Reasonable automobile insurance coverage Midland TX is the most important for drivers within the house. This information breaks down the Midland TX automobile insurance coverage marketplace, serving to you in finding inexpensive choices and perceive your protection. We will discover the whole thing from charges and reductions to the most productive insurance coverage firms and the way to economize.

Navigating the arena of vehicle insurance coverage can really feel overwhelming, however this complete information simplifies the method. We will quilt commonplace sorts of insurance policies, methods to evaluate quotes, and crucial guidelines for purchasing the most productive deal in Midland, TX.

Working out Midland TX Automobile Insurance coverage Marketplace

Midland, TX, items a novel automobile insurance coverage panorama formed through its explicit demographic profile, riding stipulations, and twist of fate tendencies. Working out those components is the most important for any individual in search of inexpensive and ok protection on this area. The marketplace is characterised through a mixture of components that may considerably affect insurance coverage premiums, from the native site visitors patterns to the sorts of automobiles repeatedly pushed.The auto insurance coverage marketplace in Midland, TX, is influenced through components such because the age and riding historical past of citizens, the superiority of explicit sorts of automobiles, and the native twist of fate charge.

Components equivalent to the standard car sort, native climate patterns, and site visitors stipulations all give a contribution to the entire chance profile. Working out those influences is vital to successfully navigating the insurance coverage marketplace.

Standard Automobile Insurance coverage Charges in Midland, TX

Automobile insurance coverage charges in Midland, TX, are in most cases in step with different Texas towns, although diversifications exist in line with explicit coverage options. Premiums are at risk of fluctuations, influenced through the entire state of the insurance coverage marketplace and the particular protection wishes of the insured. Ancient information signifies that charges can range considerably in line with the person’s riding file, car sort, and decided on protection choices.

Components Influencing Automobile Insurance coverage Premiums

A number of components give a contribution to the price of automobile insurance coverage in Midland, TX. Demographics play a the most important function, as more youthful drivers and drivers with a historical past of injuries or site visitors violations usually face upper premiums. Riding conduct, together with dashing tickets and at-fault injuries, considerably affect premiums. The kind of car additionally affects the associated fee, as sure automobiles are extra vulnerable to harm or robbery.

Not unusual Varieties of Automobile Insurance coverage Insurance policies, Reasonable automobile insurance coverage midland tx

The average automobile insurance coverage insurance policies to be had in Midland, TX, reflect the ones to be had throughout Texas and the country. Those insurance policies in most cases come with legal responsibility protection, which protects towards damages led to to different events in an twist of fate, and collision protection, which covers harm to the insured car without reference to who’s at fault. Complete protection protects towards non-collision damages, equivalent to robbery, vandalism, and weather-related incidents.

Protection Choices Presented through Other Insurance coverage Firms

Insurance coverage firms in Midland, TX, be offering quite a lot of protection choices. Some firms emphasize complete protection, whilst others would possibly center of attention on offering extra inexpensive liability-only insurance policies. It’s important to match the particular protection quantities and deductibles presented through other suppliers to make sure ok coverage. Evaluating the particular main points of various insurance coverage firms is important to picking a coverage that matches one’s person wishes.

Maximum Often Reported Automobile Injuries in Midland, TX

Injuries in Midland, TX, ceaselessly contain components equivalent to dashing, reckless riding, and deficient street stipulations. Information on twist of fate stories and police data can assist perceive the sorts of injuries that happen maximum often. Research of twist of fate stories can expose commonplace twist of fate sorts and contributing components, which in flip is helping perceive the native chance profile.

Regional or Native Traits Affecting Automobile Insurance coverage Prices

Native site visitors patterns and the superiority of sure sorts of automobiles in Midland, TX, can affect insurance coverage prices. As an example, if a specific house stories upper charges of injuries involving explicit car sorts, insurance coverage premiums for the ones automobiles could also be adjusted accordingly. Moreover, the presence of native or regional components like street development or high-traffic spaces too can impact insurance coverage prices.

Comparability of Primary Insurance coverage Suppliers

| Corporate | Reasonable Charge | Protection A (Legal responsibility) | Protection B (Collision) |

|---|---|---|---|

| Corporate A | $1,200 | $100,000 Physically Damage | $100,000 Belongings Harm |

| Corporate B | $1,500 | $250,000 Physically Damage | $50,000 Belongings Harm |

| Corporate C | $1,000 | $50,000 Physically Damage | $25,000 Belongings Harm |

Word: Those are illustrative figures and moderate charges would possibly range in line with person components. Those charges are approximations and must no longer be regarded as definitive figures.

Discovering Reasonable Automobile Insurance coverage Choices

Securing inexpensive automobile insurance coverage in Midland, TX calls for a strategic means, combining analysis, comparability, and figuring out to be had reductions. That is the most important for managing monetary sources successfully and making sure ok coverage on your car. The marketplace gives numerous choices, however figuring out probably the most cost-effective plan calls for diligent effort.

Methods for Discovering Inexpensive Automobile Insurance coverage

A mixture of proactive measures and a scientific means is vital to discovering affordable automobile insurance coverage. This comes to exploring quite a lot of methods, from bundling to reductions and on-line comparability equipment. Working out those choices empowers you to make knowledgeable choices, doubtlessly saving vital cash in your premiums.

| Technique | Main points | Value Financial savings |

|---|---|---|

| Bundling | Combining a couple of insurance coverage merchandise, equivalent to automobile insurance coverage and residential insurance coverage, with the similar supplier, ceaselessly leads to reductions. | Probably really extensive financial savings, relying at the explicit insurance policies and supplier. |

| Reductions | More than a few reductions are to be had, equivalent to the ones for just right scholar drivers, protected riding historical past, and defensive riding classes. Loyalty techniques too can be offering financial savings. | Reductions can vary from a couple of proportion issues to vital discounts, relying at the appropriate bargain. |

| Comparability Buying groceries | Using on-line comparability equipment and contacting a couple of insurers to acquire quotes is the most important for figuring out aggressive charges. | Vital financial savings are achievable through evaluating quotes from a couple of suppliers. Customers can uncover vital variations in pricing between insurers. |

Other Reductions To be had for Automobile Insurance coverage

Insurers be offering quite a lot of incentives to draw and retain consumers. Those reductions can considerably scale back your top rate prices, making insurance coverage extra inexpensive. Working out the provision of those reductions is very important in securing a aggressive charge.

- Excellent scholar reductions: Those reductions ceaselessly practice to drivers with a blank riding file and enrolled in a known tutorial establishment. They’re designed to inspire accountable riding conduct amongst younger drivers.

- Protected motive force reductions: Insurers ceaselessly praise drivers with a blank riding file and a low twist of fate historical past with reductions. This displays the insurer’s review of the driving force’s chance profile and the driving force’s proactive solution to street protection.

- Defensive riding classes: Finishing a defensive riding route can every so often result in a discount in premiums. This displays the insurer’s popularity of drivers’ proactive efforts to improve their riding talents and scale back twist of fate dangers.

- Bundling reductions: Combining automobile insurance coverage with different insurance policies, like house owners or renters insurance coverage, with the similar supplier can every so often result in reductions. This technique lets in for bundled financial savings and doubtlessly decrease premiums.

- Multi-car reductions: Having a couple of automobiles insured with the similar corporate can every so often result in discounted premiums. This demonstrates the insurer’s appreciation for the buyer’s persevered industry and dedication to a couple of automobiles.

On-line Assets for Evaluating Midland, TX Automobile Insurance coverage Quotes

A lot of on-line equipment facilitate evaluating automobile insurance coverage quotes in Midland, TX. Those sources permit for environment friendly comparability buying groceries, doubtlessly saving you cash in your insurance coverage premiums. Those platforms are user-friendly, providing simple navigation and get admission to to detailed knowledge.

- Insurify, Policygenius, and equivalent platforms: Those on-line platforms supply a handy option to evaluate automobile insurance coverage quotes from quite a lot of suppliers in Midland, TX.

- Direct comparability web sites: Many web sites specialise in evaluating automobile insurance coverage quotes from a couple of insurers. This is helping customers evaluate charges successfully and successfully.

- Insurance coverage corporate web sites: Many insurance coverage firms supply on-line quote equipment that allow customers to get adapted quotes in line with their explicit cases.

Step-by-Step Information for Evaluating Automobile Insurance coverage Charges On-line

A structured solution to on-line automobile insurance coverage quote comparability is very important for optimum effects. This systematic procedure guarantees a complete assessment of to be had choices.

- Acquire your car knowledge: This contains main points such because the yr, make, type, and VIN (Automobile Identity Quantity) of your car.

- Gather non-public knowledge: This comes to offering main points equivalent to your riding historical past, age, and placement.

- Use comparability equipment: Make the most of comparability web sites to collect quotes from other insurers. Be exact in getting into knowledge to get correct effects.

- Overview quotes: In moderation overview the protection main points and premiums presented through other suppliers. Examine no longer simply the associated fee, but in addition the protection main points and exclusions.

- Choose a coverage: Make an educated resolution in line with the protection and value that most closely fits your wishes and funds.

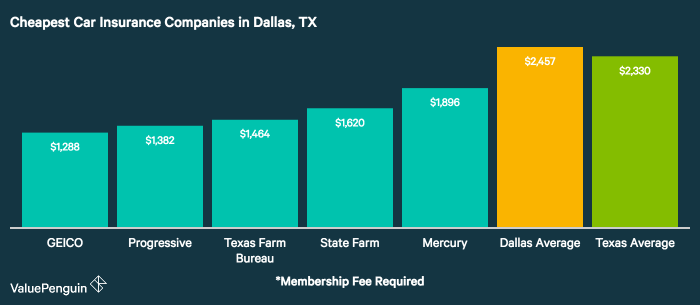

Respected Insurance coverage Firms Providing Aggressive Charges in Midland, TX

A number of insurance coverage firms persistently be offering aggressive charges in Midland, TX. Settling on a supplier with a robust popularity and aggressive pricing is vital. Components equivalent to customer support and fiscal balance additionally play a job.

- State Farm: A well-established nationwide emblem with a presence in Midland, TX. Identified for its wide selection of goods and aggressive pricing in some circumstances.

- Modern: Identified for its on-line equipment and aggressive pricing. It ceaselessly gives reductions for protected drivers and the ones with just right riding data.

- Geico: Regularly known for its aggressive charges, specifically for more youthful drivers and the ones with a blank riding file.

- Allstate: A countrywide insurance coverage supplier providing protection choices and doubtlessly aggressive charges in Midland, TX.

Standard Procedure for Acquiring a Automobile Insurance coverage Quote in Midland, TX

The method for acquiring a automobile insurance coverage quote usually comes to offering related knowledge to an insurer, both on-line or over the telephone. This procedure is designed to decide your chance profile and determine a adapted insurance plans.

- Supply car main points: The insurer wishes knowledge such because the car’s make, type, yr, and any customizations.

- Input non-public main points: This contains knowledge like your age, riding historical past, location, and any related reductions.

- Overview and settle for the quote: As soon as the insurer processes the guidelines, a quote is supplied. In moderation overview the quote and protection main points sooner than accepting the coverage.

Evaluating Insurance coverage Firms in Midland, TX: Reasonable Automobile Insurance coverage Midland Tx

A the most important facet of securing inexpensive automobile insurance coverage in Midland, TX, comes to a radical comparability of various insurance coverage suppliers. Working out their strengths, weaknesses, and customer support reputations lets in customers to make knowledgeable choices. This research delves into the specifics of quite a lot of main firms, analyzing their declare agreement processes and customer support accessibility.

Primary Insurance coverage Corporate Strengths and Weaknesses

Other insurance coverage firms cater to quite a lot of wishes and personal tastes. Some firms excel in offering aggressive charges, whilst others center of attention on complete protection applications. Comparing the particular strengths and weaknesses of every supplier lets in customers to make a choice an organization very best suited for their distinctive cases. As an example, an organization focusing on younger motive force insurance coverage would possibly be offering sexy charges however will have stricter necessities or exclusions.

Conversely, an organization recognized for its intensive protection would possibly include the next top rate. Figuring out those distinctions is very important for a sensible review.

Recognition and Buyer Provider Scores

Customer support and popularity are important components. Firms with sure customer support scores ceaselessly obtain extra favorable critiques for his or her responsiveness and helpfulness. Thorough analysis into buyer critiques, scores, and on-line comments supplies insights into how every corporate handles claims and court cases. Damaging critiques regarding lengthy declare processing occasions or deficient customer support responses must be regarded as a possible downside.

Declare Agreement Procedure

The declare agreement procedure varies amongst firms. Some firms are recognized for suggested and environment friendly declare processing, whilst others will have a name for long delays. Inspecting the declare agreement processes for every corporate is helping customers perceive the timeline and attainable demanding situations concerned. This knowledge can information choices about opting for an insurance coverage supplier with a positive popularity for declare solution.

Contacting Buyer Provider

Getting access to customer support representatives is the most important for explanation and factor solution. Every corporate gives other strategies of touch, together with telephone numbers, e mail addresses, and on-line chat platforms. Evaluating the provision and accessibility of those strategies can give a foundation for comparability. As an example, some firms would possibly prioritize telephone strengthen, whilst others would possibly be offering extra intensive on-line sources.

Varieties of Cars Often Insured

Insurance coverage firms ceaselessly specialise in explicit sorts of automobiles. Some firms would possibly center of attention on insuring vintage vehicles or luxurious automobiles, whilst others would possibly specialise in insuring smaller, less expensive automobiles. Inspecting which sorts of automobiles every corporate basically insures is very important to decide if the corporate caters to a shopper’s explicit wishes.

Touch Data for Best 3 Automobile Insurance coverage Firms

| Corporate | Telephone Quantity | Web page | Deal with |

|---|---|---|---|

| Corporate A | (555) 555-5555 | companya.com | 123 Primary Boulevard, Midland, TX 79701 |

| Corporate B | (555) 555-5556 | companyb.com | 456 Elm Boulevard, Midland, TX 79702 |

| Corporate C | (555) 555-5557 | companyc.com | 789 Oak Boulevard, Midland, TX 79703 |

Word: This desk supplies pattern information. All the time check touch knowledge with the respective insurance coverage firms. Exact touch knowledge for corporations in Midland, TX must be bought immediately from the corporations themselves.

Guidelines for Saving Cash on Automobile Insurance coverage

Decreasing automobile insurance coverage premiums calls for a proactive means. Methods vary from keeping up a blank riding file to creating sensible protection alternatives. Working out the nuances of Midland, TX’s insurance coverage marketplace and leveraging to be had reductions are the most important for attaining charge financial savings.

Bettering Your Riding File

A blank riding file is paramount to securing decrease insurance coverage charges. Constant protected riding conduct immediately correlate with lowered premiums. Fending off injuries and site visitors violations are key parts achieve this.

- Protected Riding Practices: Adhering to hurry limits, keeping up a protected following distance, and keeping off distracted riding are crucial. Continuously working towards defensive riding tactics, equivalent to expecting attainable hazards and reacting accordingly, considerably reduces twist of fate chance.

- Fending off Injuries: Taking precautions to forestall injuries, equivalent to riding sober, being conscious about your atmosphere, and in moderation assessing street stipulations, are crucial. Riding defensively and keeping off distractions like mobile phones can dramatically lower the chance of injuries and next insurance coverage prices.

- Keeping up a Blank Riding File: It is a important issue. Steer clear of dashing tickets, transferring violations, and at-fault injuries. Those infractions considerably building up insurance coverage premiums.

Opting for the Proper Protection

Settling on suitable protection ranges on your wishes is very important for minimizing insurance coverage prices. This comes to figuring out the quite a lot of sorts of protection and their related premiums.

- Legal responsibility Protection: The minimal legal responsibility protection required through regulation is ceaselessly enough for plenty of drivers. Assessing the suitable stage of legal responsibility protection is necessary. Working out the monetary implications of insufficient legal responsibility protection is significant. Good enough legal responsibility insurance coverage is very important for shielding belongings and making sure monetary accountability within the tournament of an twist of fate.

- Collision and Complete Protection: Those coverages, whilst providing extra coverage, can building up your premiums. Assessing your monetary wishes and the worth of your car is important when taking into consideration those coverages. Working out the adaptation between collision and complete protection is significant in figuring out the suitable stage of coverage.

- Uninsured/Underinsured Motorist Protection: This protection protects you if you are focused on an twist of fate with an at-fault motive force who lacks ok insurance coverage. That is the most important for monetary coverage. Working out the monetary implications of insufficient protection is important.

Fending off Useless Injuries

Fighting injuries is top-of-the-line option to scale back insurance coverage prices. Cautious riding practices, together with keeping off doubtlessly dangerous eventualities, are crucial.

- Defensive Riding Ways: Working towards defensive riding tactics, equivalent to keeping up a protected following distance, scanning the street forward, and expecting attainable hazards, considerably reduces twist of fate chance. This proactive means can lower your expenses on insurance coverage premiums.

- Automobile Repairs: Common car upkeep, equivalent to tire power exams and brake inspections, reduces the chance of mechanical disasters that might result in injuries. Correct car upkeep is very important to scale back the danger of breakdowns or injuries.

- Riding Conduct: Fending off dangerous riding conduct, equivalent to dashing, tailgating, and competitive lane adjustments, considerably reduces the chance of injuries. Working out how riding conduct impact insurance coverage charges is the most important for making knowledgeable choices.

Significance of a Blank Riding File

A blank riding file is a the most important think about acquiring inexpensive automobile insurance coverage. It demonstrates accountable riding habits and decreases the chance of injuries, which immediately affects premiums. Keeping up a blank file is the most important for long-term financial savings.

- Lowered Premiums: Insurers see a blank file as a decrease chance issue, leading to decrease premiums. That is an immediate mirrored image of accountable riding conduct.

- Monetary Balance: Keeping up a blank file contributes to monetary balance, keeping off attainable will increase in insurance coverage prices.

- Insurance coverage Eligibility: A blank riding file ceaselessly makes you eligible for reductions and favorable insurance coverage charges.

Methods to Decrease Automobile Insurance coverage Prices in Midland, TX

Enforcing quite a lot of methods can decrease your automobile insurance coverage prices in Midland, TX. Those come with using to be had reductions and negotiating charges with insurance coverage suppliers.

- Using Reductions: Many insurance coverage firms be offering reductions for protected riding conduct, equivalent to accident-free riding and defensive riding classes. Working out and using those reductions is vital to decreasing premiums.

- Negotiating Charges: Contacting insurance coverage suppliers and negotiating charges can every so often result in decrease premiums. Evaluating quotes from other firms is very important.

- Bundling Insurance coverage Insurance policies: Combining automobile insurance coverage with different insurance coverage insurance policies, equivalent to house or renters insurance coverage, can doubtlessly result in bundled reductions. Bundling insurance policies is ceaselessly a cost-saving technique.

The use of Reductions for Protected Riding Conduct

Many insurance coverage firms be offering reductions for protected riding conduct. Using those reductions can considerably decrease insurance coverage premiums. Working out and leveraging those reductions can save really extensive quantities.

- Protected Driving force Reductions: Firms ceaselessly be offering reductions to drivers with accident-free riding data. It is a mirrored image of accountable riding conduct.

- Defensive Riding Lessons: Finishing defensive riding classes can ceaselessly lead to reductions. This presentations dedication to protected riding practices.

- Multi-Coverage Reductions: Bundling automobile insurance coverage with different insurance policies, like house insurance coverage, can yield reductions. Combining insurance policies is ceaselessly a cheap technique.

Inspecting Insurance coverage Protection Choices

Choosing the proper automobile insurance plans in Midland, TX, is the most important for shielding your monetary well-being and belongings. Working out the several types of protection to be had and their explicit roles is very important to make knowledgeable choices. In moderation taking into consideration your wishes and attainable dangers will will let you make a selection a coverage that balances cost-effectiveness with ok coverage.

Other Varieties of Protection

Insurance coverage firms in Midland, TX, be offering a number of coverages to handle quite a lot of dangers related to automobile possession. Those coverages are designed to give protection to you from monetary losses as a result of injuries, harm for your car, or accidents to others.

Legal responsibility Protection

Legal responsibility protection is prime to any automobile insurance plans. It protects you from monetary accountability in the event you motive an twist of fate that leads to accidents or assets harm to others. This protection will pay for damages and clinical bills incurred through the opposite celebration. Legal responsibility protection is necessary in Texas, and the minimal limits are set through state regulation.

Failure to hold ok legal responsibility insurance coverage can result in vital criminal and fiscal repercussions.

Collision and Complete Protection

Collision protection protects your car from harm led to through an twist of fate, without reference to who’s at fault. Complete protection, however, covers harm for your car from perils rather than collisions, equivalent to robbery, fireplace, vandalism, hail, or climate occasions. Those coverages supply monetary repayment for maintenance or alternative of your car. The verdict to incorporate collision and complete protection is determined by your monetary scenario and the worth of your car.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is significant in Midland, TX, given the potential of injuries involving drivers with out ok insurance coverage. This protection steps in if you are focused on an twist of fate with a motive force who has inadequate or no insurance coverage, masking your clinical bills and assets harm. With out this protection, you will be left to undergo the monetary burden of such an twist of fate.

Protection Comparability Desk

| Protection | Description | Value |

|---|---|---|

| Legal responsibility | Protects you from monetary accountability in the event you motive an twist of fate that leads to accidents or assets harm to others. Necessary in Texas. | Varies a great deal in line with limits selected. Decrease limits are less expensive, however insufficient limits can go away you financially prone. |

| Collision | Covers harm for your car in an twist of fate, without reference to who’s at fault. | Typically varies in line with the car’s make, type, and yr. |

| Complete | Covers harm for your car from perils rather than collisions, equivalent to robbery, fireplace, vandalism, hail, or climate occasions. | Typically varies in line with the car’s make, type, and yr. |

| Uninsured/Underinsured Motorist | Covers your clinical bills and assets harm if you are focused on an twist of fate with a motive force who has inadequate or no insurance coverage. | Varies in line with the bounds selected. |

End result Abstract

In conclusion, securing affordable automobile insurance coverage in Midland, TX, comes to figuring out the marketplace, evaluating quotes, and maximizing reductions. By way of following the methods and guidelines on this information, you’ll be able to discover a coverage that meets your wishes and funds. Consider to investigate other suppliers, evaluate protection choices, and ask inquiries to make the most productive resolution on your scenario.

Solutions to Not unusual Questions

What are the standard automobile insurance coverage charges in Midland, TX?

Charges range in line with components like your riding file, car sort, and protection alternatives. Test with a couple of suppliers to get an concept of what to anticipate.

What reductions are to be had for automobile insurance coverage in Midland, TX?

Many insurance coverage firms be offering reductions for protected drivers, bundling insurance policies (like house and auto), and for college students or those that care for a blank riding file. Test along with your supplier for an inventory of explicit reductions.

How can I support my riding file to scale back insurance coverage premiums?

Deal with a blank riding file through keeping off site visitors violations and injuries. Defensive riding classes too can support your file and most likely decrease your charges.

What’s the standard procedure for acquiring a automobile insurance coverage quote in Midland, TX?

Typically, you can supply knowledge like your riding historical past, car main points, and desired protection. A number of on-line sources mean you can evaluate quotes from other suppliers.