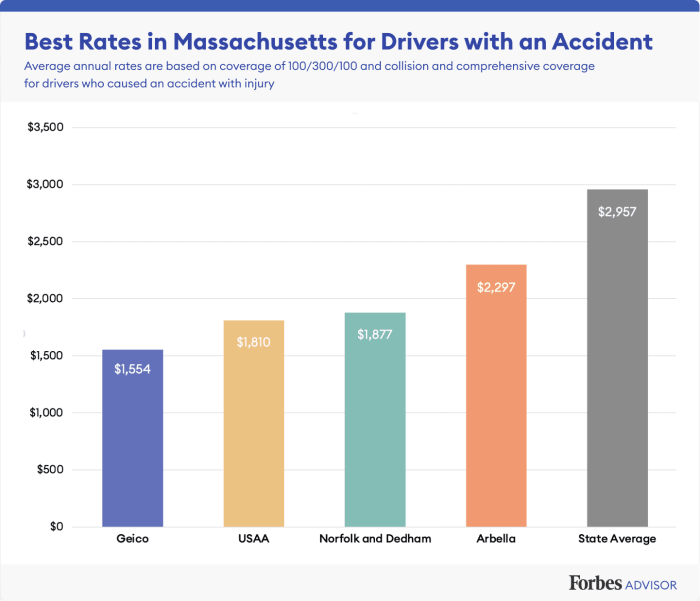

Evaluating Insurance coverage Corporations in Massachusetts

Navigating the Massachusetts automotive insurance coverage panorama can really feel like a treasure hunt, with quite a lot of firms vying for your corporation. Working out how each and every handles claims is the most important, as a easy declare procedure can prevent time and rigidity throughout a difficult length. This exploration will delve into the declare dealing with procedures of primary insurers, highlighting strengths and weaknesses to empower you in making knowledgeable choices.The declare procedure is not only about getting your automobile repaired; it is about all the revel in, from preliminary touch to ultimate agreement.

Other firms excel in several sides, whether or not it is the velocity of processing, the helpfulness of purchaser carrier representatives, or the readability of conversation all through the claims adventure.

Declare Dealing with Procedures of Main Insurance coverage Corporations

Other insurance coverage firms in Massachusetts make use of quite a lot of methods for dealing with claims. Some prioritize velocity, whilst others center of attention on customized customer support. This analysis examines how other firms means claims, bearing in mind their strengths and weaknesses.

Strengths and Weaknesses of Other Corporations’ Declare Processes

Comparing declare dealing with procedures calls for bearing in mind each the velocity and high quality of carrier. Some firms may well be identified for his or her speedy declare processing, whilst others may prioritize the detailed dealing with of each and every particular person case. Working out the original means of each and every corporate can support in settling on the most productive are compatible to your wishes.

Buyer Provider Sides of Claims Dealing with

The buyer carrier facet of claims dealing with performs a pivotal position within the general revel in. An organization with responsive and useful representatives can ease the tension related to a declare, whilst deficient conversation can exacerbate the placement. Customer support is essential, particularly throughout the irritating instances surrounding a automotive coincidence.

Moderate Declare Agreement Instances

The typical time taken to settle a declare varies considerably between insurance coverage firms. Elements such because the complexity of the declare, the supply of restore amenities, and the amount of claims processed all give a contribution to the agreement time. An organization with a name for faster declare settlements can be offering really extensive reduction.

| Insurance coverage Corporate | Moderate Declare Agreement Time (Days) | Strengths | Weaknesses |

|---|---|---|---|

| Corporate A | 25 | Environment friendly conversation, suggested reaction instances. | Restricted private consideration to main points. |

| Corporate B | 28 | Personalised carrier, detailed clarification of each and every step. | Quite slower processing instances. |

| Corporate C | 22 | Very good on-line declare portal, out there 24/7. | May also be impersonal for advanced claims. |

Commonplace Lawsuits and Critiques Referring to Claims Processes

Examining buyer opinions supplies precious insights into not unusual problems with quite a lot of insurance coverage firms’ claims dealing with procedures. Whilst some firms persistently obtain certain comments for his or her swift and effective carrier, others face complaint relating to conversation breakdowns, loss of transparency, or overly sophisticated processes. Working out those not unusual lawsuits will let you look forward to possible problems and make a extra knowledgeable determination.

Damaging stories incessantly contain extended wait instances, unclear conversation, or problem in having access to vital knowledge.

Key Steps for Submitting a Declare in Massachusetts: Perfect Automotive Insurance coverage Claims Procedure In Massachusetts

Navigating the automobile insurance coverage claims procedure in Massachusetts can really feel daunting, however with a transparent figuring out of the stairs concerned, you’ll be able to with a bit of luck pursue your declare. This information will stroll you throughout the crucial procedures, making sure a easy and effective answer.Submitting a automotive insurance coverage declare in Massachusetts comes to a structured procedure that objectives to relatively compensate you for damages.

This incessantly comes to reporting the coincidence, accumulating vital documentation, and offering the specified knowledge in your insurance coverage corporate.

Reporting a Automotive Coincidence

As it should be reporting the coincidence in your insurance coverage corporate is the most important for beginning the claims procedure. In an instant after an coincidence, acquire as a lot knowledge as conceivable. This contains the opposite motive force’s knowledge (title, cope with, insurance coverage main points, touch knowledge), witnesses (if any), and an outline of the coincidence scene. Touch your insurance coverage corporate once conceivable to file the coincidence.

Consider, suggested reporting is very important to care for a transparent file of occasions.

Documentation Required for a Automotive Insurance coverage Declare

Thorough documentation is essential for a a hit declare. The vital paperwork range relying at the nature of the declare. The documentation must meticulously element the instances of the coincidence. An entire file of occasions, supporting proof, and phone knowledge will facilitate a swift and correct declare evaluate.

Offering Data and Proof

The insurance coverage corporate would require particular knowledge and proof to evaluate your declare. This may come with pictures of the wear and tear in your automobile and the opposite automobile, police studies (if filed), clinical data (if appropriate), and service estimates. Give you the vital knowledge promptly and correctly to verify a easy claims procedure. Be ready to reply to questions in regards to the coincidence.

Very important Paperwork for Other Claims, Perfect automotive insurance coverage claims procedure in massachusetts

| Declare Sort | Very important Paperwork ||—|—|| Belongings Injury Best | Police file (if filed), pictures of wear, restore estimates, automobile registration || Non-public Damage | Police file (if filed), pictures of accidents, clinical data, clinical expenses, misplaced wages documentation, witness statements || Overall Loss | Police file (if filed), pictures of wear, appraisal of car worth, restore estimates, automobile registration || Uninsured/Underinsured Motorist | Police file (if filed), pictures of wear, clinical data, clinical expenses, misplaced wages documentation, witness statements, evidence of the opposite motive force being uninsured or underinsured |

Filing a Declare Shape

Filing your declare may also be accomplished on-line or in particular person. Many insurance coverage firms be offering on-line declare portals for simple and handy submissions. If you select to post a declare in particular person, you must seek advice from your insurance coverage corporate’s place of job or touch them to time table an appointment. Each strategies supply a solution to report your declare, making sure a transparent file of your interactions with the insurance coverage corporate.

Working out Declare Denials in Massachusetts

Navigating the arena of vehicle insurance coverage claims can every so often really feel like a maze. Working out why a declare may well be denied is the most important for proactively addressing possible problems and making sure a easy answer. This segment supplies a transparent roadmap for figuring out declare denials in Massachusetts, empowering you to with a bit of luck navigate the method.

Causes for Declare Denials in Massachusetts

Massachusetts insurance coverage firms have established tips for comparing claims. Those tips assist care for equity and make sure accountable declare dealing with. Quite a lot of elements can result in a declare denial. Working out those possible causes lets you look forward to possible issues and take steps to stop them.

- Coverage Exclusions: Insurance coverage insurance policies incessantly comprise particular exclusions that prohibit protection. Those exclusions might duvet pre-existing stipulations, particular actions, or specific instances. For instance, a coverage may exclude protection for injury brought about by way of a pre-existing mechanical failure. Completely reviewing your coverage report will expose exclusions and explain protection limits.

- Fraudulent Claims: Insurance coverage fraud undermines all the gadget and affects everybody. Submitting a fraudulent declare may end up in denial and possible criminal penalties. This may come with inflating the wear and tear quantity, fabricating an coincidence, or misrepresenting the info. Massachusetts regulation enforces strict consequences for insurance coverage fraud.

- Failure to Meet Coverage Necessities: Claims may also be denied if policyholders fail to stick to the conditions Artikeld of their coverage. Those necessities might come with reporting an coincidence inside a particular time frame, offering required documentation, or cooperating with the insurance coverage corporate’s investigation. Adhering to the coverage’s phrases and stipulations is very important for a a hit declare.

- Inadequate Proof: Insurance coverage firms want enough proof to validate a declare. This may come with police studies, witness statements, restore estimates, or pictures of the wear and tear. Loss of enough proof can result in a denial. Compiling and protecting all related documentation is the most important.

Enchantment Procedure for Denied Claims in Massachusetts

Being knowledgeable in regards to the attraction procedure for denied claims is essential. Massachusetts regulation supplies recourse for policyholders whose claims had been denied. This segment Artikels the method for interesting a denied declare.

- Assessment the Denial Letter: Moderately overview the denial letter to know the precise causes for the denial. The letter must obviously Artikel the reason at the back of the verdict.

- Collect Supporting Documentation: Bring together all proof supporting your declare. This may come with further witness statements, restore estimates, clinical data, or police studies. Make sure that the proof is entire and readily to be had.

- Touch the Claims Adjuster: Touch the claims adjuster assigned in your case to speak about your attraction and provide your supporting proof. This is a chance to provide an explanation for the instances surrounding the declare and supply any more information.

- Mediation or Arbitration: Massachusetts gives mediation or arbitration choices for resolving disputes. Those choices can assist succeed in a mutually agreeable answer.

Contacting a Claims Adjuster

Environment friendly conversation is vital within the claims procedure. Realizing the way to touch a claims adjuster in Massachusetts could make the method easier. Contacting the adjuster is the most important step to unravel problems and begin the attraction procedure.

- Touch Data: Download the touch knowledge for the claims adjuster from the insurance coverage corporate. This data is usually equipped within the denial letter or at the insurance coverage corporate’s website online.

- Documentation: Be sure that all related documentation, together with the denial letter, coverage main points, and supporting proof, is instantly to be had when contacting the adjuster.

- Professionalism: Handle a certified and respectful demeanor when speaking with the claims adjuster. Transparent and concise conversation is the most important for resolving the problem successfully.

Commonplace Causes for Declare Denials in Massachusetts

Working out the everyday causes for declare denials is very important for combating problems. This desk Artikels not unusual explanation why claims are denied in Massachusetts.

| Reason why | Clarification |

|---|---|

| Coverage Exclusions | Explicit protection obstacles Artikeld within the coverage. |

| Fraudulent Process | Intentional misrepresentation of info or instances. |

| Inadequate Proof | Loss of vital documentation to toughen the declare. |

| Failure to Meet Coverage Necessities | Non-compliance with the coverage’s reporting procedures. |

Protective Your Rights Right through the Declare Procedure

Navigating the complexities of a automotive insurance coverage declare can really feel overwhelming. On the other hand, figuring out your rights and figuring out how to offer protection to them can considerably have an effect on the end result. This segment will equip you with the data and gear to with a bit of luck assert your place all through the declare procedure, making sure an excellent and simply answer.Your rights are paramount throughout a automotive coincidence declare.

By way of taking proactive steps, you’ll be able to construct a powerful case and building up the possibility of a positive end result. Thorough preparation and a transparent figuring out of your rights could make an important distinction.

Accumulating Proof After an Coincidence

A vital step in protective your rights comes to meticulously documenting the aftermath of an coincidence. This meticulous means guarantees a complete file of the incident, safeguarding your pursuits and supporting your declare. This detailed documentation is valuable in offering a transparent and purpose account of the coincidence, bolstering your case.

- Download Detailed Police Experiences: A police file supplies a proper file of the coincidence, outlining main points such because the time, location, and contributing elements. This serves as a the most important piece of proof.

- {Photograph} the Injury: Documenting the wear and tear in your automobile, the opposite motive force’s automobile, and any surrounding belongings is essential. This visible proof is helping substantiate your declare. Images must seize the level of the wear and tear from a couple of angles.

- Collect Witness Statements: If witnesses noticed the coincidence, gather their touch knowledge and detailed statements. A witness observation can be offering precious insights into the series of occasions.

- File the Names and Touch Data of All Events Concerned: Be sure you have all related knowledge, together with names, addresses, telephone numbers, and insurance coverage main points, from all events concerned. This facilitates conversation and easy declare processing.

- Notice the Climate Stipulations: The elements stipulations on the time of the coincidence can affect legal responsibility. Documentation of things comparable to rain, snow, or fog can give a contribution to the declare.

The Position of a Attorney in a Automotive Insurance coverage Declare in Massachusetts

A talented lawyer can considerably make stronger your probabilities of a a hit declare, particularly in advanced or disputed instances. Criminal suggest may give precious toughen, making sure your rights are secure and your pursuits are complicated all through the declare procedure. An lawyer’s experience may also be the most important in negotiating settlements, scrutinizing coverage phrases, and presenting your case successfully.

- Negotiation and Agreement: A attorney can negotiate with the insurance coverage corporate in your behalf to succeed in an excellent agreement, aiming for a answer that adequately compensates you to your losses.

- Working out Coverage Phrases: Lawyers possess a deep figuring out of insurance coverage insurance policies and will successfully interpret their phrases to spot possible loopholes and ambiguities. This figuring out may also be essential in protective your pursuits.

- Disputes and Litigation: In instances the place negotiations fail, a attorney can information you throughout the litigation procedure, advocating to your rights in court docket and making sure your criminal place is powerful.

- Reimbursement for Damages: A attorney will let you assess and declare repayment for all damages, together with clinical bills, belongings injury, misplaced wages, and ache and struggling.

Speaking Successfully with Insurance coverage Adjusters

Efficient conversation with insurance coverage adjusters is vital to a a hit declare. Transparent and concise conversation can considerably have an effect on the end result of your declare. Be well mannered, skilled, and keep on with the info.

- Handle a Skilled Tone: Keeping up a peaceful and respectful tone all through your interactions fosters a favorable operating dating with the adjuster.

- Supply Correct and Whole Data: Be sure that the entire knowledge you supply is correct and entire to keep away from misunderstandings.

- Report All Communications: Handle an in depth file of all interactions with the adjuster, together with dates, instances, and the content material of conversations. This documentation is essential in case of disputes.

- Ask Clarifying Questions: Do not hesitate to invite clarifying inquiries to be sure to absolutely perceive the adjuster’s place and the following steps within the declare procedure.

Holding Detailed Information of All Communications

Keeping up a complete file of all communications comparable in your declare is very important. This detailed documentation serves as a precious reference if disputes rise up. This arranged file acts as a the most important safeguard in opposition to misunderstandings or discrepancies.

- Date and Time of All Interactions: File the date and time of all conversations, emails, and letters exchanged with the insurance coverage corporate.

- Copies of All Paperwork: Stay copies of all paperwork comparable in your declare, together with police studies, clinical expenses, and service estimates.

- Detailed Notes of Conversations: Handle detailed notes of any conversations with insurance coverage adjusters, together with the precise issues mentioned.

Assets for Customers in Massachusetts

Having access to useful assets can empower you to navigate the Massachusetts automotive insurance coverage declare procedure successfully. Those assets supply steerage in your rights and duties throughout the declare procedure.

| Useful resource | Description |

|---|---|

| Massachusetts Lawyer Normal’s Place of business | Supplies shopper coverage knowledge and assets. |

| Massachusetts Division of Insurance coverage | Provides details about insurance coverage firms and insurance policies. |

| Native Bar Associations | Can attach you with skilled lawyers focusing on insurance coverage claims. |

| Client Coverage Businesses | Supply knowledge and help relating to shopper rights. |

Selection Dispute Solution Choices

Navigating a automotive insurance coverage declare can every so often really feel like a labyrinth. Thankfully, Massachusetts gives a compass – choice dispute answer (ADR) – that will help you to find your solution to a swift and pleasant answer. Those strategies supply a extra amicable and incessantly faster means than conventional court docket procedures, saving you time and rigidity.Selection dispute answer strategies are designed to streamline the declare procedure, taking into consideration a extra customized and effective answer.

This incessantly comes to a impartial 3rd birthday party facilitating conversation and settlement between you and your insurance coverage corporate. Mediation and arbitration are not unusual sorts of ADR utilized in Massachusetts automotive insurance coverage claims, providing a pathway to answer out of doors the formal court docket gadget.

To be had Selection Dispute Solution Strategies

Massachusetts gives a spread of ADR choices for automotive insurance coverage claims. Those strategies are designed to be extra versatile and faster than conventional litigation, incessantly resolving disputes inside an affordable time frame. Mediation and arbitration are widespread alternatives, and figuring out their distinct traits can considerably affect your determination.

Mediation

Mediation is a structured negotiation procedure the place a impartial 3rd birthday party, the mediator, facilitates conversation between the events. The mediator is helping determine spaces of settlement, discover conceivable answers, and information the events in opposition to a mutually appropriate answer. Mediation is non-binding; the events aren’t obligated to simply accept the mediator’s ideas. On the other hand, the facilitated dialogue incessantly results in a agreement.

Arbitration

Arbitration is a extra formal procedure than mediation. An unbiased arbitrator, selected by way of the events, hears proof and arguments from either side. The arbitrator then renders a call, which is typically legally binding. This determination can incessantly be extra time-efficient than court docket court cases, because it usually comes to fewer formal procedures. The events might agree prematurely to the arbitrator’s determination, making sure a swift answer.

Examples of ADR Use in Massachusetts

A large number of automotive insurance coverage claims in Massachusetts have benefited from ADR. As an example, a dispute over the level of wear to a automobile may well be successfully mediated, leading to an excellent agreement agreed upon by way of each the insured and the insurer. Some other instance comes to a case the place an arbitration panel determined the fitting repayment for accidents sustained in an coincidence.

Those real-world eventualities reveal how ADR strategies can be offering well timed and efficient answers to automotive insurance coverage declare disputes.

Possible Selection Dispute Solution Services and products in Massachusetts

| Provider Supplier | Description | Execs | Cons |

|---|---|---|---|

| Massachusetts Place of business of the Lawyer Normal | Supplies knowledge and help relating to shopper rights, together with automotive insurance coverage claims. | Unfastened, unbiased steerage, and get entry to to assets. | Restricted direct answer services and products; basically informational. |

| Native Dispute Solution Facilities | Be offering mediation and arbitration services and products in particular adapted to native wishes. | Versatile choices, incessantly sooner than court docket court cases. | Charges might observe; might not be accustomed to particular insurance coverage insurance policies. |

| Personal Arbitration Services and products | Specialised companies providing skilled arbitration services and products. | Skilled arbitrators, possible for expedited answer. | Upper prices in comparison to different choices. |

Notice: This desk isn’t exhaustive, and further suppliers is also to be had in Massachusetts.

Pointers for a Clean Declare Procedure

Navigating the automobile insurance coverage claims procedure can really feel like navigating a maze, however with the fitting means, you’ll be able to ensure that a smoother revel in. Following those skilled pointers will decrease delays, keep away from not unusual pitfalls, and let you protected a positive end result. A proactive and communicative means is vital to a a hit declare.

Minimizing Delays and Headaches

Efficient conversation and suggested motion are the most important for a fast declare answer. Documentation is your best friend; accumulating all vital paperwork prematurely will streamline the method. This contains evidence of possession, police studies (if appropriate), restore estimates, and another supporting proof. Steer clear of procrastination; the earlier you begin the declare, the earlier you’ll be able to start the trail to restoration.

Working out your insurance coverage’s particular necessities and closing dates will let you keep on target. Thorough preparation will considerably cut back possible delays.

Warding off Commonplace Errors

Commonplace errors throughout the claims procedure can result in delays and headaches. One widespread error is failing to promptly file the coincidence or injury. Some other is neglecting to acquire vital documentation or failing to stay correct data. Being arranged and meticulous in documentation and conversation is very important. Be sure that all conversation is obvious, concise, and well-documented, keeping up a file of each interplay with the insurance coverage corporate.

Steer clear of making assumptions in regards to the declare procedure; at all times ascertain procedures and closing dates along with your insurance coverage supplier.

Transparent Conversation with the Insurance coverage Corporate

Keeping up transparent and constant conversation along with your insurance coverage corporate is essential. This contains offering correct and entire knowledge, responding promptly to requests, and actively taking part within the declare investigation. Make the most of the conversation channels equipped by way of your insurer, whether or not it is telephone, e-mail, or on-line portals. When you have questions or issues, do not hesitate to invite. A clear and proactive conversation technique will save you misunderstandings and facilitate a smoother declare procedure.

Managing Expectancies All the way through the Declare Procedure

Working out the declare procedure timeline and expectancies is the most important. Insurance coverage claims incessantly contain a couple of steps, from reporting to investigation and agreement. Be sensible in regards to the time required for each and every degree. Stay an open line of conversation with the adjuster and stay affected person. Realizing what to anticipate can assist save you needless rigidity and frustration.

Acknowledge that the declare answer procedure isn’t on the spot.

Key Issues for a Clean Declare Procedure

- Thorough Documentation: Gather all related paperwork (police studies, restore estimates, clinical expenses) straight away. This prevents possible delays and guarantees your declare is supported by way of robust proof. Prepare those paperwork in a readily out there folder for fast reference.

- Instructed Reporting: Document the declare once conceivable. Instructed reporting guarantees the insurance coverage corporate can start the declare procedure promptly. A lengthen in reporting may just result in headaches afterward.

- Correct Data: Supply correct and entire knowledge to the insurance coverage corporate. Faulty knowledge can lengthen or jeopardize your declare. Double-check all main points to stop mistakes.

- Lively Participation: Actively take part within the declare procedure by way of offering asked knowledge and responding promptly to inquiries. Proactive engagement displays the insurance coverage corporate you might be dedicated to resolving the declare successfully.

- Life like Expectancies: Keep in mind that the declare procedure might take time. Be ready for delays and care for open conversation with the insurance coverage corporate. Steer clear of making unreasonable calls for or expectancies.

- Skilled Conversation: Handle a certified and respectful tone in all communications with the insurance coverage corporate. Steer clear of competitive or confrontational language. This fosters a cooperative setting that helps a swift declare answer.

Ultimate Abstract

Navigating the automobile insurance coverage claims procedure in Massachusetts can really feel daunting, however this information has supplied you with the data to with a bit of luck take care of your declare. By way of figuring out the stairs, evaluating firms, and protective your rights, you’ll be able to building up your probabilities of a favorable revel in. Consider to report the entirety, keep up a correspondence successfully, and imagine choice dispute answer choices when vital.

A easy declare procedure is inside your take hold of!

Commonplace Queries

What’s the standard time frame for a belongings injury declare in Massachusetts?

The time frame for belongings injury claims in Massachusetts varies relying at the complexity of the wear and tear and the insurance coverage corporate. Typically, claims can take a number of weeks to a couple of months for an easy case, however may also be longer if there are important problems with value determinations or maintenance.

What if my declare is denied? What are my choices?

In case your declare is denied, overview the denial letter in moderation. It must Artikel the explanations for the denial. You will have the fitting to attraction the verdict, and contacting an lawyer is also really useful to assist navigate the attraction procedure.

Can I exploit mediation or arbitration to unravel my declare?

Sure, mediation and arbitration are choice dispute answer strategies to be had in Massachusetts. Those strategies can assist unravel claims out of doors of court docket, doubtlessly resulting in a sooner and no more opposed answer. Remember to analysis the precise procedures and assets to be had on your scenario.

What documentation is had to report a physically harm declare?

For physically harm claims, you’ll be able to want clinical data, police studies (if appropriate), witness statements, and another documentation supporting your accidents and damages. This will range relying at the particular declare.