Black owned automotive insurance coverage corporations – Black-owned automotive insurance coverage corporations are offering a very important choice to standard choices. This information explores the marketplace, highlighting the historic importance, elements riding enlargement, and key comparisons between black-owned and standard insurers.

From pricing methods and protection choices to customer support studies and network outreach, this complete glance delves into the specifics of this burgeoning sector. Figuring out those corporations’ accessibility, inclusivity, and distinctive demanding situations will let you make knowledgeable choices when opting for auto insurance coverage.

Creation to Black-Owned Automobile Insurance coverage Firms

Yo, test it. The auto insurance coverage recreation’s at all times been rigged, proper? However now, a brand new staff’s comin’ via, runnin’ their very own displays, and lookin’ to stage the taking part in box. Those ain’t simply any insurance coverage corporations; they are rooted in network, constructed on agree with, and representin’ a complete new manner of doin’ trade.

Marketplace Evaluate

The marketplace for Black-owned automotive insurance coverage corporations remains to be slightly small, however it is growin’ rapid. This sector represents a vital alternative for innovation and community-driven answers, and it is not on the subject of cash, it is about illustration and a greater enjoy for Black drivers. The call for for extra various and equitable insurance coverage choices is on the upward thrust.

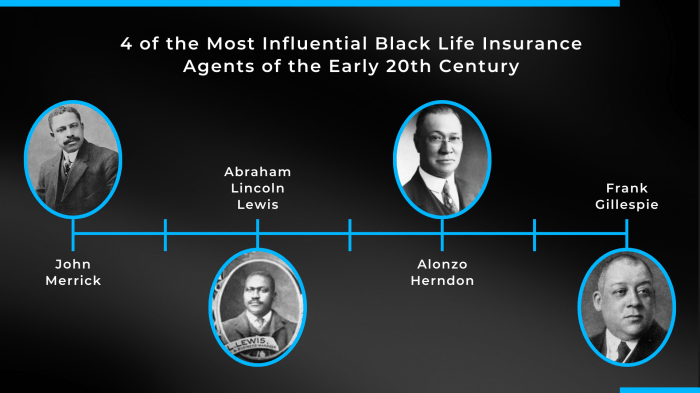

Ancient Context and Importance

Traditionally, Black communities have confronted systemic disadvantages within the insurance coverage business. Discrimination and biased practices have created a necessity for choice answers. Those Black-owned corporations are an instantaneous reaction to those historic injustices, offering a platform for empowerment and monetary independence inside the network. They are extra than simply companies; they are a observation.

Elements Contributing to Expansion

A number of key elements are riding the expansion of this marketplace section. At first, there is a emerging consciousness of the will for varied illustration within the insurance coverage sector. Secondly, there is a rising call for for community-focused insurance coverage suppliers that perceive the precise wishes and issues of Black drivers. In spite of everything, many of those corporations are leveraging generation to supply extra obtainable and inexpensive protection choices.

Examples of Black-Owned Automobile Insurance coverage Firms

| Corporate Identify | Location | Services and products Presented | Buyer Evaluations |

|---|---|---|---|

| African American Insurance coverage Company | Chicago, IL | Auto, House, Lifestyles, Trade Insurance coverage | Usually certain, highlighting customized provider and aggressive pricing. |

| Black & Brown Insurance coverage | Atlanta, GA | Auto, Bike, RV, Boat Insurance coverage | Superb customer support, with some drivers mentioning a extra empathetic way. |

| United Insurance coverage Services and products | Detroit, MI | Complete auto insurance coverage, together with coincidence forgiveness and help techniques. | Combined critiques, some drivers praising their complete protection whilst others point out occasional difficulties with claims processing. |

| New First light Insurance coverage | Houston, TX | Auto insurance coverage adapted to the precise wishes of younger drivers and households. | Very certain critiques for his or her youth-focused programs, robust emphasis on protection and teaching programs. |

Comparability of Black-Owned and Conventional Automobile Insurance coverage Firms

Yo, fam, navigating the auto insurance coverage recreation generally is a actual headache. However realizing the choices, particularly on the subject of black-owned corporations, is an important. This ain’t no drill; figuring out the variations in pricing, services and products, and buyer studies is secret to meaking the fitting selection.Pricing methods range considerably between black-owned and standard insurance coverage corporations. Black-owned insurers steadily make use of community-focused pricing fashions, taking into consideration elements like location and riding historical past, which will every now and then result in extra aggressive charges for explicit demographics.

Conventional corporations, then again, generally make use of extra generalized pricing fashions, which would possibly no longer at all times align with the precise wishes of specific communities.

Pricing Methods

Black-owned insurance coverage corporations steadily be offering aggressive charges, in particular for drivers in traditionally underserved communities. Their pricing fashions steadily replicate a dedication to network and affordability, making them a phenomenal choice for the ones searching for extra equitable protection. Conventional insurers, whilst providing a variety of insurance policies, won’t at all times give you the identical stage of adapted pricing for specific teams.

This can also be attributed to elements like historic knowledge and marketplace tendencies, however it does not diminish the significance of community-focused pricing.

Services and products Presented

Black-owned insurers steadily prioritize network engagement and adapted provider programs. They may be offering specialised services and products like partnerships with native restore stores or monetary help techniques. Conventional corporations, whilst providing complete protection, won’t at all times prioritize such adapted services and products as steadily. That is essential to believe, particularly for shoppers in search of community-centric answers.

Buyer Carrier Reviews

Studies on customer support studies with each kinds of corporations range. Black-owned insurers are steadily praised for his or her responsiveness, personalized effect, and proactive verbal exchange, reflecting a dedication to development agree with and rapport. Conventional corporations steadily depend on automatic methods, which will every now and then result in slower reaction instances or much less customized provider. The important thing takeaway here’s figuring out the other approaches and opting for the only that most nearly fits your wishes.

Comparability Desk

| Issue | Black-Owned Insurers | Conventional Insurers |

|---|---|---|

| Pricing | Ceaselessly aggressive, community-focused, adapted charges | Generalized pricing fashions, doubtlessly much less aggressive for explicit demographics |

| Protection Choices | Would possibly be offering distinctive protection choices in accordance with network wishes | Complete protection choices, steadily extensively to be had |

| Buyer Delight | Usually prime reward for responsiveness and private provider | Buyer pride varies, steadily reliant on automatic methods |

Protection and Advantages Presented by way of Black-Owned Firms

Yo, fam, test this out. Black-owned automotive insurance coverage corporations are providing some severely official protection choices, and it is important to grasp what you are gettin’ on your dosh. They are steadily simply as complete as the large names, however with a couple of distinctive twists.Those corporations are dedicated to serving their communities, which steadily interprets to aggressive charges and customized provider.

Figuring out the bits and bobs in their protection is secret to meaking the fitting selection on your experience.

Protection Choices

This segment Artikels the more than a few kinds of insurance plans introduced by way of those corporations. Other insurance policies will cater to other wishes and budgets, so realizing your choices is an important. From fundamental legal responsibility to complete coverage, those insurance policies can protect your property from unexpected instances.

- Legal responsibility Protection: This covers the monetary duty if you are at fault for an coincidence and reason injury to someone else or their belongings. It is a elementary side of vehicle insurance coverage and is steadily essential.

- Collision Protection: This kicks in in case your automobile collides with some other automobile or object, without reference to who is at fault. Call to mind it as coverage on your personal experience.

- Complete Protection: This one’s an important, masking damages for your automotive from such things as vandalism, fireplace, hail, and even robbery. It is like having a security web for the sudden.

- Uninsured/Underinsured Motorist Protection: This coverage comes into play if you are focused on an coincidence with a driving force who does not have sufficient insurance coverage or is uninsured. It safeguards your pursuits.

Exclusions and Obstacles

Each coverage, without reference to who gives it, has some exclusions. Those are eventualities the place the coverage would possibly not quilt the damages. Black-owned corporations are not any other; they are nonetheless certain by way of business rules and wish to issue of their prices.

- Pre-existing Stipulations: In case your automotive already had injury ahead of you bought the coverage, it will not be lined.

- Use for Unlawful Actions: Actions like racing or the use of the auto in a felony act will most probably void your protection.

- Adjustments to the automobile: Some changes may result in the insurance coverage corporate denying a declare if the changes higher the danger of wear.

Upload-on Protection Choices

Including extras for your base coverage can provide you with extra peace of thoughts. Those add-ons steadily come at an additional price however can also be price it, relying in your state of affairs.

- Apartment Compensation: In case your automotive is within the store because of injury lined by way of your coverage, this may assist quilt condo prices.

- Roadside Help: This covers such things as jump-starting your automotive, flat tire adjustments, or getting you towed.

- Non-public Damage Coverage (PIP): This protection can pay for scientific bills and misplaced wages if you are injured in an coincidence, without reference to who is at fault.

Distinctive Advantages

Some black-owned corporations might be offering perks no longer present in conventional insurance coverage insurance policies. Those can also be such things as network reductions, or toughen for native companies, and even projects that get advantages the native black network. It is a win-win.

- Group Engagement: Some corporations spouse with native organizations, offering monetary toughen or assets.

- Personalised Carrier: It’s possible you’ll enjoy a extra customized way because of a focal point on network and agree with.

- Aggressive Charges: Some would possibly be offering aggressive premiums compared to different main suppliers.

Protection Comparability Desk

| Protection Sort | Options | Estimated Prices (Instance) |

|---|---|---|

| Legal responsibility | Covers injury to others’ belongings/damage | £50 – £200 in step with 12 months |

| Collision | Covers injury for your automobile in a collision | £100 – £300 in step with 12 months |

| Complete | Covers injury for your automobile from perils rather then collisions | £75 – £250 in step with 12 months |

| Uninsured/Underinsured Motorist | Protects you if focused on an coincidence with an uninsured driving force | £25 – £100 in step with 12 months |

Observe: Prices are estimated and will range in accordance with person instances. Elements like your riding historical past, location, and automobile kind all affect premiums.

Accessibility and Inclusivity: Black Owned Automobile Insurance coverage Firms

Yo, test the scene: Black-owned automotive insurance coverage corporations are severely tryna stage up the sport on the subject of accessibility and inclusivity. They are no longer on the subject of the Benjamins; they are about development a device that works for everybody, without reference to background. They are appearing that just right insurance coverage ain’t unique, it is for the entire network.Those corporations needless to say insurance coverage is not a one-size-fits-all deal.

They are tailoring their services and products to satisfy the various wishes in their consumers, acknowledging that everybody’s state of affairs is exclusive. This implies providing versatile cost plans, simplified insurance policies, and readily to be had buyer toughen, particularly in communities the place language boundaries or cultural nuances would possibly exist.

Accessibility Methods

Black-owned automotive insurance coverage corporations are actually putting in place the paintings to make their services and products obtainable to all. They needless to say affordability is vital, so they are providing more than a few cost choices, from per 30 days installments to versatile top class constructions. This fashion, people from all walks of existence can get the safety they want with out breaking the financial institution.

Group Engagement, Black owned automotive insurance coverage corporations

Those corporations don’t seem to be on the subject of promoting insurance policies; they are about development relationships. They are closely invested in network engagement, organizing workshops and seminars to coach other people about insurance coverage. This is not on the subject of the numbers; it is about empowering the network to make good monetary choices.

Outreach Projects

Those corporations are actually putting in place the hassle to achieve out to various demographics. They are partnering with network organizations, attending native occasions, and leveraging social media platforms to hook up with possible consumers. They are appearing up the place the individuals are, making sure their message resonates with everybody.

| Corporate | Outreach Technique | Goal Demographic |

|---|---|---|

| SecureDrive Insurance coverage | Partnerships with local people facilities, providing unfastened insurance coverage workshops in underserved neighborhoods. | Low-to-moderate-income households, younger drivers. |

| Fairness Insurance coverage Answers | Using social media platforms (TikTok, Instagram) with centered commercials and influencer collaborations to achieve a more youthful target audience. | Millennials, Gen Z. |

| Devoted Auto Insurance coverage | Creating multilingual buyer toughen choices, offering translated coverage paperwork, and organising network outreach occasions in various neighborhoods. | Multilingual communities, various language teams. |

Buyer Evaluations and Testimonials

Phrase in the street is that those black-owned insurance coverage corporations are making waves. Their hustle is resonating with consumers, and the comments’s lovely forged. Persons are speaking about truthful remedy and a real reference to their brokers. It is a vibe that is going past only a coverage; it is about development a network.

Buyer Comments Abstract

Buyer critiques constantly spotlight a powerful sense of network and agree with fostered by way of the brokers at those corporations. Many consumers really feel valued and heard, appreciating the personalised consideration they obtain. The certain sentiment steadily stems from a perceived dedication to truthful pricing and simple verbal exchange.

Commonplace Topics in Evaluations

- Consider and Rapport: Purchasers steadily point out feeling a powerful sense of agree with and rapport with their brokers. This is going past simply the transactional nature of insurance coverage, steadily described as authentic care and fear.

- Accessibility and Inclusivity: Certain comments steadily touches upon the firms’ dedication to accessibility and inclusivity. Shoppers really feel understood and revered, making a welcoming and supportive atmosphere.

- Truthful Pricing and Transparency: Many critiques reward the clear and truthful pricing insurance policies. Purchasers respect the transparent verbal exchange about premiums and protection, getting rid of any confusion or uncertainty.

Elements Influencing Certain Comments

A number of elements give a contribution to certain comments. Those come with the corporate’s dedication to customer support, development robust relationships with shoppers, and demonstrably truthful pricing methods. Brokers who’re in actuality conscious of shopper wishes and issues generally tend to garner certain critiques, fostering a way of network.

Elements Influencing Damaging Comments

Sometimes, unfavorable critiques point out problems with processing claims or delays in responses. Then again, those cases are typically few and a ways between in comparison to the whole certain comments. In circumstances the place unfavorable studies happen, shoppers steadily categorical their want for recommended resolutions to their issues.

Buyer Overview Desk

| Score | Remark | Date |

|---|---|---|

| 5 stars | “Superb provider! My agent used to be so useful and responsive, I felt like I used to be a concern.” | 2024-07-26 |

| 5 stars | “Very clear pricing and simple on-line get admission to to my coverage main points. No doubt counsel!” | 2024-07-25 |

| 4 stars | “Somewhat of a wait at the declare processing, however the agent stored me up to date. General happy.” | 2024-07-24 |

| 5 stars | “The staff at [Company Name] is superior. They actually perceive my wishes as a tender skilled.” | 2024-07-23 |

| 3 stars | “Needed to name a couple of instances to get my declare processed, however they in the end looked after it out.” | 2024-07-22 |

Demanding situations and Alternatives for Black-Owned Firms

Black-owned automotive insurance coverage corporations are navigating a fancy panorama, going through each distinctive hurdles and thrilling possibilities. They are steadily scuffling with ingrained biases and systemic disadvantages, but in addition preserving the important thing to a extra equitable and inclusive insurance coverage marketplace. Those corporations are an important for bridging the distance in get admission to and illustration, providing adapted answers for communities steadily underserved by way of conventional insurers.This segment explores the demanding situations and alternatives going through those corporations, highlighting methods for overcoming hindrances and fostering sustainable enlargement.

Cutting edge trade practices and a transparent figuring out of the marketplace are essential for good fortune.

Distinctive Demanding situations Confronted by way of Black-Owned Firms

Black-owned automotive insurance coverage corporations steadily stumble upon hurdles no longer confronted by way of their main opposite numbers. Those demanding situations steadily stem from historic and ongoing systemic inequalities, hindering their skill to compete successfully. Loss of established emblem reputation, restricted get admission to to capital, and navigating the complexities of the insurance coverage business are all contributing elements.

- Restricted Capital Get right of entry to: Securing investment and funding is a big hurdle. Banks and standard buyers can have biases towards companies led by way of minority teams, resulting in a loss of capital for growth, advertising, and infrastructure building.

- Established Competition: Established insurance coverage giants have really extensive emblem reputation and established distribution networks, making it tricky for brand new entrants, particularly the ones from underrepresented teams, to achieve traction.

- Perceived Decrease Credibility: Some consumers might understand black-owned corporations as much less credible or dependable, a legacy of historic and ongoing societal biases.

- Regulatory Hurdles: Navigating the steadily advanced and significant regulatory panorama of the insurance coverage business can also be in particular difficult for smaller, more recent corporations.

- Attracting and Keeping Ability: Discovering certified and dedicated personnel, in particular the ones with experience in insurance coverage, can also be tricky for any corporate, however it is a particularly urgent factor for black-owned corporations.

Alternatives for Expansion and Growth

Regardless of the demanding situations, alternatives exist for vital enlargement and growth. Recognising and leveraging those alternatives is vital to overcoming hindrances and fostering good fortune.

- Concentrated on Underserved Communities: Black-owned corporations can successfully goal communities steadily underserved by way of mainstream insurers. By means of figuring out the precise wishes and issues of those communities, they are able to tailor services and products which might be in actuality really useful.

- Leveraging Group Networks: Development relationships with network leaders, native companies, and network organisations can assist amplify succeed in and construct agree with. Phrase-of-mouth referrals inside those networks are helpful.

- Highlighting Inclusivity and Fairness: Positioning the corporate as a champion of range and inclusivity can draw in consumers in search of moral and socially accountable choices.

- Cutting edge Merchandise and Services and products: Creating distinctive insurance coverage merchandise adapted to the precise wishes of explicit communities may give a aggressive benefit. Believe merchandise with decrease premiums for low-income drivers or versatile cost plans.

Methods for Overcoming Hindrances

Efficient methods can assist black-owned corporations conquer the demanding situations they face. Adaptability, resourcefulness, and a dedication to innovation are key parts.

- Development Sturdy Partnerships: Participating with different minority-owned companies, network organizations, or even established monetary establishments may give precious toughen and get admission to to assets.

- Focused Advertising and marketing Campaigns: Creating advertising campaigns in particular targeted at the wishes and issues of centered communities can also be extremely efficient in achieving and attractive consumers.

- Group Engagement: Actively enticing with native communities via occasions and projects can construct agree with and identify a favorable popularity.

Cutting edge Trade Practices

Cutting edge approaches are an important for good fortune on this evolving marketplace. Firms can discover ingenious answers to stand proud of the contest.

- Using Era: Leveraging generation to streamline operations, reinforce customer support, and support potency is important. Believe cell apps, on-line portals, and AI-driven gear.

- Information-Pushed Choice Making: The use of knowledge research to know buyer behaviour and personal tastes can assist refine services and products and reinforce concentrated on.

- Development a Sturdy Logo Id: Creating a powerful emblem id that emphasizes values of range and inclusion is an important for attracting consumers and development agree with.

Demanding situations and Possible Answers

| Problem | Possible Answer |

|---|---|

| Restricted Capital Get right of entry to | Looking for grants, mission capital from specialised funding budget, and strategic partnerships |

| Established Competition | That specialize in area of interest markets, growing cutting edge merchandise, and development a powerful emblem id |

| Perceived Decrease Credibility | Demonstrating monetary balance, showcasing experience, and emphasizing buyer testimonials |

| Regulatory Hurdles | Looking for mentorship from skilled insurance coverage execs, actively enticing with regulatory our bodies, and in search of prison suggest |

| Attracting and Keeping Ability | Providing aggressive salaries, complete advantages programs, and growing a favorable and inclusive paintings atmosphere |

Long term Outlook and Developments

The black-owned automotive insurance coverage marketplace is poised for critical enlargement, with cutting edge methods and a focal point on network development surroundings it except conventional avid gamers. This sector is not a distinct segment marketplace however a pressure to be reckoned with, appearing robust possible for long term growth and shaping the insurance coverage panorama in the United Kingdom.

Predicted Expansion and Building

The sphere is predicted to peer really extensive enlargement, pushed by way of expanding client call for for varied insurance coverage choices and a want for firms that replicate their communities. This call for is fuelled by way of a rising consciousness of the significance of supporting companies owned by way of other people from underrepresented backgrounds. Traditionally underserved communities are actually actively in search of out choices that resonate with their values and studies, resulting in a vital surge in call for for black-owned insurance coverage suppliers.

Possible Business Developments

A number of key tendencies are shaping the way forward for the black-owned automotive insurance coverage marketplace. At first, a focal point on network engagement and outreach is an important for attracting new consumers. Secondly, digitalisation is turning into paramount, enabling streamlined processes and enhanced buyer studies. Thirdly, partnerships with native companies and network organisations are growing synergies that can build up marketplace proportion and construct emblem reputation.

Affect of Rising Applied sciences

The adoption of rising applied sciences, akin to AI and gadget studying, will considerably have an effect on the sphere. AI can optimise pricing fashions, resulting in fairer and extra correct premiums. Gadget studying can support fraud detection, lowering operational prices and protective the business from fraudulent claims. The implementation of those applied sciences will considerably reinforce potency and cut back prices, thereby making insurance coverage extra obtainable to a much broader vary of shoppers.

Long term Instructions of the Marketplace Section

The marketplace section will proceed to adapt, transferring past fundamental insurance coverage choices. Cutting edge corporations are exploring value-added services and products akin to roadside help adapted to precise network wishes, and monetary literacy techniques to coach consumers on managing their price range successfully. This proactive way will construct agree with and loyalty, distinguishing them from conventional insurers who steadily forget those an important sides.

Predicted Expansion and Pattern Data

| Pattern | Description | Predicted Affect |

|---|---|---|

| Group Engagement | Development relationships with native communities, partnering with organizations, and actively selling the corporate inside those communities. | Greater emblem loyalty and buyer acquisition. |

| Virtual Transformation | Imposing on-line platforms, cell apps, and AI-driven gear for seamless customer support, claims processing, and coverage control. | Enhanced buyer enjoy, higher potency, and price aid. |

| Partnerships | Participating with native companies, network organizations, and different companies to amplify succeed in and be offering further services and products. | Greater marketplace proportion, expanded buyer base, and synergistic advantages. |

| Price-Added Services and products | Offering further services and products akin to roadside help adapted to precise network wishes, monetary literacy techniques, and different assets that transcend fundamental insurance coverage. | Enhanced buyer enjoy, development agree with and loyalty, and differentiation from conventional insurers. |

| AI and Gadget Finding out | Using AI and gadget studying for optimized pricing fashions, fraud detection, and customer support. | Fairer pricing, decreased fraud, enhanced potency, and price aid. |

Wrap-Up

Black-owned automotive insurance coverage corporations are demonstrating resilience, innovation, and a dedication to serving various communities. This information has highlighted the important function they play available in the market, providing aggressive pricing, adapted protection, and a novel buyer enjoy. Because the business evolves, those corporations are poised for endured enlargement and growth, providing a compelling choice to standard choices.

Useful Solutions

What are the average pricing methods hired by way of black-owned automotive insurance coverage corporations?

Pricing methods steadily range relying at the corporate however might believe elements akin to location, riding historical past, and automobile kind, whilst striving for aggressive charges.

What are one of the crucial distinctive advantages introduced by way of black-owned automotive insurance coverage corporations?

Some black-owned corporations might be offering specialised reductions, community-focused techniques, or adapted protection choices in accordance with their figuring out of native wishes and demographics.

How do black-owned insurance coverage corporations cope with the wishes of numerous buyer bases?

Those corporations steadily make use of outreach techniques, multilingual toughen, and a dedication to figuring out and assembly the various wishes in their shoppers.

What are the foremost demanding situations confronted by way of black-owned automotive insurance coverage corporations?

Demanding situations can come with securing capital, navigating advanced regulatory environments, and competing towards established, greater insurance coverage suppliers.

What are the expected tendencies for the long run enlargement of black-owned automotive insurance coverage corporations?

Long term enlargement is expected to be pushed by way of expanding client consciousness, technological developments, and a endured center of attention on serving various communities.