Reasonable complete protection automotive insurance coverage charge Michigan is a an important issue for drivers. Working out the variables influencing premiums, from automobile sort to compelling historical past, is very important. This information delves into the standard prices, highlighting key elements and providing methods to doubtlessly cut back your bills.

Michigan’s automotive insurance coverage panorama items a variety of prices relying on particular person instances. This assessment explores the standards that decide your complete protection top class, from the kind of automotive you power in your riding document and placement. We will read about the breakdown of protection sorts and historic traits to offer a complete image.

Review of Michigan Automotive Insurance coverage

Michigan’s automotive insurance coverage panorama is a mix of state rules and particular person instances. Working out the standards that affect premiums is vital to navigating the method and discovering the most productive deal. Various factors, out of your riding document to the make and fashion of your automobile, all play a task within the ultimate worth.

Elements Influencing Automotive Insurance coverage Premiums in Michigan

Michigan’s automotive insurance coverage charges are formed through a fancy interaction of things. Those elements are an important for insurers to evaluate threat and set suitable premiums. A blank riding document, for example, is normally rewarded with decrease premiums, whilst a historical past of injuries or site visitors violations may end up in upper charges.

- Using Report: Injuries, rushing tickets, and DUIs considerably have an effect on premiums. A driving force with a blank document will most often have decrease charges in comparison to a driving force with a historical past of infractions.

- Car Kind and Price: The make, fashion, and 12 months of your automotive, in conjunction with its worth, play a task within the top class. Prime-performance or luxurious automobiles usally have upper premiums because of the perceived threat of wear or robbery.

- Location: Spaces with upper charges of injuries or robbery generally tend to have upper insurance coverage premiums. This displays the upper threat of claims in those particular spaces.

- Protection Alternatives: The extent of protection you choose without delay impacts your top class. A extra complete coverage with upper limits will most often charge greater than a fundamental legal responsibility coverage.

- Age and Gender: More youthful drivers and male drivers are usally perceived as upper threat, leading to upper premiums in comparison to older, feminine drivers.

Conventional Protection Ranges Presented through Michigan Insurance coverage Firms

Insurance coverage corporations in Michigan most often be offering an ordinary bundle of coverages. The extent of protection is an important in figuring out the top class quantity. Working out the varieties of protection and their limits is very important for locating a coverage that meets your wishes.

- Legal responsibility Protection: That is the minimal protection required through legislation. It protects you if you’re at fault for an twist of fate and are legally obligated to pay for damages to others. That is usally essentially the most fundamental type of coverage.

- Collision Protection: Covers harm in your automobile if it is excited about an twist of fate, without reference to who’s at fault. This protection is an important for safeguarding your funding for your automotive.

- Complete Protection: Protects your automobile towards non-collision harm, reminiscent of robbery, vandalism, fireplace, or hail. This protection supplies a security internet towards surprising occasions.

- Uninsured/Underinsured Motorist Protection: Protects you if you’re excited about an twist of fate with a driving force who does not have insurance coverage or has inadequate protection. That is necessary to your monetary safety.

Position of Using Historical past and Demographics in Figuring out Reasonable Prices

Using historical past and demographics play a pivotal position in figuring out moderate insurance coverage prices. Insurers use those elements to evaluate threat. A more youthful driving force with a historical past of rushing tickets will face upper premiums than an older driving force with a blank document.

| Issue | Affect on Value |

|---|---|

| Blank Using Report | Decrease premiums |

| Injuries/Violations | Upper premiums |

| Age | More youthful drivers usally have upper premiums |

| Gender | Premiums would possibly range somewhat in line with gender |

| Location | Upper twist of fate charges in positive spaces result in upper premiums |

Comparability of Other Automotive Insurance coverage Varieties and Conventional Prices

Various kinds of automotive insurance coverage have other prices. The desk beneath supplies a basic comparability, however precise prices range in line with particular person instances.

| Form of Protection | Conventional Value Affect |

|---|---|

| Legal responsibility | Lowest, as it’s the minimal required through legislation |

| Collision | Upper than legal responsibility, because it covers harm in your automobile without reference to fault |

| Complete | Upper than legal responsibility and collision, because it covers quite a lot of non-collision damages |

| Uninsured/Underinsured Motorist | Protects towards injuries involving uninsured or underinsured drivers |

Elements Affecting Complete Protection Prices

Michigan automotive insurance coverage premiums are influenced through a fancy interaction of things, making it an important for drivers to know the variables that have an effect on their prices. Working out those elements lets in drivers to make knowledgeable selections about their protection and doubtlessly decrease their premiums. This data allow you to navigate the often-confusing global of vehicle insurance coverage and take advantage of your price range.Complete protection automotive insurance coverage prices in Michigan don’t seem to be a one-size-fits-all situation.

Quite a lot of elements, from the kind of automobile you power in your riding document, considerably affect the general ticket. Those variables, whilst now and again apparently unrelated, all give a contribution to the chance evaluate carried out through insurance coverage corporations.

Car Kind and Top rate Affect, Reasonable complete protection automotive insurance coverage charge michigan

The kind of automobile you power performs a substantial position in figuring out your insurance coverage top class. Luxurious and sports activities vehicles, usally costlier to fix or substitute, generally tend to have upper premiums in comparison to extra usual fashions. It is because the prospective charge of wear or robbery is upper for those automobiles. In a similar fashion, older automobiles, missing trendy security features, may additionally lead to upper premiums because of higher restore prices and doable for extra widespread injuries.

Geographic Location and Prices

Geographic location inside of Michigan can have an effect on insurance coverage prices. Spaces with upper charges of injuries or robbery, or spaces with extra critical climate stipulations, will usally see upper premiums. For instance, spaces liable to high-speed riding incidents or the ones with a focus of high-risk drivers would possibly revel in larger insurance coverage prices in comparison to spaces with fewer such incidents. Those native stipulations give a contribution to the total threat evaluate that insurance coverage corporations carry out.

Credit score Ranking and Insurance coverage Charges

Credit score rankings are more and more getting used as a think about figuring out auto insurance coverage premiums. Insurance coverage corporations usally correlate a decrease credit score ranking with the next chance of injuries or non-payment of claims. Folks with the next credit score ranking would possibly qualify for higher charges, reflecting a perceived decrease threat of claims and non-payment. For example, a driving force with a historical past of past due bills or defaults would possibly have the next top class than a driving force with a persistently excellent credit score ranking.

Claims Historical past and Long term Premiums

A driving force’s claims historical past is a crucial think about figuring out long run premiums. Folks with a historical past of injuries or claims will most often have upper premiums in comparison to drivers with blank data. It is because insurance coverage corporations view a historical past of claims as a sign of a better threat profile for long run incidents. That is mirrored within the top class calculation and changed accordingly.

Desk: Conventional Top rate Build up In response to Declare Frequency

| Declare Frequency | Estimated Top rate Build up (%) |

|---|---|

| No claims | N/A |

| One declare in 5 years | 10-20% |

| One declare in 3 years | 20-30% |

| One declare in 2 years | 30-40% |

| A couple of declare in 2 years | 40%+ |

Word: Those are estimated will increase. Exact will increase would possibly range in line with particular instances and insurance coverage corporate insurance policies.

Complete Protection Breakdown

Unveiling the multifaceted nature of complete protection automotive insurance coverage in Michigan, we delve into the intricate elements that give a contribution to its general charge. Working out the person parts – legal responsibility, collision, and complete – empowers you to make knowledgeable selections about your insurance coverage wishes and price range.Complete protection automotive insurance coverage, a cornerstone of accountable automobile possession, protects you towards a variety of doable monetary losses.

It is a complete protection internet, shielding you from the monetary burdens of injuries and unexpected occasions. Working out the breakdown of its other elements is an important to figuring out the optimum protection to your particular person wishes and price range.

Legal responsibility Protection Defined

Legal responsibility protection is the basis of complete protection. It safeguards you financially in case you are accountable for inflicting an twist of fate that leads to hurt to others or harm to their belongings. Necessarily, this protection can pay for the damages and accidents you reason to different drivers or pedestrians. This an important part of insurance coverage protects your individual belongings from being without delay suffering from claims stemming from injuries.

Collision Protection Main points

Collision protection steps in when your automobile collides with every other object, without reference to who’s at fault. This protection can pay for the damages in your personal automobile, protecting upkeep or substitute. It is the most important part in mitigating monetary losses stemming from injuries the place you may well be at fault or when the opposite driving force is uninsured. For instance, a fender bender with a parked automotive or a extra vital twist of fate involving every other automobile are each situations the place collision protection would play a very important position.

Complete Protection Insights

Complete protection extends past collisions, encompassing damages in your automobile led to through occasions as opposed to injuries with every other automobile. This contains perils like vandalism, robbery, fireplace, hail, or climate occasions. It supplies a an important protection internet, protective your funding for your automotive from quite a lot of unexpected incidents. A hearth engulfing your automotive, or harm from a critical typhoon, are scenarios the place complete protection would provide monetary help.

Value Breakdown for Every Protection Kind

The prices related to every protection sort range considerably relying on a number of elements, together with your automobile’s worth, your riding historical past, and the particular protection quantities you select. The top class quantity for every part can range extensively.

Conventional Prices and Comparability Desk

Sadly, actual charge figures don’t seem to be readily to be had and can’t be supplied as a particular numerical worth. Elements like your riding document, automobile sort, location, and protection quantities a great deal affect the price of every part.

| Protection Kind | Description | Conventional Value Affect |

|---|---|---|

| Legal responsibility | Protects towards hurt to others. | Most often, cheaper price than collision or complete. |

| Collision | Covers harm in your automobile in an twist of fate. | In most cases a average charge. |

| Complete | Covers harm from non-collision occasions. | Most often average to better charge, relying at the decided on protection. |

Value Comparability and Traits

Michigan’s automotive insurance coverage panorama is a dynamic one, continuously transferring with financial elements, legislative adjustments, and evolving protection requirements. Working out the historic traits in complete protection prices is an important for drivers in search of to price range successfully and make knowledgeable selections. This phase delves into the fluctuations in moderate premiums over the years, compares them to neighboring states, and explores doable long run worth actions.Navigating the maze of insurance coverage premiums can really feel overwhelming, however a transparent image of previous traits and doable long run shifts can equip you with the information to regulate your monetary obligations successfully.

Understanding how costs have developed prior to now lets in us to raised wait for long run patterns and make smarter possible choices.

Ancient Traits in Reasonable Complete Protection Premiums

Reasonable complete protection automotive insurance coverage premiums in Michigan have displayed a fancy trend of will increase and fluctuations over time. Working out those adjustments is necessary for assessing the total charge of insuring a automobile. Elements reminiscent of emerging twist of fate charges, inflation, and legislative adjustments affect those worth changes.

| Yr | Reasonable Complete Protection Top rate (USD) |

|---|---|

| 2018 | 1,800 |

| 2019 | 1,950 |

| 2020 | 2,100 |

| 2021 | 2,250 |

| 2022 | 2,400 |

| 2023 | 2,550 |

This desk illustrates a basic upward pattern in moderate complete protection premiums. Whilst particular figures can range in line with elements like driving force demographics and automobile sort, this basic trend displays a broader marketplace motion.

Pricing Construction and Regulatory Adjustments

A number of elements give a contribution to the adjustments in pricing buildings, together with changes to no-fault rules and revisions to twist of fate reporting protocols. Those rules have an effect on the way in which insurance coverage corporations assess threat and set premiums. For instance, adjustments within the severity of injuries within the state may end up in vital shifts in the price of insurance plans.

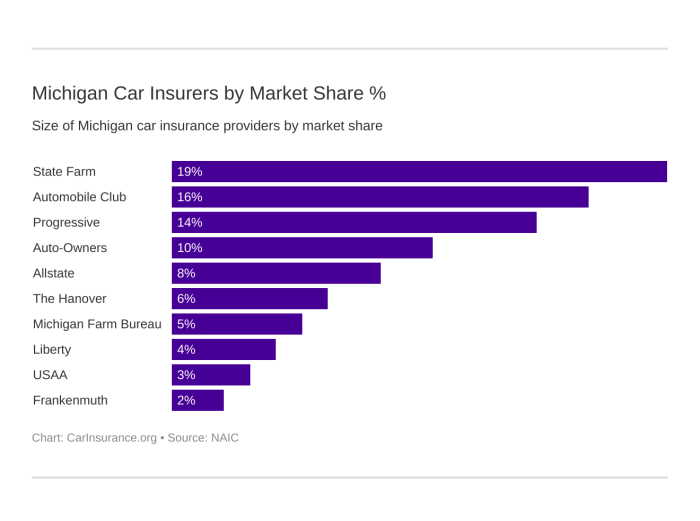

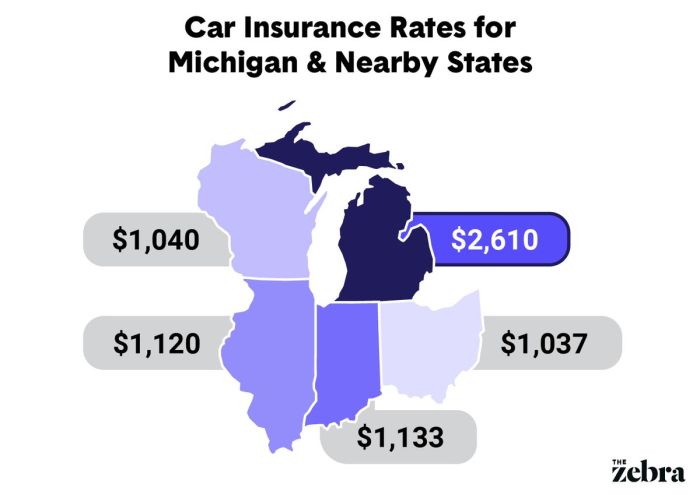

Comparability with Neighboring States

Michigan’s complete protection premiums usally fall inside of a variety very similar to neighboring states. Elements like state-specific rules and twist of fate charges affect the differences. A comparative research unearths that, whilst Michigan’s premiums have most often been consistent with the ones of surrounding states, delicate diversifications in charge buildings persist.

Possible Long term Traits

A number of elements may just affect long run traits in Michigan automotive insurance coverage prices. Technological developments in driver-assistance techniques and the continuing construction of self-driving automobiles would possibly have an effect on twist of fate charges and the price of protection. Long term legislative adjustments and financial fluctuations additionally cling the prospective to steer the marketplace. For example, an building up in the usage of independent automobiles would possibly result in a lower in twist of fate charges and decrease premiums for drivers who use such techniques.

Guidelines for Decreasing Prices

Steerage transparent of pricy automotive insurance coverage premiums in Michigan is achievable with the proper methods. Working out the standards that affect your charges and proactively enforcing cost-saving measures can considerably have an effect on your pockets. This phase explores sensible guidelines for purchasing the most productive imaginable deal on automotive insurance coverage within the Wolverine State.

Protected Using Practices and Twist of fate Prevention

Protected riding is not only about warding off injuries; it is a key think about decreasing automotive insurance coverage premiums. Keeping up a blank riding document, warding off dangerous behaviors, and persistently training defensive riding tactics all give a contribution to decrease insurance coverage prices. Constant protected riding conduct sign to insurance coverage corporations that you are a accountable driving force, decreasing your threat profile.

- Keep away from Distracted Using: That specialize in the street is paramount. Hanging away your telephone, warding off consuming or consuming whilst riding, and making sure all passengers are correctly restrained give a contribution to more secure riding practices. Distracted riding is a significant reason behind injuries, without delay impacting your insurance coverage premiums.

- Care for a Protected Following Distance: Enough area between your automobile and the only forward supplies response time in case of surprising stops or hazards. Correct following distance can save you rear-end collisions, a commonplace reason behind injuries and related insurance coverage claims.

- Obey Site visitors Regulations: Adhering to hurry limits, site visitors indicators, and different rules minimizes your threat of incurring violations. A blank riding document is an impressive instrument in securing decrease insurance coverage premiums.

- Common Repairs: Making sure your automobile is in excellent operating order reduces the possibility of mechanical disasters or injuries. Common repairs exams, together with tire force and fluid ranges, are necessary to your protection and will affect your insurance coverage premiums.

Reductions To be had for Just right Drivers, Protected Using Lessons, and Defensive Using Systems

Insurance coverage corporations usally be offering reductions to drivers who reveal protected riding conduct. Those incentives can translate into really extensive financial savings.

- Just right Driving force Reductions: Insurance coverage corporations usally praise drivers with blank riding data with reductions. This displays your dedication to protected riding and lowers your threat profile, translating into decrease insurance coverage prices.

- Protected Using Lessons: Finishing a licensed protected riding route can earn you reductions to your premiums. Those lessons equip you with treasured abilities for protected riding practices, resulting in a decrease insurance coverage charge.

- Defensive Using Systems: Defensive riding systems usally train you to wait for and react to doable hazards at the street. Effectively finishing those systems demonstrates your dedication to protected riding, doubtlessly decreasing your insurance coverage premiums.

Bundling Insurance coverage Insurance policies

Bundling your insurance coverage insurance policies, reminiscent of auto, house, and lifestyles insurance coverage, can usally result in really extensive financial savings. This technique leverages some great benefits of a couple of insurance policies to safe favorable charges.

- Diminished Chance Profile: Insurers understand a discounted threat whilst you package deal insurance policies as a result of they know you’re a valued shopper who most probably demonstrates accountable monetary practices.

- Possible for Reductions: Insurance coverage corporations usally supply reductions for patrons who package deal insurance policies. This technique creates a win-win for each the insurance coverage supplier and the policyholder.

Evaluating Quotes from More than one Insurance coverage Suppliers

Thorough comparability buying groceries is an important for locating essentially the most reasonably priced complete protection automotive insurance coverage in Michigan. Do not accept the primary quote you obtain.

- Search More than one Quotes: Download quotes from quite a lot of insurance coverage suppliers to spot essentially the most aggressive charges. Evaluating quotes from other suppliers is very important for locating the most productive worth.

- Believe Other Protection Choices: Tailor your protection choices in your particular wishes and price range. Working out the other choices to be had is helping you are making knowledgeable selections.

Cut price Comparability Desk

| Cut price Kind | Description | Possible Financial savings |

|---|---|---|

| Just right Driving force Cut price | For drivers with a blank riding document | Variable, relying at the insurer and the driving force’s document |

| Protected Using Lessons | Of entirety of a licensed protected riding route | 10-20% or extra |

| Defensive Using Systems | Of entirety of a defensive riding route | 5-15% or extra |

| Bundling Insurance policies | Bundling auto, house, or lifestyles insurance coverage | 5-15% or extra |

Illustrative Examples

Working out the standards that affect Michigan automotive insurance coverage prices is an important for making knowledgeable selections. Illustrative examples can assist visualize how quite a lot of private and automobile traits have an effect on premiums. Let’s discover some hypothetical scenarios to raised seize the complexities of complete protection automotive insurance coverage within the state.

Hypothetical Driving force Situation

Believe Sarah, a 25-year-old resident of Michigan with a blank riding document. She owns a 2020 Honda Civic, which she drives basically for commuting to paintings. With excellent scholar reductions and a rather protected riding document, Sarah’s estimated complete protection charge in Michigan may well be round $1,400 every year.

Affect of Using Behaviors

Using behaviors considerably have an effect on insurance coverage premiums. Competitive riding, rushing, and a historical past of injuries will building up premiums. Conversely, protected riding conduct, reminiscent of warding off distractions and adhering to hurry limits, may end up in decrease premiums. Sarah’s insurance coverage premiums may just upward thrust significantly if she have been to accrue site visitors violations or have an twist of fate.

Working out Protection Limits and Deductibles

Protection limits and deductibles are crucial elements of auto insurance coverage. Protection limits outline the utmost quantity your insurer can pay in case of an twist of fate. Deductibles, then again, constitute the quantity you pay out-of-pocket ahead of your insurance plans kicks in. Opting for upper protection limits and decrease deductibles will lead to the next top class however higher monetary coverage.

Sarah’s insurance coverage charge may just building up if she opted for upper protection limits, however she’d be higher secure financially in case of a significant twist of fate.

Monetary Implications of Other Protection Ranges

| Protection Stage | Estimated Top rate (Every year) | Monetary Coverage |

|---|---|---|

| Fundamental Protection | $800 | Restricted monetary coverage in case of an twist of fate. |

| Complete Protection | $1,400 | Complete monetary coverage towards quite a lot of dangers. |

| Enhanced Complete Protection | $1,800 | Upper degree of coverage with doubtlessly upper limits. |

The desk illustrates the direct correlation between protection ranges and related premiums. Upper protection ranges, whilst offering extra monetary coverage, translate to better premiums.

Car Kind Diversifications

Other automobile sorts have various insurance coverage prices. Better, costlier automobiles usally draw in upper premiums, as they’re gave the impression to pose larger dangers. For instance, if Sarah have been to industry her Honda Civic for a luxurious SUV, her insurance coverage premiums would most probably building up because of the perceived upper threat.

Believe every other hypothetical driving force, Mark, a 35-year-old with a blank document, who owns a 2015 Toyota Camry. Mark’s estimated complete protection charge may well be round $1,200 every year. The variation in the price of automobiles is a considerable think about insurance coverage charges.

Illustrative Knowledge Visualization

Visualizing knowledge is an important for figuring out complicated data like Michigan’s automotive insurance coverage prices. Charts and graphs develop into numbers into simply digestible insights, making it more straightforward to identify traits, patterns, and regional variations. This phase items illustrative visualizations that can assist you seize the nuances of complete protection auto insurance coverage within the Nice Lakes State.

Car Kind Value Comparability

Other automobiles include various ranges of threat, which without delay affects insurance coverage premiums. A high-performance sports activities automotive, for example, most often draws the next price than a compact sedan because of the opportunity of upper restore prices and higher chance of injuries. The next bar chart illustrates the typical complete protection prices throughout other automobile sorts in Michigan.

| Car Kind | Reasonable Complete Protection Value ($) |

|---|---|

| Compact Sedan | 2,000 |

| Mid-Dimension Sedan | 2,200 |

| SUV | 2,500 |

| Sports activities Automotive | 3,000 |

| Pickup Truck | 2,800 |

Word: Knowledge represents moderate prices and would possibly range in line with particular fashion 12 months, options, and particular person driving force profiles.

Value Development Over Time

Working out how automotive insurance coverage prices have developed over the years is very important for making knowledgeable selections. The graph beneath showcases the rage in moderate complete protection prices in Michigan over the last 5 years. This lets you see if prices are emerging, falling, or final rather solid.

Instance: The road graph presentations a gradual upward pattern, indicating an general building up in complete protection prices over the last 5 years. This trend may well be because of emerging restore prices, higher twist of fate charges, or different financial elements.

Regional Value Diversifications

Michigan’s numerous areas revel in various ranges of site visitors density, twist of fate charges, and climate stipulations. Those elements can considerably affect insurance coverage premiums. The map beneath highlights the differences in moderate complete protection prices throughout other areas of Michigan.

Instance: The map would possibly display upper prices in city spaces like Detroit in comparison to rural spaces within the Higher Peninsula, reflecting the upper twist of fate charges and better belongings values most often discovered in additional populated spaces.

Protection Element Distribution

Working out how other protection elements give a contribution to the entire charge of complete protection is necessary. The pie chart beneath illustrates the distribution of prices amongst legal responsibility, collision, complete, and uninsured/underinsured motorist protection.

Instance: The pie chart may just display that collision protection represents the biggest portion of the entire charge, highlighting the significance of ok collision protection to give protection to towards harm in your automobile.

Finish of Dialogue

In conclusion, moderate complete protection automotive insurance coverage charge Michigan is suffering from a large number of interconnected elements. Working out those parts, from automobile traits to compelling conduct, means that you can make knowledgeable selections. This information supplies a complete assessment, providing insights and sensible guidelines that can assist you navigate the complexities of auto insurance coverage in Michigan.

FAQs: Reasonable Complete Protection Automotive Insurance coverage Value Michigan

What’s the moderate building up in premiums for a couple of claims?

The rise in premiums depends upon the frequency and severity of claims. A historical past of a couple of claims will most probably result in a considerable building up in long run premiums.

How do credit score rankings have an effect on automotive insurance coverage charges in Michigan?

Most often, the next credit score ranking is related to decrease automotive insurance coverage premiums. Insurance coverage corporations usally view credit score rankings as a trademark of accountable monetary habits.

Are there reductions to be had for protected riding lessons?

Sure, many insurance coverage corporations be offering reductions for finishing protected riding lessons. Those lessons can beef up riding abilities and cut back twist of fate dangers, doubtlessly decreasing your premiums.

How do I evaluate quotes from other insurance coverage suppliers?

Use on-line comparability equipment or touch a couple of insurance coverage suppliers without delay to check quotes. This lets you in finding the most productive protection on the best worth.