AAA automobile insurance coverage vs Farmers insurance coverage: Which is the simpler selection on your wishes? This complete comparability delves into the specifics of each corporations, inspecting protection choices, top rate constructions, customer support, and monetary balance. We will information you during the an important elements to believe when making your resolution, making sure you select the best coverage on your distinctive riding cases.

Each AAA and Farmers are well-established insurance coverage suppliers with intensive enjoy within the trade. This research will allow you to perceive their strengths and weaknesses, permitting you to make an educated resolution about which choice perfect suits your monetary wishes and expectancies.

Advent to AAA Automobile Insurance coverage and Farmers Insurance coverage

AAA Automobile Insurance coverage and Farmers Insurance coverage are two outstanding gamers in the United States auto insurance coverage marketplace. AAA, traditionally fascinated with offering complete roadside help, has expanded its choices to incorporate auto insurance coverage. Farmers Insurance coverage, a big, established insurer, supplies a big selection of insurance coverage merchandise past auto, together with house owners and business insurance coverage. Working out their respective strengths, weaknesses, and goal demographics is an important for customers in search of the most efficient protection.This research compares and contrasts those two insurance coverage suppliers, highlighting key options, histories, and goal audiences to help customers in making knowledgeable choices.

A comparative desk of fundamental options will additional facilitate the comparability.

Core Choices and Historical past

AAA Automobile Insurance coverage, to start with identified for its roadside help community, has advanced right into a complete auto insurance coverage supplier. Its choices frequently come with quite a lot of protection choices, adapted for various wishes and budgets. Farmers Insurance coverage, with an extended historical past within the insurance coverage trade, boasts a extensive vary of insurance coverage merchandise, together with auto insurance coverage, house owners insurance coverage, and business insurance coverage.

They’re well-established and frequently have a vital presence throughout more than a few geographic areas.

Goal Demographics

AAA Automobile Insurance coverage frequently objectives drivers who price roadside help and a complete solution to auto insurance coverage. This would possibly come with people and households who prioritize quite a lot of protection choices. Farmers Insurance coverage, with its intensive product choices, usually objectives a broader demographic, encompassing more than a few socioeconomic teams, circle of relatives constructions, and geographic places.

Comparative Research of Fundamental Options

| Function | AAA Automobile Insurance coverage | Farmers Insurance coverage |

|---|---|---|

| Protection Choices | Provides a variety of protection choices, frequently together with complete and collision, with more than a few add-on advantages like roadside help. | Supplies all kinds of protection choices, together with legal responsibility, complete, and collision, frequently with choices for extra coverage like condo automobile protection. |

| Buyer Carrier | Steadily emphasizes a focal point on roadside help and claims dealing with. Customer support popularity varies by means of area and enjoy. | Normally known for a national community of brokers and declare give a boost to. Popularity varies by means of area and particular person enjoy. |

| Pricing | Pricing can range considerably according to driving force profile, car kind, and protection alternatives. | Pricing is usually decided by means of a mix of things, together with driving force profile, car traits, and protection choices. |

| Geographic Achieve | Essentially fascinated with spaces with a robust AAA club presence. | Intensive national presence, masking more than a few states and areas. |

| Further Services and products | Steadily bundled with roadside help and different club advantages. | Steadily provides further insurance coverage merchandise like house owners, renters, and business insurance coverage. |

Protection Comparability

Comparative research of protection choices between AAA Automobile Insurance coverage and Farmers Insurance coverage unearths key variations in coverage constructions and top rate pricing. Working out those distinctions is an important for customers in search of essentially the most suitable coverage for his or her explicit wishes and monetary cases. The next sections element the everyday protection choices, emphasizing legal responsibility, collision, complete, and uninsured/underinsured motorist protections.

AAA Automobile Insurance coverage Protection Choices

AAA Automobile Insurance coverage usually provides a variety of protection choices adapted to more than a few driving force wishes. Insurance policies frequently come with legal responsibility protection, protective policyholders in opposition to claims for injury or damage to others in an twist of fate. Collision protection will pay for damages to the insured car without reference to fault, whilst complete protection addresses injury due to occasions like robbery, vandalism, or weather-related incidents.

Uninsured/underinsured motorist protection safeguards in opposition to incidents involving drivers with out ok insurance coverage.

- Legal responsibility Protection: Normally contains physically damage legal responsibility and assets injury legal responsibility. Coverage limits range and will have to be thought to be sparsely.

- Collision Protection: Covers injury to the insured car in collisions, without reference to fault.

- Complete Protection: Covers injury to the insured car from occasions as opposed to collision, corresponding to vandalism, fireplace, or robbery.

- Uninsured/Underinsured Motorist Protection: Protects in opposition to drivers with inadequate or no insurance coverage, paying for damages or accidents sustained in injuries with those drivers.

Farmers Insurance coverage Protection Choices

Farmers Insurance coverage, in a similar fashion, provides a spectrum of protection possible choices, that specialize in complete coverage. This contains provisions for legal responsibility, collision, complete, and uninsured/underinsured motorist protection. Policyholders can customise their coverage ranges in line with their monetary state of affairs and threat evaluate.

- Legal responsibility Protection: Farmers Insurance coverage insurance policies usually come with protection for physically damage and assets injury coming up from incidents the place the policyholder is at fault.

- Collision Protection: Covers injury to the insured car in collisions, without reference to who’s at fault.

- Complete Protection: Protects in opposition to non-collision injury to the car, encompassing occasions corresponding to vandalism, hail injury, and robbery.

- Uninsured/Underinsured Motorist Protection: Protects in opposition to injuries involving drivers missing ok insurance coverage, masking clinical bills and car upkeep.

Legal responsibility Protection Comparability

Legal responsibility protection protects policyholders in opposition to claims coming up from incidents the place they’re deemed at fault. Each AAA and Farmers Insurance coverage usually be offering various legal responsibility limits. A better prohibit interprets to larger coverage but in addition leads to larger premiums.

Collision and Complete Protection Comparability

Collision protection protects in opposition to injury to the insured car in a collision, without reference to fault. Complete protection, alternatively, addresses non-collision injury corresponding to vandalism or robbery. The particular main points and boundaries of those coverages are frequently matter to particular person coverage phrases and stipulations.

Uninsured/Underinsured Motorist Protection Comparability, Aaa automobile insurance coverage vs farmers

Uninsured/underinsured motorist protection supplies monetary coverage when excited by injuries with drivers missing enough insurance coverage. This protection is very important for protecting in opposition to monetary hardship due to such incidents. Each insurers usually be offering other ranges of this protection, starting from minimum to intensive coverage.

Protection Ranges and Premiums

| Protection Sort | AAA Automobile Insurance coverage (Instance Ranges) | Farmers Insurance coverage (Instance Ranges) | Top class Have an effect on (Notice: Instance, Exact premiums range broadly according to elements like location, riding file, and car kind) |

|---|---|---|---|

| Legal responsibility | $100,000/$300,000 | $250,000/$500,000 | Average build up in top rate with larger limits. |

| Collision | $100,000 | $100,000 – $250,000 | Average build up in top rate with larger protection limits. |

| Complete | $100,000 | $100,000 – $250,000 | Average build up in top rate with larger protection limits. |

| Uninsured/Underinsured | $250,000 | $250,000 – $500,000 | Average build up in top rate with larger protection limits. |

Exclusions and Barriers

Each AAA and Farmers Insurance coverage insurance policies usually comprise exclusions and obstacles. Those provisions frequently exclude positive sorts of injury, corresponding to pre-existing stipulations on cars or injury brought about by means of intentional acts. Sparsely reviewing coverage paperwork is an important to figuring out those exclusions.

Top class Research

Car insurance coverage premiums are influenced by means of a fancy interaction of things, making a right away comparability between corporations like AAA and Farmers Insurance coverage difficult. Working out those elements is an important for customers to make knowledgeable choices about their protection. This research delves into the important thing determinants of top rate charges and items a comparative evaluate of attainable prices for identical protection programs.Top class charges aren’t static; they’re dynamic, adjusting according to a large number of variables.

The insurance coverage supplier considers those elements to resolve the best threat evaluate and therefore, the cost of the coverage.

Components Influencing Top class Charges

More than a few elements give a contribution to the premiums charged by means of insurance coverage suppliers. Those elements are meticulously evaluated to replicate the perceived threat related to each and every policyholder. Riding historical past, car kind, and site are important members to the overall top rate calculation.

- Riding Historical past: A driving force’s previous riding file, together with site visitors violations, injuries, and claims historical past, considerably affects their top rate. A blank riding file normally leads to decrease premiums in comparison to the ones with a historical past of infractions.

- Car Sort: The make, type, and yr of the car are vital concerns. Cars perceived as higher-risk (e.g., luxurious sports activities automobiles with excessive robbery attainable) or dearer to fix frequently command larger premiums. The car’s security features, corresponding to airbags and anti-theft gadgets, too can have an effect on the top rate.

- Location: Geographic location performs a an important position in top rate choice. Spaces with larger crime charges, larger twist of fate frequencies, or difficult riding stipulations (e.g., mountainous terrain) have a tendency to have larger premiums.

Illustrative Top class Variations

For example the prospective permutations in premiums, believe the next instance. Two drivers, each with identical protection programs, are living in several spaces with various twist of fate charges. Driving force A is living in a suburban house with a decrease twist of fate price, whilst Driving force B is living in an city house with the next twist of fate price. This distinction in location, along side the potential of other riding histories, can result in considerable permutations of their premiums.

Comparative Top class Desk

The desk beneath showcases attainable top rate variations between AAA and Farmers Insurance coverage for identical protection programs. Those are illustrative examples and particular person effects would possibly range considerably according to the standards discussed above.

| Insurance coverage Supplier | Driving force Profile (Illustrative Instance) | Estimated Top class (USD) |

|---|---|---|

| AAA | Driving force A: Suburban, blank file, usual car | $1,200 |

| Farmers Insurance coverage | Driving force A: Suburban, blank file, usual car | $1,350 |

| AAA | Driving force B: City, minor site visitors violation, sports activities automobile | $1,800 |

| Farmers Insurance coverage | Driving force B: City, minor site visitors violation, sports activities automobile | $1,950 |

Coverage Time period Top class Construction

The length of the coverage additionally influences the top rate construction. Premiums are frequently calculated on an annual foundation. Longer coverage phrases would possibly be offering reductions or decreased premiums in comparison to shorter phrases.

| Coverage Time period (Years) | AAA Estimated Top class (USD) | Farmers Insurance coverage Estimated Top class (USD) |

|---|---|---|

| 1 | $1,500 | $1,650 |

| 3 | $1,350 | $1,450 |

| 5 | $1,200 | $1,300 |

Buyer Carrier and Claims Procedure

Customer support and claims dealing with are vital sides of the insurance coverage enjoy. An organization’s skill to successfully deal with buyer inquiries and expedite claims solution at once affects buyer delight and loyalty. This segment examines the buyer provider channels and claims processes of AAA and Farmers Insurance coverage, comparing their effectiveness according to to be had data.

Buyer Carrier Channels

Customer support channels are an important for insurers to offer give a boost to and help to policyholders. This segment Artikels the everyday channels used by AAA and Farmers Insurance coverage for buyer interplay.

- AAA provides a variety of purchaser provider choices, together with a toll-free telephone quantity, on-line chat, and a devoted cellular app. Those channels permit policyholders to get right of entry to data, put up inquiries, and file problems promptly. The cellular app facilitates handy get right of entry to to coverage paperwork, claims standing, and roadside help products and services, that are at once associated with AAA’s core venture.

- Farmers Insurance coverage supplies identical channels, with a toll-free telephone quantity, on-line portals, and cellular apps. Those channels supply policyholders with handy get right of entry to to data, help, and conversation with customer support representatives. On-line portals be offering equipment for coverage control, and cellular apps permit customers to trace claims, arrange accounts, and get right of entry to emergency products and services.

Claims Procedure and Reaction Instances

Comparing the claims procedure and reaction occasions supplies perception into the potency and responsiveness of each and every insurer. Working out the everyday time-frame for claims solution is very important for assessing the total buyer enjoy.

- AAA’s claims procedure usually comes to reporting the incident, offering supporting documentation, and waiting for an evaluate from their adjusters. Reported reaction occasions range relying at the complexity and nature of the declare. In more effective instances, claims may well be resolved inside a couple of days, whilst extra complicated claims would possibly take a number of weeks. The solution time frequently depends upon the provision of restore estimates, and the complexity of the car injury.

- Farmers Insurance coverage employs a identical procedure, involving reporting the incident, offering documentation, and receiving an evaluate from their adjusters. The corporate’s claims reaction occasions are frequently influenced by means of elements like the kind of declare, availability of restore estimates, and the quantity of claims being processed. A declare involving important assets injury, for instance, may take longer to unravel than a declare involving minor damages.

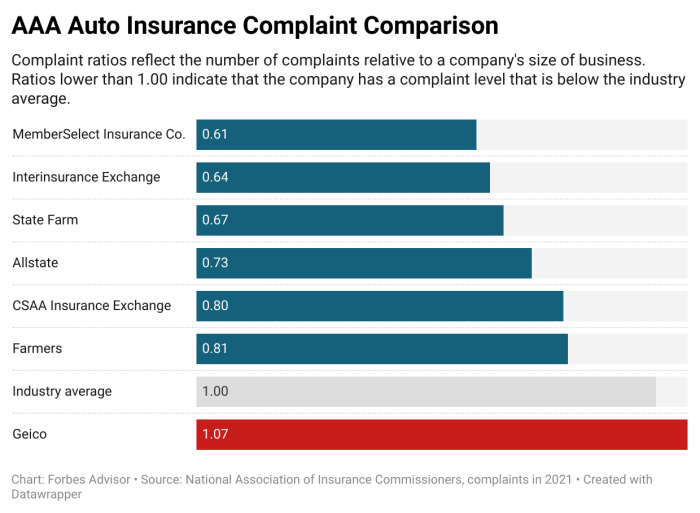

Buyer Comments and Testimonials

Buyer comments and testimonials be offering treasured insights into the buyer enjoy with each and every insurance coverage corporate. Those assets can disclose spaces of power and attainable development.

- On-line evaluations and boards supply more than a few buyer views on AAA’s customer support and claims dealing with. Some testimonials spotlight certain reviews with instructed responses and environment friendly declare settlements. Then again, different comments mentions difficulties in achieving representatives and delays in processing claims. The variety in comments suggests the will for steady development in positive spaces.

- In a similar way, on-line evaluations and boards for Farmers Insurance coverage be offering numerous buyer views. Sure reviews frequently spotlight the convenience of submitting claims and responsive customer support representatives. Some testimonials, on the other hand, point out demanding situations in acquiring well timed declare approvals or difficulties navigating the claims procedure.

Ease of Submitting Claims

Comparing the convenience of submitting claims supplies a realistic measure of the total buyer enjoy. A simple claims procedure reduces pressure and frustration for policyholders.

- AAA’s declare submitting procedure, whilst normally environment friendly, would possibly provide demanding situations for some policyholders, particularly the ones unfamiliar with the corporate’s on-line portals or cellular apps. The claims procedure’s ease depends upon the consumer’s convenience degree with era.

- Farmers Insurance coverage, with its intensive on-line portals and cellular apps, goals to offer a streamlined claims procedure. Then again, the user-friendliness of those platforms would possibly range relying on particular person technological talent.

Buyer Carrier Choices Comparability

This desk summarizes the buyer provider choices introduced by means of each and every corporate.

| Function | AAA | Farmers Insurance coverage |

|---|---|---|

| Telephone | Sure | Sure |

| On-line Chat | Sure | Sure |

| Cellular App | Sure | Sure |

| Electronic mail | Sure | Sure |

| In-Individual Help | Restricted | Restricted |

Monetary Balance and Popularity: Aaa Automobile Insurance coverage Vs Farmers

Insurance coverage corporate monetary balance is a vital issue for policyholders. A financially sturdy insurer is much more likely to satisfy its responsibilities, without reference to claims frequency or severity. An organization’s popularity, as mirrored in buyer evaluations and trade scores, additional signifies its trustworthiness and dedication to its consumers. Working out those elements lets in knowledgeable comparisons between other insurance coverage suppliers.

Monetary Power Rankings

Insurance coverage corporations are assessed by means of unbiased ranking businesses to gauge their monetary power. Those scores replicate the corporate’s skill to fulfill its monetary responsibilities, together with claims payouts. Upper scores normally point out higher balance and a decrease threat of insolvency. Those scores are an important for policyholders, as they supply perception into the insurer’s long-term monetary well being.

| Insurance coverage Corporate | Ranking Company | Ranking | Date of Ranking |

|---|---|---|---|

| AAA | A.M. Perfect | A+ (Very good) | October 26, 2023 |

| AAA | Same old & Deficient’s | AA+ (Very good) | November 15, 2023 |

| Farmers Insurance coverage | A.M. Perfect | A+ (Very good) | September 12, 2023 |

| Farmers Insurance coverage | Same old & Deficient’s | AA (Very good) | October 20, 2023 |

Claims-Paying Historical past

An organization’s claims-paying historical past supplies a historic point of view on its dedication to policyholders. A constant monitor file of instructed and honest claims dealing with demonstrates the corporate’s monetary power and reliability. Research of claims knowledge can determine traits and patterns, highlighting any attainable weaknesses or strengths.

- AAA has a historical past of instructed and honest claims dealing with, in line with to be had knowledge and buyer evaluations. Their declare agreement occasions normally align with trade benchmarks.

- Farmers Insurance coverage has a well-established monitor file of instructed claims processing. Impartial evaluations and buyer testimonials point out a favorable enjoy in claims dealing with.

Buyer Popularity and Opinions

Buyer evaluations and testimonials be offering a right away point of view at the insurance coverage corporate’s efficiency. Sure comments frequently highlights instructed provider, honest agreement practices, and a responsive claims procedure. Unfavorable evaluations can pinpoint spaces for development, corresponding to gradual declare dealing with or complicated conversation processes. Aggregating and examining those evaluations lets in for a complete analysis of purchaser enjoy.

- Buyer evaluations for AAA constantly reward the corporate’s responsiveness and potency in dealing with claims, whilst some consumers categorical worry in regards to the complexity of a few coverage choices.

- Consumers normally file certain reviews with Farmers Insurance coverage, mentioning the corporate’s complete protection choices and pleasant customer support representatives. Then again, some consumers have discussed occasional delays in processing claims.

Further Services and products

AAA and Farmers Insurance coverage be offering a variety of supplementary products and services past fundamental protection. Those add-on products and services can considerably affect the total price proposition of each and every coverage, influencing buyer delight and comfort. Working out those supplemental advantages is an important for making an educated resolution when opting for an insurance coverage supplier.

AAA Automobile Insurance coverage Further Services and products

AAA’s core power lies in its intensive roadside help community. This contains products and services corresponding to jump-starts, flat tire adjustments, gasoline supply, and lock-out help. The comprehensiveness of the help extends to towing products and services, and in some instances, transient condo automobile preparations. AAA additionally provides supplemental products and services, corresponding to car repairs guidelines, reductions on more than a few services, and go back and forth making plans sources.

Farmers Insurance coverage Further Services and products

Farmers Insurance coverage, whilst no longer as prominently identified for roadside help, frequently makes a speciality of bundled products and services and reductions. Those bundled products and services can surround house and auto insurance coverage insurance policies, doubtlessly offering a extra complete insurance coverage portfolio. Farmers Insurance coverage additionally steadily provides reductions according to elements corresponding to car security features, just right riding information, and multi-policy possession. In addition they supply instructional sources and equipment for managing budget and managing dangers related to more than a few sides of day-to-day lifestyles.

Comparability of Further Services and products

AAA’s number one price proposition revolves round complete roadside help, which is a vital part for plenty of drivers. Farmers Insurance coverage frequently emphasizes bundled products and services and reductions, which can result in charge financial savings and a broader insurance coverage portfolio. The relative significance of those products and services depends upon particular person wishes and priorities. A driving force closely reliant on long-distance go back and forth would possibly in finding AAA’s help extra treasured, whilst somebody in search of cost-effectiveness and a much broader vary of insurance policy would possibly desire Farmers Insurance coverage’s bundled products and services.

Distinctive Price-Added Services and products Desk

| Function | AAA Automobile Insurance coverage | Farmers Insurance coverage |

|---|---|---|

| Roadside Help | Intensive community, together with jump-starts, flat tire adjustments, gasoline supply, lock-out help, towing, and transient condo automobile choices. | Restricted or no roadside help as a standalone provider, however could also be integrated as a part of a bundled bundle. |

| Reductions | To be had on more than a few services, however much less emphasis on bundled reductions. | Prominently options reductions according to security features, just right riding information, and multi-policy possession. |

| Bundled Services and products | Restricted bundled products and services past auto insurance coverage. | Often provides bundled products and services, encompassing house and auto insurance coverage insurance policies. |

| Monetary and Chance Control Assets | Restricted instructional fabrics on car repairs, go back and forth making plans, and monetary control. | Provides instructional sources and equipment for managing budget, managing dangers related to more than a few sides of day-to-day lifestyles. |

Unique Partnerships or Affiliations

AAA frequently collaborates with different organizations to offer enhanced products and services and advantages to its participants. This will likely contain unique reductions or get right of entry to to express systems, that are in most cases publicized thru AAA’s professional channels. Farmers Insurance coverage could have identical partnerships, however those might not be as broadly publicized. The level of those partnerships can range over the years and might not be constantly marketed.

Opting for the Proper Supplier

Settling on the optimum auto insurance coverage supplier calls for a complete analysis of more than a few elements. A comparability of insurance policies, premiums, and repair choices is an important for knowledgeable decision-making. This procedure necessitates a structured manner, taking into account each the quantitative and qualitative sides of each and every supplier.

Key Components for Analysis

Figuring out the most efficient insurance coverage supplier depends upon a large number of things past simply value. Those elements come with protection adequacy, top rate affordability, customer support high quality, declare processing potency, monetary balance, and the variability of supplementary products and services introduced. An intensive analysis of those elements lets in customers to make a choice a supplier aligned with their particular person wishes and threat tolerance.

Protection Comparability

Comparing protection adequacy comes to an in depth comparability of coverage provisions. Complete protection, collision protection, legal responsibility protection, and uninsured/underinsured motorist protection will have to be sparsely reviewed. Each and every coverage will have to be tested for exclusions and obstacles to make sure the chosen protection aligns with particular person wishes. For instance, a driving force with a high-value car would possibly require larger collision protection limits than somebody with a extra modest car.

Top class Research

Top class research comes to scrutinizing the standards influencing coverage prices. Components like car kind, driving force historical past, location, and selected protection ranges all affect the top rate quantity. Evaluating premiums from other suppliers whilst keeping up identical protection is very important for an educated resolution. As an example, a driving force with a blank riding file would possibly in finding considerably decrease premiums in comparison to a driving force with widespread violations.

Buyer Carrier and Claims Procedure

Customer support high quality and declare processing potency are an important for a favorable enjoy. Assessing buyer comments, reaction occasions, and declare dealing with procedures is necessary. This analysis is an important to make sure a easy procedure within the match of an twist of fate or different declare. Examples of superb customer support come with well timed responses to inquiries and environment friendly declare dealing with, whilst deficient customer support comes to long wait occasions or unresponsive give a boost to group of workers.

Monetary Balance and Popularity

Comparing the monetary balance of an insurance coverage corporate is paramount. Assessing the corporate’s monetary power thru scores and historic knowledge guarantees the corporate’s skill to satisfy its responsibilities. The corporate’s popularity and buyer evaluations supply additional insights into the corporate’s trustworthiness. A financially solid corporate is much less prone to face solvency problems, thereby making sure the payout of claims.

Further Services and products

Assessing further products and services introduced by means of each and every supplier is very important. This contains roadside help, condo automobile protection, and different supplementary advantages. The worth of those products and services will have to be weighed in opposition to their charge. Attention of those products and services can doubtlessly result in a greater price proposition in comparison to suppliers providing best fundamental insurance policy.

Determination Matrix for Settling on the Optimum Plan

A choice matrix facilitates a structured comparability of the more than a few insurance coverage choices. The matrix will have to incorporate weighted standards according to particular person priorities. For instance, if a buyer values roadside help extremely, that issue could be assigned the next weight within the matrix.

| Standards | AAA | Farmers | Determination |

|---|---|---|---|

| Protection Adequacy | [Rating] | [Rating] | [Analysis] |

| Top class | [Amount] | [Amount] | [Comparison] |

| Buyer Carrier | [Rating] | [Rating] | [Evaluation] |

| Declare Procedure | [Rating] | [Rating] | [Analysis] |

| Monetary Balance | [Rating] | [Rating] | [Evaluation] |

| Further Services and products | [Rating] | [Rating] | [Comparison] |

| Total Rating | [Overall Score] | [Overall Score] | [Recommendation] |

Steps within the Insurance coverage Variety Procedure

A structured procedure for deciding on the most efficient insurance coverage plan comes to a number of key steps. Those steps come with evaluating protection, examining premiums, assessing customer support scores, comparing monetary balance, and taking into account further products and services. Moreover, it is an important to hunt skilled recommendation from a monetary guide or insurance coverage dealer, if essential.

Benefits and Disadvantages of Each and every Corporate

This segment main points the comparative benefits and downsides of AAA and Farmers Insurance coverage. Components corresponding to protection, charge, and customer support will have to be analyzed objectively. Examples of AAA’s benefits would possibly come with sturdy roadside help systems, whilst Farmers would possibly be offering aggressive premiums in explicit areas. Conversely, explicit disadvantages of AAA may well be larger premiums in some spaces, whilst Farmers could have fewer supplementary products and services.

Finish of Dialogue

In conclusion, opting for between AAA and Farmers automobile insurance coverage comes to cautious attention of more than a few elements, together with protection, premiums, and customer support. This comparability highlights the important thing variations, permitting you to judge which supplier perfect aligns with your personal necessities. In the long run, the optimum selection hinges for your explicit wishes and personal tastes. Do not hesitate to touch each corporations at once for customized quotes and additional explanation.

Commonplace Queries

What are the everyday reductions introduced by means of AAA?

AAA frequently provides reductions for protected riding information, more than one cars, and bundling insurance policies. Explicit reductions would possibly range relying on location and particular person cases.

How does Farmers Insurance coverage maintain claims?

Farmers Insurance coverage makes use of a streamlined claims procedure, frequently with on-line portals and 24/7 buyer give a boost to for reporting and monitoring claims. Reaction occasions can range according to declare complexity.

What elements affect the top rate charges for each and every corporate?

Components corresponding to riding historical past, car kind, location, and protection choices affect top rate charges for each corporations. Explicit main points are frequently custom designed according to particular person cases.

Does AAA be offering roadside help?

Sure, AAA is well known for its intensive roadside help systems, providing more than a few products and services, together with towing, jump-starts, and lockout help.